Yü Group has delivered wonderful multi-bagger returns during the last few years. Maynard Paton recaps the energy supplier’s entrepreneurial leadership and remarkable recovery following an accounting bombshell.

Everybody loves shares that keep on rising.

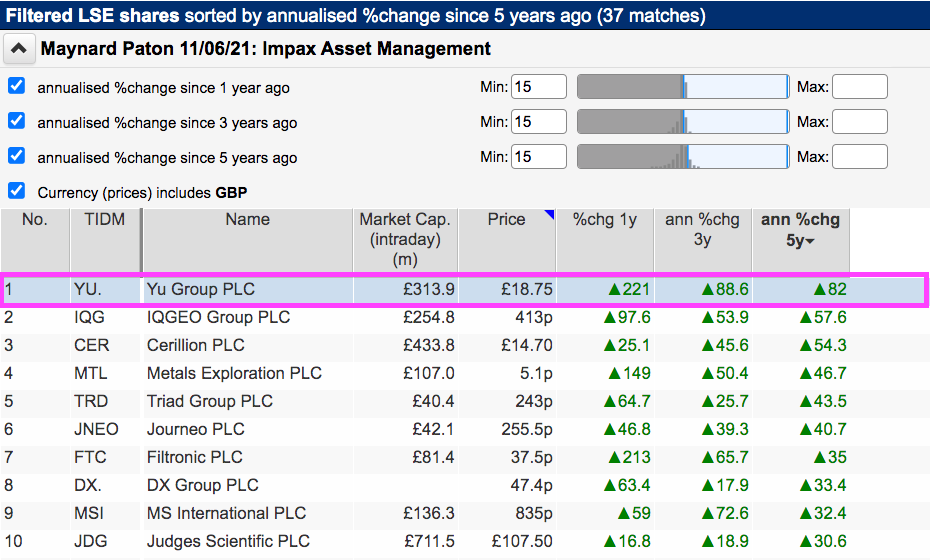

SharePad lists 37 names that have consistently delivered 15% or more annualised returns during the last one, three and five years:

(You can run this screen for yourself by selecting the “Maynard Paton 11/06/21: Impax Asset Management” filter within SharePad’s impressive Filter Library. My instructions show you how.)

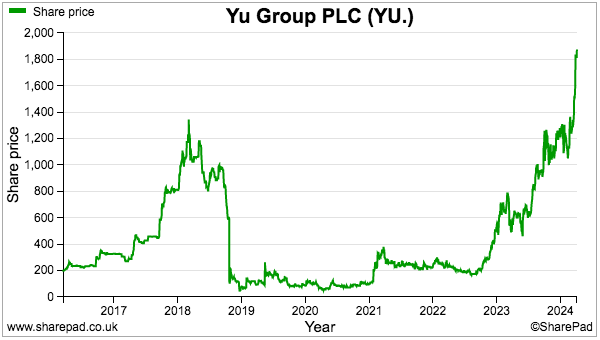

The shares of independent energy supplier Yü Group have certainly kept on rising; they have more than tripled since April 2023 and have 20-bagged since early 2019.

Factors involved in this superb investment include:

- A ‘market-pariah’ valuation caused by an adverse accounting review;

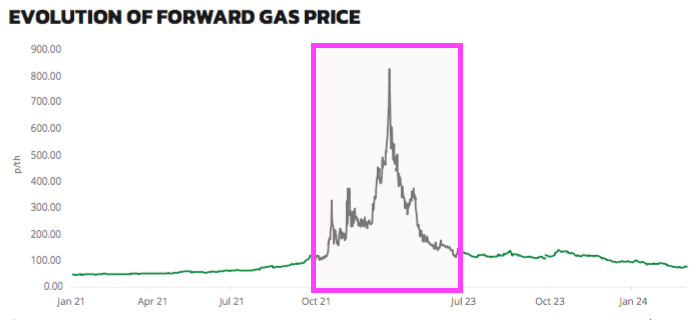

- An astounding recovery buoyed by elevated energy prices;

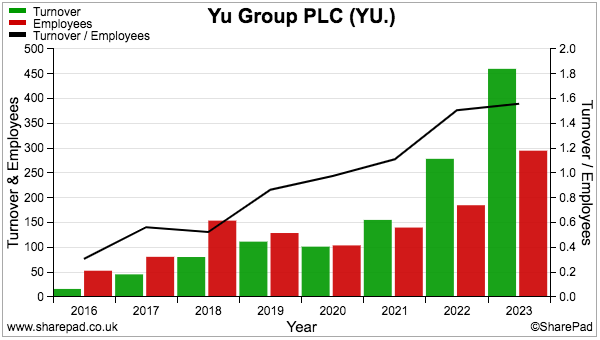

- A ‘scalable’ business that generates extra revenue without a commensurate increase to the workforce, and;

- The entrepreneurialism and commitment of founder Bobby Kalar;

Let’s take a closer look.

Introducing Yü Group

Bobby Kalar’s journey to establish Yü and create his current £162 million shareholding was far from conventional.

Armed with an engineering degree, Mr Kalar spent his first year or two after university at Marconi and COLT Telecom. But an overwhelming desire to run his own business then prompted a move into care homes.

Mr Kalar believed the care sector offered significant growth potential but at the time was blighted by poor service. With the help of a loan from his parents, he became the youngest person in the UK to own a care home during 2002. Some ten years later, Mr Kalar owned four homes turning over more than £4 million.

The idea for Yü then emerged via another industry delivering poor service. Mr Kalar recounted the story within Yü’s annual report:

“For months every fellow care-home operator I spoke to had the same frustrations as I was experiencing: ‘poor service to business customers’, ‘lack of transparency’, ‘archaic’. How hard could it be to start a competitor B2B energy business, supplying the entire UK with gas and electricity?“

“It was never a deliberate plan to move from healthcare to energy supply. Although it seems a long time ago now, I’ll never forget when the light bulb moment scratched the itch. ‘If I can’t beat them, then I’ll join them’. I was thinking about the Big Six, who had almost perfected the art of poor service to SMEs. “

The care homes were sold during 2012 and Yü was founded a year later to resell gas and electricity to small UK businesses. Yü today claims to serve more than 30,000 customers that typically spend less than £30,000 a year on their utility bills:

Most customers are introduced to Yü through a broker, with the sales pitch involving keen pricing, tip-top service and straightforward billing. Clients include restaurants, factories, car workshops and estate agents. Yü supplies their gas and electricity through a five-year wholesale arrangement with Shell.

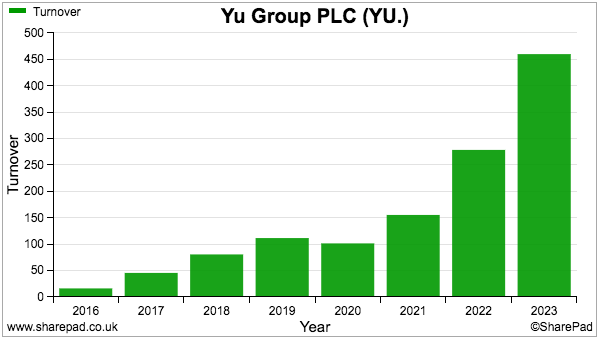

More customers and higher energy prices have pushed revenue to £460 million:

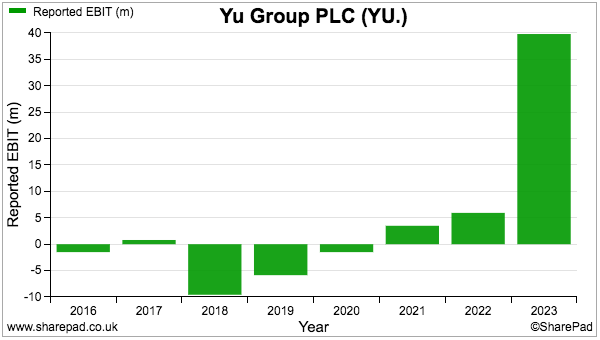

The higher revenue has converted losses into a magnificent £39 million profit:

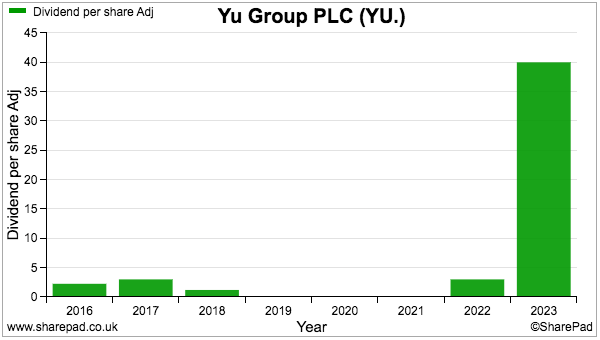

The dividend has staged a similarly remarkable recovery:

Last year’s bumper 40p per share payout followed years of token dividends or no dividends at all.

The absence of dividends reflected a sorry time for Yü. The shares joined AIM during 2016 at 185p, and rallied to £13…

…only to slump to less than £1 during 2019 and 2020 following an alarming accounting update mixed in with the pandemic downturn. Those troubles now seem a distant memory with the recent £19 price supporting a £314 million market cap.

Bookkeeping bombshell

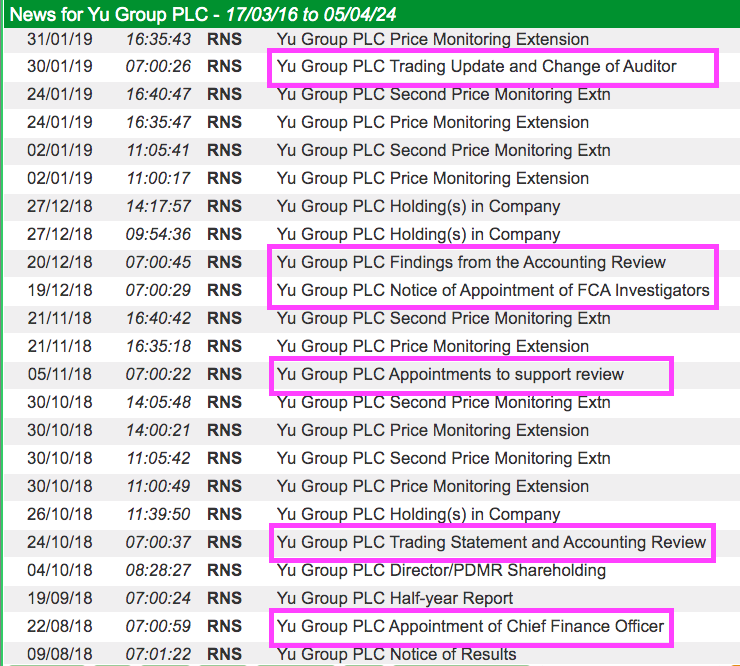

The aforementioned alarming accounting update stunned the stock market during October 2018.

Leading up to the bombshell, Yü’s results had shown upbeat progress; annual revenue almost tripled from £16m to £47m to lift profit from £205,000 to £3.1 million. In fact, the week after those figures were published, investors supported a £12 million placing at £10 a share.

Yü’s finance director announcing his departure two months after investors parted with £12 million was, with hindsight, somewhat ominous.

A new finance director was appointed in September 2018 and quickly unearthed concerns about accrued income, trade debtors and the associated impact on gross margins.

Yü had essentially over-estimated certain revenue and under-estimated bad debts. The upshot would be a £10 million hit to expected profits that would ultimately lead to the group reporting a £10 million loss.

Yü suffered an FCA investigation and received a public censure from the Stock Exchange. Yü admitted the problems were due to its “rapid expansion…which had, at the time, outgrown [the group’s] internal financial controls and reporting systems.” The LSE waived a £300,000 fine because of Yü’s then precarious financial position and the “economic uncertainty” due to the pandemic:

Joining the new finance director has been a new chairman, a new non-exec and a new auditor, which introduced two new key audit matters for 2019 — i) Revenue recognition, and; ii) Valuation of trade receivables — that reassuringly remain in force today.

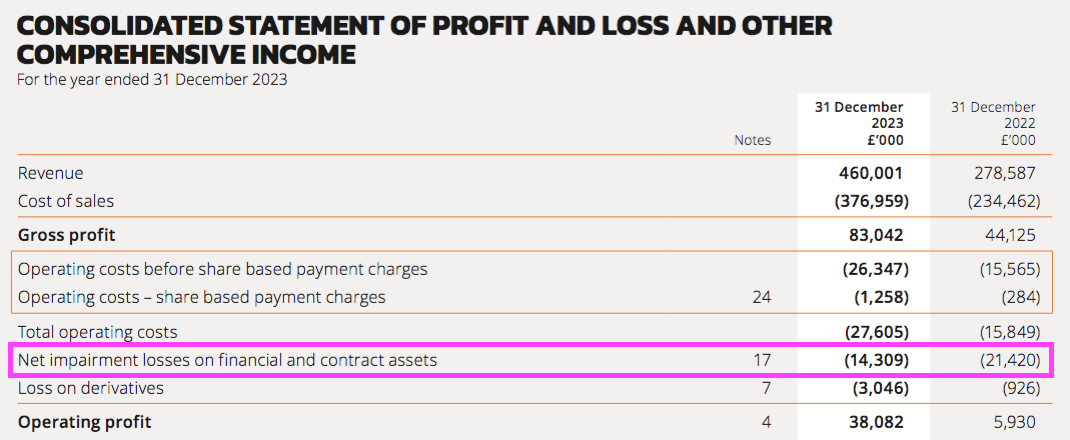

Last year’s bumper £39 million profit suggests the bookkeeping bother has now been resolved. Yü nonetheless continues to invoice customers — and therefore recognise revenue — based on estimated meter readings that could be very inaccurate.

And struggling small-business customers may still not pay their bills, whether the meter readings are accurate or not.

Bad debt charges are not insignificant here; the latest accounts show Yü suffering a £14 million provision for 2023 that followed a £21 million charge for 2022:

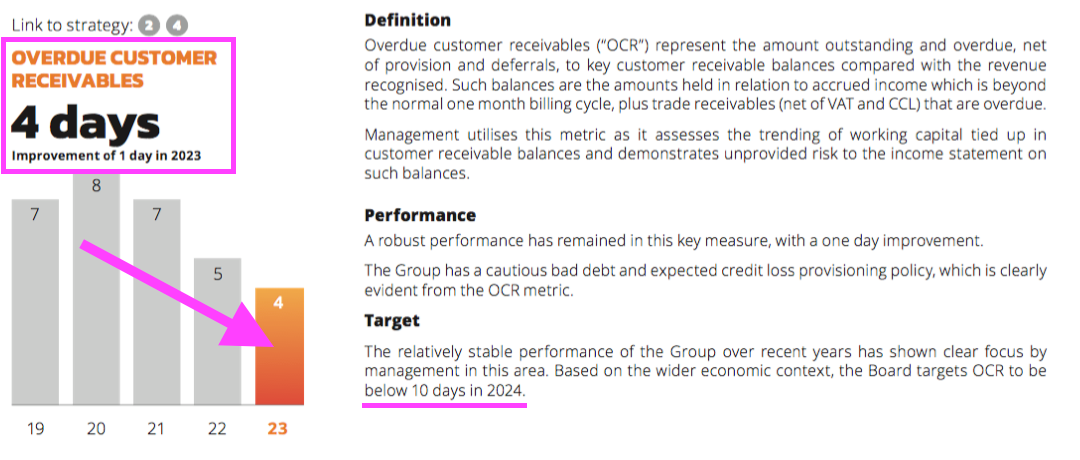

Still, the ‘overdue customer receivables’ KPI shows promising reductions during the last few years:

Mind you, a KPI target of ten days for 2024 versus four days for 2023 does not seem too challenging.

Yü’s SharePad summary

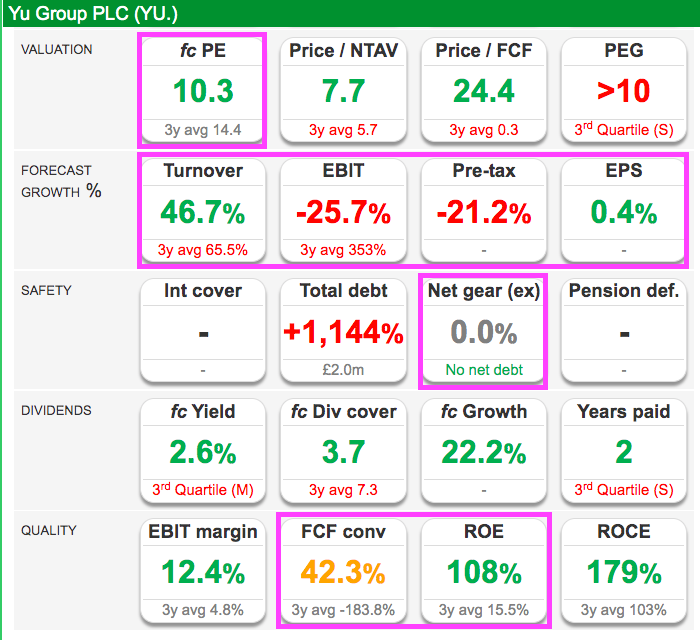

Yü’s SharePad summary is shown below:

I note:

- The P/E of 10 on the top row;

- The mixed forecast growth rates on the second row;

- The presence of net cash on the middle row, and;

- The weak cash conversion and high ROE on the bottom row.

Let’s start with that bottom row.

Cash conversion, return on equity and profit margins

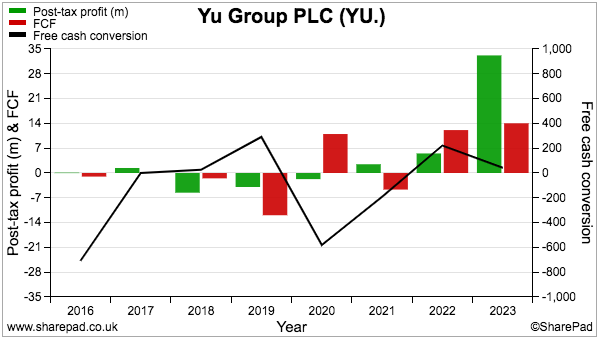

Yü’s conversion of reported earnings into free cash has fluctuated significantly from year to year:

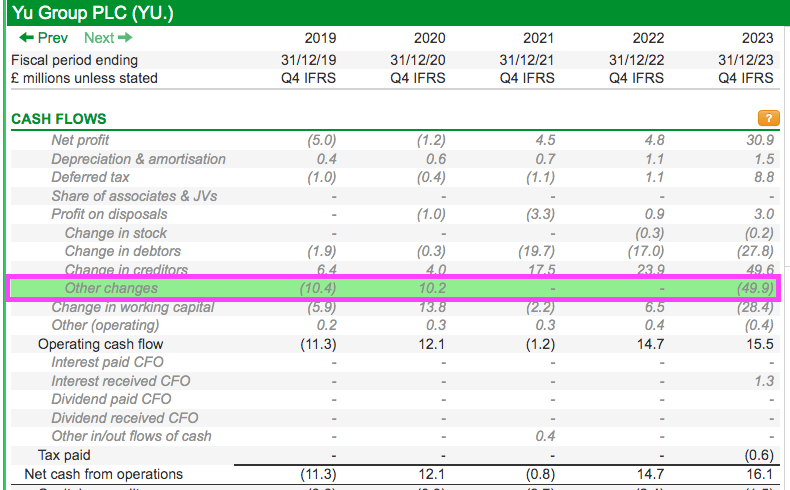

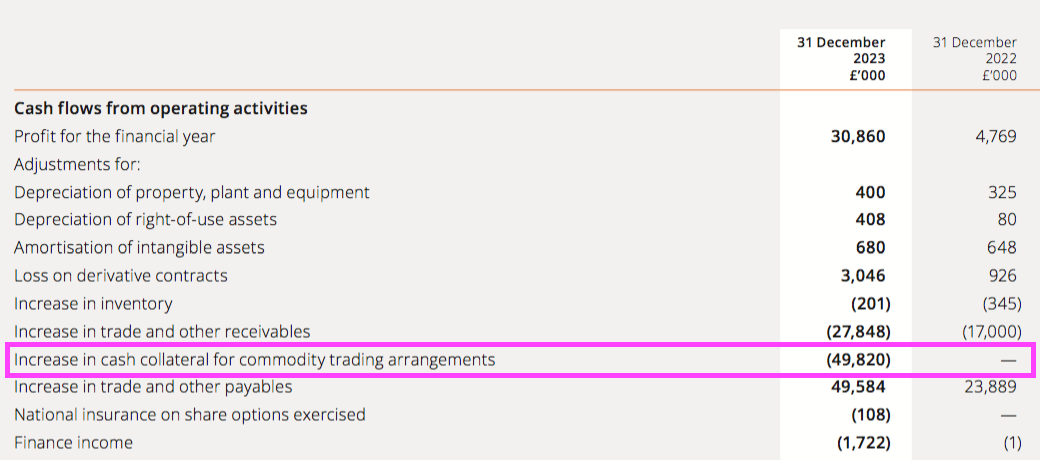

SharePad shows the fluctuations have been due mostly to substantial sums accounted for as ‘other changes’:

Yü’s annual reports reveal the ‘other changes’ relate to the collateral required by the group’s (previous) wholesale energy supplier:

Prior to signing the aforementioned arrangement with Shell earlier this year, Yü had to occasionally post collateral with its (previous) wholesale supplier to cover potentially adverse market movements.

The new Shell deal does not require collateral, which should improve Yü’s cash conversion for 2024 and beyond. The termination of Yü’s previous supply arrangement means the £50 million collateral lodged last year will return to the group.

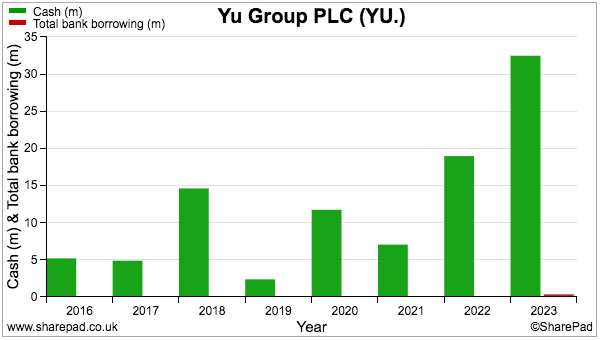

Net cash was £32 million last year…

…but with the £50 million collateral being returned gives £82 million or 489p per share.

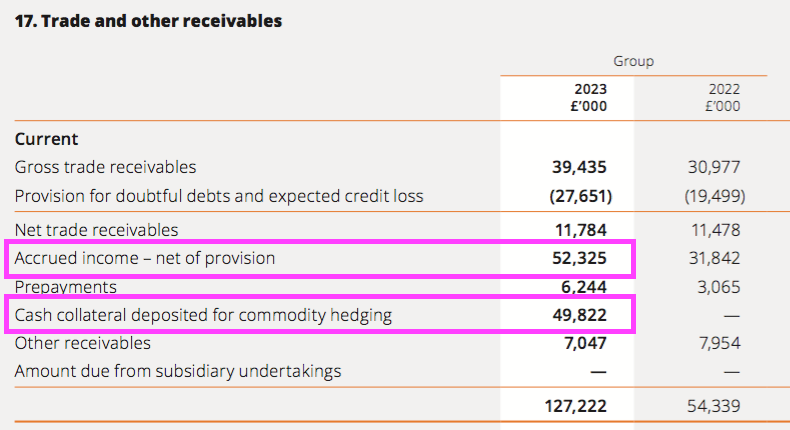

The £50 million collateral was treated as a receivable and was Yü’s second-largest asset for 2023:

The largest asset was ‘accrued income’ at £52 million, which reflects (estimated) invoices yet to be sent to customers.

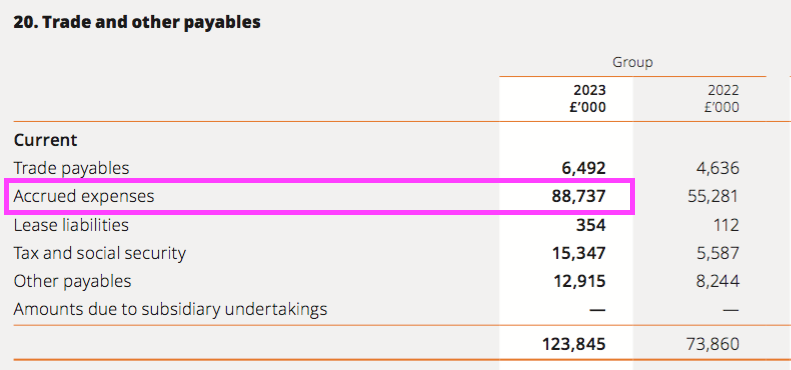

The ‘accrued income’ is thankfully more than counterbalanced by ‘accrued expenses’ of £89 million:

‘Accrued expenses’ represent costs incurred during the year for which an invoice has yet to be received. The £89 million entry includes £21 million to pay the regulator for renewables obligation certificates, while the rest presumably relates to money owed by Yü to its previous wholesale supplier.

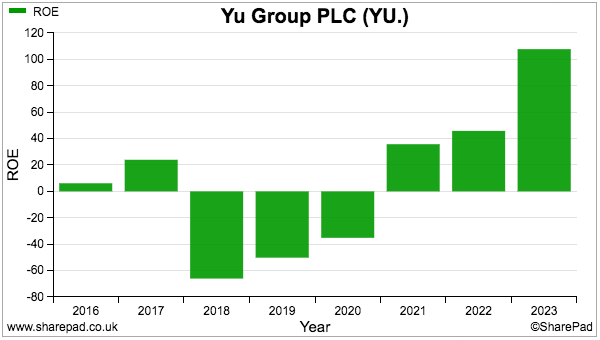

All the monies owed to and by Yü largely balance each other out to leave a relatively small equity base, and the bumper 2023 profit therefore pushed ROE to a super 108%:

Although Yü will not be required to lodge collateral with Shell, payment terms with the new wholesaler may be tighter and therefore the level of ‘accrued expenses’ that Yü could enjoy might not be as generous.

Yü’s last results suggested the Shell deal would help preserve its gross margin:

“Through our efficient and capital-light trading agreement with Shell, we can access wholesale commodity markets to forward buy our customers’ demand requirements, which mitigates risks from market volatility and preserves gross margin assumed at the point of sale”

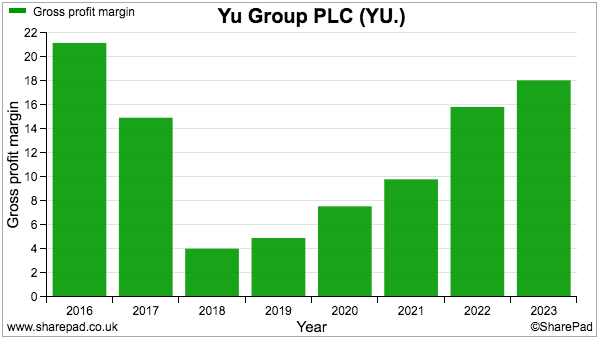

The gross margin has improved over time to 18% as customer volumes and energy prices both increased:

Also helping the margin is Yü’s ‘black-swan-tested’ hedging that ensures wholesale supplies are purchased according to the fixed-price contracts paid by customers:

“Our commodity hedging programme has been stress-tested over various black-swan events which increased commodity volatility to 20-year highs and we have demonstrated through our results that our hedging remains robust even in highly volatile markets.”

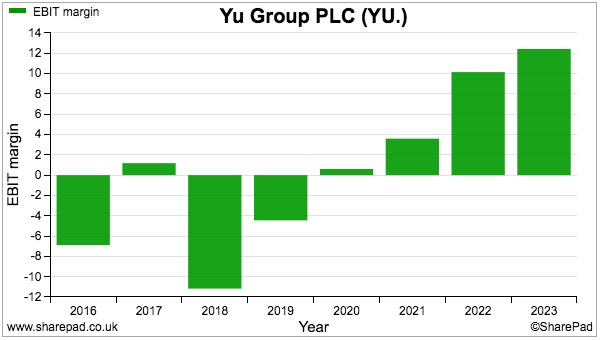

The improved gross margin plus admin costs kept at 6% of revenue have lifted the operating margin to 12%, which seems a very commendable level for an energy reseller:

Management and employees

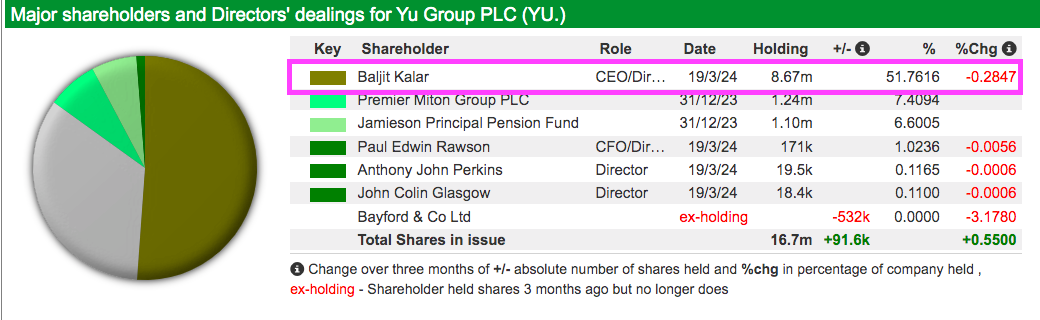

Bobby Kalar remains Yü’s chief executive and — despite the rocketing share price — has yet to lock in any gains:

After selling nearly 40% of his holding at the float, Mr Kalar retains a 52%/£162 million stake and encouragingly appears invested for the long term. Mr Kalar certainly has time on his side versus many other quoted-company chief execs; he turns 49 later this year.

Comments from the chairman — including “energetic stewardship” and “indefatigable and entrepreneurial vision” — suggest Mr Kalar leads Yü with a deep sense of urgency.

The last annual report talks of the group cultivating a “dynamic, engaging and inclusive work environment where ambition thrives, and our team is motivated to create meaningful change for our customers…”

…while revenue per employee has reflected Mr Kalar’s industrious work ethic through tremendous improvements:

Shareholders who have multi-bagged with Yü probably won’t mind too much about employee options representing a notable 9% of the share count with vesting dependent on undisclosed conditions.

Nor will they quibble with Mr Kalar collecting a bonus (£670k) that was twice his annual salary (£330k) last year.

Risks, valuation and verdict

I see four main risks for Yü:

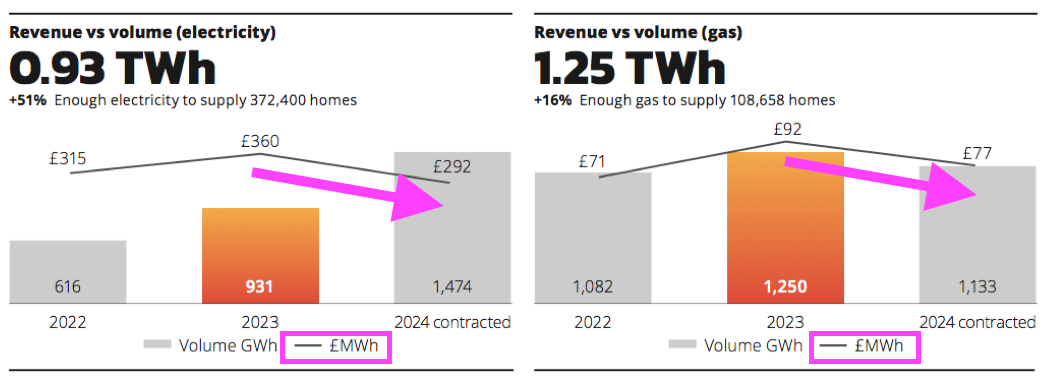

1) Wholesale energy prices decline leading eventually to lower customer bills and revenue. I note contracted revenue per MWh is lower for 2024 than it was for 2023:

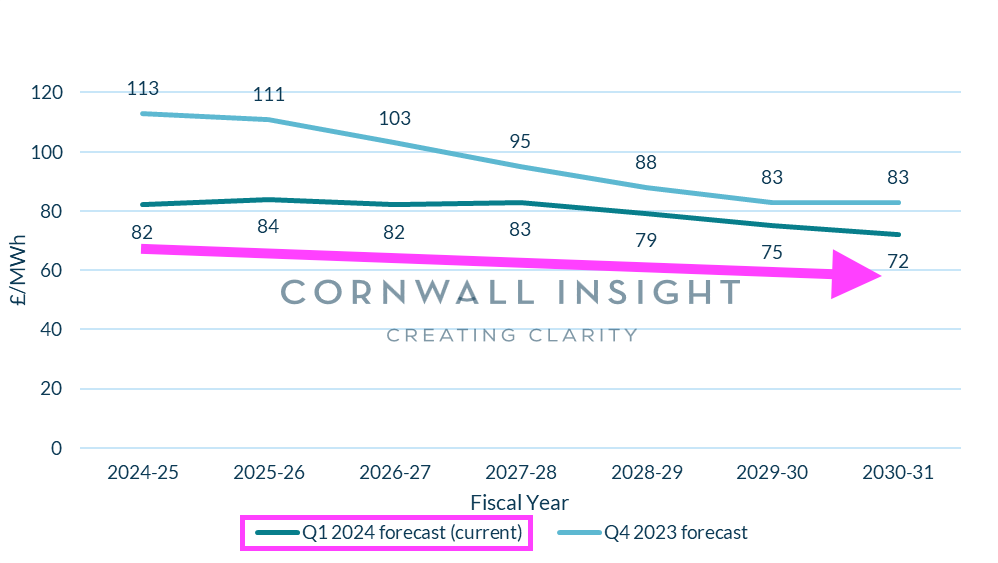

Consultants Cornwall Insight meanwhile reckon power prices will be flat at best for the rest of the decade:

2) The ‘black-swan-tested’ hedging fails to cater for an unexpected market event and Yü finds itself stuck with inappropriate wholesale contracts.

3) The economics of the new Shell deal do not prove as beneficial as management had expected.

4) A deteriorating economy leads to a greater number of small-business failures and increased bad debts.

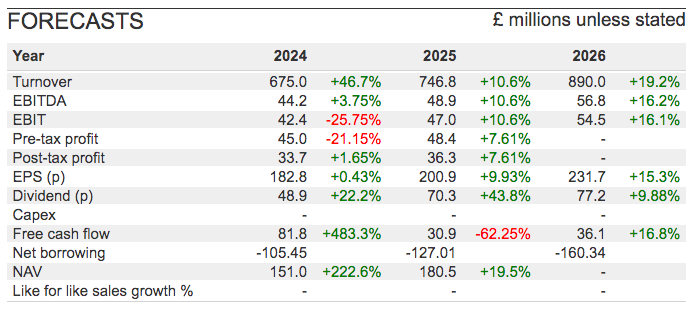

Maybe those worries explain that P/E of 10 on the Summary page. SharePad carries the following forecasts:

Note the mixed growth rates for 2024 are due to SharePad, brokers and the company each having differing interpretations of profit.

Believe the 2026 projections, and the P/E drops to 8, the yield tops 4% and the anticipated net cash of £160 million supports half the current market cap at £19.

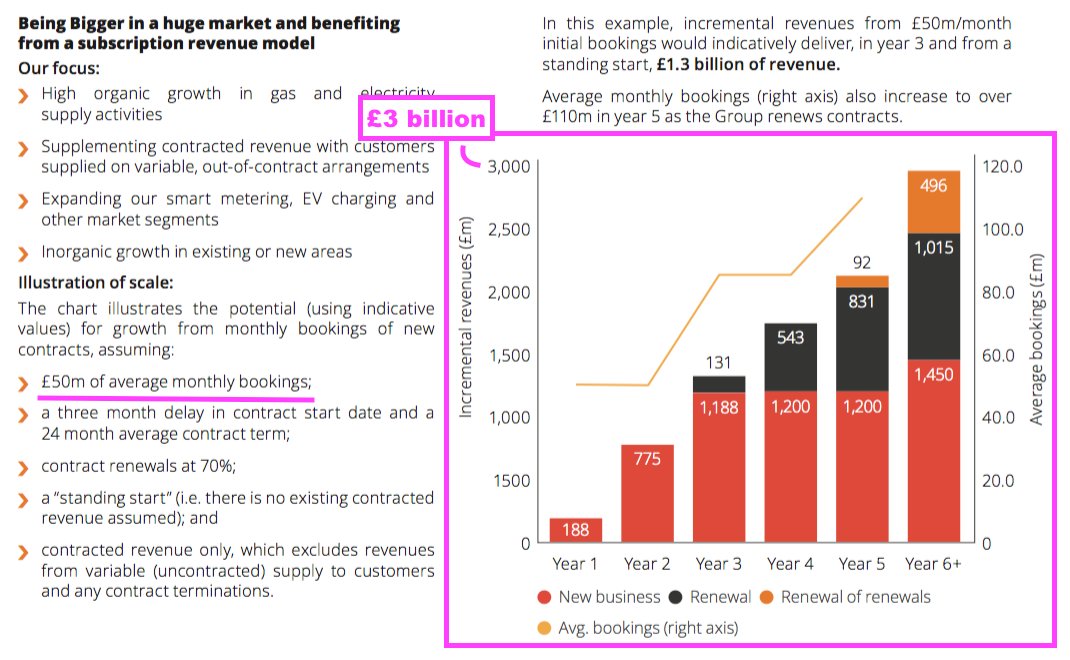

More intriguingly, Yü has presented the following chart that seemingly implies its current (£55 million) run-rate of monthly bookings could translate into revenue of £3 billion after the next six years:

Yü has already gone from zero revenue to £460 million in ten years and is already saying the Shell deal should help it scale to £1 billion.

Revenue of £3 billion may seem a tall order, but having survived an accounting bombshell, the pandemic and the gas-price spike of 2022…

…maybe the “energetic stewardship” of Mr Kalar could indeed take Yü to what would be only a c6% share of the business energy market.

After all, Yü’s potential is predicated mostly on capturing unhappy customers from the likes of British Gas, EON and EDF…

…and poor service from the major suppliers is quite possibly the only predictable feature of the UK’s energy market.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Yü Group.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.