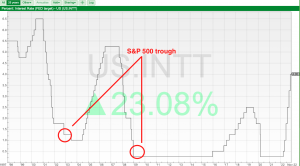

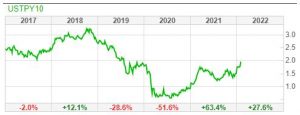

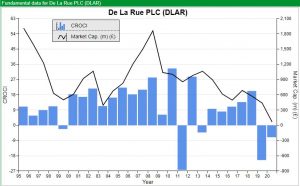

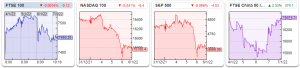

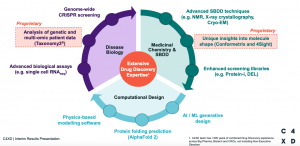

Bruce looks at the bounce in markets over the last 2 months and suggests some ideas that could benefit from a recovery in risk appetite. C4XD, CRL, PEEL, FCAP We’ve had a strong rally in markets since the lows at the beginning of October, the pound is up +15% against the dollar and AIM is […]