Bruce looks at tech stocks reporting Q1 results in the US, Google vs Facebook, and the resurgence of Microsoft. Plus a mix of UK companies reporting this week, including Tristel, Water Intelligence, HeiQ and Sylvania.

Bruce looks at tech stocks reporting Q1 results in the US, Google vs Facebook, and the resurgence of Microsoft. Plus a mix of UK companies reporting this week, including Tristel, Water Intelligence, HeiQ and Sylvania.

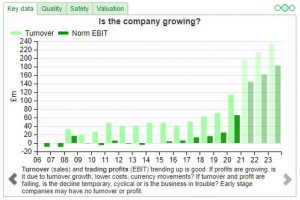

Markets have been very strong recently, so it’s important not to get carried away. Bruce looks at stocks with accrued income, % revenue recognition, acquisition and fair value accounting adjustments.

Bruce wonders if value vs momentum factors is really the best way to think about companies on the stock market. He also looks at the Novacyt profit warning, The Mission, and two high performance stocks: Volex and Impax.

We are most of the way through result season for companies with December year ends. Bruce discusses how companies with patchy track records can border on evasive in their RNS disclosure, without quite crossing the line to unacceptable. Often the share price reactions suggests that investors aren’t fooled though.

There have been at least 15 ten baggers since the March low in the UK. Bruce looks at 4 stocks that now have a fair wind behind them, that should be geared into further recovery.

Bruce compares a couple of Direct Carrier Billing (DCB), mobile payment platforms: Boku v Bango. He wonders if platform economics has become too popular, with the benefits well recognised but not downside. Also Ocean Wilsons, the Brazilian (Salvador, Bahia) port business.

Bruce looks at the fungible vs non fungible assets, using examples from recent events in the art markets. Stocks covered this week are Kape, Somero and Tremor.

With Scottish Mortgage Inv Trust down 9% last week, Bruce looks at the debate between Lawrence “usually a mistake to sell” Burns of Baillie Gifford and Andrew “take profits” Dickson of Albert Bridge Capital. Companies covered Renishaw, Solid State, K3 Capital and Franchise Brands.

Nasdaq sold off last week, down 7% since the middle of February, though still up since the start of the year. Tesla fell to $680, versus a peak of $896 earlier in February. US 10y yields hit 1.49% last week up over 50bp in the last month Financial bubbles don’t pop because speculators suddenly start […]

At midnight, on 1st January this year, the K.L.F. released their back catalogue of music (hits such as 3AM Eternal, Justified and Ancient, Last Train to Trancentral) on Spotify and uploaded their old videos to YouTube. This was their first activity as a band since 1992, when they announced they were leaving the music industry […]

Last week Bloomberg reported that junk bond yields in the US fell below 4% the lowest level ever recorded and down from 11.5% peak yield in March last year. This is the opposite direction to the yield on the “risk free rate” of US 10y bond (hitting 1.18% last week) which has been steadily rising […]

Moonpig IPO’ed last week at 350p, valuing the company at £1.2bn, and the shares rose +24% to 430p the following day. Meanwhile the FT reported that Elon Musk is expecting SpaceX to be valued at $60bn in a funding round later this month. Virgin Galactic is up +163% in the last 3 months. Valuations are […]

Some of the speculative exuberance has spilled over the punch bowl at the cryptocurrency party into a number of glass half empty equities. GameStonk, err I mean GameStop, rose from below $20 a share earlier this month to over $500 per share, as retail traders from the Reddit thread “Wall Street Bets” piled in to […]

I was initially unimpressed by the UK’s mass vaccination rollout. However it is important to keep updating your beliefs when data is better than you had been expecting and not miss the inflection point. From below 150K per week in December, we now have almost 5m vaccinated. My mistake was to extrapolate in a linear […]

In the early days of a new Democrat presidency, the President’s campaign manager observed that: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a 0.400 baseball hitter. But now I want to come back as the bond market. You can intimidate anybody.” The […]

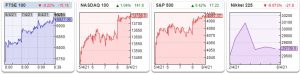

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington. 10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of […]

“Until the day when God shall deign to reveal the future to man, all human wisdom is summed up in these two words… wait and hope.” – The Count of Monte Cristo The FTSE 100 finished the year at 6460, down 14% from 7585 this time last year. There were some odd movements in share […]

The FTSE 100 closed around 6,487 to 24 December down -15% from the start of the year. From a peak of 7670 in mid-January the index fell by -35% to a low of 4998 at the end of March before recovering +30%. A reminder of the importance of pound cost averaging, because a -30% drop, […]

The FTSE stayed level around 6580, while Nasdaq hit a new high of 12752. Bitcoin rose through $20,000 for the first time. I have a dim memory of a party in South London, around 2006-2007, when someone began trying to convince me that everyone could create their own electronic currency. After all, he said, money […]

After a strong November and start of December the FTSE 100 was largely unchanged this week at 6566. More broadly, the signs of a cyclical recovery are evident: oil price rose through $50 a barrel and copper and other industrial commodities have also been strong. Airbnb IPO’ed with the shares closing on their first day […]

The best performing FTSE 100 stock last week was Rolls Royce, up 19%. The worst was Unilever down 6.5%, which suggests expectations of a vaccine are inoculating investors against risk. On Nasdaq, the vaccine stock Moderna, was the best performing up 44% in the last 5 days, while Zoom was the second worst performing down […]

FTSE weakened slightly to 6300 in the second half of last week, but the bounce of former “Covid losers” continued with Rolls Royce, Glencore, Shell and BP all up 8% in the last 5 days. Nasdaq continued to rise to 12152 and Tesla’s value exceeded half a trillion dollars. airbnb IPO Last week airbnb filed […]

We are beginning to see companies operating in the “real” economy announce raised guidance. Somero (exceeding previous revenue guidance by +7%), but also Headlam (materially ahead), Acesso (comfortably ahead). Saga share price was also up +57% during the week. The FTSE 100 is currently 6378, which is the same level as early March this year. […]

Banks and other “covid losers” were up strongly at the start of last week as Pfizer announced they believe they have a credible vaccine. US Treasuries 10 year yield jumped up to 0.98% (the red dot on the chart below) from the 0.79% last week. This is a significant move, the yield curve seems to […]

The US Presidential election turned out to be closer than most people expected. Nasdaq up almost +10% over the week to 12078. Tech stocks reacted well to the uncertainty, but so did 10 year US Bond yields, which initially jumped to 0.9% before falling back to 0.78%. I’m not sure if you’d predicted the result, […]

Last week markets sold off into the rising cases of Covid. The FTSE 100 fell 5% last week to 5561. Large UK banks HSBC and NatWest reported encouraging results, although the sector remained unloved. Directors selling Given the strength of the market’s rally over the last 6 months, and then last week’s sell off, I […]

Markets recovered slightly towards the end of the week, with the FTSE 100 at 5888. Nasdaq was at 11662. Last week Netflix reported Q3 results, with “only” 2m net new subscribers in the quarter, v 16m in Q1 and 10m in Q2. The company had previously guided that subscribers would slow in Q3 to 2.5m […]

“Fad companies are companies with good business models or good products. So, why would we be interested in shorting a company that has a good product? Because of the threat it presents to others and their likely response to that threat. For example, Netflix had a terrific idea of renting DVDs through the mail, which […]

Last week the FTSE recovered to just over 6000. The (perhaps inappropriately named) Bond film No Time to Die, was postponed until next year by its Hollywood studio, MGM, which has left cinemas in trouble. Cineworld is on the brink, a victim of an overly leveraged balance sheet but no product to distribute. Up until […]

Last week Andy Haldane at the Bank of England gave an interesting speech on “Economic Anxiety” noting that pessimism can be as contagious as the disease. Haldane is most famous for his “Dog and the Frisbee” speech, which he co-wrote with the famous psychologist Gerd Gigarenzer in 2012. Catching a frisbee is difficult; theoretically it […]

Markets sold off last week as virus case rises rose (FTSE 100 fell to below 5800 before recovering slightly later in the week, Nasdaq down 4% to 10,800). The virus itself seems reasonably predictable, everyone has been expecting cases to rise as summer turns to autumn. What hasn’t been predictable is Government responses around the […]

The FTSE 100 just about held its level above 6000 last week. Last week was Chilean Independence Day. It is a little known footnote in history that Lord Cochrane, who was involved in the great Stock Exchange scam of 1814 (accused of starting rumours of Napoleon’s death via the Admiralty’s semaphore telegraph) helped not one, […]

The oil price fell to a 3 month low in the middle of last week to below $40 a barrel. Oil is in contango (futures price higher than spot price) which suggests that despite production cuts, traders are still worried about demand over the next few months. Ironically Tesla shares were off even more sharply […]

St Leger Day, as in ““Sell in May and go away, don’t come back till St Leger Day”, is approaching. I’ve always wondered who St Leger was, and why a saint might have had a horse race named in his honour. Was Saint Leger the patron saint of book making? Well no, it turns out […]

Nasdaq continued to hit new highs, at 11,666 up +30% from the start of the year and up 2.5x in the last 5 years. I can’t think of anyone suggesting in January that all three of I) Gold, II) Govt bonds and III) Nasdaq would be up strongly from the start of the year. Such […]

Rightmove released a survey showing that the UK housing agreed sales picked up strongly to a record £37bn. A day later Persimmon reported half year results to end of June, adding that reported sales since the start of July were up 49% vs the same period last year. This would not have come as a […]

The last “forever” stock For Jeremy’s last weekly note he reviews his value investing mistakes and aims to find the stock that in 10 years’ time will ensure he is remembered fondly. Read more

Lessons In the spirit of reflection in a year of uncertainty and extremes, Jeremy analyses some past weekly notes and takes another look at one he wants to dig his heels in on and say “I am sure I am right”. Read more

The Relative Value Trade With a huge injection of liquidity last week the valuation differential between large US tech stocks and UK small companies is becoming extreme. Jeremy takes a look at the relative merits of LoopUp vs Zoom and Beeks Financial Cloud vs RobinHood. Read more

Clearing up the debris The pace of structural change is faster, perhaps, than ever before and there are an increasing number of quoted companies dedicated to managing this change. A new entrant into the insolvency funding market, RBG Holdings, could well be set to benefit despite a number of red flags. Read more

Flight to Quality As the bubble spreads from large tech to healthcare and motor companies in anticipation of a flight to quality Jeremy takes a look at Judges Scientific and SDI Group. Read more

Inflation The growth bubble continues, but eyeing inflationary storm clouds gathering over the horizon Jeremy takes a look at Melrose Industries as a potential hedge against inflationary threats. Read more

Director Dealing As markets tread water after extreme volatility Jeremy finds that directors have a 77% win rate on their purchasing during the volatility. A trawl of those still underwater may indicate some treasures that are overlooked. Read more

High Conviction from here on With the seamless transition from bear market to bubble Jeremy suspects that now is a time to make sure we have conviction in our holdings. Tatton Asset management is his highest conviction holding. Read more

On-line valuations The silly valuation of the latest US IPO causes Jeremy to ponder some of the UK online valuations and finds the spreadbetters to be under appreciated by UK markets Read more

The Recovery Trade In this strong market the pain trade is to buy. There are reasons this could be right and Jeremy suggests the carpet retailers recovery potential hasn’t yet been reflected. Read more

Dash to Trash After 14 years of growth out-performance, value is now set to perform in a recovery. Jeremy takes a look at the value available in the high street banks and wonders if the value will out. Read more

Investing in Intangibles Intangibles take greater precedence today. Both accountants and governments struggle with this while markets are quick to find answers through royalty companies. Trident looks potentially interesting while Duke Royalty may have a good concept but may have strayed into private equity land. Read more

Investing in Acquirors Jeremy worries about software valuations and is concerned that returns at Ideagen and Tracsis could turn out to be far less than markets appraise them to be. Read more

The 50-year view As equity markets squeeze up Jeremy suggests equities may have further to go on the back of credit markets. A screen of resilient dividend payers finds 3 strong fund managers to be some of the best performers in the current money printing environment. City of London Investment Group is the recovery situation […]

The Small Cap Opportunity With markets squeezing up, pushed by central banks money printing we are at a moment of opportunity for overlooked small cap stocks. Jeremy takes a look at Eddie Stobart Logistics and FBD Holding as two complex and therefore potentially overlooked situations. Read more

To the Future With markets trending sideways Jeremy sees inflation ahead and takes at look at the food manufacturers which could be beneficiaries. Devro’s sausage casings could benefit in due course while Greencore could be a recovery stock. Read more

Depression in a Wall of Money The market is caught between an oncoming depression and a wall of money inflating valuations. In this environment the bar bell approach is more appropriate than ever. Jeremy looks at Genus, Aquis Exchange and Urban Exposure as companies at differing ends of the bar bell. Read more

With Recovery comes Refinance It is easy to stress over whether we are in a bear rally or the start of a bull market. But we know that companies have stressed balance sheets from disruption. Rather than chase individual opportunities it may be simpler to own the quoted brokers. This could be their time. Read more

After Value comes Recovery In a world full of value Jeremy takes a look at what a recovery may look like and picks a couple of cyclical recovery stocks with strong balance sheets that should benefit strongly in recovery. Mission Group and Zotefoams. Read more

Value time With no earnings visibility it is easy to forget there are green shoots over the horizon. This is a time to seek value. A SharePad screen reveals 11 situations, of which 6 look worthy of further research. Read more

Irrational or True? We are now in a market of fear and there are signs of inefficiency and irrational behaviour, which is a time of opportunity. Jeremy highlights Plus 500 with conviction. Read more

Timing is everything With the current crisis Jeremy dusts off the recovery stocks folder. Airlines that survive will have huge upside on the back of a lower oil price. The opportunity may be in the likely refinancing issues, and Primary bid is a useful tool to enables retail investors to participate. Jeremy registers his interest […]

Purging Excess Bear markets cleanse excess. Jeremy takes a look at the growth narratives and accounting adjustments that have been adopted and suspects the bear market may continue until these are cleansed. Read more

Correction or Bear Market? The question of whether the sudden market correction is a temporary contagion of fear, or the beginning of a bear market is key now. Fearing the bear, Jeremy finds a lot of attractions in Andrew Sykes. Read more

Barbell Portfolio The tax advantages of technology companies and private equity combined with quantitative easing are shrinking stock markets. Until this changes the shrinkage will continue. In this environment a Barbell portfolio is likely to outperform. Jeremy suggests Alpha FX and Non Standard Finance as two companies at polar opposites of the valuation spectrum. Read […]

Dinosaurs don’t gallop Jim Slater coined the term “elephants don’t gallop” and in this technology enabled era it may be better termed “dinosaurs don’t gallop”. In a hunt for tech enabled small companies Jeremy finds himself enamoured with Plus 500. Read more

Employee Culture With quality as the watchword a review of staff feedback can tell us much about the culture of a company. A review of all companies on AIM underlines conviction in some highly rated companies while underlining that Applegreen, the petrol forecourt operator is more about financial leverage than staff welfare. Read more

Mind the Gap It’s been a good few months. The FTSE small cap is up 14% since October, while the FTSE 100 is up around 7%. Suddenly the buy ideas start to disappear with prices adjusting upwards as the arrival of dawn reminds us the party is nearing a close. Which is often a useful […]

Culture in Payments There were no spare seats when I arrived at Panmure Gordon’s offices last week for the Non-Standard Finance investor day titled “Culture driven Performance”. The presentation was riddled with keywords such as “Integrity”, “Clarity”, “Respect”, “Trust”, “Empathy” etc. I particularly liked John Van Kuffeler’s description of the loan correspondence he has from […]

Culture Luck plays a part in investing but there is also a theory that you make your luck. Both K3Capital and Dart Group are cyclical businesses which performed strongly in the second half of last year. It could be that they got lucky with the cycle going in their favour or Thomas Cook going bust, […]

The Roaring 20’s Nothing quite starts a new decade as reassuringly as Greggs Vegan Steak Bake causing late night queuing in Newcastle. With Pizza Hut’s vegan pepperoni pizza, Costa’s vegan ham and cheese toastie, KFC’s vegan chicken burger and M&S’ vegan chicken Kiev and Macdonald’s veggie dippers this could be a good decade to be […]

Change Alley Suggesting that Scrooge’s drive and self-discipline was something we should aspire to didn’t go down well with my millennial children. I rationalised the barrage of criticism as the product of low rates, plentiful debt and cheap money making the concept of being economical unpopular. Scrooge’s world was one of narrow dark alleyways -similar […]

Lessons for 2020 It has been rather enjoyable as the year draws to a close. The Boris Bounce was a pleasant experience for investors. Excitingly for some it was a rally in the value stocks. Top of the leader board was the FTSE Small cap rising 5.6% closely followed by those high yield stocks while […]

The Golden Era of Small Caps The fear was palpable last Thursday as I sat in a broking office. The millennials queuing at the voting booths put the fear of God into those traders worrying about a labour government. The traders’ buy to let property portfolios that they had constructed in the image of the […]

The Volatility Reduction Trade The gating of M&G’s property fund caused the press to become excitable last week. The Questor column in The Telegraph advised investors they were “crazy” to have money in open ended property funds as Aberdeen Property fund redemptions accelerated. Brexit crisis and retail gloom also featured as news wires sensed a […]

Shrinking Markets The liquidation of Nautilus Minerals caught my eye last week. This was a company which was to be one of the first underwater miners aiming to recover gold, silver and copper from deep water off the coast of Papua New Guinea. Such escapades are not new. In the 1680’s the government “found” some […]

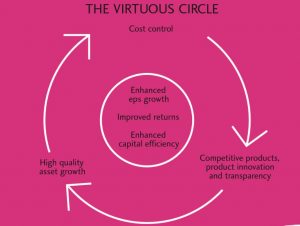

Superstocks I have been living with value stock affliction for some time. It can be irritating particularly when the wind is blowing the wrong way. In the past it has led to text messages from colleagues saying “What price did you get into G4M – oh dear you don’t have any” – just after they […]

What Goes Around…. It is clear the technology growth bubble is now starting to unwind but the difficult question is where to go to next? I have wondered about the mining sector in previous weeks and last week I used some SharePad screens to find cheap, well capitalised, quality companies. In truth I have been […]

The Cult of Equities Each week that passes my excitement is building. Value is coming back. I have felt like a fish out of water as what appear to me to be millennials tell me I am crazy not buying the latest hot stock on a PE of 45X. And these millennials are buying their […]

Profiting from Folly and Disaster Old fashioned companies such as TP ICAP have started putting strong trading statement out which is strange times indeed. This is an old-fashioned voice broker of financial products. The staff are renowned for loud and boisterous traditional city behaviour which resulted in a £15m settlement with the regulator for their […]

Sticking to our guns Investing can be lonely. Buying stocks in a downturn can be hard – we don’t know if we are catching a falling knife. Traders tell us we should operate with a stop loss policy so we sell when a stock has gone down, say 20%, but for a long-term investor this […]

A New Era Dawns Often it is easy to be so pre-occupied with the present that we miss the elephant quietly sauntering past the boardroom windows. The focus on Woodford Investment Management closing its doors over the week end was deafening. It will no doubt continue on BBC Panorama at 8.30 tonight when it airs […]

Forex There are reasons to be gloomy just now. As I walked past Westminster last week the protester carrying an anti-Brexit placard looked forlorn as the extinction rebellion protesters drowned out his signage. Over in Hong Kong the protests are about something else altogether. While in Japan typhoons are disrupting the rugby. It is getting […]

Special Situations At times like this it is easy to make mistakes. I confess to being bored of my stocks. They haven’t done anything exciting for a while. The most exciting thing last week was Gervais Williams of Miton tipping Randall & Quilter in the Telegraph causing a 9% rise on the day. Volumes are […]

Liquidity Crunch Across the table in the rather tired looking meeting room, the grey haired but immaculately presented fund manager bit his bottom lip as he prepared to disclose something – telling me he was uncomfortable about what he was about to utter. This was probably the important part of the meeting. He is a […]

Navigating Change Conservatively Sometimes it can be useful to stand back and take stock so we don’t get those market eyes that can’t see the wood for the trees. It seems with the abandoning of the WeWork IPO the bubble may be drawing to a close. We have had such bubbles before. In the 1680’s […]

Inefficient Markets I find myself increasingly bullish. Or maybe I have recently had a holiday and by the end of the week all bullishness will have gone. Seemingly macro fears have led to risk aversion. The FTSE 100 is 7.7% down from its peak in May 18, while the FTSE Small Cap index is 18% […]

Business Models I found myself wondering whether models become outdated over time. In this age of diversity, governance reporting, and gender indexes I question whether our parliament using whips may be a little outdated. When I was at university, business models were those of manufacturers, distributors and retailers. We didn’t have “Bricks and Clicks”, “Freemium […]

It’s a bi-polar world Printing money hoping that will engineer inflation has in the past resulted in inflation, but it hasn’t worked. As central banks increase their balance sheets the hope was that banks use the reserves to create money to increase their lending, but that only happens when banks wish to lend and borrowers […]

The Great British Corporate Sale One of the things the City of London excels at is selling its own to overseas acquirors. Back in the day Messrs Wasserstein and Perella sold themselves to Dresdner Bank to create Dresdner Kleinwort Wasserstein which didn’t seem to end very well. Warburg sold themselves to Dillon Read until the […]

Agricultural Investing The nerves were tested last week. Back in Q4 last year the 17% fall in the FTSE 100 was one of those typical draw-downs that happen towards the top of a bull market. It is necessary to have sucked in all the “buy the dip” money before the market can reset finally when […]

The Narrative of Growth I suspect I am not alone in being trained as a value investor in the 1980’s. That was an era when straws were made of plastic, burgers were made of meat and bonds paid an income. No longer. Today in an era when bonds don’t pay income the trophies go to […]

In need of boredom Equity investors need to be an optimistic bunch – since equity markets outperform over the long run. Academics Dimson Marsh and Staunton titled their study of 20th century market returns “Triumph of the Optimists”. But sometimes it’s hard. Like last Wednesday when Intu reported a decline in NAV/share to 252p and […]

Testing times I find this one of the most uncomfortable investing era’s I can recall. The outperformance of growth stocks continues while markets grind higher over a sultry summer. I have always had a secret hankering after the ugly duckling that turns into a swan and so have a natural bias to value. Which has […]

The Greening of Fund Management It is still useful to contemplate the state of the world over a good lunch as I did last week enjoying a long and slow sunny afternoon with a fund manager friend. We reflected that undoubtedly the investors buying into Beyond Meat, the $10.7bn plant burger company would be the […]

Where are the Customers’ Yachts? The book “Where are the Customers’ Yachts?” by Fred Schwed was written 75 years ago but as we watch the continuing headlines over Woodford it seems as relevant today as then. It has some very useful investing lessons for us. Three of my favourite lines in the book are as […]

The Bubble has burst Sometimes we spend so long waiting for something to happen we don’t realise it has started. But I think it has already started. No one rings a bell at market changing points. There are the 1987 and 1929 crashes that are obvious but the top of the technology bubble in 200 […]

Disruption in the Courts Early for lunch on the 24th floor of Tower 42 in the City I gazed over the tower blocks of the city. When I started work the City buildings stopped at Liverpool Street Station. The area to the north of the station building was rough land inhabited by a flock of […]

Structural Change in the City It always amazes me how debt can lead to innovation. Humans find ingenious solutions. The Bank of England was founded in 1694 because the 9-year war against France was expensive. Usefully that enabled us to continue to increase the debt which brought about the South Sea Bubble and subsequent crash […]

It’s “avoid the warnings” time Last week saw a few profit warnings. Somero, Ted Baker, Quiz, Pendragon warnings were based on revenue disappointments but I suspect cost pressures are building too at the moment. The trend of increasing warnings appears to be a growth trend with Q1 showing the highest number of warnings in this […]

Companies with Culture The noise around Woodford’s humiliation last week was deafening. And it was a bad week for Hargreaves Lansdown (-14%). I don’t recall such a lot of noise around a fund manager since the demise of New Star in 2008 having paid a special dividend to shareholders and gearing up into a bear […]

The “End of Global Trade” Week Last week the talk moved from politics to trade wars. Consensus seems to be that the trade war between the US and China is set to continue for a while. With the UK political situation causing uncertainty which slows management decision making processes there is reason to worry that […]

Time to own value? Unicorns The Unicorns stable door has been left wide open. Beyond Meat, a US loss making protein meat brand, listed in New York in early May rising 163% on its first day of trading valuing it at 27X last year’s revenues. This followed the loss-making Pinterest rising 28% on its first […]