The Great British Corporate Sale

One of the things the City of London excels at is selling its own to overseas acquirors. Back in the day Messrs Wasserstein and Perella sold themselves to Dresdner Bank to create Dresdner Kleinwort Wasserstein which didn’t seem to end very well. Warburg sold themselves to Dillon Read until the swiss arrived and they all sold to UBS. Credit Suisse had already acquired Buckmaster and Moore in 1987. Merrill Lynch had bought Smith New Court and HSBS had bought James Capel and Samuel Montague. The blue blooded Cazenove was one of the last to hold out from the advances of overseas acquirors until JP Morgan finally bought them in 2009.

A particularly canny deal was the sale of 58% of Artemis in 2002 to the Dutch bank ABN Amro. In 2008 financial distress forced the sale of Artemis and was sold to BNP Paribas’ Fortis Bank triggering a payment of $558m for the 37% of Artemis still owned by staff. BNP Paribas then became a forced seller so in 2010 the staff and Affiliated Managers Group”AMG” “helped” Fortis out of their problem and bought the company back. The deal price was undisclosed, but AMG said it was at the low end of the range – between 8- and 10-times EBITDA. Based on the 2007 accounts at company’s house this would value the business at £434m-£542m which is not far above what the management received for their 37% stake less than 2 years previously.

I find myself wondering if we may enter an era when the rest of the UK sells itself to overseas acquirors. KPMG reported recently that the volume of private equity deals in the UK was down 35% in H1 2019 because of uncertainty over Brexit. If this is the case, there must be money waiting to be deployed as private equity has been raining funds this year. There are normally three things required for a good old-fashioned M&A feeding frenzy:

- Weak Sterling

- Credit availability

- Confidence

Perhaps we should take each of these in turn.

1. Weak Sterling

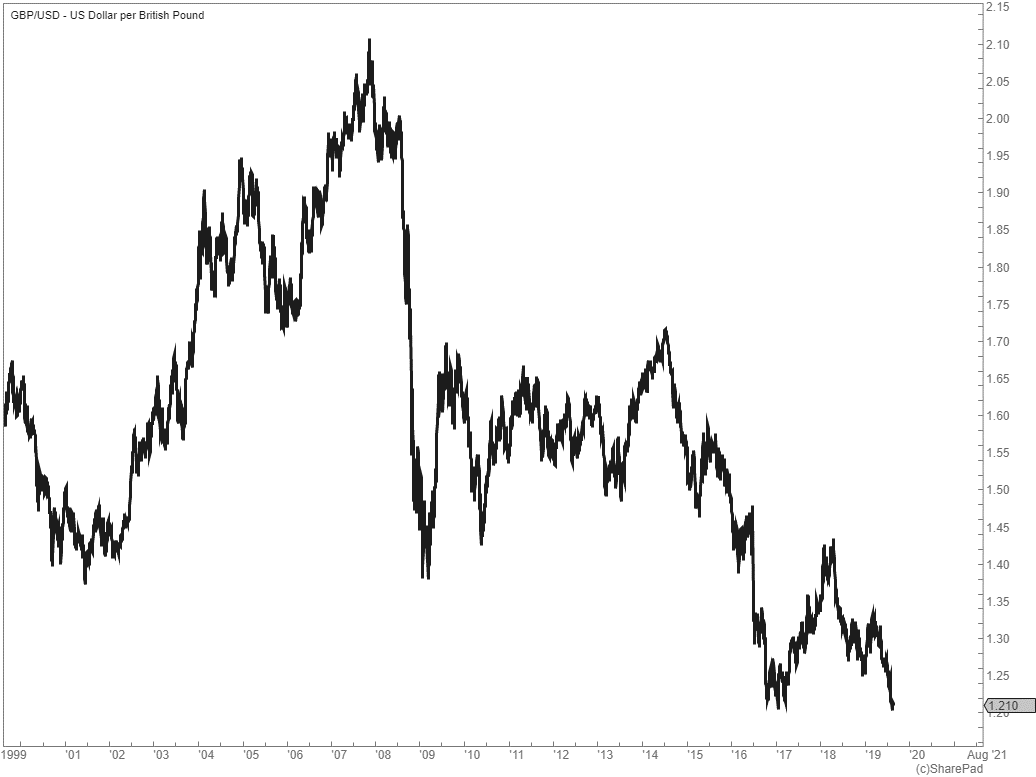

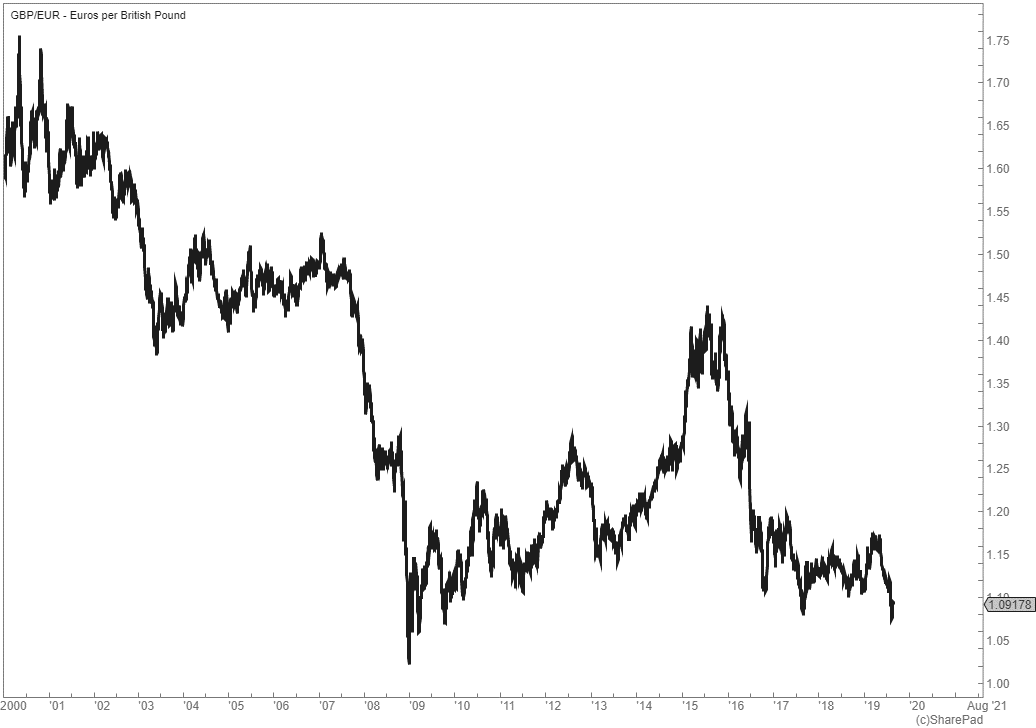

The Sharepad charts show that £ is close to a 20-year low against the US$ while against the Euro we haven’t quite reached the 2009 level, but it is getting close.

GBP/USD

GBP/EUR

This weak sterling will make UK companies far cheaper to a US buyer who is using dollars or a European buyer using Euros. While many Asian economies have pegged their currency to the dollar for several years it probably fair to say the same principle will apply to Asian countries.

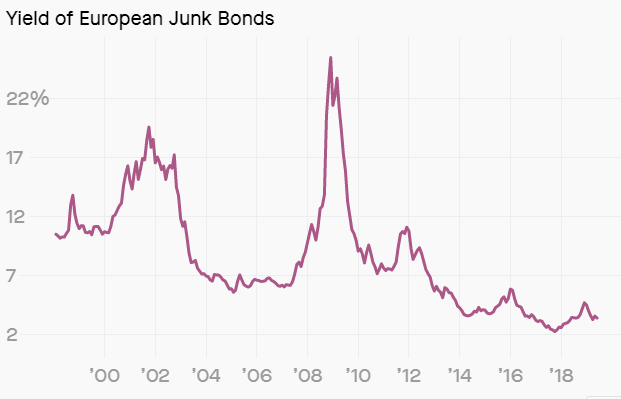

2. Availability of Credit

We know that interest rates are low driven by central banks. Governments can raise 50-year money at negative rates. Meanwhile junk bonds now yield less than some governments can raise money at.

Source: ATLAS Data: ICE BofAML

3. Confidence

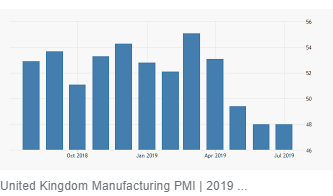

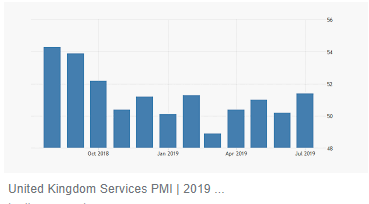

We are a little short on confidence at the moment but potentially post Brexit this could improve significantly. Trade Wars and Trump Tweets don’t help confidence. The Purchasing Managers Index (“PMI”) illustrates this well. This is a monthly survey of new orders, inventory levels, production, supplier deliveries, and employment which are equally weighted into a business confidence index. Below we can see that manufacturers have less confidence that Services, but both are well down on a year ago.

Source: tradingeconomics.com

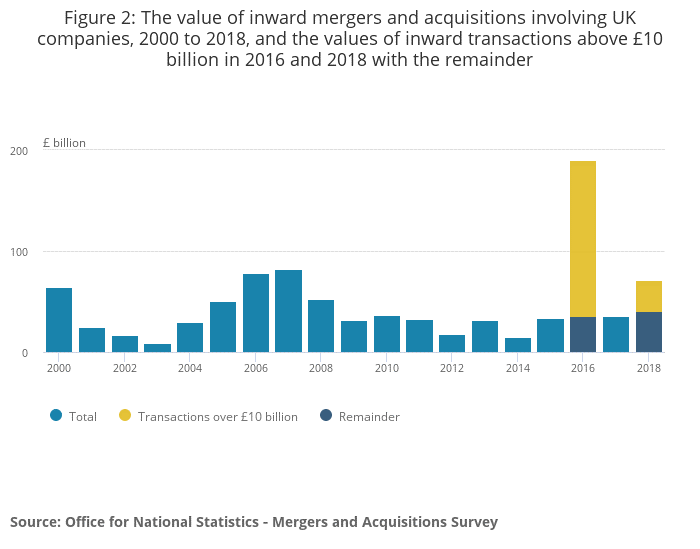

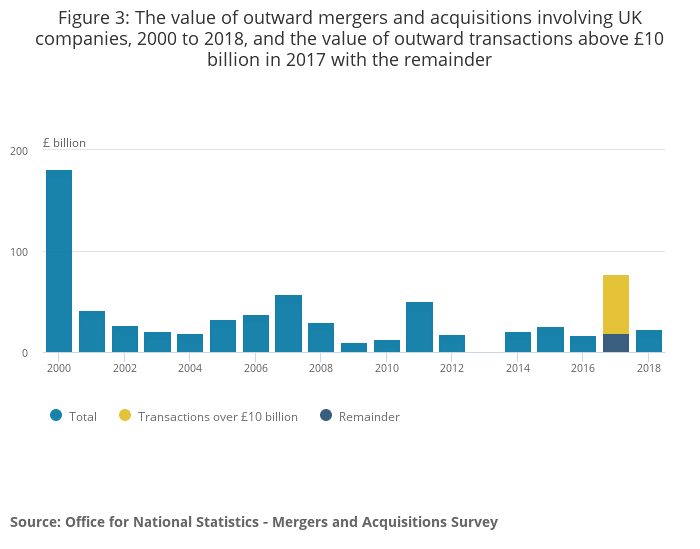

It seems likely that when confidence returns the ingredients are in place for a huge M&A party. M&A in the UK has increased over recent year but if we strip out a couple of very large transactions such as Vodafone selling Sky and the underlying levels are below the 2007 peak while the volume of money has expanded. As investors we need to be positioned for this phase of the market. The table below shows the “inward” M&A since 2000 which is companies acquiring into the UK.

Interestingly incoming deal activity has picked up more than companies acquiring outside the UK

The great sale of UK assets to overseas buyers may just be starting.

What has happened recently?

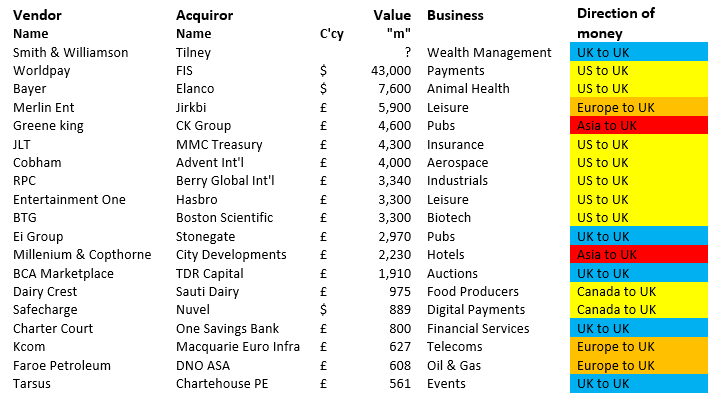

In order to determine which sectors and ultimately companies might be attractive in this environment it is worth looking at the takeovers that have happened this year. Below is a table.

Source: Investors chronicle/RNS

There are a few things to notice in this table:

- UK acquiring UK – This accounts for 10 of the 41 deals listed compared to 12 deals where US was the acquiror. However, these deals are largely in structurally challenged industries. Wealth management, Real Estate, Pubs and Retail are all mature industries where consolidation is needed.

- European acquirors – 4 of the deals listed are from European acquirers, the same number as from Canada. Canadian acquisitions tend to be in the industries where Canada is strong such as Mining, Food producing and financial services (digital payments).

- US Acquirors – So far, the 12 US acquisitions have been at the larger end where they can gain scale.

The space to hunt for consolidation targets therefore looks likely to be:

1. Mature companies in a structurally challenged sector

These usually come in the form of a “value” investment. Which usually carry a risk of profit warnings happening while we wait for the predator to arrive. Companies that come to mind are:

- Mitchells and Butler has risen 15% last week on the back of bid speculation. Joe Lewis bid for Mitchells and Butler in 2011 and still has 27%. John Magnier and JP McManus own 23%.

- Brewin Dolphin and Rathbones are two companies with very secure earnings while it is also a sector that Canada is strong in. Both Royal Bank of Canada and Canaccord have a significant presence in this space and Canaccord has been acquisitive, buying Hargreave Hale and previously bidding for Collins Stewart. There has been talk of the two merging before but with Smith and Williamson in talks to merge with Tilney to create a £45bn AUM challenger this could be a catalyst. Brewin Dolphin has £44bn AUM and Rathbone £49bn AUM. Brein was up 3.8% last week and Rathbone 3.5%.

2. Scaled players that provide a market position or a technology advantage to the US acquirer.

- Morrisons – Even the house broker, Shore Capital said it was an interesting target last week. The shares are down 30% over the past year and the company has 85% of stores freehold property. The shares were unmoved on the week.

- ITV– Liberty Global, the US owner of Virgin Media is reported to be building a growing stake. The shares were up 4.7% on the week.

- Whitbread – As Elliot Advisors, the activist investor declared a 6% stake in April this year the shares rose 7% valuing the company at £7.7bn. Costa has since sold its Costa Coffee chain to Coca Cola for £3.9bn returning £2.5bn to shareholders via a share buy back.

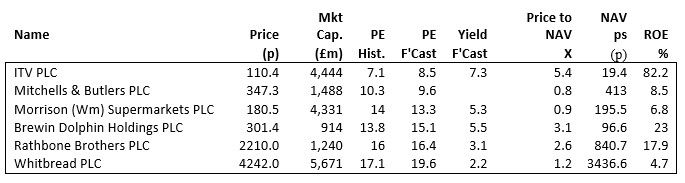

Valuations

The valuations of these candidates are below in forecast PE order:

Companies

Company – The increasing PER tells us the profits are expected to fall in the current year to December 2019 as the company transitions to digital distribution online. As the space fragments advertising revenues become more competitive. The new competitors such as Amazon and Netflix are buying unique content to give them the eyeballs for advertising to. The company has a little over £1bn of net debt. It is possible this company could get taken over but that will depend on the strength of its content.

View – For me this one looks a little dangerous. The debt is only c.1.5X last year’s profits but I recall thinking how cheap Johnston Press looked, the regional newspaper publisher a couple of years ago. The risk of further profit warnings looks high to me.

Company – This company is cheap in PER terms but while the market cap is £1.5bn there is £2bn of debt on the balance sheet and a £200m pensions deficit. Greene King was taken over last week for £4.6bn enterprise value by the Hong Kong businessman Li Ka Shing. The company has over 2,700 pubs and outlets valuing the outlets at £1.7m each which were 81% freehold or long leasehold. A read across valuation to Mitchells & Butlers largely freehold 1700 pubs would proved an enterprise value of £2.9bn, which is below the Mitchells & Butlers current enterprise value of £3.7bn.

View – Perhaps because of the shareholder structure it seems a bid is fully priced into this stock.

Company – The threat from Lidl and Aldi the new discounters is significant. As a result, Morrisons has been re-engineering its model to become more competitive. Own brands have been introduced and stores re formatted, local products introduced and costs have been taken out. It has now resumed like for like sales growth. Net debt is £1bn while the property plant and equipment held on the balance sheet has £6.2bn of freehold and long leasehold land and buildings which provides a lot of comfort. opThe pension scheme is shown as an asset rather than a liability. The net assets of the company were £4.6bn at February which is above the current market cap of £4.4bn

View – This looks like an interesting takeover play. The shares are down 23% over the last year over supply worries on Brexit while the operating performance looks like it may be improving. It is possible that it could become a thorn in the side of the discounters necessitating them to bid for it. This will become more likely as the discounters current opening program starts to mature. It may be early, but this looks like one worthy of further research.

Company – After new management arrived in 2013 the returns have improved from this company but in a mature sector the targeted growth on discretionary assets is 5%. With increasing competition from both financial planners and self-directed platforms the company has increasing pricing pressure as well as competitive threats. The arrival of Tilney merging with Smith & Williamson bringing them £45bn AUM to rival £44bn of Brewin’s AUM brings an increasing threat. Tilney is private equity owned (Permira). With 723 of the 1,763 staff employed being in business support function the costs savings on a merger with Rathbone could be significant. In May the company raised £60m of equity to finance the acquisition of Investec’s business in Ireland.

View – The company will be busy integrating Investec’s business for a while, but the arrival of a private equity backed peer may live this space up. The price paid for Smith & Williamson (if it happens) will be an interesting benchmark. But with the shares down 18% over the past year the company now trades at under 2% EV/AUM. These companies normally change hands at 2-4% of AUM. Or another solution though a merger with Rathbone could create value.

Company – This high operating margin wealth manager has £49bn of AUM which is close to Brewin’s 44%. The same arguments for a merger apply as for Brewin’s with significant cost synergies across offices. Rathbone however has a new CEO who took up the post at the AGM in May. He is set to unveil a strategy to stimulate more growth in October which the analyst community are awaiting with bated breath.

View – Rathbone’s valuation is a market cap/AUM of 2.5% so higher than Brewin while the shares are down 16% over 12 months. It is however a licensed bank which it uses obligingly to offer very secure loans to their customer where they hold the assets in a portfolio. With a higher valuation than Brewin and fewer significant acquisitions available the strategy update will reveal much in October. For now, I am struggling to see it as persuasive as Brewin

Company – Having sold the Costa Coffee business to Coca Cola this year for £3.9bn and returned £2.5bn to shareholders via a buy back the Premier Inns business is now trading on a PE of 19. The company now has net cash on its balance sheet and suggests it can reinvest in further assets at strong ROCE. Thus, it is becoming a growth company.

View – The sale of Costa Coffee looks to have removed the takeover threat and the company in now on a growth strategy with a growth rating. That further suggests that the activist investors could start looking for the exit door. Not one for me.

Summary

With a weak pound, cheap debt and confidence amongst overseas buyers while structural changes in markets are accelerating it looks like the stage is set for a wave of corporate activity. Investors need to position for this. It looks to me as both Morrison’s and Brewin Dolphin may be good ways to play this theme. And while investors wait, they can collect a dividend yield in excess of 5%

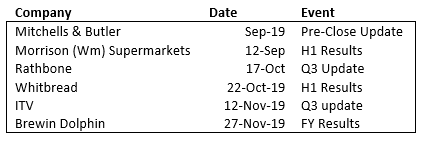

Forthcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 27/08/19

The Great British Corporate Sale

One of the things the City of London excels at is selling its own to overseas acquirors. Back in the day Messrs Wasserstein and Perella sold themselves to Dresdner Bank to create Dresdner Kleinwort Wasserstein which didn’t seem to end very well. Warburg sold themselves to Dillon Read until the swiss arrived and they all sold to UBS. Credit Suisse had already acquired Buckmaster and Moore in 1987. Merrill Lynch had bought Smith New Court and HSBS had bought James Capel and Samuel Montague. The blue blooded Cazenove was one of the last to hold out from the advances of overseas acquirors until JP Morgan finally bought them in 2009.

A particularly canny deal was the sale of 58% of Artemis in 2002 to the Dutch bank ABN Amro. In 2008 financial distress forced the sale of Artemis and was sold to BNP Paribas’ Fortis Bank triggering a payment of $558m for the 37% of Artemis still owned by staff. BNP Paribas then became a forced seller so in 2010 the staff and Affiliated Managers Group”AMG” “helped” Fortis out of their problem and bought the company back. The deal price was undisclosed, but AMG said it was at the low end of the range – between 8- and 10-times EBITDA. Based on the 2007 accounts at company’s house this would value the business at £434m-£542m which is not far above what the management received for their 37% stake less than 2 years previously.

I find myself wondering if we may enter an era when the rest of the UK sells itself to overseas acquirors. KPMG reported recently that the volume of private equity deals in the UK was down 35% in H1 2019 because of uncertainty over Brexit. If this is the case, there must be money waiting to be deployed as private equity has been raining funds this year. There are normally three things required for a good old-fashioned M&A feeding frenzy:

Perhaps we should take each of these in turn.

1. Weak Sterling

The Sharepad charts show that £ is close to a 20-year low against the US$ while against the Euro we haven’t quite reached the 2009 level, but it is getting close.

GBP/USD

GBP/EUR

This weak sterling will make UK companies far cheaper to a US buyer who is using dollars or a European buyer using Euros. While many Asian economies have pegged their currency to the dollar for several years it probably fair to say the same principle will apply to Asian countries.

2. Availability of Credit

We know that interest rates are low driven by central banks. Governments can raise 50-year money at negative rates. Meanwhile junk bonds now yield less than some governments can raise money at.

Source: ATLAS Data: ICE BofAML

3. Confidence

We are a little short on confidence at the moment but potentially post Brexit this could improve significantly. Trade Wars and Trump Tweets don’t help confidence. The Purchasing Managers Index (“PMI”) illustrates this well. This is a monthly survey of new orders, inventory levels, production, supplier deliveries, and employment which are equally weighted into a business confidence index. Below we can see that manufacturers have less confidence that Services, but both are well down on a year ago.

Source: tradingeconomics.com

It seems likely that when confidence returns the ingredients are in place for a huge M&A party. M&A in the UK has increased over recent year but if we strip out a couple of very large transactions such as Vodafone selling Sky and the underlying levels are below the 2007 peak while the volume of money has expanded. As investors we need to be positioned for this phase of the market. The table below shows the “inward” M&A since 2000 which is companies acquiring into the UK.

Interestingly incoming deal activity has picked up more than companies acquiring outside the UK

The great sale of UK assets to overseas buyers may just be starting.

What has happened recently?

In order to determine which sectors and ultimately companies might be attractive in this environment it is worth looking at the takeovers that have happened this year. Below is a table.

Source: Investors chronicle/RNS

There are a few things to notice in this table:

The space to hunt for consolidation targets therefore looks likely to be:

1. Mature companies in a structurally challenged sector

These usually come in the form of a “value” investment. Which usually carry a risk of profit warnings happening while we wait for the predator to arrive. Companies that come to mind are:

2. Scaled players that provide a market position or a technology advantage to the US acquirer.

Valuations

The valuations of these candidates are below in forecast PE order:

Companies

Company – The increasing PER tells us the profits are expected to fall in the current year to December 2019 as the company transitions to digital distribution online. As the space fragments advertising revenues become more competitive. The new competitors such as Amazon and Netflix are buying unique content to give them the eyeballs for advertising to. The company has a little over £1bn of net debt. It is possible this company could get taken over but that will depend on the strength of its content.

View – For me this one looks a little dangerous. The debt is only c.1.5X last year’s profits but I recall thinking how cheap Johnston Press looked, the regional newspaper publisher a couple of years ago. The risk of further profit warnings looks high to me.

Company – This company is cheap in PER terms but while the market cap is £1.5bn there is £2bn of debt on the balance sheet and a £200m pensions deficit. Greene King was taken over last week for £4.6bn enterprise value by the Hong Kong businessman Li Ka Shing. The company has over 2,700 pubs and outlets valuing the outlets at £1.7m each which were 81% freehold or long leasehold. A read across valuation to Mitchells & Butlers largely freehold 1700 pubs would proved an enterprise value of £2.9bn, which is below the Mitchells & Butlers current enterprise value of £3.7bn.

View – Perhaps because of the shareholder structure it seems a bid is fully priced into this stock.

Company – The threat from Lidl and Aldi the new discounters is significant. As a result, Morrisons has been re-engineering its model to become more competitive. Own brands have been introduced and stores re formatted, local products introduced and costs have been taken out. It has now resumed like for like sales growth. Net debt is £1bn while the property plant and equipment held on the balance sheet has £6.2bn of freehold and long leasehold land and buildings which provides a lot of comfort. opThe pension scheme is shown as an asset rather than a liability. The net assets of the company were £4.6bn at February which is above the current market cap of £4.4bn

View – This looks like an interesting takeover play. The shares are down 23% over the last year over supply worries on Brexit while the operating performance looks like it may be improving. It is possible that it could become a thorn in the side of the discounters necessitating them to bid for it. This will become more likely as the discounters current opening program starts to mature. It may be early, but this looks like one worthy of further research.

Company – After new management arrived in 2013 the returns have improved from this company but in a mature sector the targeted growth on discretionary assets is 5%. With increasing competition from both financial planners and self-directed platforms the company has increasing pricing pressure as well as competitive threats. The arrival of Tilney merging with Smith & Williamson bringing them £45bn AUM to rival £44bn of Brewin’s AUM brings an increasing threat. Tilney is private equity owned (Permira). With 723 of the 1,763 staff employed being in business support function the costs savings on a merger with Rathbone could be significant. In May the company raised £60m of equity to finance the acquisition of Investec’s business in Ireland.

View – The company will be busy integrating Investec’s business for a while, but the arrival of a private equity backed peer may live this space up. The price paid for Smith & Williamson (if it happens) will be an interesting benchmark. But with the shares down 18% over the past year the company now trades at under 2% EV/AUM. These companies normally change hands at 2-4% of AUM. Or another solution though a merger with Rathbone could create value.

Company – This high operating margin wealth manager has £49bn of AUM which is close to Brewin’s 44%. The same arguments for a merger apply as for Brewin’s with significant cost synergies across offices. Rathbone however has a new CEO who took up the post at the AGM in May. He is set to unveil a strategy to stimulate more growth in October which the analyst community are awaiting with bated breath.

View – Rathbone’s valuation is a market cap/AUM of 2.5% so higher than Brewin while the shares are down 16% over 12 months. It is however a licensed bank which it uses obligingly to offer very secure loans to their customer where they hold the assets in a portfolio. With a higher valuation than Brewin and fewer significant acquisitions available the strategy update will reveal much in October. For now, I am struggling to see it as persuasive as Brewin

Company – Having sold the Costa Coffee business to Coca Cola this year for £3.9bn and returned £2.5bn to shareholders via a buy back the Premier Inns business is now trading on a PE of 19. The company now has net cash on its balance sheet and suggests it can reinvest in further assets at strong ROCE. Thus, it is becoming a growth company.

View – The sale of Costa Coffee looks to have removed the takeover threat and the company in now on a growth strategy with a growth rating. That further suggests that the activist investors could start looking for the exit door. Not one for me.

Summary

With a weak pound, cheap debt and confidence amongst overseas buyers while structural changes in markets are accelerating it looks like the stage is set for a wave of corporate activity. Investors need to position for this. It looks to me as both Morrison’s and Brewin Dolphin may be good ways to play this theme. And while investors wait, they can collect a dividend yield in excess of 5%

Forthcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.