Special Situations

At times like this it is easy to make mistakes. I confess to being bored of my stocks. They haven’t done anything exciting for a while. The most exciting thing last week was Gervais Williams of Miton tipping Randall & Quilter in the Telegraph causing a 9% rise on the day. Volumes are generally low in small stocks and results have generally been well flagged in advance so in the absence of much movement brings the temptation for investors to relax their standards.

Generally, I want to own stocks which are:

- Overlooked

- Good businesses

- Lowly valued

Gervais’ tips aside, overlooked stocks remain overlooked. Good businesses remain good, and valuations remain low generally. After an extended period of time every bone in my body wants to buy something that could produce some excitement, causing me to relax my criteria, which usually ends in tears.

This is a problem Warren Buffett is familiar with. Some 31 years ago he wrote:

“our insurance subsidiaries sometimes engage in arbitrage as an alternative to holding short-term cash equivalents. We prefer, of course, to make major long-term commitments, but we often have more cash than good ideas. At such times, arbitrage sometimes promises much greater returns than Treasury Bills and, equally important, cools any temptation we may have to relax our standards for long-term investments. (Charlie’s sign off after we’ve talked about an arbitrage commitment is usually: ‘Okay, at least it will keep you out of bars.’)”

That works if you have the temperament for arbitrage and the scale to use leverage but for mere mortals like myself, I will have to stick to bars, and be patient. Terry Smith will testify that “doing nothing” is far harder for investors than most can imagine.

Markets have been waiting for a change and we are beginning to see signs of change. The Unicorns are looking rather sick in the US.

Source: Author

Given the outlandish valuation of these largely loss-making companies I suspect the failure of the WeWork IPO last week is a sign of wider malaise. The vet may ultimately be called out to administer to these loss-making Unicorns. Dynatrace, on the right-hand side of the chart above, only came to market on Wednesday last week and is already usefully underwater from the IPO price.

It may be different this time, I find myself thinking. Which is one of the most dangerous investing thoughts. When the tech bubble burst at the beginning of the millennium NASDAQ fell 50% between March 2000 and October 2002. The FTSE 100 then also fell 48% from its peak in January 2000 to the trough in March 2003. Back then, however, the FTSE 100 index was full of tech names while today the largest FTSE stocks are Royal Dutch Shell, Unilever, and HSBC, and none are loss making.

Also, today the FTSE is 3% above the 2000 peak, which is very little progress in 19 years. It seems the tech bubble this time may be in privately held and US quoted Unicorns rather than in the FTSE.

Nevertheless, this change gives us a feel for a change in investing appetite which we should listen to. Back then the good call was to switch into mining stocks as the Sharepad chart below shows.

The only fund manager I am aware of that called that right at the time was Roger Whiteoak at Framlington who subsequently retired, while his colleague, Chris Bell who ran the “Net-Net” fund watched his investments implode before being relieved of his position. The stakes are high. Perhaps it will be alternative energy this time, but most of the solar and wind assets are wrapped up in funds, so we can’t access them directly as quoted companies. Other companies such as Spirax-Sarco, which is an old company manufacturing steam pumps already trades on 29X earnings.

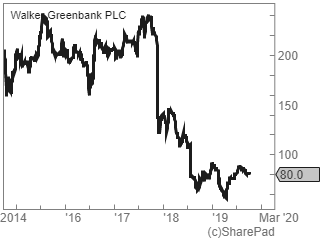

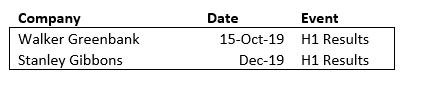

In a difficult market therefore, I am looking to hold what the industry describes as “Special Situations” where there are particular drivers to the share price that can over-ride the choppy economic conditions and volatile investor sentiment. Walker Greenbank, while still being sensitive to the consumer, does have a driver to re rate the business over time. It has genuine intellectual property in the form of brands that are unlikely to disappear over-night and the shares have already suffered from the weak consumer. Another ailing brand is Stanley Gibbons, the stamps and coins business. Both of these businesses are overlooked and sometimes there are gems in the overlooked under growth.

Walker Greenbank

Share Price 80p

Mkt Cap £57m

Business

The company owns some very old interior furnishing brands that have stood the test of time, such as Sanderson, Morris & Co, Harlequin, Zoffany, Scion, Anthology, Clarke & Clarke and Studio G and has showrooms in London, New York, Paris, Amsterdam, and Dubai. The brands are proud to be “made in Britain”. Printed fabrics are manufactured at the Lancaster factory while wallpapers are manufactured in the East Midlands while the group has two distribution centres in the Milton Keynes and Haslingden in Lancashire.

Trading

In October 2017 the company warned on weak consumer demand, resulting in a 10% downgrade. Results to January were in line with these revised expectations. In July 2018 the company reported that its expectations for licensing income were overly optimistic although licensing income will still represent a substantial upward step change on the prior year. In October 2018 the CEO stood down amongst other board changes and In March this year the new CEO, Lisa Montgomery joined from being the COO at Mulberry. The H1 trading update to July 2019 said that trading was in line with expectations despite challenging trading conditions.

Financials

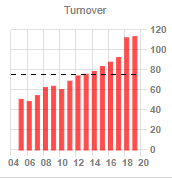

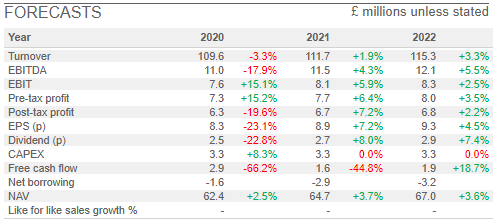

The company has grown its revenue significantly over the last 15 years

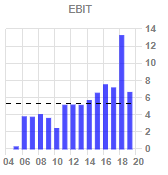

But with thin operating margins of c 6% the EBIT is highly geared to changes in trading performance.

Balance Sheet

The NAV of £60.9m includes £30.8m of intangibles as the company has acquired brands over the years. The company has £2m of debt at January 2019 which should be viewed in the context of also having £2.4m of cash. However, the pension deficit was £9.7m, which is the net of £66m of assets and £75m of obligations. The manufacturing plant and equipment appears to be maintained as the capex spend of £2.1m in each of the last two years is in line with the depreciation charge. There is perhaps some inventory risk as the stock of £28m is more than 3 months turnover.

Catalyst

So, we have a UK manufacturer of brands under pressure but what I suspect could trigger a re-rating is the licensing revenues. This is effectively royalties from the brands which is high margin and of course requires no capital so will also enhance ROE. Last year this licensing revenue doubled to £6.5m but it is yet only a small part (6%) of total revenue. This is a key part of the company’s strategy, and so far, agreements have been reached with H&M, Uniqlo, and Radley amongst others.

Valuation

Forecasts anticipate a 20% decline in PBT this year to £7.3m and the company trades at 9.6X PER, while the 30% pay-out ratio provides for a 3.1% dividend yield.

Personal View

The company has a unique library of brands that have endured many generations. Wallpaper may be out of fashion, but fashion does tend to go in cycles. Overseas revenues, which accounts for 40% of turnover also won’t be helped by the weak pound and increasing global nationalism. With a new CEO it is possible we could have another profit warning as the new broom sweeps the floors clean. However, as licensing income looks set to become a larger part of the group it looks unlikely that the single figure valuation multiple will be remain the appropriate rating. For patient investors this could do well over the medium term while the shorter-term investor may wish to see if we get another down leg on results due on 15 October.

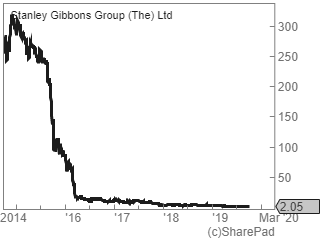

Stanley Gibbons

Share Price 2.05p

Mkt Cap £8.8m

Business

For anyone who like alternative assets this company is the world’s best-known brand for stamp collectors and it also owns Baldwins, the leading coin auction house. The company developed an investment business which under wrote the prices of stamps by offering guaranteed buy back prices. This led to a restructuring whereby Phoenix UK Fund acquired 58% of the business in a complex restructuring since when the company with its small market cap and complex restructuring has largely been ignored. The investment side of the business has been put into liquidation removing the crippling liabilities from the guarantees., costs have been cut and revenue has declined. But the company remains based at its shop on the Strand from where it has traded for 130 years.

The CEO is now Graham Shircore, who is an ex fund manager employed by Phoenix UK Fund, and when I recently met with him it was apparent that he is passionate about saving this Iconic brand.

Income Statement

In the year to March 2019 the company reported £11.7m turnover which is largely derived from trading stamps, coins and medals where the gross margin is c.50% delivering £6m of gross margin. The revenue was down 13% year on year following the companies’ troubles. The Revenue is derived from 42% stamps, 19% publishing (catalogues etc), 28% from coins and medals and 11% from the rental income from a sub-let property in New York. Last year’s operating loss was £3.9m, although this was £3.3m from the continuing operations. Corporate overhead was £3.1m which reduced 7.4% over the year and the company says that further savings are possible.

In order to bridge the gap to get to profitability therefore the company needs to add c £3m to profits. Perhaps £0.5m of further cost savings can be achieved from the central overhead and further savings are likely to be delivered now that the company has reduced it footprint in the Strand from 5 floors to 3 floors. So, if say another £1m of cost savings come through it seems likely that perhaps another £3-4m of revenue needs to be delivered to achieve profitability, which is 25%-30%.

Too build sales the company has revamped its website and has plans to launch new albums, refurbish the shop and re-engage the customer base with marketing. The International trade will also be re-engaged through attending trade shows.

In the CEO’s annual report, he refers to a year of two halves and it is notable that H1 revenue was £5m while H2 revenue was £6.7m suggesting this revenue improvement may be very achievable, but perhaps outside of a 1-year timescale.

Balance Sheet

The balance sheet shows net assets of only £7.3m courtesy of a whopping £77.7m of retained losses. The largest asset is £18m of stock financed by a £11.5m loan from Phoenix. This loan is secured by a charge over the business and assets so ultimately if the company struggles the business can simply be taken over by Phoenix which could wipe out the minority shareholders. There is evidence that Phoenix are behaving honourably however as the interest charge is a very reasonable 5% and the CEO is provided and paid for by Phoenix, effectively subsidising the minority. There is also a £5.5m pension

deficit.

Despite relaunching the website and putting the catalogues online only £30k of software development was capitalised last year and the cash flow from operation was similar to the operating profit. The borrowing is repayable in March 2023 and the covenants require £1.5m of cashflow and EBITDA in 2020, £2.5m in 2021 and £2.5m in 2022. A further £5m facility is available from Phoenix.

Estimates

There are no analyst estimates in the market. Recently the company has moved broker to Liberum which I wondered whether it was a sign of increased coverage to come although I gather it was more driven by cost considerations than the need for coverage yet.

Valuation

At £8.8m market cap for a company which should achieve break even in perhaps 2 years’ time it is hard to say the company is cheap. If we then include the £11m debt (which looks set to increase as the refurbishment is carried out) and the £5m pension deficit the valuation rises to £25m which is 2.1X last year’s turnover.

Personal View

It seems as if the company remains in a precarious position. If the debt is called by Phoenix investors downside is 100%, while I find it hard to make the case for 100% upside unless turnover accelerates very fast. I am unable to make that case as I don’t believe that stamp and coin collecting is a growth market. It is too early for me.

Summary

Current markets are difficult and at times like this it is often a good idea to do nothing. But this is a time when special situations with share price drivers that are outside of markets can still perform. Added to this these special situations can become overlooked. I find myself rather keen on Walker Greenbank with its brands that have survived many cycles in the past as it transforms itself towards a higher margin licensing business, while at Stanley Gibbons I feel the risks outweigh the rewards.

Forthcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 07/10/19 – Special Situations

Special Situations

At times like this it is easy to make mistakes. I confess to being bored of my stocks. They haven’t done anything exciting for a while. The most exciting thing last week was Gervais Williams of Miton tipping Randall & Quilter in the Telegraph causing a 9% rise on the day. Volumes are generally low in small stocks and results have generally been well flagged in advance so in the absence of much movement brings the temptation for investors to relax their standards.

Generally, I want to own stocks which are:

Gervais’ tips aside, overlooked stocks remain overlooked. Good businesses remain good, and valuations remain low generally. After an extended period of time every bone in my body wants to buy something that could produce some excitement, causing me to relax my criteria, which usually ends in tears.

This is a problem Warren Buffett is familiar with. Some 31 years ago he wrote:

“our insurance subsidiaries sometimes engage in arbitrage as an alternative to holding short-term cash equivalents. We prefer, of course, to make major long-term commitments, but we often have more cash than good ideas. At such times, arbitrage sometimes promises much greater returns than Treasury Bills and, equally important, cools any temptation we may have to relax our standards for long-term investments. (Charlie’s sign off after we’ve talked about an arbitrage commitment is usually: ‘Okay, at least it will keep you out of bars.’)”

That works if you have the temperament for arbitrage and the scale to use leverage but for mere mortals like myself, I will have to stick to bars, and be patient. Terry Smith will testify that “doing nothing” is far harder for investors than most can imagine.

Markets have been waiting for a change and we are beginning to see signs of change. The Unicorns are looking rather sick in the US.

Source: Author

Given the outlandish valuation of these largely loss-making companies I suspect the failure of the WeWork IPO last week is a sign of wider malaise. The vet may ultimately be called out to administer to these loss-making Unicorns. Dynatrace, on the right-hand side of the chart above, only came to market on Wednesday last week and is already usefully underwater from the IPO price.

It may be different this time, I find myself thinking. Which is one of the most dangerous investing thoughts. When the tech bubble burst at the beginning of the millennium NASDAQ fell 50% between March 2000 and October 2002. The FTSE 100 then also fell 48% from its peak in January 2000 to the trough in March 2003. Back then, however, the FTSE 100 index was full of tech names while today the largest FTSE stocks are Royal Dutch Shell, Unilever, and HSBC, and none are loss making.

Also, today the FTSE is 3% above the 2000 peak, which is very little progress in 19 years. It seems the tech bubble this time may be in privately held and US quoted Unicorns rather than in the FTSE.

Nevertheless, this change gives us a feel for a change in investing appetite which we should listen to. Back then the good call was to switch into mining stocks as the Sharepad chart below shows.

The only fund manager I am aware of that called that right at the time was Roger Whiteoak at Framlington who subsequently retired, while his colleague, Chris Bell who ran the “Net-Net” fund watched his investments implode before being relieved of his position. The stakes are high. Perhaps it will be alternative energy this time, but most of the solar and wind assets are wrapped up in funds, so we can’t access them directly as quoted companies. Other companies such as Spirax-Sarco, which is an old company manufacturing steam pumps already trades on 29X earnings.

In a difficult market therefore, I am looking to hold what the industry describes as “Special Situations” where there are particular drivers to the share price that can over-ride the choppy economic conditions and volatile investor sentiment. Walker Greenbank, while still being sensitive to the consumer, does have a driver to re rate the business over time. It has genuine intellectual property in the form of brands that are unlikely to disappear over-night and the shares have already suffered from the weak consumer. Another ailing brand is Stanley Gibbons, the stamps and coins business. Both of these businesses are overlooked and sometimes there are gems in the overlooked under growth.

Walker Greenbank

Share Price 80p

Mkt Cap £57m

Business

The company owns some very old interior furnishing brands that have stood the test of time, such as Sanderson, Morris & Co, Harlequin, Zoffany, Scion, Anthology, Clarke & Clarke and Studio G and has showrooms in London, New York, Paris, Amsterdam, and Dubai. The brands are proud to be “made in Britain”. Printed fabrics are manufactured at the Lancaster factory while wallpapers are manufactured in the East Midlands while the group has two distribution centres in the Milton Keynes and Haslingden in Lancashire.

Trading

In October 2017 the company warned on weak consumer demand, resulting in a 10% downgrade. Results to January were in line with these revised expectations. In July 2018 the company reported that its expectations for licensing income were overly optimistic although licensing income will still represent a substantial upward step change on the prior year. In October 2018 the CEO stood down amongst other board changes and In March this year the new CEO, Lisa Montgomery joined from being the COO at Mulberry. The H1 trading update to July 2019 said that trading was in line with expectations despite challenging trading conditions.

Financials

The company has grown its revenue significantly over the last 15 years

But with thin operating margins of c 6% the EBIT is highly geared to changes in trading performance.

Balance Sheet

The NAV of £60.9m includes £30.8m of intangibles as the company has acquired brands over the years. The company has £2m of debt at January 2019 which should be viewed in the context of also having £2.4m of cash. However, the pension deficit was £9.7m, which is the net of £66m of assets and £75m of obligations. The manufacturing plant and equipment appears to be maintained as the capex spend of £2.1m in each of the last two years is in line with the depreciation charge. There is perhaps some inventory risk as the stock of £28m is more than 3 months turnover.

Catalyst

So, we have a UK manufacturer of brands under pressure but what I suspect could trigger a re-rating is the licensing revenues. This is effectively royalties from the brands which is high margin and of course requires no capital so will also enhance ROE. Last year this licensing revenue doubled to £6.5m but it is yet only a small part (6%) of total revenue. This is a key part of the company’s strategy, and so far, agreements have been reached with H&M, Uniqlo, and Radley amongst others.

Valuation

Forecasts anticipate a 20% decline in PBT this year to £7.3m and the company trades at 9.6X PER, while the 30% pay-out ratio provides for a 3.1% dividend yield.

Personal View

The company has a unique library of brands that have endured many generations. Wallpaper may be out of fashion, but fashion does tend to go in cycles. Overseas revenues, which accounts for 40% of turnover also won’t be helped by the weak pound and increasing global nationalism. With a new CEO it is possible we could have another profit warning as the new broom sweeps the floors clean. However, as licensing income looks set to become a larger part of the group it looks unlikely that the single figure valuation multiple will be remain the appropriate rating. For patient investors this could do well over the medium term while the shorter-term investor may wish to see if we get another down leg on results due on 15 October.

Stanley Gibbons

Share Price 2.05p

Mkt Cap £8.8m

Business

For anyone who like alternative assets this company is the world’s best-known brand for stamp collectors and it also owns Baldwins, the leading coin auction house. The company developed an investment business which under wrote the prices of stamps by offering guaranteed buy back prices. This led to a restructuring whereby Phoenix UK Fund acquired 58% of the business in a complex restructuring since when the company with its small market cap and complex restructuring has largely been ignored. The investment side of the business has been put into liquidation removing the crippling liabilities from the guarantees., costs have been cut and revenue has declined. But the company remains based at its shop on the Strand from where it has traded for 130 years.

The CEO is now Graham Shircore, who is an ex fund manager employed by Phoenix UK Fund, and when I recently met with him it was apparent that he is passionate about saving this Iconic brand.

Income Statement

In the year to March 2019 the company reported £11.7m turnover which is largely derived from trading stamps, coins and medals where the gross margin is c.50% delivering £6m of gross margin. The revenue was down 13% year on year following the companies’ troubles. The Revenue is derived from 42% stamps, 19% publishing (catalogues etc), 28% from coins and medals and 11% from the rental income from a sub-let property in New York. Last year’s operating loss was £3.9m, although this was £3.3m from the continuing operations. Corporate overhead was £3.1m which reduced 7.4% over the year and the company says that further savings are possible.

In order to bridge the gap to get to profitability therefore the company needs to add c £3m to profits. Perhaps £0.5m of further cost savings can be achieved from the central overhead and further savings are likely to be delivered now that the company has reduced it footprint in the Strand from 5 floors to 3 floors. So, if say another £1m of cost savings come through it seems likely that perhaps another £3-4m of revenue needs to be delivered to achieve profitability, which is 25%-30%.

Too build sales the company has revamped its website and has plans to launch new albums, refurbish the shop and re-engage the customer base with marketing. The International trade will also be re-engaged through attending trade shows.

In the CEO’s annual report, he refers to a year of two halves and it is notable that H1 revenue was £5m while H2 revenue was £6.7m suggesting this revenue improvement may be very achievable, but perhaps outside of a 1-year timescale.

Balance Sheet

The balance sheet shows net assets of only £7.3m courtesy of a whopping £77.7m of retained losses. The largest asset is £18m of stock financed by a £11.5m loan from Phoenix. This loan is secured by a charge over the business and assets so ultimately if the company struggles the business can simply be taken over by Phoenix which could wipe out the minority shareholders. There is evidence that Phoenix are behaving honourably however as the interest charge is a very reasonable 5% and the CEO is provided and paid for by Phoenix, effectively subsidising the minority. There is also a £5.5m pension

deficit.

Despite relaunching the website and putting the catalogues online only £30k of software development was capitalised last year and the cash flow from operation was similar to the operating profit. The borrowing is repayable in March 2023 and the covenants require £1.5m of cashflow and EBITDA in 2020, £2.5m in 2021 and £2.5m in 2022. A further £5m facility is available from Phoenix.

Estimates

There are no analyst estimates in the market. Recently the company has moved broker to Liberum which I wondered whether it was a sign of increased coverage to come although I gather it was more driven by cost considerations than the need for coverage yet.

Valuation

At £8.8m market cap for a company which should achieve break even in perhaps 2 years’ time it is hard to say the company is cheap. If we then include the £11m debt (which looks set to increase as the refurbishment is carried out) and the £5m pension deficit the valuation rises to £25m which is 2.1X last year’s turnover.

Personal View

It seems as if the company remains in a precarious position. If the debt is called by Phoenix investors downside is 100%, while I find it hard to make the case for 100% upside unless turnover accelerates very fast. I am unable to make that case as I don’t believe that stamp and coin collecting is a growth market. It is too early for me.

Summary

Current markets are difficult and at times like this it is often a good idea to do nothing. But this is a time when special situations with share price drivers that are outside of markets can still perform. Added to this these special situations can become overlooked. I find myself rather keen on Walker Greenbank with its brands that have survived many cycles in the past as it transforms itself towards a higher margin licensing business, while at Stanley Gibbons I feel the risks outweigh the rewards.

Forthcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.