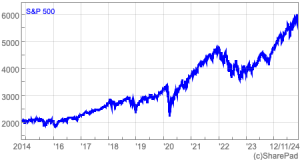

Phil looks at the state of the US stock market following the presidential election and the reasons why it might continue to boom and why it might not. Even if you don’t invest in US shares, what happens on Wall Street has a big say in how UK shares will perform. A high-flying US stock […]