For some people, the thought of picking their own shares can be a little bit daunting.

Rest assured, it doesn’t have to be.

Whilst it is best to do at least a little bit of homework before you part with your hard-earned cash, successful investing does not require a high IQ or lots of specialist knowledge despite the efforts of the financial industry to convince you otherwise.

Armed with plenty of common sense and a few simple rules it is possible for just about anyone to put together their own share portfolio.

To make things easier, you can build your own set of investing rules but make sure you stick to them. Chopping and changing is not the best way to grow the value of your savings.

We’ve built up a list of rules to help you with this task:

Only Invest in businesses you can understand

You need to know how a company makes its money. If you can’t work this out then don’t invest in its shares.

This is one of legendary investor Warren Buffett’s simple rules that he has resolutely stuck to over the years.

Most of us can understand what a supermarket company like Sainsbury’s does but might struggle to understand a technology or engineering business. If you can’t explain what a company does to a friend then perhaps you shouldn’t be investing in it.

It also pays to understand how a company’s profits have fared through good economic times and bad ones. Companies that suffer when there is a recession are likely to do so again when the next one comes along. This can cause investors to lose a lot of money when profits crash.

You can find this out by studying its financial history.

ShareScope has an unrivalled amount of historical financial information available to private investors which makes this task easy.

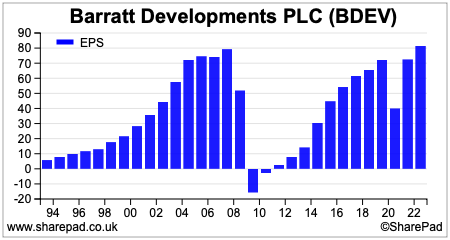

If you look at a house-building company such as Barratt Developments in ShareScope, you can go back 30 years and see how its earnings per share (the profit for each share) has fared over time.

You can see that profits have been very lumpy and have even turned into losses. This doesn’t mean that the share cannot be a good investment but being forewarned about what could happen in a recession can help you decide whether the timing is right.

Bigger companies can be safer than smaller ones

You might make a fortune buying the shares of an unknown small company but you can also lose all your money as small businesses tend to have a higher failure rate.

Smaller company shares tend to be harder to buy and sell – they are more illiquid – which can result in very big share price movements when there are large buy and sell orders from investors.

It is important to understand how much risk you are prepared to take with your money. If you can’t stomach seeing the value of investment fall significantly then perhaps investing in shares is not for you.

All companies can see big share price falls from time to time, but the risk of this happening tends to be greater the smaller the company is.

Sticking to the shares of established companies that have been around for a long time – such as those in the FTSE 350 index – is usually a safer bet.

Make sure that a company can grow its profits

Company profit growth is the key to making good money from shares. Without growth, many shares can deliver disappointing returns and losses.

It is usually better to pay a bit more for a share – one with a higher valuation – with good growth potential than to buy a share that looks cheaper but cannot grow.

This is because shares tend to be valued on a multiple – such as ten times or twenty times – of their profits. As long as the multiple isn’t too high -can be a sign that a share is expensive – if profits can grow over time there’s a reasonable chance that the share price will too.

Insist on a long track record of continuous dividend payments

A company does not have to pay a dividend to its shareholders. It is also possible to have very successful investments from the shares of non-dividend-paying companies.

That said, many investors like dividends for their income but also for the fact that once it has been paid, it cannot be taken away.

Dividends represent a return to shareholders on their investment which is independent of the share price. Share price gains can disappear very quickly if sentiment towards a company deteriorates.

A company needs to have a consistent level of profits and cash flow to pay a dividend to its shareholders. This makes dividend payments a good signal of company health.

A company that has paid a dividend for a long period of time – say at least ten years – can end up being a better and safer investment than a company that has not.

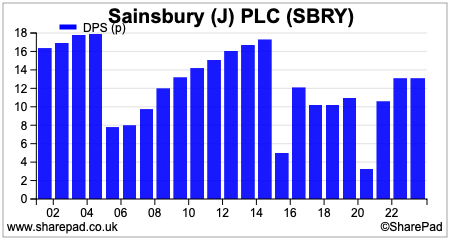

Sainsbury’s dividend had been reduced several times over the years.

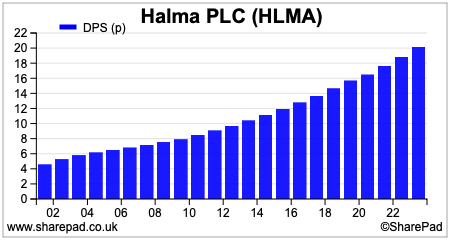

Halma, on the other hand, has one of the most impressive dividend track records on the London Stock Exchange. It is one of the reasons it has been a much better investment than Sainsbury’s.

Avoid companies with lots of debt

With the exception of utility companies – where their stable profits usually mean they can cope with debt – avoid companies with lots of debt.

Debt is your enemy as a shareholder.

A company has to pay interest on its borrowings before it can pay any money to shareholders. The more debt it has and the more interest it has to pay the more risky its shares tend to be.

If profits fall sharply, then interest on the debt can wipe the shareholders out. To avoid sleepless nights, buy shares in companies that can comfortably pay the interest on its borrowings.

You might set a minimum interest cover (the number of times a company’s trading profits cover the interest bill) of at least five times for example.

Be prepared to own a share for at least 5 years

A share trader might sometimes only own a share for a couple of hours. An investor tends to look at owning a share for many years to maximise their chances of making good returns from it.

Having a long-term investing mindset means that you will worry less about the ups and downs of the stock market because there is usually more time for good times to offset bad times.

Buy fewer shares not more

It is important to have a diversified portfolio. Having all your money in just one investment can pay off handsomely if it performs well but can cause misery if it does not.

This is why investors tend to own a portfolio of different investments or shares to diversify their risk.

However, you can have too many investments.

If you are going to do well, then you need to have enough of your money invested in a share/investment so that it makes a difference to the value of your portfolio if it gains in value.

That’s why owning 10-15 investments or shares rather than dozens or sometimes more than a hundred is often a smarter way to invest.

This makes it a lot easier to know what you own and why. It also makes it easier for you to react to changes in prices and know what to do.

Reinvest your dividends

Using your dividend income to buy more shares can be a great way to build up your nest egg.

Dividend income and its reinvestment can make up a large chunk of the money made from owning shares over the years.

The magic of compound interest can work wonders for the value of your investments if you reinvest dividends over a long period of time. This makes you less reliant on the stock market going up as well.

Your Isa and Sipp provider can set up your accounts so dividends are automatically reinvested for you.

Invest in a business that gets a good bang for its buck

You should look at companies in the same way as you look at savings accounts.

Ones that earn high rates of interest on their money invested (known as return on capital employed or ROCE) tend to be good businesses.

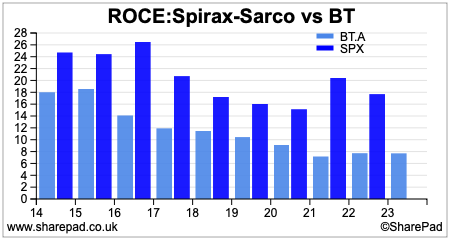

You might do this by aiming for a ROCE of at least 15 per cent and one that has been consistent over time.

Spirax-Sarco has been a much better long-term investment than BT. One of the main reasons for this is that it has a much higher ROCE.

.

Make sure that profits consistently turn into cash

Companies can be profitable but generate very little surplus cash. Cash is the lifeblood of any business. Without it bills and dividends cannot be paid.

Avoiding companies with consistently weak cash flow is usually a good thing to do. Look for companies that can turn at least two thirds of their profits into cash.

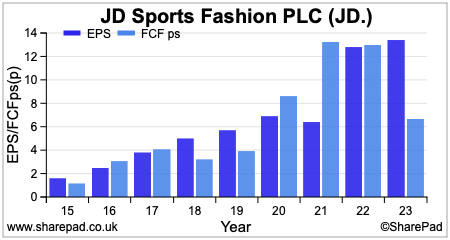

Many investors look for companies where the free cash flow is a very high proportion of the earnings per share (EPS).

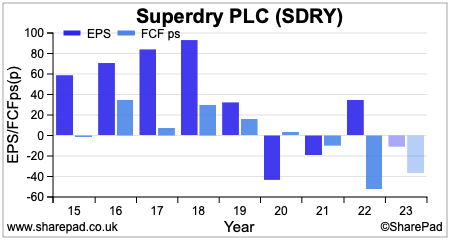

For example, JD Sports shares look more attractive than Superdry on this measure – especially as the free cash flow has been growing.

Superdry’s free cash flow has been very poor and has been shrinking. Its shares have not been a great investment.

Don’t pay too much for a share

This is probably the biggest mistake that investors make.

Too often, paying too much for the latest hot share is the road to losses when expectations of big profits are never met.

Avoid this pitfall by setting yourself a rule for how much you will pay for a share. For example, you could set a limit of 15 or 20 times current earnings (a PE of 15 or 20) or 20 times ten-year average earnings.

Whatever rule you set, stick to it.

That said, don’t be afraid to pay what looks like a very high valuation for a growing company. Over the long haul, growth is more important than the initial price paid for a share – providing the growth materialises.

ShareScope can help you find shares that fit your rules

If you are going to manage your own investments, you should seriously consider subscribing to suitable investment software like ShareScope to help you find attractive investment opportunities.

The attraction of ShareScope is that you can make your rules as simple or as complicated as you want – simpler is usually better.

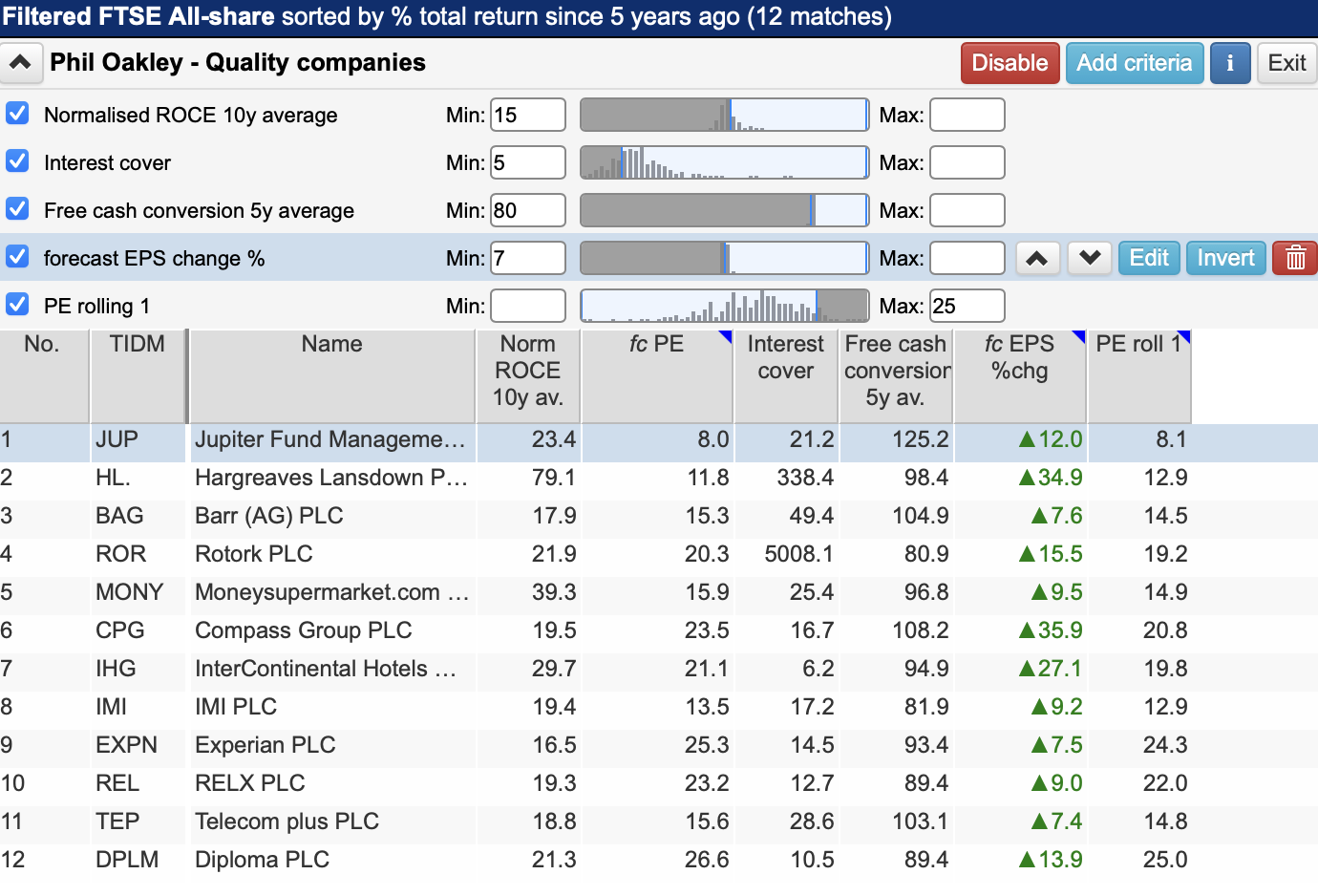

Below is a ShareScope screen looking for shares with the following criteria:

- Good quality with decent levels of profitability. This is defined as a company with a 10-year average return on capital employed(ROCE) -or return on money invested – of at least 15 per cent.

- Not overburdened with debt – the trading profits of the business can cover the annual interest bill on its borrowings – its interest cover – by at least five times.

- A good chunk of profits turn into free cash flow – over the last five years, free cash flow per share is at least 80 per cent of earnings per share.

- Profits(EPS) are expected to grow by at least 7 per cent over the next year.

- The shares are not very expensive – the share price compared with the next year’s forecast EPS is no more than 25 times. Good companies can rarely be bought cheaply but don’t pay too much for them.

Phil Oakley

Got some thoughts about this article? Share these in the comment section below.

Not subscribed to ShareScope before? Click below to find out how ShareScope can make you a better investor.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.