There are many different ways to make money from the stock market. Over the last few years, one of the most popular and discussed strategies has been about buying the shares of high quality businesses or quality investing.

Warren Buffett has long been a cheerleader for long-term investing in quality companies. In the UK, the success of fund managers such as Terry Smith, Nick Train, AKO Capital and Keith Ashworth Lord who all follow a quality investing approach has helped to grow the popularity of it.

I am a huge fan of the quality investing approach and use it to invest my own money. I have even written a book on the subject. However, it is quite easy to misunderstand what quality investing actually is and how to use the strategy to get the best results.

Quality investing can easily be misinterpreted as a painting by numbers exercise that is suited to quantitative investors. It should not be in my opinion. It requires a thorough understanding of the business you are invested in, but above all else, a set of personal characteristics that allow you to run your investment portfolio in the right way.

This article is my take on what quality investing actually is and how investors can get the most from it.

Characteristics of quality companies

Quality companies exist because they do something that is very difficult for others to copy. They sell a unique product or service that is so good that customers do not – or cannot – go elsewhere for it. This often leads to businesses that produce some highly sought after financial characteristics such as:

- Steady and predictable profits and cash flows.

- High profit margins.

- High returns on capital employed (ROCE)

- Convert most of their profits into free cash flow.

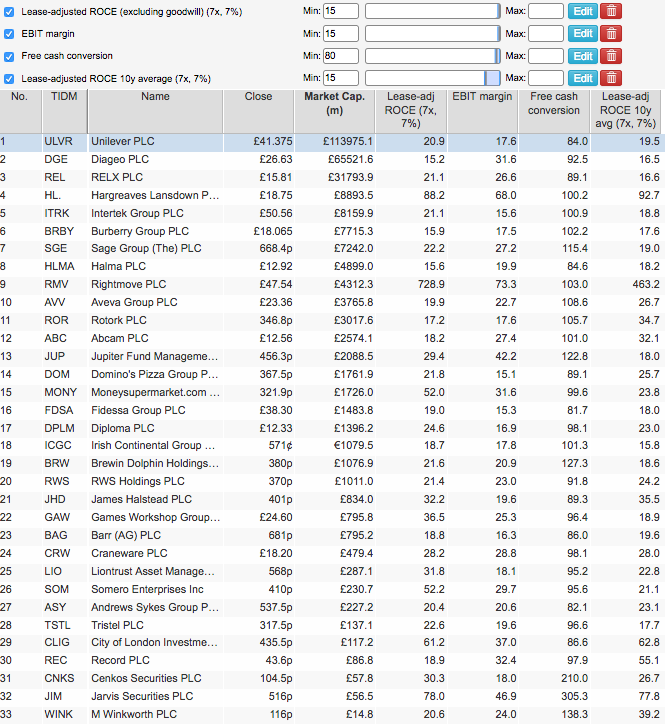

It is very easy to quickly screen for companies with these characteristics using investment software such as SharePad. Below is a list of shares that meet the following criteria:

- Current lease adjusted ROCE of at least 15% and ten-year average ROCE of at least 15%.

- Current EBIT margin of at least 15%.

- Conversion of at least 80% of post-tax profits or earnings per share (EPS) into free cash flow.

You could put together a portfolio of shares based on this list and it might perform very well for you. However, these characteristics, whilst very desirable are not enough to put the odds in your favour.

It is vitally important that you understand how and why a company has become so profitable and whether it is likely to keep on being so. If you don’t, then you do not know if you have fallen into a trap and buying into a business which looks great but won’t stay great. You need to spend time thinking about how a company can keep on growing whilst keeping competitors from eating its lunch.

The importance of growth

Having high profit margins and high ROCE is all well and good, but if the company cannot grow its revenues and profits then its shares are unlikely to reward you.

The whole point of investing in high quality businesses is to utilise the power of compounding. If a company with high profit margins and high ROCE can keep on selling more products and services at high returns then it will become more valuable over time.

It’s exactly the same process as putting more money into a high interest savings account. An account with a high interest rate will compound into a bigger sum of money in the future than one with a lower interest rate.

Many businesses go through a lifecycle. They grow very quickly at first and then growth slows down as the business matures or new competitors arrive. Despite being extremely profitable in terms of profit margins and ROCE, an absence of meaningful revenue and profit growth can lead to disappointing future investment returns.

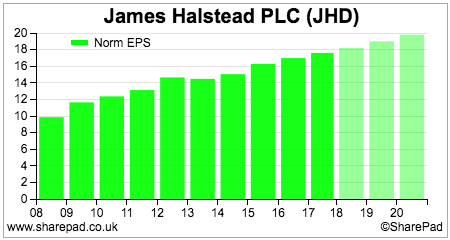

James Halstead (LSE:JHD), a manufacturer and distributor of high quality flooring products could be a case in point. It is an extremely profitable and consistent business with profit margins of nearly 20% and ROCE of more than 30%. In recent years, its profits growth has slowed and is expected to be quite modest going forward.

The company’s shares were very highly valued up until around a year ago but have fallen significantly since then as future growth expectations have moderated.

It is interesting that James Halstead is currently thinking about buying one of its competitors, Airea (LSE:AIEA). This business has much lower profit margins and I assume that James Halstead thinks that under its ownership it could be much more profitable and perhaps increase its own growth prospects.

What’s the right valuation for a high-quality business?

Very good businesses are scarce. Scarcity tends to increase the value of most things. There are very good grounds for arguing that the stock market undervalues the scarcity of high quality businesses. It therefore stands to reason that just as high-quality bottles of wine deservedly cost more than cheap plonk, high quality businesses should command richer valuations than mediocre ones.

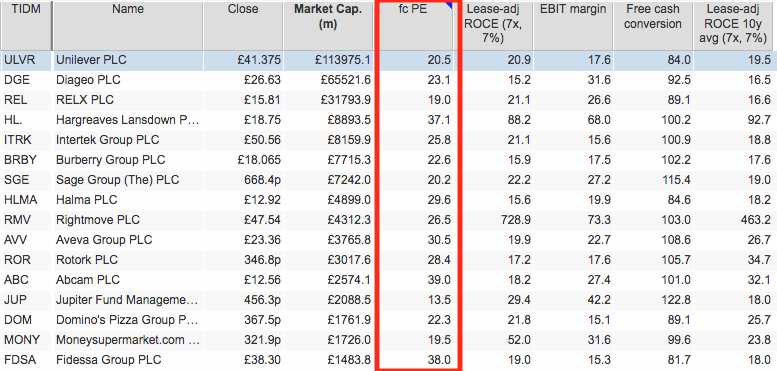

As you can see, many of the companies from the filter above command what many people would deem to be quite high valuations.

Leading protagonists of quality investing have all made the argument that quality companies are actually undervalued despite looking expensive to others. Terry Smith has persuasively argued that the quality of the business is a far bigger determinant of investor returns than the price paid for it due to the power of compounding high returns over a long period of time. Nick Train has made many arguments to justify the valuations of some of his investments such as Unilever and Heineken.

In the excellent book, Quality Investing by Lawrence Cunningham, Torkell Eide and Patrick Hargreaves, the following argument is made to justify a high valuation for quality companies:

“The risk of overpayment is also offset by a general tendency of stock markets to under-price quality companies. Share prices, even when at seemingly high valuations multiples, often fail to fully capture the combination of predictability and value creation such companies offer.”

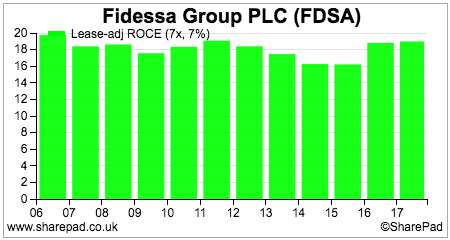

A very good recent example of this is Fidessa (LSE:FID). The financial software business has been consistently profitable with a stable and high ROCE.

Its shares have commanded a very high multiple of earnings for some time, but this did not stop it being on the end of two takeover approaches earlier this year. The company has agreed to be taken over for a price valuing it at an exit PE multiple of 38.4 times 2018 expected EPS.

You can argue that all these quality investors are talking their own book in order to justify their strategy. This is undoubtedly true but is a sign of conviction in their process that anyone investing in their funds would want to see. Whilst I agree with the tone of their arguments, I would not interpret them as saying that quality companies are a buy at any price.

However, the point I am trying to get across here is that it is very difficult to be a successful quality investor with a value investor’s mindset. Except in the times of general stock market falls, you should not expect to buy the shares of high quality businesses for cheap valuations such as low price to earnings (PE) multiples.

It may sound complacent, but there are plenty of examples of good things happening to good companies over time. Paying up for quality businesses has served many investors well.

You should always be disciplined on the valuation you pay when buying shares but being stingy when long-term investing in high quality, growing businesses can mean you miss out.

Personal characteristics needed for successful quality investing

Having a strategy of investing in high quality businesses makes sense to many investors. However, in order to get the best out of it, you have to practise it in a certain way. This is not easily taught and usually comes with some experience and after making a few mistakes.

I can think of three essential characteristics that will serve all quality investors well as well as many others.

The first one is to be a long-term investor. If you are paying a reasonably high price tag for shares in a quality business you need to give yourself plenty of time for the magic of compounding to do its work. You should not necessarily expect to make a lot of money quickly.

The second is to do as little as possible with your portfolio. You must resist the temptation to trade and time the market. The costs of broker commissions, stamp duty and bid-offer spreads (the difference between the buying and selling prices of shares) add up and eat into your investment returns.

Trying to time the market by buying low and selling high also tends to be a futile exercise. Staying invested is the key to making money. If you can’t stomach the ups and downs of stock market investing then don’t invest in shares.

Terry Smith has been extremely good at practising what he preaches in terms of doing as little as possible with his portfolio. His costs of voluntary dealing in shares (excluding new subscriptions and redemptions) as a percentage of the value of his fund has been extraordinarily low and has been a contributor to his excellent investment results.

| Year | Voluntary dealing costs | Total Return of FS Equity R Class |

| 2017 | 0.011% |

21.84% |

|

2016 |

0.003% |

26.77% |

|

2015 |

0.014% |

15.12% |

|

2014 |

0.005% |

22.69% |

| 2013 | 0.025% |

24.72% |

Source: Fundsmith Equity Annual Reports

Finally, concentrate on what really matters and ignore what doesn’t. By this I mean focus your time on monitoring the business results of the company you are invested in and learning as much as you can about it. Don’t obsess with daily share prices or chatter on bulletin boards or social media.

Learn to think independently and trust your own judgement. I find tuning out from the noise is immensely helpful when investing. I set up alarms and email alerts for specific company news in SharePad and subscribe to company investor alerts to keep me informed. My aim is to only sell a share when its business deteriorates permanently or its shares become extremely overvalued.