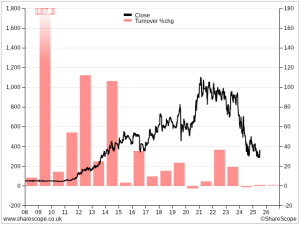

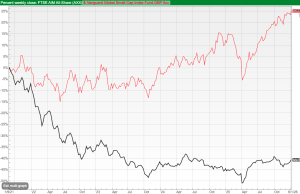

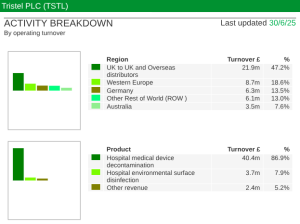

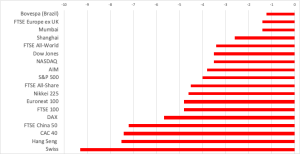

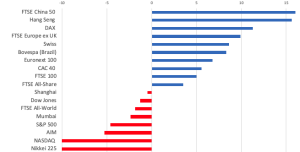

Bruce returns with a looks at some of AIM’s top performers (EEE, MTL, YU.) since the market peaked in Sept 2021. Plus results from SRT and CRW. The FTSE 100 fell -1% but remained above 10,000 over the last 5 trading days. The Nasdaq100 was up +1%, while the FTSE China 50 fell -4.6%. Brent […]