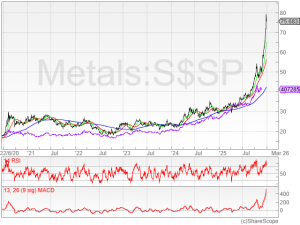

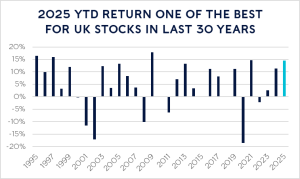

This month’s deep dive into all thing’s funds-related looks at turbulent Japan, why it’s time to become more nervous about gold prices, an under-the-radar UK-listed PE fund that could be a great play on the UK economy, and a fab model portfolio of alternative listed funds from a UK investment bank. Japan – what’s going […]