There’s something of an income theme to this month’s funds focus. First up is a specialist lending fund whose shares have fallen sharply in value yet the fund is still churning out a reliable 8% plus yield. Next up we investigate the ups and downs of the music royalty funds – very much a yield play – and then switch focus to a superior equity income, dividend-based ETF. We finish with a deep dive into an ESG-friendly trust that is trading at a silly discount for a portfolio of rock-solid large-cap equities.

Updates 1: Biopharma – deeply discounted quality income story

I’ve long been suggesting that income investors keep a close eye lending fund Biopharma Credit which has a current net yield of around 8.4%. This reasonably large, US-based fund lends to life sciences companies that are looking to scale up by deploying capital to develop new therapies and drugs. Traditionally the shares have traded at between par and a 5% discount but that has now shot out to discount of just under 20% because of concerns about a reasonably big loan to a life sciences firm called LumiraDx (LMDX) – the loan is due in March next year, and currently represents 11.8% of NAV. The market is worried that there is a serious possibility this (stock market listed) borrower won’t be able to repay their loan.

I’ve long thought that the market was overegging the downside – even if LumiraDx went bust and Biopharma received nothing back, the discount is still too great. A complete write-off would put Biopharma back on a 9.5% discount which is well above the managers declared aim of keeping the discount tight at no more than 5%.

But it also strikes me as overly pessimistic that the loan would be a complete write-off – surely there is some value in the secured assets in the listed business? Matt Hose a fund analyst at Jefferies notes that “as a UK-domiciled company LMDX could potentially be subject to a pre-pack administration, whereby a sale of the company is agreed before it enters a formal insolvency process. This would expedite the recovery of value for BPCR, particularly compared to if it was subject to U.S. bankruptcy code”.

He also notes that the fund has “taken senior security over substantially all assets of the testing company, not just simply the product’s intellectual property (as is typically the case with loans backed by drug cash flows), which should enhance the recovery potential. For example, as at 30/06/23 LMDX held over $100m of property, plant and equipment, $85m of inventories and $65m of tax, trade and other receivables.”

Jefferies has just this week upgraded Biopharma to a buy – I agree. I think the dollar-denominated shares (there’s also a sterling class) might trade back closer to $0.90 or even $0.95, especially if the managers kick off a big share buyback programme.

Update 2: Hipgnosis (SONG) – cheap at this price despite the issues

It’s been an exciting time in the music royalty’s space. I’ve long kept a close eye on the two big funds in this rather specialist niche, Hipgnosis and Roundhill. Both have had their issues and traded at huge discounts. The two key issues here were first whether we could get entirely comfortable with their valuations and secondly, whether the yields were generous enough in a new normal of rising rates. My core view has been that although both funds have their ‘issues’, the discount is just too great and that sooner or later someone would buy them. Well, a few weeks back London London-listed fund Roundhill announced an agreed takeover for its book of music rights. A business called Concord announced it would pay $468m or $1.15 a share – a premium of approximately 64.0 percent to the six-month volume weighted average price per RHM Share of US$0.70 and a discount of approximately 11.5 percent to RHM’s Economic NAV per RHM Share of US$1.30 (as at 8 September 2023).

That naturally prompted focus on Roundhill’s main rival, the longer-established Hignosis (SONG). Investors have got increasingly worried about the huge discount and clearly want some meaningful action. The board of the fund has clearly got the message and the good news is that the board is looking to sell 29 catalogues for an aggregate gross consideration of $465m. The proceeds of this sale would be used to fund a share buyback programme of $180m (16% of current market cap and 12.6% of current NAV) and to repay $250m of the company’s revolving credit facility. The board also proposes the introduction of additional, lower investment advisory fee tiers. Fees up to £750m remain unchanged but there are two new tiers: the fees will fall to 0.7% p.a. of the average market cap between £750m and £1,000m, which is new and 0.6% p.a. of the average market cap in excess of £1,000m, which is also new.

So far so good but there are still two concerns. The first is that the catalogues sold – on an 18.3x historical net publisher share multiple – are to Hipgnosis Songs Capital, a partnership between Hipgnosis Song Management and funds managed and/or advised by Blackstone i.e an elated entity to the fund manager. This throws a light on an already slightly awkward issue: the private fund with Blackstone was always fairly controversial and it has now emerged as a white knight, but it does leave open the question of who comes first for the manager, Hipgnosis, the listed fund or Blackstone? The other concern is that the agreed price is 17.5% below current carrying NAV which takes us back to all the old concerns about establishing a true market valuation. In the simplest terms possible, can we fully trust the stated NAV as a reflection of what the remaining catalogue is worth if it was sold?

On balance though there are some big positives. A buyback this size will probably eventually help move the share price and the reduction of the debt facility is also good news and cuts cash outflows while the lower management fees amount to “a reduction in fee payments for investors of £0.35m p.a. at current market cap, and £0.25m p.a. after the disposal if the current discount to NAV remains unchanged” according to analysts at Liberum. With the fund still trading at 80.9p on a 47% discount I think there is room to see the share price move first above 90p with the buybacks and then 100p over time.

Ideas 1: Menhaden Resource Efficiency – a portfolio of quality large-cap shares at a bargain price with a sustainable tilt

I’m not a fan of ESG investing, which consists of using environmental, social and governance filters to build a portfolio of shares in sustainable corporates. I’ve long argued that it is faddish, built on marketing hype and uses a set of deeply questionable screens that imply a set of moral judgments many of us don’t subscribe to. To take one example, most ESG screens explicitly screen out defence contractors as well as firms involved in the nuclear energy industry. I happen to think nuclear power is an essential part of the drive to reduce emissions and I also think that defence contractors are absolutely vital to the functioning of a safe, secure advanced democracy. This, sadly, is just one of the many criticisms lobbed at ESG strategies.

By contrast what I am interested in is investing in funds that have a direct impact on outcomes, such as investing in renewables. I’m also amenable to the idea that well-built screens can help you identify corporates that will prosper in an uncertain new era for the environment i.e using ESG as just another way to identify quality, long-term sustainable corporates.

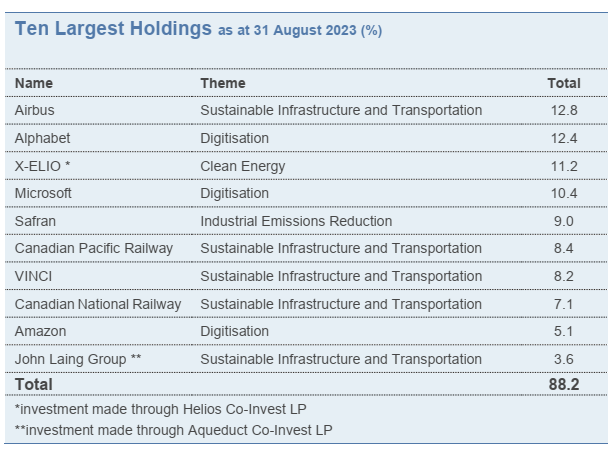

All of which brings me to Menhaden Resource Efficiency. This is a small, frankly sub-scale investment trust that was set up a few years ago by green financier Ben Goldsmith to invest in impact-oriented investments. It has gone through various permutations – and has been dogged by underperformance in previous years – as well as a number of strategy changes. The good news is that it is now focused on “investing in businesses and opportunities that are demonstrably delivering or benefiting significantly, from the efficient use of energy and resources, irrespective of their size, location or stage of development”. In simple terms, it ditched its rather narrow focus and embraced a willingness to invest in large-cap equities with a quality ESG tilt, alongside a much smaller, legacy portfolio of private assets (around 16% of the portfolio). That strategic rejig has meant that it boasts a portfolio full of (more than 75%) of large-cap, quality names, mostly based in the US. The table below is from the fund’s latest fact sheet and shows the top holdings (there are 17 in total) – you’ll be familiar with names such as Airbus, Alphabet, Microsoft and Amazon. There’s also railway firms and aircraft engine business Safran in the portfolio plus infrastructure business VINCI. Overall, the fund says that 45% of the portfolio is in ‘sustainable infrastructure and transport’ while another 30% is in digitisation. Clean energy represents a 10% exposure.

Performance has been quietly impressive in recent months. In the interims through to 30th June, the fund produced NAV returns of 16.9% versus 8.1% for the MSCI World index – helped along by surging tech valuations. The quoted equities returned 16.1% while FX hedges also kicked in a couple of per cent. The private investments in businesses such as a Spanish solar park developer also chipped in a decent set of returns. As an aside, within the private market segment, a new $25m commitment was made to the next vintage of the TCI Real Estate Partners strategy (fund IV).

So far so good, but frankly readers might be wondering, ‘what’s the point of this fund’? It’s too small with a market cap of just over £75m. Its exposure to big large-cap equity names is far from unique and its private assets portfolio is even smaller and not a major driver of returns long term. I think that’s probably an overly harsh assessment as the equities portfolio of quality, large-cap, sustainable names is a good selection but that’s really my point.

The key point is that this fund boasts a liquid portfolio of easily sellable assets (bar the private assets chunk) that is currently trading at a 37% discount to NAV. To put it as bluntly as I can, the fund could liquidate its entire large-cap holdings overnight and pay back shareholders their existing share price. That would leave a rump of probably quite valuable private assets as straight profit – probably purchased by one of the bigger listed renewable funds.

In sum, a 37% discount doesn’t strike me as a sensible valuation. I completely accept the challenges but feel that a 15% to 20% discount is probably more appropriate – and is equivalent to other large to mid-cap quality equity funds.

Ideas 2: A superior take on the Dividend Index Tracker strategy

Temperamentally I’m not drawn to long-term defensive equity strategies such as those that emphasize dividend growth stocks. It’s not that I don’t see value in the ‘steady as she goes’ banking the dividend cheque strategies, it’s just that it doesn’t really fit with my own investment outlook.

The slight catch is that pretty much every study of long-term investing emphasizes that over most (though not all) decades, it’s dividends, the growth in those dividend payouts, and their subsequent reinvestment, which delivers the bulk of total returns. The caveat here is that in some decades that dividend focus is drowned out by changes in the PE multiple applied to shares in expectation of operating margin and earnings growth. My own suspicion is that we’ve seen one of those decades where the driver has been multiple expansions driven by technological change (and concentration of corporate oligopolistic power).

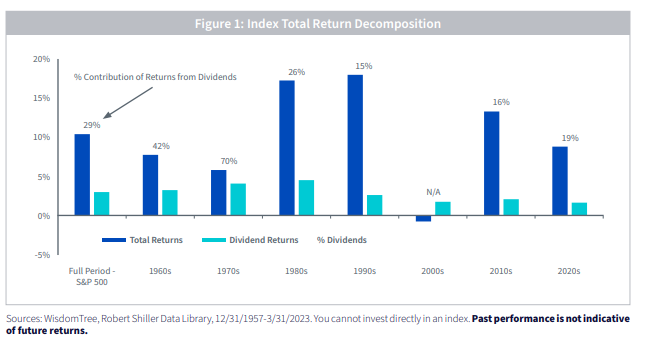

ETF issuer Wisdom Tree has long championed the power of equity dividends and to help promote the cause they’ve just released a paper that looks at the decade-by-decade contribution of dividends to total returns for the S&P 500 – they reckon that over the long-term these payouts contributed almost 30% to the 10.4% annual total returns of the S&P 500. More specifically:

· In the 1970s, a decade characterized by high inflation and weak economic growth, dividends made up 70% of total returns.

· The 1990s—the decade of the dot-com bubble—had the lowest contribution from dividends of just 15%.

· The 2000s was the only decade with negative total returns. The dividend returns of nearly 2% provided a cushion to offset negative price returns driven by the bursting of the dot-com bubble and the Global Financial Crisis.

· Unsurprisingly, in the 2010s and 2020s dividends formed only a small part of total returns

OK, so what does this mean in practical terms for those of us trying to build a durable diversified portfolio?

If we’re entering an era of higher inflation and more volatile equity returns – a real possibility – then relying on momentum to drive your returns (firms getting ever higher multiples based on growth) might be a tough proposition. The less jargon way of saying the same thing is to say that relying on a handful of big US tech stocks might not be a smart strategy. Then again, that view may be hopelessly cautious and maybe the profound technological changes we’re seeing play out will drive up valuations for a select band of stocks.

If you believe the former scenario is a real possibility, you are likely to be drawn to a strategy that is much more defensive in nature, and thus a focus on dividends and their growth might make eminent sense. By contrast, if you still buy the growth strategy, you should avoid the defensive dividend growth story.

If this all sounds a bit abstract, let me put it in more concrete terms.

Most investors have a core portfolio that they don’t tend to tinker with which is based around a core diversified equity markets tracker i.e. an ETF that invests in something like the MSCI World. These market cap ETFs make absolute sense if you have zero view of what kind of stock will prosper. In a sense, you are letting the market decide and you simply follow in its trail.

But this strategy is increasingly being influenced by the power of US stocks – nearly 70% of most world indices – and in turn by growth-oriented, tech-focussed mega large-cap stocks. Again, that probably makes absolute sense, but it is not without risk. A more defensive long-term investor might say that a) they are nervous about valuations, b) they are worried about the focus on US stocks and c) they are frightened that technology stocks might derate.

If this describes your position, then it might make sense to switch that long-term global equities position to one that is more defensive and dividend-oriented. To repeat again, I’m not saying this is the right strategy, just that some investors might be attracted to its virtues.

The catch is that traditionally equity income or equity dividend growth strategies have been the preserve of active fund managers, with all their attendant ‘challenges’ – higher costs, idiosyncratic stock selection risk etc.

By contrast, cheaper dividend-weighted global equities ETFs have been profoundly underwhelming in performance terms. My suspicion is that they are based on indices that are first, simplistic, and secondly, too rules-driven. As a consequence, active managers have trounced them.

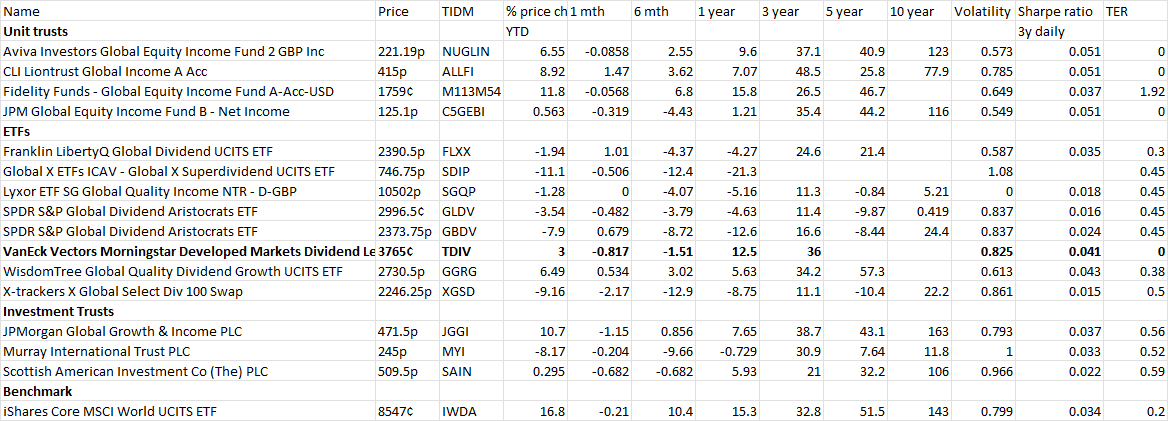

But that has been changing and we are now seeing the emergence of a next generation of dividend growth ETFs built around ‘smarter’ indices. The leader in this field has, unsurprisingly, been Wisdom Tree – in the UK its best product by far is its WisdomTree Global Quality Dividend Growth UCITS ETF, ticker GGRG. This does exactly what it says on the tin – it focuses on those stocks with a more than decent dividend, where the possibility of dividend growth from increased profits is likely.

As you can see in the big table below, over the last five years this Wisdom Tree ETF has produced a total return of 57% which is in excess of the returns from a handful of leading actively managed unit trusts in this space (Aviva, Liontrust and Fidelity) as well a clutch of leading investment trusts. Over the last three years, its also beaten most, though not all, of these actively managed funds.

But it now faces real competition from an upstart ETF – issued by VanEck –called the VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF, ticker TDIV. This index tracking fund “delivers a regular income through equities. The Morningstar global research company seeks the top 100 income payers globally, selected for their dividend yields, resilience, and likely growth.”

Shares must meet the following criteria to be included in the index:

• The dividend has been paid in the past 12 months.

• The dividend TTM dividend per share is not lower than the TTM dividend per share 5 years ago.

• The forward dividend payout ratio is less than 75%.

• The index then selects the 100 shares with the highest dividend yield. The weight of each share is based on the total dividend paid.

• The maximum weight of a share at the time of review is 5%.

• The maximum weight of a sector at the time of review is 40%.

• The index is reconstituted and rebalanced semi-annually, in June and December. Currently provides

If you want to read more about the index, you can download the index rule book HERE. If you dig around inside the data on the fund, you’ll see that this approach has some virtues:

1. It’s much less focussed on the US which comprises only 22% of the value of the index. French businesses account for 12.7% of the index followed by Germany at 11.62%. Of note is that the UK doesn’t even feature in the top 10!

2. Valuations are low. The see-through portfolio price-to-earnings ratio is just 8.91 and the price-to-book ratio is 1.17. This is massively lower than in the MSCI World Index.

3. The current historic 12-month yield is 4.67% per annum. Again, much higher than the MSCI World Index.

4. The TER is a low 0.38%

Top five holdings:

· VERIZON COMMUNICATIONS INC 4.51%

· CONOCOPHILLIPS 4.19%

· TOTALENERGIES SE 4.00%

· INTERNATIONAL BUSINESS MACHINES CORP 3.62%

· RIO TINTO PLC 3.15%

There are some complications to this approach. The first is that if the markets spend the next decade favouring growth stocks, this index and its ETF will massively underperform. The heavy focus on European stocks strikes me as a real risk if the continent continues to struggle at the macroeconomic level (and by this, I mean Germany). I’d also be alive to the fact that the index is heavily weighted towards the financials sector, with 40% of the index in financials.

So, stepping back from the detail, I’d say this cost-effective global mega large-cap strategy is attractive to value-oriented, defensive-oriented long-term investors i.e it could easily be a replacement for an MSCI World or MSCI ACWI index tracker. It’s not without its risks and I certainly wouldn’t recommend it for a risk-friendly, younger investor who is happy to accept market volatility in search of growth.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.