This month we have another gaggle of fund ideas, starting with a deep dive into gold index trackers – if you want a safe haven asset in volatile markets which are the best ETCs. Talking of deep dives we also identify a deeply discounted way of playing the digital infrastructure space. And last but by no means least a big-picture analysis of asset allocation ideas reveals which strategies help reduce downside risk. Spoiler alert – the classic 60/40 portfolio of equities and bonds is not the way to go!

Gold

Investors have always been attracted to gold in uncertain, turbulent markets. Look at classic portfolio combinations such as the Permanent Portfolio, which are designed to protect against the ‘unexpected’, and you’ll see that gold is one of the four equally weighted components. If nothing else, if things go really bad and we all head for the hills – or to the bunkers – then gold is also portable and instantly recognisable. Yet gold is also viewed by most professionals as the financial equivalent of a barbarous relic and something which an alien from Mars would struggle to understand as a safe haven. More quantitative finance-driven types tend to be a little more understanding of the shiny stuff, pointing out that in certain economic regimes such as the unsettled 1970s, gold did provide diversified returns in a more inflationary environment. But they also quickly remind us that gold’s relationship with macroeconomic ‘regimes’ is highly contingent i.e. it depends on lots of conflicting processes and influences. In this vein, the problem with gold is that its alleged hedging properties – especially against some types of inflation – come with lots of caveats and complications. Yes, it is a good inflation hedge especially against hyperinflation but not necessarily with all forms of stagflation. Gold is also heavily impacted by the absolute level, and direction of, interest rates. And then there’s the dollar which exerts its own gravitational force.

Put it all together and you end up with an asset class that does have value in volatile times but is ‘complicated’, as my kids would say i.e it works sometimes but not always. That said, it’s clear that gold has retained its value in recent years and hasn’t fallen away as it has after previous highs. And according to Gerry Celeya, chief strategist at Tricio and one of the best quant-driven technical analysts out there, gold is looking more interesting from a short-term point of view. He suggests watching the “ $2,072/oz. area all-time high to see if this holds off gold bugs, with support layered at $1,980/oz., $1,930/oz. and then $1,800/oz. ahead of the $1,600/oz. zone. A sustained break above $2,072/oz. would leave the risk to $2,200/oz. and higher open, yikes!”.

I personally have no set view on what will happen to gold next month, next year or even in the next decade. I don’t regard it as a barbarous relic and would note that plenty of central banks buy the shiny stuff as an insurance policy – if it’s good for pointy-head central bankers, it must have some utility. Equally, though I am aware that gold doesn’t produce any cashflows, and apart from limited use in jewellery and to a lesser degree industrial processes, it doesn’t have much functional utility except as a sum of all our fears. In simple terms then, gold is useful some of the time but pointless most of the time. Whether it will be useful in the next six months, I leave to your judgement.

But if you are attracted to gold, I would suggest checking the table below which lists the various gold-based trackers – these are usually exchange-traded commodities and are usually, though not always, physically backed. This means that for every £1 you invest – or more typically $1 – you get £1 of physical, allocated gold in a vault somewhere (less the charge for expenses of running the ETC). The location of that vault does have some relevance – most of the time those vaults are in the UK or the US but some investors like the option of owning physical gold in a jurisdiction such as Switzerland which is highly unlikely ever to try and confiscate your gold – as the US did in the 1930s.

The cynic might suggest ignoring this concern with jurisdiction and focusing only on the cheapest tracker but there are some other considerations worth bearing in mind. First, do you want to invest in a dollar-denominated tracker – the most common – or a sterling-priced one? An alternative might be to invest in a tracker which hedges out the sterling risk – a sensible strategy when sterling is weak, less so currently. Some investors also like to think they are not investing in gold whose provenance on ESG grounds hasn’t been verified – thus responsibly sourced gold from say the Royal Mint here in the UK might seem attractive (HANetf offer a Royal Mint ETC). Investors might also find themselves attracted to the largest ETC by market cap (from iShares) – thus almost certainly guaranteeing the smallest bid-offer spread and most liquid trading environment. Last but by no means least, gold equities might also be attractive – they have a very different return characteristics though they tend to be more volatile in terms of pricing. The table below lists your main gold ETC options for UK-based investors.

Table: Gold ETCs

| Category | ETC | AuM £m | TER | 1 year return | Ticker |

| Biggest by AuM | iShares Physical Gold | 12344 | 0.15 | 6.56% | IGLN |

| Long established | Gold Bullion Securities | 2946 | 0.40 | 6.56% | GBS |

| Swiss Gold | Wisdom Tree Swiss Gold | 2197 | 0.15 | 6.85% | SGLD |

| Most innovative / ESG focused | HANetf Royal Mint Responsible Gold | 696 | 0.22 | 6.70% | RMAU |

| £ Hedged | Wisdom Tree Physical Gold GBP Daily Hedged | 1011 | 0.25 | -.0.28% | GBSP |

| Gold mining equities | Van Eck Gold Miners | 766 | 0.53 | -8.33 | GDX (GDGB sterling) |

Music Royalty funds

I’ve written before in these articles about the two, large (by market cap) listed London stockmarket funds that invest in music royalties: the Hipgnosis Songs Fund and RoundHill Music. These both raised substantial amounts of money which was then invested in the music rights to some of the best-known pop and rock stars on the planet. For a while, both funds were flavour of the month – here was an income-producing alternative asset class which doesn’t seem highly correlated to the broader macroeconomy. In simple terms, whether consumers choose to stream songs by Taylor Swift doesn’t seem to be terribly closely related to the state of the economy. The problem though is that listed stockmarket funds that pay out a regular dividend (from those music royalties, from streaming to film sync rights) do have shares which are very much correlated with the interest rate environment. When interest rates started rising, investors started souring on the sector – if you can get not far off 4% from cash with no risk, why invest in music rights fund whose share price can be volatile? And boy, are these funds volatile in share price terms – both have declined very substantially in value in the last year as those interest rates have increased.

To be fair, rising interest rates were not the only headwind. Investors also became highly suspicious of the financial models that underpinned the net asset value estimates. The challenge was that both funds must rely on a financial model that incorporates various elements such as the risk-free rate (in turn, impacted by increased interest rates), a discount rate for owning risky assets, and an income stream from all those royalties (the cashflow used to cover the dividend payments). In both funds, the same independent valuation firm ran the numbers – Citron Cooperman. What happens if those experts were wrong? Who provided a second opinion?

Table: Music Royalty Funds

| Music royalty Fund | Share price | Discount | Net yield | Market Cap £ | 12 month share price return | |

| Hipgnosis | 85.3p | -40% | 6.2% | 1031 | -25% | |

| Roundhill | $0.60 | -50% | 7.1% | 420 | -35% |

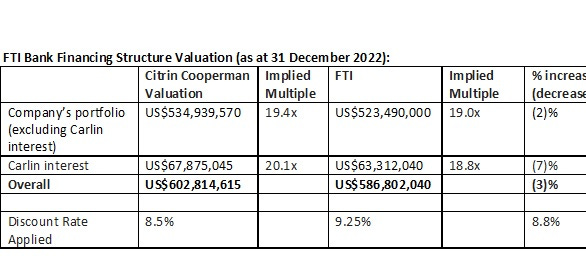

The directors running the RoundHill Music fund have listened to this criticism and instructed another firm – FTI – to conduct a separate valuation exercise ahead of the fund’s full-year results later this month. The existing report has tagged the economic NAV of Roundhill at $1.28 while its unaudited IFRS NAV was $0.93. According to Roundhill, the economic NAV included “a c.US$43 million increase in the valuation of the Company’s portfolio to c.US$603 million (including its equity interest in RH Carlin Holdings LLC ). Here’s a summary of the report they provided: “The FTI Report provides two valuations. One is based on a transaction using financing with traditional bank debt and one financed through an asset backed securitisation structure. The discount rate that results from the Weighted Average Cost of Capital analysis in the bank debt valuation is 9.25% and the discount rate that results from the WACC analysis of the ABS valuation is 8.25%. This compares to a discount rate of 8.5% used by Citrin Cooperman. FTI applies a low, mid and high range of valuations. In its mid case, FTI forecasts that overall portfolio cash flow will grow by 7%, 6% and 5% in 2023, 2024 and 2025, respectively. The FTI growth rates compare to Citrin Cooperman’s base case assumption of 5% for all income types (excluding a 2% assumption for ‘Other’ income) in 2023, 2024 and 2025, respectively. While FTI assumes a higher discount rate, their elevated growth assumptions largely offset any negative impact. Accordingly, FTI’s valuation for the traditional bank debt approach results in an overall variance of just (3)% compared to the Citrin Cooperman valuation. The results of the FTI Report are set out below and are based on the mid case valuation.”

I suppose if you’d wanted to be uber cautious you’d have inputted a higher discount rate than the one used by FTi and a lower portfolio cash flow growth rate but at least Roundhill is attempting to answer those cynics worried about the reliance on one set of valuers.

Stepping back from this detail, I now think that shares in RoundHill are possibly over-discounting the risks on the downside. The Hipgnosis fund trades a whole 10% lower in its discount at 40%, yet arguably RoundHill is now providing a more rigorous scrutiny of its NAV calculations. Both funds are still producing decent NAV growth as well as churning out the regular income, with the RoundHill net yield (on a 50% discount), running at 7.1%. My own hunch is that RoundHill and Hipgnosis should both be trading at roughly the same discount which in my perfect world would be somewhere between 30 and 40% – that level of discount would provide investors with some margin of safety. That implies there’s some possibility of an upside for RoundHill’s shares – my guestimate is that they wouldn’t seem unreasonably priced at $0.70 a share.

Adding D9

I’m probably not the only shareholder at Digital 9 who bought into the fund at launch and is now wondering what the heck went wrong – for the record I also bought into its rival Cordiant at launch and continue to own shares in both funds (yikes). To recap, for those who don’t know either fund, Digital 9 and Cordiant both invest in a portfolio of digital infrastructure assets such as data centres, towers for mobile phone operators, fibre optic cabling and even broadcast facilities.

For many months D9 traded at a premium to NAV as investors bought into the ‘hard-to-argue-with’ secular data growth story (more data usage exponentially increasing) alongside the sensible buy-in multiples for the fund acquisitions at launch – both funds usually bought their operating businesses in the 10 to 15 times EBITDA range which compares very favourably with the listed data centre and towerco peers who tend to trade on PE multiples of more than 30.

Then, last year, it all started to go wrong, and that premium vanished within weeks. One obvious headwind was the increase in interest rates which in turn impacted discount rates and risk-free rates and generally hurt dividend-sensitive stocks. Both D9 and Cordiant (to a lesser degree, as Cordiant had a lower initial dividend target at launch) were marketed as income and growth funds.

That said I have always been a bit wary of this structural explanation. I can see why renewable or generalist PPP funds with lower capital growth rates and average yields (in the 5% range) might be impacted by this rate regime change, but for businesses focussed on capital growth via strong secular trends (increasing digital demand), I’m a little more confused as to why this matters so much. And case in point, neither fund has drastically changed its discount rate after these interest rate rises.

Nevertheless, it’s impossible to deny that there was an infrastructure sector sell-off, and that could explain the elimination of the premium for both digital infra funds.

Key Fund Facts:

– Share price 70.9p, ticker DGI9

– NAV 110p

– Market cap £610m

– Discount 35%

– Current net yield 8.5%

But D9 was also badly impacted by two other fund-specific events. The first is that its launch manager left, rather unexpectedly last year. The timing was less than helpful as D9 was also finishing up the takeover of a big new business – Arqiva, the UK digital broadcast infrastructure business. This deal unnerved some investors and analysts, not because there’s anything especially wrong with Arqiva – there isn’t – but because it required a large amount of capital to complete the acquisition.

This sparked unease amongst some investors about the leverage and cashflow requirements – many of these worries were crystallized in a sell note from respected analysts at Investec (who are house brokers to Cordiant). If we had to focus this debate around financing, I suppose we’d look most closely at the cashflow required to pay for this acquisition and future accretion payments (see below) versus the cash flow needed to pay the dividend. In addition, the fund also needs to fund capital spending to grow the core businesses, especially Verne Global which I think is a world-class business. I don’t have any easy answers to this and as I discuss below, I’d rather the fund cuts ( or even abandon) the dividend and funds Verne’s expansion rather than keep the market guessing as to how the funding arrangements will develop.

But stepping back from this debate, I think one can understand why investors were nervous and thus the shares have now crashed to a 35% discount. I also think it’s fair to say that these worries are likely to depress sentiment in the near term. Let’s list the various ‘concerns’ and ‘challenges’ weighing on sentiment – with the help of broker comments.

– The dividend is currently covered on a 0.4x basis. Investec analysts reckon that “this calculation assumes that assets were held for the duration of 2022, and therefore it is likely that actual dividend cover in the year was materially lower than this”. That said, the fund reckons it can get back to full cover soonish. My own view is that uncertainty about the dividend is a serious drag on the share price and that the focus should be on funding the growth of Verne Global. Better to be brave and cut the dividend and focus on NAV growth in my view.

– High debt. As of 31 December 2022, the company had drawn £331.2m (25.0% of GAV) on its revolving credit facility. The company also has a £163m vendor loan note (VLN), used to fund the acquisition of Arqiva. Arqiva’s debt amounts to £754m. On a look-through basis, including the debt on Arqiva’s balance sheet, adjusted net debt/EBITDA is 5.7x.

– Financing for growth. According to Investec, “the RCF is currently £356m drawn and the 2023 capex pipeline is £223m alone so, whilst a c.£85m loan will help alleviate immediate concerns, longer-term solutions will need to be found”. According to Numis “Gearing is currently 28.3%, or 40.5% including the vendor loan note used to fund the Arqiva acquisition, within its limits. If it were to take gearing to the limit, it would provide up to £120m of additional capital”.

– Investec focuses its attention on something called accretion payments. “Arqiva uses interest rate swaps, including inflation-linked interest rate swaps, to hedge interest rate exposures. The inflation-linked swaps convert existing interest costs to RPI-linked costs, which fluctuate in line with the RPI index. The notional amounts of these swaps accrete with RPI, and these accretion amounts require cash settlement annually in June. Some 65-70% of Arqiva’s revenues are linked to inflation, and therefore a high inflationary environment is beneficial to the long-term profitability and value of the company’s investment in Arqiva over the long term, however high inflation negatively impacts the operational cashflow of the business.” The accretion payment due in June 2023 is based on the prevailing RPI index at the end of March 2023.

I would in no way attempt to underplay these challenges, but I think we also must take a step back and say that nothing we’ve seen so far undermines the secular growth story that was outlined at IPO and has been reinforced by recent trading numbers. D9 is caught in a funding-for-growth trap, where it has competing priorities – does it continue to fund growth, or does it fund the dividend? The fund will no doubt say it can do both – we’ll see! But Arqiva Global (alongside the fibre business Aqua Comms) continues to produce a steady stream of cashflow, while Nordic-focused data centre operator Verne Global is well positioned to grow very substantially. The challenge for the board and the new manager is how to square the circle – more capex spending whilst also keeping income investors happy.

It’s also worth listing the positives for D9 – the board does seem to be listening to investors and the fund recently staged what seems like a positive capital markets day for institutional investors. As a result of this and the recent trading numbers, I’d highlight the following:

– The fund has a sensible discount rate, increasing marginally over the year from 12.56% to 12.64%.

– The recent results were actually pretty good. On a run-rate basis which assumes the data centre business contracted revenue hits the target, the portfolio generated EBITDA of £226m, a £20m uplift on actual EBITDA, and an increase of 6% on the prior year. The NAV at 31 December 2022 was 109.76p/share, an increase of 4.9% over the year, and a NAV total return of 10.4%.

– Share purchases. Numis reports that “the investment manager has purchased 150,000 shares at an average price of 61.40p on 31 March. In addition, senior members of the Digital Infrastructure team purchased a further 240,000 shares. The manager, including senior members of the Digital Infrastructure team, now holds a total of 2.33m shares, c.0.27% of share capital.”

– New funding. According to D9, “term sheet having been agreed for a $100 million facility to be provided to one of the high growth Investee Companies. Completion is expected in May 2023. Also “syndication of a minority stake in existing Investee Companies to a strategic capital partner progressing in line with timetable. Terms are expected to be announced in August 2023”.

– The managers reckon they can see a path to a fully covered dividend if inflation falls to right level (c4%) and the Verne Global ramp-up pays off.

– Verne Global is nearly 40% of the portfolio. I want to emphasize this as Verne Global is, in my view, a gem of a business. Its core proposition is enormously convincing – I’ve visited the main Iceland site and talked to senior management and come away hugely impressed.

In simple terms, Verne’s Icelandic hub can process data for data-hungry corporates using cheap, renewable Icelandic electric power at a fraction of the cost of mainstream European metropolitan data centre rivals. That ticks various green boxes of course but the cost saving is huge and there’s no especially obvious issue with data latency for corporate users i.e why would a vast German motor manufacturer running design centre simulations worry that a piece of computation took tiny fractions of a second longer if the cost was hugely lower. My own view is that as a leading player in the Nordic data centre scramble, Verne Global is an acquisition target especially as it ramps up capacity over the next three years. But it does need financing – probably to the tune of £95m in 2023.

– Arqiva (27% of portfolio) is a much more defensive business, comprising two main revenue lines – broadcast and smart meters, with likely growth in water metering.

– One message I got from those who attended the capital markets day is that the heads of the individual businesses were regarded as highly capable. The issue with leadership is not at a business level but at the fund level. With a fair wind, I think it’s reasonable to expect a new Head of Digital/fund manager to be in place by Q2.

Overall, I think the sell-off is now overdone and I think the shares are well positioned to rebound, if not imminently because of the concerns I’ve highlighted above.

My target is for the shares to trade closer to 85p to 90p by the end of the year and possibly above 110p in the event of a takeout which I think is increasingly likely in the next 2 to 3 years i.e D9 could be acquired by a trade buyer at close to NAV.

My finger in the air guestimate is that said bidder might wait until Verne Global is scaled up and then pounce on the fund – Arqiva and Aqua Comms are both reliable, defensive businesses and thus easily sold off to get to Verne Global. Acquisition or not, the challenge is now for D9 to fund the Verne Global business to get to that scale – and keep funding the water smart meters business for Arqiva and more fibre rollouts for Awua. If that is the strategic objective – build Verne Global and other business lines – then I think the fund should hunker down, cut the dividend, conserve cashflow in the rest of the group, accept the short-term pain to the share price as income investors sell, and fund the data centre expansion program.

I’m adding D9 to my alternative funds trading list (alongside Cordiant which is already on the list). I’m starting to add to my position on a drip feed basis, partly because I suspect there may be some continued volatility in the share price and I wouldn’t be surprised to see the shares trading below 70p and even 65p at some stage.

An essential asset allocation primer

I want to finish with what I think is a pivotal piece of investment research which looks at how to allocate between different asset classes over the long term. I read about it in the excellent daily blog by Liberum strategist Joachim Klement – you can read his blog for free HERE. Klement looks at a paper by two US-based investment researchers Mikhail Samonov and Nonna Sorokina which involved testing various different asset allocation mixes over a period from 1926 through to 2020. These strategies included the following:

- US 60/40: The workhorse benchmark portfolio of 60% US large-cap stocks and 40% US bonds.

- Global 60/40: The same as above but using global equities and global bonds (unhedged in US dollars).

- Diversified 60/40: The same as above but splitting equities and bonds up into smaller sections including small caps, emerging markets, high yield bonds, plus 6% commodities.

- Risk parity proxy: One-third of the total portfolio risk (volatility) is allocated to US large-cap equity, US government bonds and commodities.

- Endowment proxy: This portfolio replicates the average weights of modern-day endowment funds and in particular includes 13.5% private equity, 9.3% venture capital, 20% marketable alternatives (e.g. hedge funds), and 11.5% real assets.

- Factor-based portfolio: a combination of 70% of the US 60/40 portfolio and 30% invested in 15-factor indices (2% each, covering 8 equity factors, 2 currency factors, 2 bond factors and 3 commodity factors).

- Dynamic allocation: This is a dynamic allocation between US large-cap stocks and US bonds targeting the same volatility as the US 60/40 portfolio over the last five years and using trailing 11-month returns as return estimates.

I’d highlight some key observations from the paper on losses:

“One prominent feature of nearly all portfolios is their synchronous decline in value at the time of the major stock market downturns, such as the Great Depression, WWII, the stock market crash of the early 1970s, the Black Monday crisis in 1987 and, finally, in the Great Recession. The drawdown could get as deep as 62% for the U.S. 60/40, and it could take up to almost 7 years to recover and reach the pre-crisis wealth level ….Wealth losses of 15% or more occurred more than ten times over the past century in all portfolios, except Factor-Based and Dynamic portfolios”

Also, this observation stands out for me:

“Dynamic allocation stands out sharply among the rest of the popular investment strategies with only 8 drawdowns of 15% or more, only 2 of 25% or more, and the maximum drawdown of 26%, a stunning achievement when the next lowest of Factor-Based portfolio is at 44%. In sum, unconditionally, Dynamic allocation significantly reduces drawdown risk, however, such insights can only be fully appreciated when all allocations are reviewed over their complete long-run histories”.

And their conclusion?

“It turns out that most strategies are prone to deep, frequent, and prolonged downturns in portfolio value (drawdowns) in the event of a market crash that occur several times during the observed period. Only Factor-Based allocation offers a significant improvement over others when it comes to a large-scale loss of wealth when markets approach their trough. Dynamic allocation stands out in stark contrast with others with maximum drawdown of only 26% and very infrequent incidences of 15-25% drawdowns, as compared to 62% maximum wealth loss in US 60/40, Risk Parity, and Endowments, and others not too far behind in terms of the observed maximum and frequency of severe downturns”.

Just for added measure, here’s Joachim Klement’s own takeaways:

- Diversification works: As if this needs any proof, but it is nice to see that the more diversified a portfolio gets, the better it is compared to the US 60/40 starting point. The Diversified 60/40 portfolio has about the same return (8.7% p.a.) as the US 60/40 portfolio but lower volatility (10.4% vs. 11.6% for the US 60/40). And while the more diversified portfolio doesn’t necessarily have less drawdown in a crisis, it gets out of the hole significantly faster than a less diversified portfolio. The diversification benefits increase if we move towards a risk-parity portfolio or an endowment-style portfolio.

- The lowest drawdown risk exists in the dynamic portfolio allocation indicating the importance of adjusting portfolio weights in changing environments to reduce losses.

- The highest return is shown by the endowment portfolio, which in no small part is due to the high returns in alternative asset classes like private equity and venture capital. However, this higher return comes at an important cost. Drawdowns and time underwater for endowment portfolios are substantially bigger than for more conventional portfolios. If you don’t have a very long time horizon of several decades and an iron discipline to stick with the strategy in what can be years and years of underperformance, these portfolios are not for you.

- Mixing systematic factor exposures in a portfolio can be a good middle ground between less diversified 60/40 portfolios and the more complex endowment portfolio. And they have the lowest drawdowns and time underwater of all static portfolios. So, if you are not into dynamic asset allocation, why not look into a combination of many different factor portfolios from value to momentum, low volatility, etc.?

I would echo Joachim’s conclusions – this analysis reinforces the idea that a more active asset allocation strategy, possibly using ETFs, can be a productive exercise. It is possible to dial down risk and dial it up again without engaging in pointless market timing – but you need to do it intelligently and rigorously. I would also echo the point about using different factors during different phases of a market cycle. This is an idea – using factor ETFs – which I will return to in later months. That said, if all this talk of portfolio strategies confuses you, or even worries you, ignore this modelling and stick with a long-term buy-and-hold strategy and just wait out the next 20 to 30 years.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.