This month our funds expert outlines an alternative strategy for those investors looking for growth in global emerging markets – why focus on the big names of the EM space such as China and India, when you can invest in the next 1 billion potential consumers from 10 developing countries around the world? Back in the UK, maybe equity income’s time has come – analysts at Morningstar certainly think so – plus an update on the digital infrastructure funds D9 and Cordiant as they struggle with huge discounts and annoyed investors.

Digital Infrastructure funds begin to stir

I’ve become ever more confident in recent weeks that we’ll see a turnaround in sentiment – and share prices – for the two digital infrastructure funds, Cordiant and Digital 9 aka D9. Both funds are on my buy lists, and I have been buying more stock on a regular basis and will continue to do so. The big picture is that both funds have first-rate digital assets – data centres, phone network towers, fibre optics and broadcast infrastructure – but both have been hit badly by a combination of stock-specific issues (especially at D9) and a wider sell-off of in infrastructure assets because of higher UK gilt yields. That latter driver isn’t going to diminish any time soon but both funds are making solid operational progress and I would argue that sooner or later investors will realise that in the private equity space, high-quality digital infra-assets such as D9 and Cordiant will at some stage become the target of a wave of corporate M and A activity.

That said, I would want to under-estimate the challenges both funds face, particularly D9 which has suffered from a number of self-inflicted wounds. These included its manager upping sticks and moving on almost immediately after a huge acquisition (Aqiva) which put the balance sheet under some pressure and resulted in investors doubting the ability to fund the generous dividend. Digital 9’s shares currently trade at a discount of c.37% on an 8.5% dividend yield. The good news is that the board and managers of the fund are keenly aware of the negative sentiment surrounding the shares and have been very active in recent months. Recent announcements include :

- Managing debt costs at Arqiva. The terrestrial TV and radio broadcasting network in which Digital 9 Infrastructure (DGI9) has a 48% stake, has taken out an inflation collar on its inflation-linked interest rate swaps – this limits the risk of a significantly higher payment next year and in subsequent years until the swaps expire in 2027

- At the main fund level, the board has appointed a new manager, Diego Massidda. He has over 20 years’ operating experience in global telecommunications and digital infrastructure having spent 16 years with Vodafone Group. He is currently CEO of Vodafone Partner Markets, responsible for all services provided by Vodafone to other mobile operators

- The Nordic-focused data centre operator Verne Global is, in my view, the jewel in the crown of the portfolio and is currently being refinanced so it has enough cash to grow the business. On this score, D9 announced that it has signed a new $100m (£80m) green term loan debt facility with an uncommitted $50m (£40m) accordion provision for Verne Global Iceland. To pay for the loan D9 has agreed to an interest rate swap for the first three years of the Facility to manage longer-term fluctuations in interest rates at 7.14%. The funds chairman notes that the capex funded by the loan will generate “significant returns that far exceed the cost of borrowing”

In the background, there’s also an ongoing process to get new investors to put money into Verne Global equity which will help reduce D9’s fund borrowings. I’d expect an announcement on that fairly soon.

Stepping back from the detail, I stick by my view that in 2024 I would expect 10-year gilt rates to start to fall back again as the UK enters a slowdown/recession. That will take pressure off valuations in the infrastructure sector more generally and make the discount on D9’s quality assets seem excessive. My own hunch is that a discount closer to 20% would make sense although I would warn investors that I believe the fund will cut its dividend to conserve its balance sheet and minimise cash outflows.

Cordiant Digital Infrastructure has not suffered from any self-inflicted mishaps but has also found itself in the dog house alongside D9. Cordiant currently trades at a 32% discount and has a 5.2% fully covered dividend yield which is highly likely to grow over the next few years. It’s just released an update on trading – it boasts a handful of high-quality digital assets mostly in central and Eastern Europe.

For the 12 months to the end of March 2023, the fund increased NAV to 113.4p, which represents an increase of 5.5% since 30 September and 6.6% for the year as a whole. The portfolio businesses generated solid growth, and the fund was helped by FX movements, but the numbers were also impacted by an increase in discount rates to reflect increases in market interest rates and higher risk premia.

According to a report by fund analysts at Numis on Cordiant, looking at the portfolio companies, in total they “generated combined revenue of £197.1m, representing a 7.8% increase over the prior year, on a like-for-like proforma, constant currency basis. Portfolio EBITDA increased 10.0% over the year, on a like-for-like proforma, constant currency basis to £103.8m. In particular, Emitel in Poland delivered a strong performance with revenue up 13% and EBITDA up 8%. Performance exceeded management expectations reflecting contractual escalators offsetting an increase in energy prices”.

So, again, stepping back from the details of both funds I want to emphasise that although investor sentiment for D( and Cordiant is negative, both funds have solid portfolio companies that are growing as expected. In a new world of higher rates for longer, the real trick for infrastructure companies is to grow the net asset value of the funds and that means improving operational performance. The dividends on both fund though meaningful are not quite as important as that accretive Nav growth and I would maintain that both funds are in the sweet spot for investors in the long term – cash-generating infra assets, benefitting from solid demand growth with steady margins and inflation protection. My own target is for a 10% to 15% discount for Cordiant by mid-2024 and a 20% discount for D9 though I think the latter is highly likely to be a bid target within the next 18 months, especially as its Verne Global business expands.

The Next Billion 10 Nations – an ETF portfolio

One of my small beefs with the whole concept of emerging markets as expressed through benchmark indices such as the MSCI Emerging Markets index, is that although it claims to be a very diversified, disparate bunch of nations and companies, in reality, it is very China and Greater China-focused. By Greater China I mean PRC, Hong Kong and Taiwan plus South Korea whose main trading partner is…Chins. In sum, it doesn’t strike me as a very diversified index.

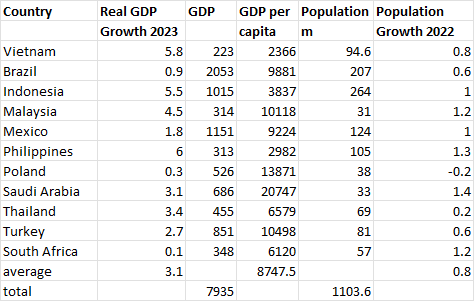

My natural default position is to opt out of global benchmarks and buy individual national markets such as India for instance or smaller markets that don’t tend to get the same publicity (and fund flows). That’s prompted me to come up with the idea of the Next Billion. This comprises 10 very different, very diversified countries that are populated by 1.1 billion people, some of them nearly middle-income, others less so. My selection of countries was informed by one crucial constraint – I wanted countries where you could, as a UK investor, buy individual country funds (exchange-traded funds). Here’s the ten countries and their key macro numbers in the table below.

I would like to include some other countries such as Nigeria or Chile in the list but my constraint is that they are not tracked by either ETFs or actively managed funds i.e they have potential, but you can’t invest in them easily! I also had one country that I was tempted to include – Pakistan – but is just too insanely frontier and risky for my shortlist. So, this gives me ten countries which can be tracked by ETFs – and in some cases actively managed funds. On that point Vietnam is well served by actively managed investment trusts listed on the LSE and in this case, I would switch to an investment trust.

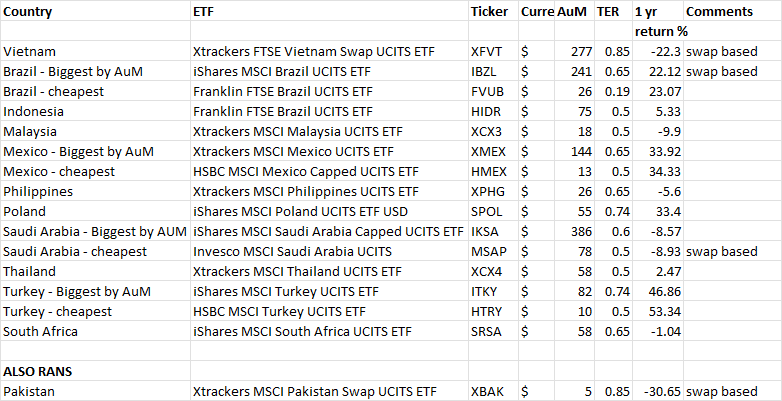

Anyway Vietnam aside, each of these 10 countries is easily accessed by ETFs – in the next table below I’ve listed your choices. In most cases, there’s only one fund available but in a few (Brazil, Saudi, Turkey) you have a choice, which is either the biggest by assets under management (AuM) or the cheapest by total expense ratio.

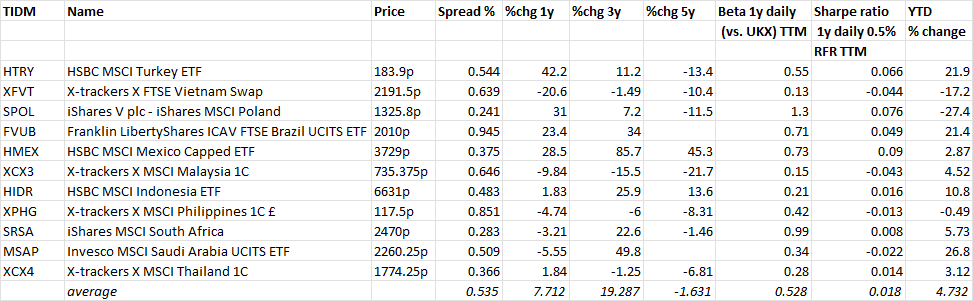

There are advantages to investing in the biggest by AuM as the ETF is likely to have greater liquidity but in the next table below I’ve opted in each case for the cheapest ETF by TER. This table also shows recent price returns from the ten ETFs I’ve opted for. As you can see from the bottom line, I’ve averaged out returns for these ten ETFs: YTD they are up an average of 4.7% while over the last year they are up 7.7%. Unfortunately, over the last five years, these ten Next 1 billion ETFs have averaged a LOSS of 1.6%.

I will now be monitoring this portfolio in real time but I would make the following claim: in my view, if you want to capture the real potential of the emerging markets and all their budding consumers, you need an alternative to the default EM weighting towards Greater China and India (not that there’s anything wrong with India as a stand lone option) – this list of ten ETFs, for me at least, represents a diverse, diversified bunch of lower and middle-income markets with population growth and an emerging consumer and middle class. It’s the EM shortlist I would want to have exposure to over the long term. |Some of the countries are resource-oriented (Saudi and Brazil), many are export-oriented (Poland, Thailand, Malaysia), some are middle-income already (Poland and Brazil), some are still loving up the ranks (Indonesia). Some are appallingly run at the moment (South Africa, Turkey and Thailand), others seem fairly sensible (the Philippines, Brazil), while some are likely to benefit directly from an exodus out of China (Vietnam and Mexico). Crucially, as a private investor, you can buy into these ten ETFs easily and efficiently – and the TERs are without exception very reasonable.

UK Equity Income

One last thought – dividends matter for fund buyers. For most investors, the dividend is a source of income but financial history tells us that in fact dividends should be seen as a large component of total returns – which implies any dividend you receive is reinvested in the underlying investments. Volatile market regimes – such as our Higher for Longer new normal – tend to favour more defensive strategies where dividends are a more important component of total returns. Put simply, with gyrating share prices, the reliable dividend cheque begins to look like a safe haven.

This thinking helps explains why more investors are beginning to dust off their dividend-focused investments – and funds – and think about deploying more money. Even in the US, we are seeing consistent dividend growth (as opposed to share buybacks) as local investors begin to focus on corporate cash generation and returning money to shareholders. This coincides with the fact that many US businesses are enjoying elevated profit margins and in some cases, it’s not obvious what they should do with the spare cash they are generating!

Even in the UK, we are seeing record dividend payouts, and this has sparked renewed interest in UK equity income strategies. Spotting the trend, analysts at Morningstar have just released a report called UK Equity Income: Dividends Aplenty or Yesterday’s Strategy?

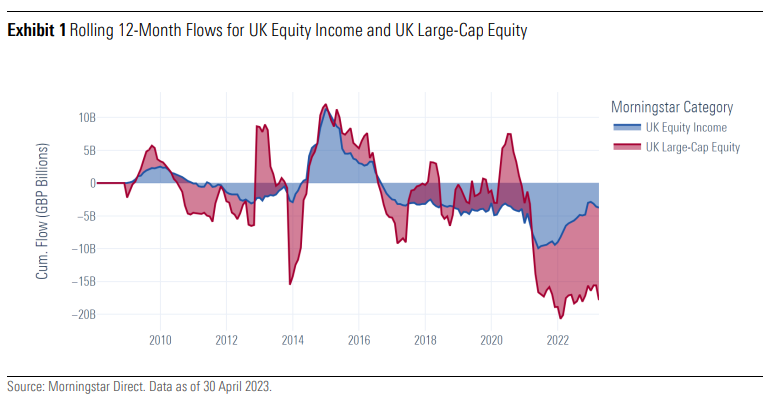

First though a bit of background. UK equity income has had a terrible few years and as an IMA sector suffered £33 billion in outflows, while UK large-cap equity GBP 18 billion was also hit by outflows, since June 2016, with these numbers representing 60% and 23% of starting assets, respectively. As a result, many UK equity income managers have tilted their portfolios towards a blend that includes growth stocks, while another subset have taken small-cap bets. As a result, Morningstar reckons that traditional equity income stocks are now at attractive valuations. Furthermore, dividend stocks also hold the potential for dividend growth, which typically more than compensates for inflation and could make them interesting for an income investor.

The report also argues that the macro backdrop that favoured growth stocks from 2009-21 has now ended with rising rates and expensive growth stocks plummeting in value. But it’s also complicated by the fact that high dividend names are seen as riskier which has in turn prompted a push into “the growthier areas of the [equity income] market, with sectors like luxury brands and technology being desirable not just from a return but also from a risk perspective” argues the Morningstar report. “As a result of the UK equity market’s underperformance, traditional equity income stocks are attractively priced, such as Legal & General (who are trading on two-thirds of its five-year average price-to-book with an 8% yield) and National Grid (trading under its five-year price-to-earnings with 5.4% dividend yield). Even though yields have risen considerably over 2022, to the point where cash can offer attractive rates versus equities, investors are generally well-rewarded for investing at these sorts of valuations in total return terms.”

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.