Our monthly funds roundup looks at why prospects for the UK economy and funds investing in our local markets might be looking up, the general election notwithstanding. We also repeat the bull case for gold and look at a model that suggests that gold could push closer to $2750 an ounce in an optimistic scenario. Last but by no means least, we look at how one energy efficiency investment trust is doing everything in its power to narrow its discount, making it an excellent idea for income seekers.

The UK and UK equity funds

So, we’re about to suffer from a short summer general election campaign, with the inevitable steady drip-feed of rows, debates and concerns. The good news is that if you look beneath the big promises, both main parties’ raft of economic policies don’t look seismically different. The emphasis seems to be either steady as she goes or steady as she goes with more tax cuts and less regulation.

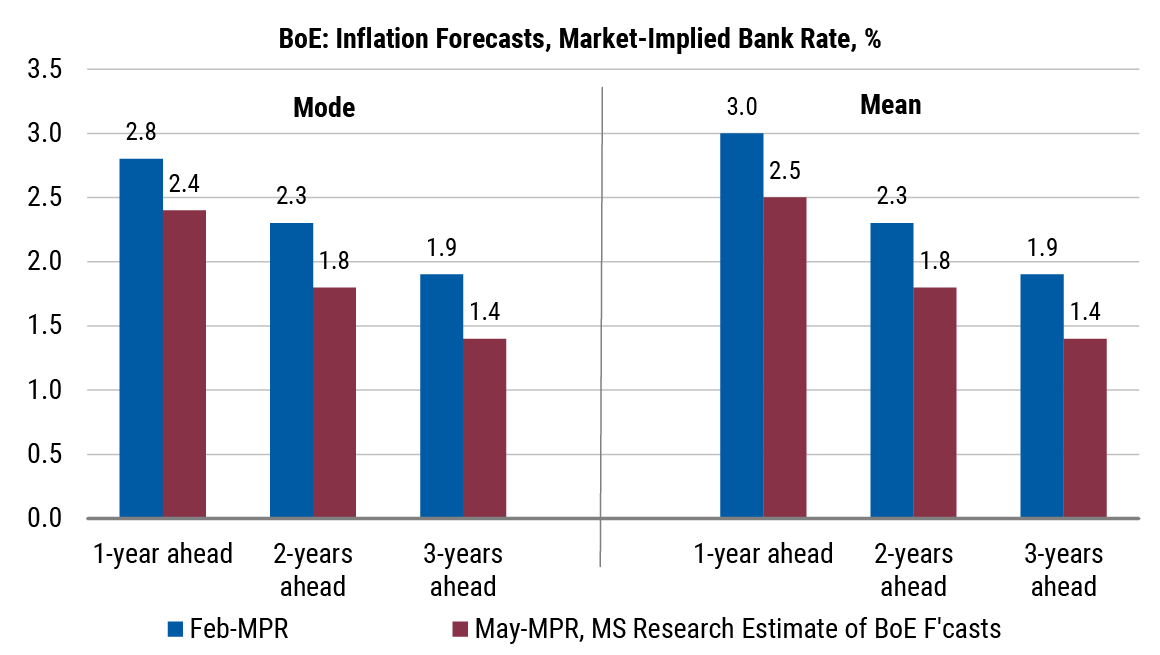

Markets don’t seem too spooked by the impending general election, and most investors I talk to are instead more focused on the macroeconomic data, of which there has been a run of good news stories starting. The big story, of course, was that the UK is no longer in a recession – it was admittedly a short, technical one – and that the economy is growing again. The recent inflation figures, though not quite what the market – and the BoE – expected, showed a considerable improvement on last year’s numbers and suggest that UK inflation rates might be stabilising below 4%, which is a big plus for most investors.

This slow stabilisation in inflation has prompted many economists to begin to map out a positive case for the UK economy in the next 18 months, general elections notwithstanding. A typical bull is John Calverley, Chief Economist at Tricio and a former bank economist who has what I think is a straightforward argument for why the UK will likely surprise on the upside.

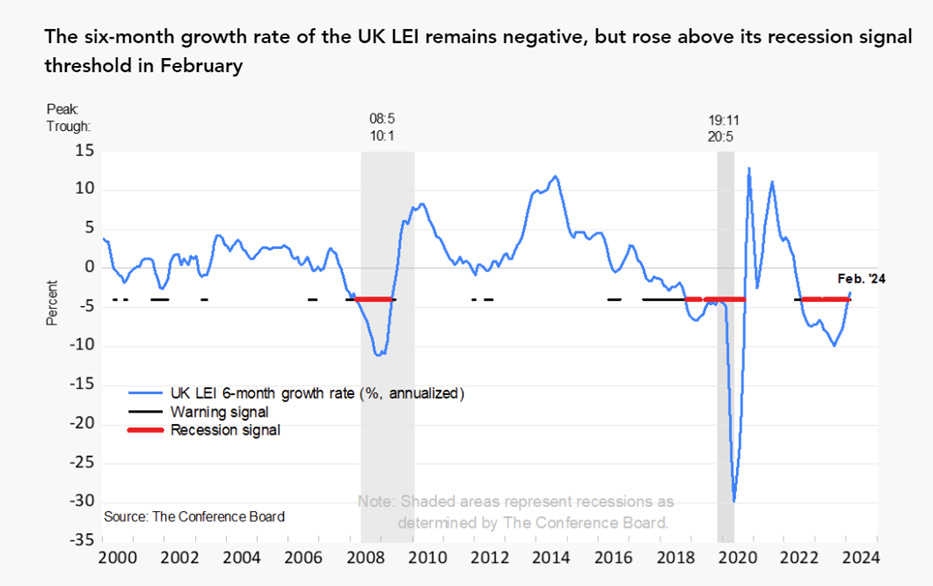

For him, the key development is that the fall in real income caused by the energy shock is over. With headline inflation falling and more under control and wages still growing at 6%, real incomes are increasing. Of course, the interest rate shock is still coming through for mortgage holders, but on the positive side, the money supply has been picking up in recent months. Calverley also notes that “the household savings rate also went up last year to 10.2%, almost double what it was in 2019. It could easily come down again—it should do really—which would boost demand. In terms of data, expectations for Q1 GDP are positive. The Conference Board’s leading index is still falling, but the 6-month change is declining less than before, which is a positive signal”.

The chart below gives a clear idea of recent GDP trends.

So, I think if you spend enough time looking at the endless supply of macroeconomic data and charts, one can build a case for the UK bulls as follows :

- Money supply and credit conditions are improving

- Interest rates are likely to come down

- Real incomes are starting to rise again

- Inflation is falling, maybe by not quite as much as the Bank of England would like, but it is heading in the right direction and might even surprise us all by how low it falls

- The service sector and construction is strong, and even the manufacturing sector is positive

- Immigration has hit record highs, and regardless of your views about that development, that MIGHT be positive news for the UK economy, though its benefits will be unevenly distributed

- The UK housing market looks like it has stabilised, although it is a bit crestfallen and illiquid

Some of that news has also been reflected back into the UK stock market, which has had a decent start to the year. Year to date, the UK market is not too far behind the US market, although, in Europe, one of the best-performing markets has actually been Germany. We’re still far from even starting to close the huge recent gap in outperformance between the UK and the US, but the mood in the City is palpably more confident.

And it’s certainly the case that, in aggregate, UK equities are cheap by developed world standards and also cheap against their 5-year average valuations (by around 20%) – on this basis alone, a 10 to 20% rally is entirely possible. Digging around in the fundamental data for UK companies, it’s also possible to say most big UK equities are highly profitable and benefit from high ROCE and high operating margins. Their problem is that they aren’t growing earnings by as much as their US peers.

The caveat I would add to the bullish case is that there’s a considerable dispersion within the two main benchmark indices (the FTSE 100 and FTSE 350), which, in my humble opinion, suggests that active stock pickers stand a decent chance of outperforming passive index tracking funds. Also, I’d note that the FTSE 250 is still lagging behind virtually every major developed world index, largely because of the poor returns from investment trusts.

So if you are feeling more confident about prospects for the UK economy and the UK market, what might a sensible choice be in terms of funds? I’ve tried to summarise what I think are the best choices, either in exchange-traded funds or investment trusts. In the latter, I’ve tried to focus on the trusts with a decent long-term performance track record and the most reasonable discounts (or even premiums). Regard the list below as a starter for 10 for your own research.

ETFs

All UK equities (mainly but not exclusively large caps)

- Lyxor Core UK Equity All Cap, ticker LCUK, TER 0.04%

- L&G UK Equity UCITS ETF, ticker LGUK, TER 0.05%

Large Cap FTSE 100

- iShares Core FTSE 100 UCITS ETF, ticker ISF, TER 0.07%

- Vanguard FTSE 100 UCITS ETF, ticker VUKG, TER 0.09%

Mid-cap FTSE 250

- Vanguard FTSE 250 UCITS ETF, ticker VMIG, TER 0.10%

Dividend Focus

- iShares UK Dividend UCITS, ticker IUKD, TER 0.40%, follows the FTSE Dividend Plus

- SPDR S&P UK Dividend Aristocrats UCITS ETF, ticker UKDV, TER 0.30%, follows the S&P UK High Yield Dividend Aristocrats index

Investment Trusts

All UK companies

- Aurora (-9.8%)

- Fidelity Special Values (-8.8%)

UK Equity Income

- Finsbury Growth and Income (-8.4%) on a 2.3% yield

- Law Debenture (0%) on a 3.7% yield

- Edinburgh Investment Trust (-10%) on a 3.7% yield

UK Mid-Cap

- Mercantile (-10.2%) on a 3.1% yield

Small Cap and Micro Cap

- JPMorgan UK Small Cap Growth & Income (-6.1% discount)

- BlackRock Throgmorton Trust (-10.4% discount)

- Odyssean IT -micro-cap – ( 1.1% premium)

SDCL – worth a closer look for income investors

I’ve long thought the market undervalues SDCL Energy Efficiency Income Trust (SEIT). Over the last few years, it has done pretty much everything to prove that its discount – which at one point hit 42% – was wide of the mark. Its sold assets at or above their net asset value. It runs an extensive share buyback programme. It has a covered dividend from relatively dull assets. Its net yield, even now, is a compelling 9.5%. Its managers have bought shares, and so have the directors. It even turned in decent trading numbers back in March: a quick summary below.

- The portfolio aggregate EBITDA outperformed the budget for the calendar year 2023

- The Investment Manager has selected a preferred bidder for one of the Company’s larger investments and aims to select a partner for another in the coming months

- The Company is on track to deliver fully cash-covered aggregate dividends of 6.24p per share for the financial year to 31 March 2024

- SEEIT made organic investments totalling £52 million between 1 October 2023 and 18 March 2024, all of which into existing assets under development or construction – predominantly in Red Rochester and Onyx – where the Company anticipates strong double-digit internal rate of returns

I think the fund’s research team at Numis summed it up nicely (back in March) when they observed that “SEIT’s update contains positive comments on EBITDA delivery from the portfolio, a cash covered dividend, and progress on its disposal plans with an update expected by the end of June along with additional clarity on capital allocation priorities. Potential proceeds will be used to repay the £155m drawn balance on its RCF.”

It was also recently announced that US private equity firm General Atlantic has built a 12% stake in SDCL Energy Efficiency Income Trust (SEIT), making it the second-largest shareholder after wealth manager Investec, according to Citywire. Here’s a bit more colour from that Citywire report :

“After shares in the £950m renewable infrastructure fund derated last year, New York-based General Atlantic started to build a $99m (£79.3m) position in December. It last bought shares in March. They currently trade on a 28% discount, reducing its market value to £679m.

Headed by executive chair Bill Ford, General Atlantic portrays itself as a patient, long-term investor in unquoted growth companies on behalf of wealthy families.”

So, to repeat, this is a quality fund with a well-covered dividend, proving its net asset value, with a big strategic investor on board and still yielding 9.5% on a 25% discount. As soon as interest rates start to decline, I think investors will begin to realise that even at a 25% discount, this is dirt cheap. I think there’s a decent chance that by this time next year, the share price could be back above 80p, and in the meantime, investors will also pick up the healthy dividend cheque. For income-seeking investors, this is well worth a closer look.

Gold

Another asset class that I’m very positive about is gold. I’ve written about gold in previous fund roundups. In my view, I think it represents a decent hedge against geopolitical risk and, more importantly, the rise of big government and massive fiscal deficits. As John Stepek at Bloomberg reports, “Gold is back at a new record high. The price of the yellow metal is now above $2,400 an ounce. A number of things strike me as interesting about gold’s current advance. As I’ve mentioned before, it’s not generating much fanfare, partly because lots of other stuff is hitting record highs too (have I mentioned the FTSE 100 lately?).

Another is that it has largely happened against a backdrop of higher interest rates and a strong US dollar. Neither of those things are traditionally viewed as good for gold. Gold is priced in US dollars (so all else being equal, a rising US dollar should mean a falling gold price); and gold pays no interest, so in a rising rate environment, that’s a drawback. One factor generally agreed to have kept gold resilient is hefty demand from central banks, and China in particular. The International Monetary Fund’s first deputy managing director, Gita Gopinath, highlighted this factor in a striking recent speech to the Stanford Institute for Economic Policy Research.

China’s central bank has increased the share of gold in its total currency reserves from below 2% in 2015 to 4.3% last year. Meanwhile — and the dollar doomsters will find this interesting — it has reduced its holdings of US bonds from 44% to 30%.”

Interestingly, analysts at French bank SocGen—typically moderately bearish about gold and much more equities-friendly—echo many of these bullish arguments. They think investors should stay positive on the precious metal assuming the current context continues—i.e., inflation stickiness, problematic public deficits, geopolitical dangers, and diversification by central banks/monetary authorities.

“Our analysis shows that current gold prices are not aligned with their usual drivers: US 10y real yields, the dollar index, and market risk appetite. In fact, the theoretical gold price, as defined by traditional pricing factors, was already much lower than the actual price prior to the $400/oz surge from mid-February to mid-March.

Central bank’s demand for gold has once again become a key driver of the gold price, especially demand from non-Western aligned countries of the Global South. In 2023, global central bank’s purchases of gold amounted to over 1,000 tonnes, double the 2010-21 average. It is tricky to value gold price (no dividend distribution), which when compared to S&P 500 is at multi-decade lows. Turning to technical analysis, we find that the gold price has been on a secular upturn since 2018 and see a possibility of it reaching the $2750/2770 level by year-end. The gold price broke free from its usual drivers when the Ukraine war started. As a haven of last resort, gold has benefited from a world in which the number of identifiable tail risks has surged higher. In particular, we see no relief on geopolitical fears on the eve of the US elections (5 Nov 2024). This, in turn, should drive demand from central banks in the Global South…since then, the gold price has risen by 30.0%”.

Another positive view comes from analysts at ETF firm Wisdom Tree (spoiler alert – they run some of the biggest gold ETCs), who run a gold price behaviour model. Their model indicates that at the end of March 2024, gold should have increased by 13.4% year-on-year, matching the 13.2% year-on-year increase we saw. Their model accounts for US dollar appreciation and rising treasury bond yields, which have been a drag on gold prices, but the higher level of inflation counteracts these drags.

One factor that hasn’t been much help is fund flows—according to Wisdom Tree, today’s positioning is in line with the five-year average and does not indicate being overstretched.

“Investor sentiment towards gold has not universally improved, with exchange-traded product (ETP) investors still sitting out this rally. It is unusual for ETP investors to shy away from a gold rally for so long. However, outflows from gold ETPs have slowed, and we have not seen any signs of profit-taking due to the sharp price rise.”

The key driver for analysts at Wisdom Tree are central banks.

“ While gold’s gains have been fully accounted for in our model approach, strong central bank demand also appears to have supported the metal. According to the World Gold Council, central banks bought 64 tonnes of gold in January and February 2024, which is 43% lower than in 2023 but a fourfold increase in 2022. Noting that the full year 2022 was an all-time high for central bank buying, with more of the purchases taking place in the latter part of the year, it may be too early to say if the 2024 trend is so far indicative of what is to come later this year.”

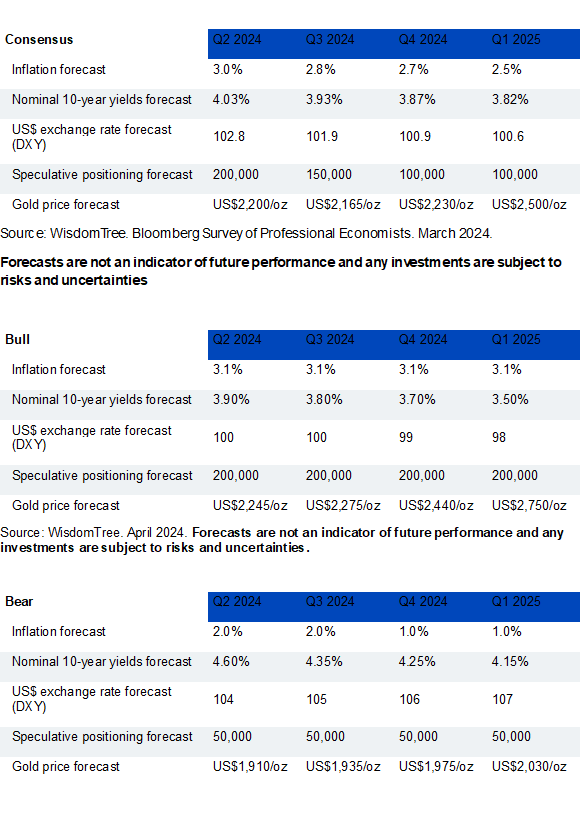

So, what does the Wisdom Tree model suggest might happen next? It takes the Bloomberg Survey of Professional Economists’ average views on inflation, the US Dollar, and treasury yield forecasts. They reckon the consensus is looking for inflation to continue to decline (although to remain above the central bank target), the Dollar to depreciate, and bond yields to decline.

“In the consensus case scenario, gold reaches US$2,500/oz by Q1 2025, clearly above the high in April 2024, although prices may moderate in the coming months before we reach that point.

Bull Case: In this scenario, inflation remains stuck at a higher level. The Federal Reserve nevertheless commences its cutting cycle. Meanwhile, elevated geopolitical risks and fears of policy errors keep sentiment towards gold higher (expressed in speculative positioning). In this scenario, gold could reach US$2,750/oz by Q1 2025.

Bear Case: With the Federal Reserve reluctant to cut interest rates, inflation falls faster, the US Dollar appreciates, and bond yields do not fall as much as the consensus currently expects. We also reduce the speculative positioning in gold to reflect a decline in geopolitical risks. In this scenario, gold could fall to US$1,910/oz by Q2 2024, retracing prices back to October 2023 levels before rising again to US$2,030/oz by Q1 2025.”

Personally, I’m more inclined to buy the bull case over the bear case (gold above $2750 by the end of the year) and remain overweight in gold as an asset class

Source: WisdomTree. April 2024. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.