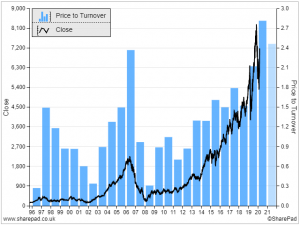

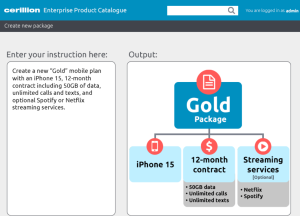

Richard’s filter strikes out, so he takes a closer look at Cerillion, the software company that achieved no strikes at all last time. The company has a perfect track record, but how much does that tell us about the future? 5 Strikes Over the last few weeks, very few companies have published annual reports, only […]