I don’t trade indices as I much prefer equities – however one thing I learned from the pandemic is that instead of shorting 30-40 stocks, I could’ve easily boosted my returns by putting on an index short. Once you go above 20 shares, you start to significantly correlate the very index you’re trying to beat. […]

Author: Michael Taylor

The Trader: 3 principles for trading on the stock market

Breakouts are an excellent way to swing trade and profit from bull markets. I love breakouts because they’re a high probability pattern of continuation and also because it means that the price is rising. However, many people try strategies that that are inherently risky. Sadly, one private investor commented that they’d invested into a stock […]

4 FTSE miners | Centamin, Fresnillo, Ferrexpo, Petropavlovsk

We looked at two potential stage 2 stocks a few weeks ago here. The issue with some AIM stocks is that they don’t offer the liquidity that some traders prefer. In this article, we’ll look at some FTSE miners that trade on both the FTSE 100 and FTSE 250 indices. These stocks are traded in […]

The Trader: Two potential early stage 2 stocks

I was at lunch this week with some trader friends, discussing the market and the various strategies you can use to make money. We came to the agreement that in the small caps space, having an informational edge is definitely an advantage. Knowing what you own and why you own it is one of Peter […]

The Trader: Risk-off market

The market has been risk-off in the last few weeks. Why? It’s anyone’s guess. The Talking Heads will say inflation, price of lumber rising, price of lumber falling, geopolitical tensions… If only they could tell us before the event instead of finding reasons for why things happened after the event.

The Trader: More results from my filter

April is typically a strong month – perhaps because of all the tax-selling clearing and reducing sell pressure. New ISA money tends to enter the market too. Cash is a position, but many punters feel it burning a hole in their pockets and so tend to end up spending it.

The Trader: More results from my filter

I run my filter every week, usually on a Saturday morning. By running the filter every week, it allows five trading sessions to pass and therefore potentially offer up new stocks. Time is a trader’s greatest asset, and it makes no sense to run the filter every day when almost all of the stocks will be the same.

The Trader: Introducing the single page

A few months ago, SharePad released a new feature called the Single Page. Learn to use it and maximise your productivity.

The Trader: Trading Turnarounds – Part II

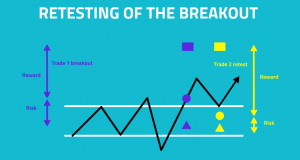

The breakout retest is a great way of trading a breakout if you missed the initial rally. We looked at how traders should look to play these and the importance of a well-timed buy.

The Trader: Trading Turnarounds

Everyone likes a turnaround. This is because people like the idea of buying at the bottom and reaping the rewards.

However, trading turnarounds can take a lot of time. Businesses are often slow to change and it is not a quick process.

This article will show you how to trade some potential turnaround stocks and give you some pointers to look at next time you are considering trading a turnaround.

The Trader: Results from my filter

My last article detailed my new filter. If you missed it then you can read about it here. As discussed, this filter looks for stocks that are uptrending and are off their recent highs. It provides trading ideas that we can then dig further into. Here are some recent results. Calnex Solutions (CLX) Calnex is […]

The Trader: Introducing my new filter

I released a new filter several weeks ago. This was a new filter I was testing and mentioned this in my Investors Chronicle column. I’ve released it onto the library due to popular demand and in this article I’ll explain how to get the best out of this filter. First of all, you can find […]

The Trader: A look at the pharmaceuticals sector

The pharmaceuticals sector is another popular sector with private investors and retail traders. This is because the volatility is high and traders are often attracted to the blue-sky lottery ticket type stocks. The road for a junior pharmaceutical company is long and hard. First of all, drugs need to go through three phases of testing […]

The Trader: A look at the commodities sector

The commodities sector is popular with private investors and retail traders. Life changing gains (and life changing losses) can be made on this sector. Back the right minor and you can see stocks appreciate in value several-fold, although the vast majority never amount to anything other than value destruction through endless placings. In this article […]

The Trader: A look at the automobile sector

The automobile sector is not one I usually deal in. However, by using the RNS service each morning and sifting through company reports, it’s easy to keep on top of various sectors and how they’re performing. Customer spending has seen a large boom as people are restricted from going on holiday and eating out (aside […]

The Trader: A look at the hospitality sector

The hospitality sector has been smashed in recent months. This is for several reasons. Lower footfall in high streets, offices closed and the work from home trend, and finally because many were already being hit in the casual dining crisis that is far from over. In the aftermaths of the Great Financial Crisis restaurants boomed. […]

The Trader: The Impact of Coronavirus on Trading

One of the effects on Coronavirus has been to crash the entire stock market only to see it recover strongly. However, the impact of Coronavirus for the private investor and retail trader has been huge. Social media has contributed to market inefficiency It is a widely held view that the internet has created a more […]

The Trader: Spread Betting

Spread betting is another way of buying and selling shares. Instead of buying the actual stock when we purchase through our broker, in spread betting we are literally placing a bet on the stock that it will either rise or fall as defined by the spread. The spread is the price to buy and the […]

The Trader: Working Through Rough Periods

Unless you’re an Instagram trader, set with a laptop by the pool and a Lamborghini in the background, everybody goes through rough patches in trading. It is a fact. So much of this business is uncertain, and ironically people want to get into trading for the ‘freedom’ it provides. But free we are not, and […]

The Trader: A Day In The Life of a Stock Trader

One of the questions I’m frequently asked is how I structure my day. Time is a trader’s most important currency because sometimes it can be the first person eats, the second person goes hungry. Being alert and organised is the key to performing well. My day starts early compared to most at 04:45. Before I […]

The Trader: Knowing Your Market

We have covered many aspects of trading in previous articles, such as Why You Should Be Using R, Exit Strategies, and How To Avoid Blowing Your Account, and having had conversations with recent traders it is clear that knowing your market in what you trade is a necessary criterion. This article will introduce new traders […]

The Trader: Examining Retail Trading Behaviour

One of the many oft-repeated quotes around traders is that 90% of traders lose money. However, this depends on how one classifies a ‘trader’. Many people – and I can believe that it is 90%+ of people – lose money when they enter trading. But often newcomers aren’t coming into the market prepared. There’s a […]

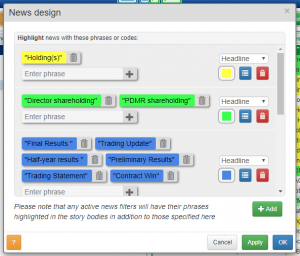

The Trader: Taking advantage of ShareScope News

In this article, I’ll show how you to set up your news feed in order to get the best out of your subscription. First of all, we need to click “News” at the top of our ShareScope across the main toolbar. This brings up the raw RNS feed that we need to filter and make […]

The Trader: Five rules for traders

A combination of market volatility and being locked in during lockdown has led to many turning their eye to getting involved in the stock market. The failure rate for traders is estimated to be around 90%, and many of the spread bet firms report that 70%+ of clients lose (the real figure I believe is […]

The Trader: How to Avoid Blowing Your Account

The market is moving with extreme volatility in recent weeks. This offers traders many opportunities to prosper and profit, but volatility is a double-edged sword. It can be your best friend one day and your worst enemy the next. Many traders love volatility when the trade is going in their favour, but struggle to deal […]

The Trader: Why You Should Be Using R

R is a component in trading that we use to define risk. It is a crucial aspect of trading systems and by thinking in terms of R we can improve our results. In this article I will introduce to you the concept of R and how to use it for your own trading. It is […]

The Trader: Why the trend is your friend

“It is a truth universally acknowledged, that a single man in possession of a good fortune, must be in want of a wife.” Whether or not you agree with Jane Austen’s opening line in Pride and Prejudice, by the end of this article I hope you will agree with my version. “It is a truth […]

The Trader: Exit Strategies

In April 2017, I had a real nightmare. I had been trading full time on the market for four months and had had enormous success buying bubbley story stocks and riding them upwards. I was convinced that I knew what I was doing. I made all the classic mistakes of complacency, which turned into denial […]

The Trader: Optimising Your RNS Feed

In this article, I’ll show you how to clean up and manage your RNS feed by adding a filter and removing noise, colour coding your RNSs, and highlighting words and phrases within the stories itself. We’ll also get rid of all stocks without EPIC codes. The RNS feed is an important part of the screen […]

A market of stocks or a stock market?

January was a good month, despite the FTSE 100 closing down nearly 3.5% and the outbreak on coronavirus soon to kill us all. Or is it? Well, it’s been declared a global health emergency by the World Health Organisation. But what seems likely is that the media has whipped up the story in order to […]

Taste the Feeling

Taste the Feeling is a Coca-Cola slogan from 2016. I think it’s a very good, because Coca-Cola isn’t just a product. It’s a religion. The fervour seen during the launch of New Coke, launched in 1985, as a response to Pepsi’s taste tests showing consumers preferred a sweeter alternative, showed that it wasn’t about the […]

Why mindset is the most important factor

“Nature versus nurture” has been a debate that has raged for hundreds of years. Sir Francis Galton (pictured above), who was a Victorian era statistician and psychologist (amongst investor, explorer, and other disciplines) coined the phrase in his book Hereditary Genius. He had been influenced by Charles Darwin’s Origin of the Species, and so in […]

The Wright brothers were not capitalists

Warren Buffett is famous to have said “If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright”. This is because the airline industry is deemed to have sucked huge amounts of money and destroyed shareholder value more than any other sector. But is that fair? […]

Cups and bowls

Cups and handles, and bowls, have been very popular with trend traders. These patterns can be powerful as they show sentiment of the stock gradually changing and buyers slowly overpowering suppliers of the stock. This is a classic cup and handle pattern. The cup is the deeper bowl, along with a handle which is the […]

Is there life on the High Street?

With Debenhams going bang, the demise of Mothercare, and Carpetright finally succumbing to their challenges (Carpetright was taken over – but at a price only slightly higher than the all time low), the narrative of the high street being dead seems to be coming true with every new departure. Thomas Cook went bust a few […]

Support & Resistance

Support and resistance are two common concepts when it comes to technical analysis. They are the most basic but also the most important points when plotting levels on a chart. Technical analysis is a self-fulfilling prophecy as many traders and investors look at the same levels on charts, and therefore support becomes support because people […]

Two Technical Analysis Tools You Need: Candlesticks and Volume

We briefly touched on technical analysis in my previous article ‘The Four Stages of a Stock’, and in this article I want to introduce some simple technical analysis components, which, if understood, can provide a lot of clarity on price action in the market. Candlesticks are said to have been invented by a Japanese rice […]

Why shorting is good for investors

Although I am much more of a trader myself as I rely on trading profits to pay my bills, I do think investors have much to be gained learning from the art of short selling stocks. There are several reasons that will be explained in this article, but first it is important to understand what […]

The Four Stages of a Stock

Technical analysis is either loved or hated. Many people like to claim it as ‘voodoo’ and trying to predict the future, but the fact is that technical analysis is useful simply because everyone looks at the same charts and sees the same patterns. It becomes a self-fulfilling prophecy. Those who do not bother to learn […]