Financial statistics from SharePad and non-financial data from the company itself all indicate Motorpoint is no ordinary car dealer. If you’ve bought a vehicle from the company, or read its annual reports, you’ll probably know why. My article on Electrocomponents showed how I find most of my investing ideas with the simplest of SharePad filters, […]

Category: All

Stock Watch – Portmeirion

Portmeirion Group is based in Stoke on Trent and is a leading maker of homeware products such as tableware, cookware, placemats, candles and fragrances. It trades under some well-known brand names such as Portmeirion, Royal Worcester, Pimpernel, Spode and Wax Lyrical. Around half its products are manufactured at its own site in Stoke on Trent […]

When bad companies become good: IG Design

IG Design, formerly International Greetings, is one of my biggest investment mistakes—even though I made a few quid on it. Since I sold my shares in International Greetings—as it was called then—in April 2014, the company’s share price has risen from 71p to nearly £5.00. Clearly I misjudged the prospects of the business and that […]

Stock Watch: Morrisons – Is a bad business turning itself into a reasonable one?

Ten years ago, Morrisons was doing reasonably well. Under the leadership of Dutchman Marc Bolland it was wooing customers with a very simple and powerful strategy – offering good food at low prices. When he left to run Marks & Spencer, the supermarket industry was beginning to change and the company lost its way. It […]

Stock Watch: Superdry

Superdry wants to create a global lifestyle brand by selling premium, high quality and affordable clothing to people. Its brand may not be as recognisable as leading sportswear brands such as Nike or outdoor brands such as North Face but its distinctive logos with Americana and Japanese graphics are not an uncommon sight. Superdry is […]

Buying quality on its own is no guarantee of success

There are many different ways to make money from the stock market. Over the last few years, one of the most popular and discussed strategies has been about buying the shares of high quality businesses or quality investing. Warren Buffett has long been a cheerleader for long-term investing in quality companies. In the UK, the […]

Stock Watch: InterContinental Hotels

Disclosure: At the time of writing I own shares in InterContinental Hotels. InterContinental Hotels (IHG) can trace its roots back to the Bass brewing company. Bass, long known for its ales set about turning itself into a leisure conglomerate with pubs, Gala Bingo, Coral bookmakers and hotels. In 2000, the company sold its brewing business […]

A new issue that is already a winner

Looking through the prisms of profitability, debt, cash flow, strategy and valuation, Strix may be an exception to the rule that new issues make bad investments. Finance professor Elroy Dimson and his colleagues made a startling find when they studied the long term returns of UK Initial Public Offerings between 1980 and 2014. The longer […]

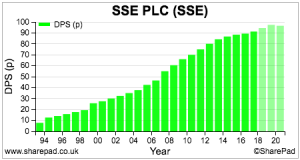

Dark days for regulated utility shares

Since they were privatised in the mid 1980s and early 1990s, the shares of regulated utility companies have found a place in many private investors’ portfolios. Their main attraction has been an ability to offer a higher income than government bonds with plenty of dividend growth on top. This made them ideal income stocks. With […]

AGMs – If in doubt, ask

Most companies will answer questions from shareholders and potential shareholders. At Annual General Meetings shareholders have a right to ask questions and get answers. A large proportion of listed companies report full-year results in late winter and spring because their financial year-ends coincide with the end of the calendar year in December. As surely as […]

Stock Watch: Cranswick

Cranswick is a UK-based food producer. It specialises in the production and selling of pork and poultry products. The sales mix of its business is as follows: Fresh Pork (34% of sales) – Cranswick is the third largest pig producer in the UK. Its own herd of outdoor reared pigs provides 18% of its own […]

Should investors avoid low margin companies?

Highly profitable companies can make outstanding long-term investments. Arguably, the best way to measure a company’s profitability is to compare its profits with the amount of money invested to make them. This is known as the return on investment or return on capital employed (ROCE). One person’s definition of a highly profitable business will differ […]

Putting performance in perspective

To get a grip on where a company is going you have to understand where it has come from. Fortunately, that doesn’t mean reading every annual report. Usually, it’s not enough to read the latest annual report. To understand a firm’s business model and strategy, how it makes money, how it plans to make more, […]

Stock Watch: Domino’s Pizza

Domino’s Pizza is a very good business. It has exploited the trend of the growth in take-away pizza superbly and now has a 46% share of the UK’s £2.1 billion pizza market. For many years it has been able to grow its sales and profits whilst producing high profit margins, high returns on capital employed […]

Working out what could go wrong with a share

Investors pin their hopes on what could go right. The great product. The winning strategy. The growing market. The new technology. These may be good reasons to own a share, but only if you have also considered what could go wrong. In my last article I left you on a cliff-hanger. I described power adapter […]

Checking out a company’s cash conversion

A couple of weeks ago I wrote about the issues investors faced in working out a company’s true profits. In many cases, the ways in which companies calculate their so-called adjusted profits are becoming increasingly absurd. Investors are frequently asked to ignore certain real costs so that profits are as big as possible. The harsh […]

Decrypting a company’s business model and strategy

While it’s comforting to know a business has enjoyed success, long-term investors must also form an opinion on its prospects if we’re to hold the shares through thick and thin. In How to read an annual report, I identified the sections of a typical annual report that explain how a company has made money, how […]

Stock Watch: Hollywood Bowl

Hollywood Bowl is the UK’s largest operator of tenpin bowling centres. It currently has 58 centres across the UK with 43 trading under the Hollywood Bowl brand, 4 as Bowlplex and 11 as AMF. In total, these centres have 1,390 bowling lanes. The average size of each centre is around 30,000 square feet with 24 […]

Can you trust a company’s profits?

This article is more suited to experienced investors. Profits are all important when it comes to investing in companies. To make money over the long haul it usually helps to invest in a company that is growing its profits. The more profitable a company is, the more valuable its shares tend to be. However, profits […]

Stock Watch: Galliford Try

Shares in building and construction company Galliford Try have been hammered since it announced its half year results a couple of weeks ago. The results themselves were pretty good but the shares have crashed due to other reasons, namely: Cost overruns in its construction business. A cut in the dividend – albeit a small one. […]

How to read an annual report

Rule number one in long-term investing is to understand how the businesses you expect to profit from will make money – otherwise, how can you be confident they will? Annual reports are the most complete source of public information on how businesses make money, and how they intend to make more money. Investors who read […]

A smarter way to use analysts’ EPS forecasts

Should investors pay much attention to analysts’ profit forecasts? There is a school of thought that suggests that they should not. Detractors say that forecasts are nothing more than educated guesswork and that analysts are very bad at predicting changes such as profit warnings or recessions. In many cases, forecasts are merely the extrapolation of […]

Stock Watch: City Pub Group

(LSE:CPC 196p, Mkt Cap £96.3m, EMS 1500, Analysts 2) City Pub Group listed on AIM back in November. The company currently owns 38 managed pubs situated in London and the south of England. Twenty three of these pubs are freeholds (owned outright by the company) with 15 leased or rented. Thirty three pubs are currently […]

The Terry Smith algorithm

In this article I’ve attempted to find Fundsmith-like companies using SharePad. The results are mixed but there’s a lot to be learned from the experiment. A letter from Terry If like me you hold units in Fundsmith, last month you will have received a letter from the fund’s celebrated manager Terry Smith. In publishing an […]

A checklist for busy investors

There are many full time private investors out there but for others investing is a hobby or something that they fit around their day to day activities. If you don’t have a lot of time on your hands one of the toughest tasks you will have is narrowing down the list of potential investments on […]

Using SharePad’s “Live” tables in your own spreadsheets

Maybe you already download tables of data from SharePad by clicking on the sharing button in SharePad’s blue Table view, but this data is dead. It doesn’t change in your spreadsheet if it changes in SharePad. Now there is a new option: Export “Live” Table. This allows you to incorporate data into spreadsheets that updates […]

Stockwatch: Avon Rubber

Avon Rubber is a good example of a company that fits into the category of a profitable niche business. It started off as a cloth mill in 1885 but most people will know its name from Avon Tyres which was sold off in 1994. Today it makes its money from selling protective breathing products and […]

A better way to track changes in company performance

It doesn’t take too much time to get a feel for how well a company is doing. Most people do this by looking at percentage changes in key numbers – such as turnover and profit – from one period to the next. They may also look at key ratios such as profit margins or return […]

Stock Watch: Nichols

Soft drinks company Nichols (AIM:NICL) has been a good share to own over the last few years. It has many of the hallmarks of a high quality business but its shares have been drifting downwards in recent weeks. This seems like a good time to take a closer look at what has been going on […]

Buy and build

If you take a look at Diploma through the lens of SharePad’s summary page (under the green ‘Financials’ tab), you will find it shares many qualities of a good business. It has raised the dividend every year since 1999, a significant period in the company’s history as we shall see. It has grown turnover, profit, […]

Magic Formula stocks for 2018

For those of you who like the idea of a buy and forget investing strategy then Joel Greenblatt’s Magic Formula of buying good companies at fair prices takes a lot of beating in my view. It is a simple and powerful way to put together a portfolio and one that has a pretty good long-term […]

Settings for the big picture

Happy New Year! I’ve started mine by tidying up my many desktops: my physical desk, my laptop’s desktop, and SharePad. I did so much experimenting with SharePad in 2017, I’ve overwhelmed the lists of settings. Settings are how we make SharePad our own. They are where we save list and chart configurations we use repeatedly, […]

Simple is best – Magic Formula Investing in 2017

If you were to ask me to recommend just one book on investing then I would struggle to think of anything better than Joel Greenblatt’s book ‘The Little Book that beats the Market’. It is very easy to read and is not very long. The book does a great job in convincing the reader that […]

Stock Watch: Henry Boot (LSE:Boot)

Henry Boot is a Sheffield-based company which makes money from property and construction activities. It has four main sources of income: Buying land, getting planning permission for it and then selling it to house builders for a profit. Developing commercial property such as warehouses, offices and industrial units. It also has a small house building […]

Two charts to unlock a company’s finances

By way of introducing two charts I’m routinely using to suss out how companies are financed – the twin pillars of debt and equity – I need to return briefly to my last article on hire firms. In the main, tool and plant hire firms serve the construction industry which is notable for its instability. If […]

Searching for companies paying out more of their profits

One of the main considerations for people investing in shares these days is the dividend income they will get from owning them. With a world of low interest rates on savings accounts and bonds and a change in the rules for taking pension income the choice of dividend-paying shares has arguably never been more important. […]

Stock Watch: Fenner

Over a decade ago when I was a smaller companies analyst in the City, UK engineering company Fenner was part of the portfolio of stocks that I researched. I also got to know the company and its management team reasonably well when I gave up being a stockbroker and went to work for a fund […]

Is the current ratio an outdated measure of company safety?

One of the most commonly cited measures of a company’s financial strength is something known as the current ratio. It is a measure of liquidity and compares a company’s current assets – defined as assets that can be turned into cash within one year – with its current liabilities (those which have to be paid […]

The elusive hire firms you can buy and hold

Last week I introduced the listed plant and tool hire companies and mentioned in passing the industry has a bit of a boom bust reputation. Perhaps I didn’t egg the pudding enough, though. Ashtead’s market capitalisation is nearly £10bn, more than ten times what it was nearly two decades ago. In one sense it’s an outstanding growth […]

Income Opportunities From Dividends

In the last of his Investors Chronicle articles, Phil looks at companies reinstating dividends or starting to pay them for the 1st time. Read pdf article

Homing in on hire firms

Homing in on hire firms When business is sluggish at construction sites and factories, tools and equipment are returned and hire companies make less profit. The hire industry has a boom-bust reputation built on top of the boom-bust reputations of some of the industries it serves. It may seem like an ambitious project to seek […]

How to steer clear of dividend traps

First published in Investors Chronicle, Phil explains how to avoid the shares that might let you down. Read pdf article

Finding safe high-yielding shares

First published in Investors Chronicle, Phil explains how to identify which high-yielding shares are most likely to maintain or grow their dividends. Read pdf article

Stock Watch: Abcam – is lower profitability worth paying for?

Abcam shares are more popular than ever. Perhaps they’re worth it. Nailed on growth stock There’s no doubt Abcam has grown. In performance terms it’s about ten times better than it was when it floated in November 2005. Revenue in its first year as a listed company (to June 2006) was just under £20m. Eleven […]

When valuations don’t matter and when they do

Lots of people will tell you that the price you pay for a share really matters. This is because it has a big say on the kind of long-term returns you will make from it. What this means in practice is that paying too much for a share – too high a valuation – is likely to […]

Stock Watch: Elegant Hotels Group

Elegant Hotels is the owner and operator of a number of upmarket hotels on the Caribbean island of Barbados. The company has been in business for a while and was previously listed on the stock exchange under the name of St James’ Beach Hotels until it was bought by a private equity firm in the […]

Finding companies that speak your language

Finding companies that speak your language It’s a commonly held view that the only bits of financial reports worth paying attention to are the numbers at the back – in the profit loss account and balance sheet for example. For investors alive to potential shenanigans, the audited numbers get us close to the unalloyed truth […]

How much is a company worth? A look at different ways to value shares

Two weeks ago I wrote about how to try and value companies that aren’t making a profit. This week I’m going back to basics for more inexperienced investors. Although I’m sure there will be some reminders here for regular readers. For many successful investors, the price they pay for a share of a company is […]

Tech recruiter is statistically attractive, but is it special?

There are two questions I ask of all companies I might invest in. Do the statistics indicate the business is highly profitable and, if they do, can I identify what makes it special? SharePad can answer the first question, and it can help with the second. Today I’m looking at Harvey Nash because it satisfies […]

How to value loss-making companies

One of the questions I am frequently asked is: “How do I value loss-making companies?”. The short answer is that it can be really quite difficult. It is so much easier to try and value profitable businesses with an established financial history. However, the value of any business is based on how much money it […]

How I choose my next share using filters and charts

After many years of investment I still feel a sense of anticipation when I examine lists of shares looking for new opportunities. It’s like opening a map to find new places to visit, or a menu at a restaurant that serves everything. There are other ways to generate investment ideas, but in my experience they’re […]

Stock Watch: Redrow

The state of the housing market – and the direction of house prices in particular – is a key driver of Britain’s economy. When house prices are going up, people feel wealthier, banks are happy to lend money against property and economic activity tends to increase. More houses are built, more people move home, more […]

Stock Watch: Scapa Group

Scapa Group has transformed itself over the last few years by following a strategy of offering more value to its customers. It has worked well and has seen a significant boost in profits which has helped to make its shares an exceptional investment. The business Scapa Group describes itself as a supplier of bonding solutions […]

A blueprint for better long term investing

Holidays are great for switching off from the stresses and strains of the daily grind and concentrating on what’s really important in life. I’ve just had three weeks away from work – I can’t remember the last time I did that – spending time relaxing with my family and doing jobs around the house that […]

Shares to hold to the grave, and beyond…

For my debut SharePad article, I’ve been invited to introduce my stockpicking strategy. It’s a daunting prospect because strategy is everything. Without a strategy, luck or instinct will determine our returns and in the stock market neither can be relied on. There are many reinforcing activities that make a good strategy, so please forgive the […]

Stock Watch: Ashtead Group

Ashtead makes its money by renting out equipment to construction and industrial companies – things like aerial platforms, forklift trucks, tools, diggers, cranes, power generators and pumps. It makes most of its profits in America and its shares have been a terrific investment. They have been a proverbial ten bagger over the last decade. After […]

Stock Watch: Castings

Castings plc is a foundry business. Foundries are factories which produce metal castings. Castings has two in the UK – in the West Midlands and South Yorkshire – which take scrap steel and alloys and turn them into castings up to 40kg in weight. It also has a machining business which allows it to turn […]

Hunting in the minefield of cheap shares

Most people like a bargain. Bargain hunting on the stock market has long been a popular pastime or even a full time occupation for investors. There’s no shortage of books, articles and advice that tell investors to pursue a ‘cheap is best’ strategy if they want to get rich. Yet in most cases there is […]

The case for dividend investing in dangerous markets

I am finding investing more than just a little bit frustrating these days. The reason for this is that I am struggling to find shares that I am comfortable owning for the long haul. To put it simply, I think my favoured high quality businesses are overpriced whilst the valuations on many so called growth […]

Stock Watch: RPC

RPC (rigid plastic containers) designs and manufacturers plastic products for packaging markets. The company makes thousands of different products such as plastic bottles, food containers, plastic tubes, paint containers, wheelie bins and bin liners. Plastic is everywhere in our lives and there is a good chance that most of us use or come across an […]

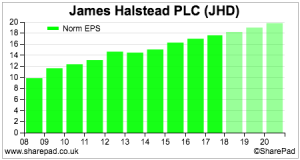

Stock Watch: James Halstead

James Halstead has been in business since 1915. It started out dyeing, finishing, waterproofing and rubberising textiles that were used in rainwear and outdoor clothing. Today it has established itself as a leading manufacturer and distributor of high quality flooring for commercial, contract and domestic markets. Its main commercial brand is its Polyflor vinyl flooring […]

Making sense of highly priced shares

In my 20 years of investing I am finding the current stock market conditions the most challenging I have ever encountered. My investing career started during the early stages of the TMT (technology, media and telecoms) boom. The case for investing in these sectors was based on a belief in transformational business models and the […]

Stock Watch: Watkins Jones

Stock Watch: Watkins Jones Watkins Jones is a property developer, best known for building private student accommodation. It floated on AIM in March 2016. The company makes money from three sources at the moment: Building student accommodation units for professional investors Managing student accommodation units for professional investors Building private residential accommodation The bulk of […]

The case for enterprise valuations

A couple of weeks ago I wrote about the subject of PE ratios (click here to read the article) and the ins and outs of using them to value companies. One of the main drawbacks of PE ratios – and any valuation using a share price – is that it can be distorted by the […]

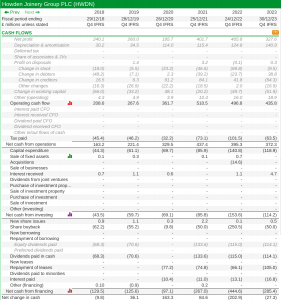

Stock Watch: Howden Joinery Group (Howdens)

Howden Joinery Group is the parent company for Howdens. Howdens was established in 1995 with 14 depots by its current chief executive Matthew Ingle when the business was part of the MFI Group. MFI was sold off in 2006 but the company (it was known as Galiform back then) was responsible for some significant onerous […]

PE ratios and how to use them

PE ratios and how to use them Price to earnings (PE) ratios are the most commonly used method of weighing up the value of a company and its shares. They are calculated using the following simple formula: PE ratio = Share price/Earnings per share (EPS) PEs are popular with investors because of their perceived simplicity […]

Stock Watch: Smart Metering Systems (AIM:SMS)

I recently wrote about Smart Metering Systems in my exclusive weekly newsletter for SharePad and ShareScope customers. It’s an interesting company so I have decided to dedicate a Stock Watch to it. Smart Metering Systems (SMS) has been in business since 1995. The company’s roots were established following the deregulation of the domestic gas meter […]

Stock Watch: FW Thorpe

FW Thorpe was founded in 1936 and has been listed on the stock exchange since 1965. The company designs and manufactures professional lighting systems for commercial markets. It has been very successful in carving out a profitable niche for itself and its shares have proven to be a very decent long term investment. What makes […]

Looking beyond free cash flow

Ask me about the kind of financial characteristics I like to see in a potential investment and the first two I will usually cite are as follows: A high and sustainable return on capital employed (ROCE). Ideally I am looking for companies where ROCE adjusted for rented assets (leases) is more than 15%. Conversion of […]

Stock Watch: FW Thorpe

FW Thorpe was founded in 1936 and has been listed on the stock exchange since 1965. The company designs and manufactures professional lighting systems for commercial markets. It has been very successful in carving out a profitable niche for itself and its shares have proven to be a very decent long term investment. What makes […]

Analysing the stocks in a filter

Running filters or screens is a popular way of finding shares to invest in. Whilst screening can be very powerful it is important to recognise that blindly buying shares which meet a set of financial criteria is rarely a route to success. Good investors use screening as a way of concentrating their research efforts. SharePad […]

UK Dividend aristocrats

Phil’s Investors Chronicle article on how to be a successful dividend investor. Read the article

Why depreciation matters and EBITDA doesn’t

When it comes to weighing up asset-intensive sectors, depreciation matters. It is a real cost. This does not stop people ignoring it and touting the merits of companies based on their EBITDA. Investors ignore the significance of depreciation at their peril and should be suspicious of companies that talk about EBITDA too much. To get […]

The end of “hidden debts”

Accounting is a dry subject but a very important one. I perfectly understand why private investors’ eyes glaze over at the mere mention of the topic. That said, I am a firm believer that when it comes to this subject a little knowledge can go a long way and can help you make better investment […]

Stock Watch: XP Power

XP Power is based is headquartered in Singapore and has manufacturing sites in Vietnam and China. The company makes power control systems which convert power from an electrical mains supply to a safe level to be used in its customers’ products. It sells its products into the Industrial, Healthcare and Technology sector where they are […]

How to avoid value traps

In this instalment, Phil explains how to spot value traps and finds some cheap shares that might bounce back. Read the article

Free cash flow: what it is and how to use it

In this week’s Investors Chronicle, Phil explains how to use free cash flow to your advantage. Read the article

Stock Watch: Treatt plc (LSE:TET)

Treatt plc has been in business since 1886. Based in Bury St Edmunds, the company specialises in making and selling products based on essential oils. It takes natural plant oils such as orange, lime, peppermint and eucalyptus and uses them to create flavours and fragrances to sell to consumer goods companies. These flavours and fragrances […]

Kraft-Heinz’s bid for Unilever

Disclosure: Phil Oakley owns shares in Unilever Last week’s bid by US food company Kraft-Heinz for Unilever caught many investors by surprise. But in retrospect maybe it shouldn’t have. The bid came in response to the difficulties that many large consumer goods companies are facing right now. It also tells investors a great deal about […]

Weighing up investment trusts

Many private investors like to build a portfolio of individual shares in order to grow the value of their savings as well as trying to beat the market as a whole. But some also like to complement their portfolios by owning investment funds. One of the best and easiest ways to do this is to […]

Riding a retail roll out

Note: This in an advanced article best suited to more experienced and confident investors. One of the most profitable investing strategies can be to buy the shares of rapidly expanding retail companies – when a company sets out a plan to open lots of new stores over a period of time. This is affectionately known […]

Does Tesco buying Booker make sense?

Mergers and takeovers are part and parcel of the investing world. However, I think it’s fair to say that last week’s (27th January 2017) announcement that supermarket giant Tesco (LSE:TSCO) was buying cash and carry operator Booker (LSE:BOK) was something of a surprise. Takeovers or acquisitions as they are commonly known are a very grey area for investors. Are […]

Value investing today

One of the great things about investing is that there are lots of different ways for people to try and make money. This means that there is a style out there that will suit most temperaments. Probably the most well known investing strategy is value investing. Yet I find that this term is frequently overused […]

If you want to beat the stock market own fewer shares not more

As a private investor managing your own share portfolio you have to achieve two things over the long haul to consider your efforts a success. First and foremost you have to make money. This means doing better than if you had put your money in a savings account. The second thing you need to try […]

Sector Watch: Beverages

Companies which make and sell branded drinks have long been popular with investors. One of the main reasons for this is that as businesses they are very easy to understand. They sell products which millions of people consume daily and are very familiar with. Let’s take a quick tour around the UK quoted beverages sector […]

Sector Watch: FTSE 100 and AIM 100 Miners

Mining companies are very difficult to analyse. Their profits and cash flows are very closely related to trends in commodity prices and sentiment towards the economy in general which means that they tend to be very volatile. Unsurprisingly, share prices move and up and down a lot too. From an investor viewpoint, the inherent volatility […]

Paying up for quality shares – how much is too much?

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett “The desirability of a business with outstanding economic characteristics can be ruined by the price you pay for it. The opposite is not true.” – Charlie Munger The quote from Warren Buffett above is often cited […]

A great year for modified magic formula investing

A year ago I started a trial of three model portfolios based on Joel Greenblatt’s magic formula approach (click here to read more about this). I wanted to see how this strategy would work in the real world and with all investing costs taken into account as many studies of investment strategies ignore costs. The portfolios are […]

What is investing?

Why do people invest their money rather than just save? It’s not just about growing your savings so that you will have more money in the future. It’s about growing the buying power of your money. You want the £1 that you are investing today to buy more things in the future than it does […]

A brief guide to tax-efficient saving

Tax-efficient savings accounts (ISAs) and self-invested personal pensions (SIPPs) are the best option for most savers and investors. Here’s what you need to know. Savings Individual savings accounts (ISAs) are tax-free savings accounts. That is, you are not liable to pay capital gains tax (CGT) on the profits you make on this money. You can […]

Choosing your first investments

For some people the thought of picking their own shares can be a little bit daunting. Rest assured, it doesn’t have to be. Whilst it is best to do at least a little bit of homework before you part with your hard earned cash, successful investing does not require a high IQ or lots of […]

Investing in funds, investment trusts and ETFs

Many investors like to build a portfolio of individual shares and even bonds but for some investors, investment funds can be a useful alternative. For example, some investors may want to have a degree of control over their investments but don’t wish to dedicate the time to choosing and managing a lot off individual investments. […]

Investing your portfolio for retirement income

From what I can see we are still firmly in a bull market in shares. Momentum remains a strategy that is paying off handsomely with a select group of companies continuing to see their share prices increase faster than their profits. But this will not go on forever. Shares with stretched valuations have little downside […]

Chapter 1: You can be a Stock Market Analyst

Updated: August 2024 If you are reading this, the chances are that you’ve decided to take control of your investments or are doing so already. You may have been investing for some time but feel you could do better. Many of you may be new to investing, or have previously left the management of your […]

Chapter 2: Balance sheets

Updated: August 2024 ShareScope is packed full of useful financial data. This data holds the key to understanding the financial health and value of any company you are looking at. To a new or inexperienced investor, the mass of numbers may seem a little daunting. That’s quite understandable but it shouldn’t be. If you understand […]

Chapter 3: Analysing balance sheets

Updated: August 2024 In the previous chapter, we looked at how a balance sheet was put together and the numbers that go into it. In this chapter, we are going to take all those numbers from the balance sheet and turn it into useful information for investors. A company’s balance sheet contains a wealth of […]

Chapter 4: Income statements

Updated: August 2024 Hopefully, you will now understand balance sheets and how important and useful they are. Let’s move on to a set of numbers which most people think are even more important – profits. Just as we did with balance sheets, I am going to explain the numbers in an income statement in this […]

Chapter 5: Analysing income statements

Updated: August 2024 Now that we’ve dealt with the basic format of an income statement it’s time to move on and show you how ShareScope turns those numbers into really useful information. Knowing your way around an income statement is vital to understanding what makes a company tick. However, to get the most out of […]

Chapter 6: The cash flow statement

Updated: August 2024 The last four chapters have been spent looking at the balance sheet and income statement and how to use them. In this chapter, we will move on to arguably the most revealing piece of financial information that a company gives investors – its cash flow statement. When a company’s financial results are […]

Chapter 7: Analysing cash flow statements

Updated: August 2024 We did a little bit of cash flow analysis in the last chapter. In this one, we look at the cash flow ratios that ShareScope calculates for you and what they can tell you about a company’s financial performance. The key issues that this chapter will point out are: Cash flow is […]