Ask me about the kind of financial characteristics I like to see in a potential investment and the first two I will usually cite are as follows:

- A high and sustainable return on capital employed (ROCE). Ideally I am looking for companies where ROCE adjusted for rented assets (leases) is more than 15%.

- Conversion of a high proportion of profits into free cash flow (FCF).

If you can find a reasonably valued company with a high ROCE, and the ability to grow without huge additional capital requirements then history suggests you will do quite well from owning its shares over the long haul. These are the kind of companies that I mainly look to invest in with my own portfolio.

But what about companies that are investing lots of money in order to grow and have low or negative free cash flow?

Diligent investors are rightly spending more time scrutinizing a company’s cash generation. Free cash flow is the amount of cash left over to pay shareholders after all mandatory expenses such as interest, tax and capex have been paid. Comparing this with a company’s profits or earnings is a good way of spotting very good and potentially very bad companies.

Yet a company which doesn’t convert all its profits into free cash flow or even has negative free cash flows shouldn’t necessarily be seen as a bad investment. In fact, it could turn out to be a very good one.

The danger with focusing on companies which produce lots of free cash flow is that you can miss out on some very good investment opportunities. Free cash flow is a desirable characteristic in a company – you’d rather have it than not – but it is a performance measure which penalises companies that invest lots of money today – at the expense of short term free cash flow – in the hope of producing more free cash flow tomorrow.

As long as companies are earning a good incremental ROCE on the money they invest then a low or negative free cash flow is actually making the company more, not less valuable. When you come across a company doing this you actually want it to invest as much money as it possibly can without endangering its financial health.

In this article, I am going to show you how you might be able to spot such companies and what things you need to look out for to keep you away from trouble.

Searching for companies with high capex, decent ROCE and FCF less than profits

In my experience there are three main reasons – there are others – why a company’s free cash flow per share tends to be less than its earnings per share:

- It has significant working capital requirements such as building stocks and selling on credit which can consume some of a company’s trading or operating cash flow.

- Additional pension fund payments to plug a deficit in a final salary pension scheme. Here the cash paid is more than the annual pension cost expensed against revenues.

- Capex is more than depreciation. Here the cash spent on new assets is greater than the depreciation expense in the income statement.

The first two reasons can be a cause for concern. The last reason is nothing to worry about as long as ROCE is maintained at a decent level and not falling off a cliff.

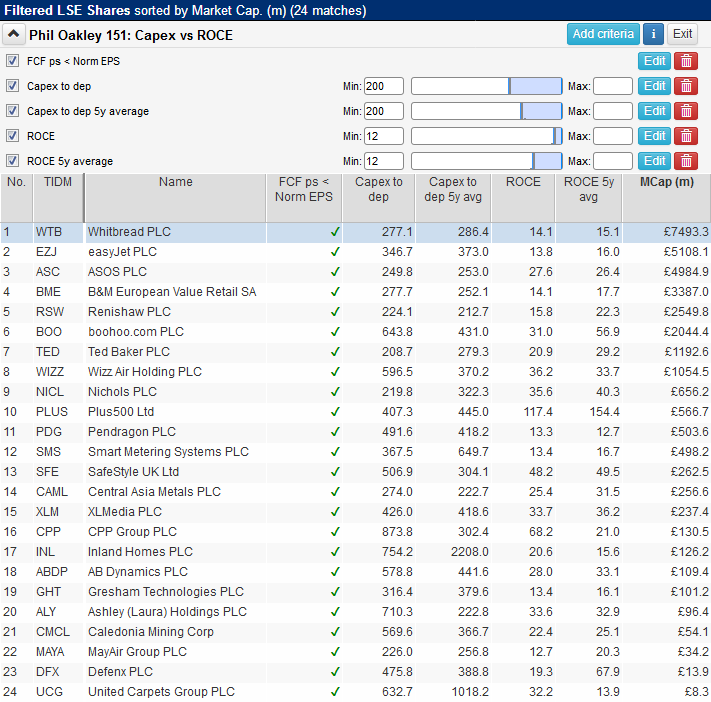

I’ve used SharePad to find companies on the London Stock Exchange which have been investing heavily in new assets (capex) but where ROCE has remained at a reasonable level for the last few years. The specific screening criteria are as follows:

- Current Capex to depreciation ratio of at least 200% (twice depreciation) as a sign of heavy investment.

- 5 year average Capex to depreciation ratio of at least 200%. In other words, sustained heavy investment.

- Current ROCE (not lease-adjusted) of 12%. A reasonable level of profitability.

- 5 year average ROCE of at least 12% – consistently good profitability.

- Current free cash flow per share is less than earnings per share (EPS). The kind of company that some FCF-focused investors might dismiss.

This filter has produced a list of 24 companies which meet the criteria.

We’ve added this filter – called Phil Oakley 151: Capex vs ROCE – to the SharePad filter library.

I am going to look a little more closely at five of them to give you a feel for what you should be looking out for when you come across these kind of companies:

I am going to ignore the valuation of each company’s shares. Instead I am going to try and weigh up the shares by briefly considering three important questions:

- Has the investment led to higher, lower or maintained levels of ROCE?

- Has the investment lead to higher, lower or maintained levels of trading cash flow?

- What is the remaining investment and growth potential? Has investment peaked or is it set to continue?

Regular readers will know that I usually look at ROCE on a lease-adjusted basis. However, as this article is about free cash flow and cash capex spending, I have ignored the impact on ROCE of adjusting for leases as I did not want to go through the lengthy exercise of adjusting capex figures for leases.

Investors can always supplement this analysis by looking at lease-adjusted figures to get a further insight into company returns. This would be relevant for Whitbread, Ted Baker, easyJet and B&M. Less so for Smart Metering Systems.

Whitbread (LSE:WTB)

(Disclosure: At the time of writing Phil Oakley owns shares in Whitbread)

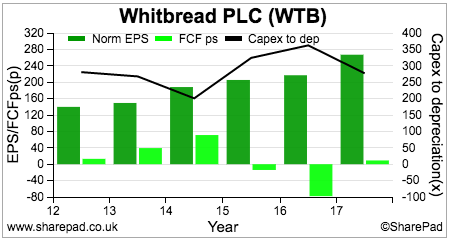

Whitbread has been investing heavily in new Premier Inn hotels, Costa Coffee shops and Costa Coffee Express machines. This has led to significant growth in earnings but at the expense of free cash flow as the chart above shows.

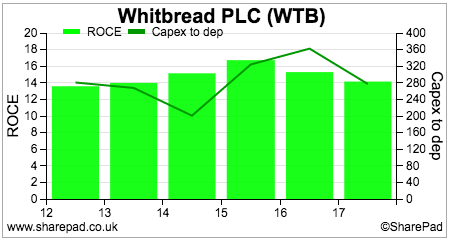

ROCE has held up well which is reasonably reassuring. However, ROCE has trended down for the last two years. Is this a sign that Whitbread is earning lower returns on new assets or that the profits on existing ones are being competed away?

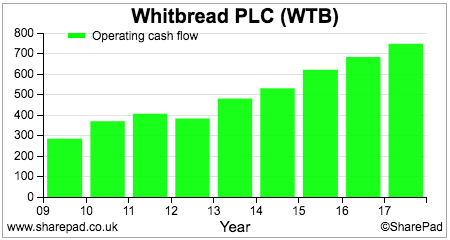

One of the key signs I look for in a capex-heavy company is to see if all the investment in previous years is producing an increase in trading cash flow coming into the company. This along with the trend in ROCE is a sign that the company is getting some kind of return on its investment.

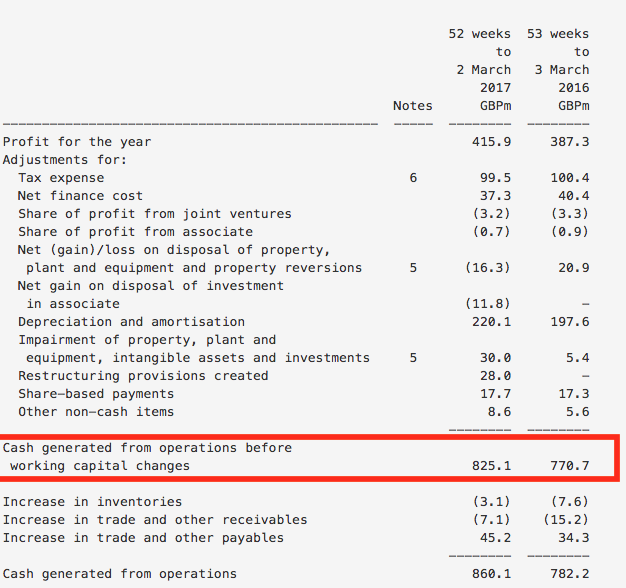

In Whitbread’s case, operating cash flow has been trending up which is a good sign. However, you need to look at the sources of operating cash flow. Ideally, you should look at cash flow before working capital changes as working capital is rarely a sustainable source of cash flow.

The good news is that on this measure cash flow is improving for Whitbread. (You might want to check out the asset impairments and restructuring provisions as well to see if that is a source of trouble). This is a sign that underlying cash generation is reasonably good.

So what about the ability of the future investment pipeline to generate growth?

This seems reasonable too. Capex in 2017/18 is expected to be £650-£700m. The company believes that it is on track to grow the number of UK Premier Inn rooms from 68,000 today to 85,000 in 2020 and ultimately to 100,000. It wants to grow the number of Costa Coffee shops from 2218 to over 3,000 and keep on increasing the number of Express machines.

If ROCE on these new investments can match current levels then Whitbread could have materially higher profits in the future and become a more valuable business than it is today. The key risk is that profit margins come under pressure (Costa margins came down in 2016/17) and ROCE falls. This is what the current lacklustre share price seems to be factoring in.

easyJet (LSE:EZJ)

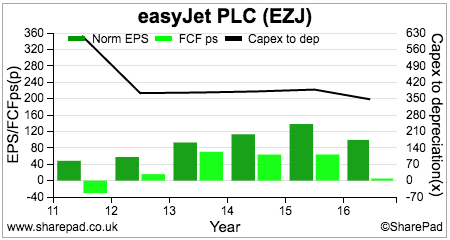

Like Whitbread, easyJet has been investing heavily in recent years at the expense of its free cash flow conversion.

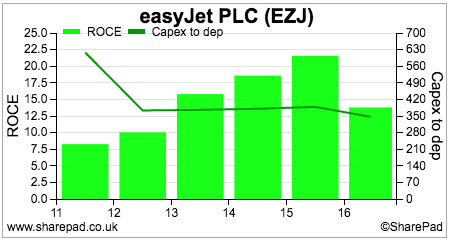

Here the recent trends are less positive. ROCE was trending upwards but plunged in 2016.

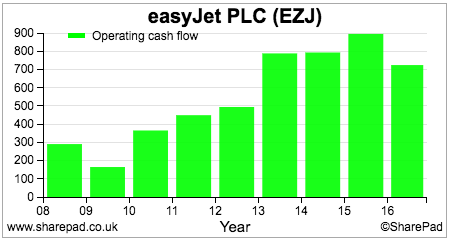

This trend is also shown up in a decline in operating cash flow.

Has easyJet been over expanding and throwing good money after bad?

The worry is that it might have been. It has been growing its capacity (number of seats flown) aggressively along with other airlines and this has put downwards pressure on the fares it can achieve per seat flown (its passenger yield). It is relying on a cost-cutting plan to offset this. If cost-cutting does not pay off then spending extra money on new planes will get a lower bang for its buck than previously.

However, the shares have been strong in recent weeks; load factors have improved (how full its planes are) with fares not falling by as much as was feared. There is also more confidence on the company getting a satisfactory EU flying licence post-Brexit.

The other thing to consider is that easyJet is playing the long game with big capacity increases. It could be doing so in the hope that it will put weaker competitors out of business. This in turn will allow prices to go up and for the larger asset base to earn higher returns and grow the value of the business.

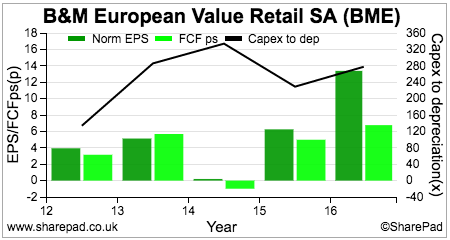

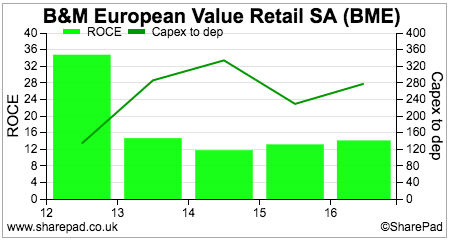

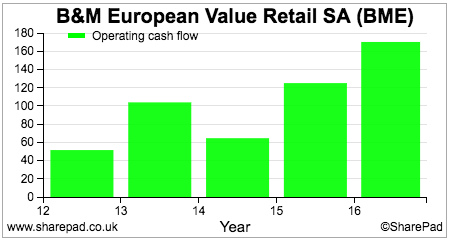

B&M European Value Retail (LSE:BME)

B&M is a value retailer. Its proposition to customers is based on concentrated buying and narrow product ranges in order to sell goods at very competitive prices.

The company is pursuing an aggressive retail roll out strategy by opening up new stores in the UK and to a lesser extent in Germany. The signs are that this strategy is paying off.

ROCE is being maintained despite the high capex and this has been feeding through into strong EPS growth and increased operating cash flow. Unlike companies such as Tesco which squeezed supplier payment terms to boost its cash flow, there is no evidence of this going on at B&M.

What is particularly encouraging for owners of the shares is that the roll out of new stores is being boosted by a very strong and improving like-for-like sales performance from existing stores. LFL sales growth in the UK was 8.2% during the third quarter. If strong LFLs continue then B&M’s retail roll out would become turbo-charged.

The company reckons that it still has plenty of growth opportunities in the UK. It has an ambition to grow from the current 533 stores to 850. If ROCE on these new stores can be maintained then it is perfectly possible to paint a very bullish outlook for the company. This perhaps explains the current rich valuation (23 times forecast PE) attached to its shares.

Sometimes it has proven better to ride a retail roll out until underlying growth slows. The danger for investors is that the roll out eventually turns sour due to over-expansion and a slowing market. Restaurant Group and Dunelm are good examples of this.

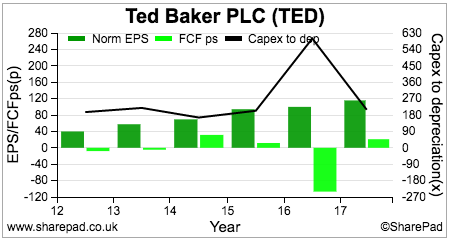

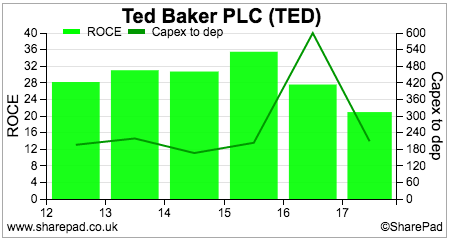

Ted Baker (LSE:TED)

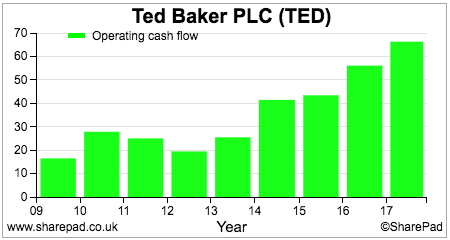

Ted Baker’s heavy investment in new stores across the globe has led to a horrible free cash conversion performance. Its strategy is about creating a global lifestyle fashion brand. It has a three-pronged attack of selling from its own retail stores, licensed stores (from which it receives licence income) and wholesaling.

ROCE looks to have peaked and has fallen sharply in both 2015/16 and 2016/17. That said, ROCE has still been at 20% but there are signs that incremental returns on investment are falling. Is this as good as it gets for Ted Baker?

The trend in operating cash flow has been positive which is an encouraging sign.

The shares have softened on the back of recent full year results which slightly missed expectations. That said, City analysts continue to predict strong rates of earnings growth for the next few years from 115p in 2016/17 to 162p in 2020.

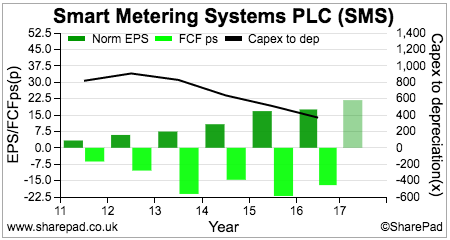

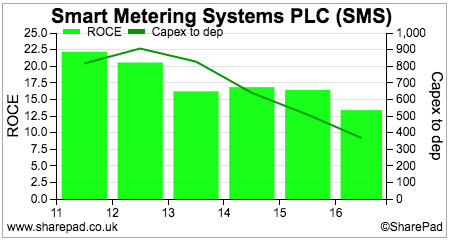

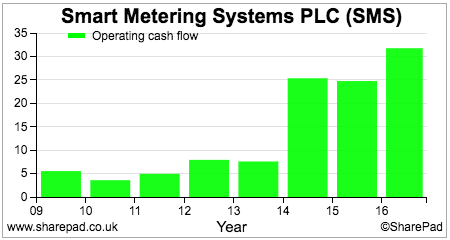

Smart Metering Systems (LSE:SMS)

This company installs, owns, connects and maintains smart gas and electricity meters for utility companies. It receives income for installing the meters and then gets an inflation-linked rental income for metering and data services.

Capex has been invested in new meters to supply to customers. This has led to significantly negative free cash flows but profits (EPS) have grown steadily.

After a capex splurge a few years ago, capex spending relative to depreciation has come down. ROCE has also fallen as well.

Without undertaking a detailed study of the business it is difficult to say why this has happened. My guess is that it is due to a change in revenue mix from installation (one-off) and recurring rental income.

The good news is that operating cash flow has been rising.

It seems that there is significant growth potential due to the slow roll out of smart metering in the UK. The government looks as if it will miss its target of having a smart meter in every home by 2020.

The slow roll out means that there are 48 million smart meters that need to be installed over the next 4-5 years which suggests that the company has a significant growth opportunity if it can grab a decent slice of the market.

As to what ROCE the extra investment will bring, it is hard to tell. However, long-term, inflation-linked rental income is unlikely to have many costs associated with it. Once the labour costs of installing meters have come and gone, SMS could be a very profitable and cash-generative business. This is the bull case for the business.

Summary

- Poor free cash flow can be a warning sign to investors. This is especially true if it is caused by rising working capital requirements and pension fund payments.

- High capex and poor free cash flow is not an issue if the money spent is earning an acceptable ROCE and increasing operating cash flow. In fact, it can be a very bullish sign.

- Spend time examining the scope for further investment in a business. Is there still a decent growth opportunity or has most of it already occurred?

- Don’t focus exclusively on the prospects for growth. Pay attention to the performance of a company’s existing assets. Is new investment masking a decline elsewhere?

- Be mindful of over-investment which might reduce future returns and weaken a company’s financial position due to too much debt.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.