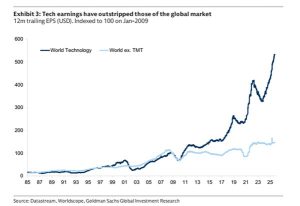

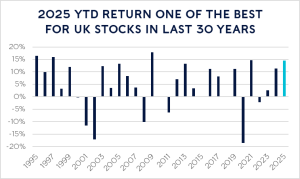

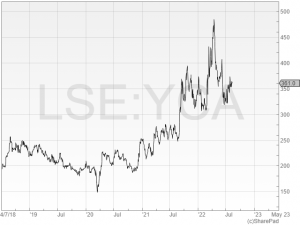

David Stevenson argues the global equity rally is broadening beyond AI and the US, highlighting new opportunities across markets and sectors. He also examines a new Indian equities ETF, revisits HgCapital after its sell-off, and explores how funds can help investors manage downside risk. In this month’s funds article, we examine whether the broad equity […]