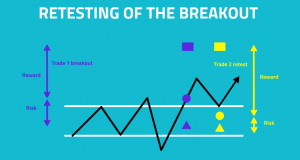

Michael Taylor explores the hidden problem with demo trading – not the lack of skill, but the absence of emotion. He explains why finding the right balance of risk is essential for developing discipline, consistency and long-term trading success. Demo accounts are the source of contention amongst traders. Some say they are a way to […]