Weekly Market Commentary 25/07/22| SDI, RBGP, HOTC | The capital cycle

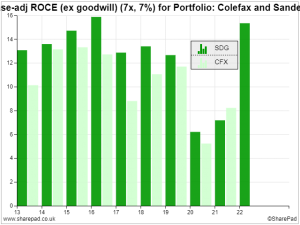

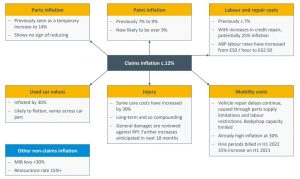

Bruce considers whether profit warnings in the insurance and adtech signal that too much capital has been chasing too few opportunities. Sophisticated data models are no replacement for management turning cautious at the top of the cycle. Stocks covered SDI, RBGP and HOTC profit warning. The FTSE 100 recovered +1.6% last week to 7,276. Markets