Alpesh Patel on US investing: Latest Smart Money Thinking on a Stock Market Crash

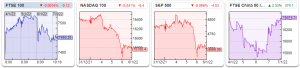

The S&P 500 has shed 500 points amid inflation fears. It’s been a punishing start to 2022. Alpesh Patel considers whether it is just a bump on the road or are we set for the stock market crash that some commentators have been predicting for years? Stock market turbulence throughout January has caused a significant