The FTSE 100 was up half a percent last week to 7,124. The Nasdaq 100 had a better week +1.2% and the China 50 rebounded +4.5%, though that index is still down -14% in the last 3 months. The US 10-year bond yield finished last week at 1.35%, recovering from a low of 1.19% in […]

Month: August 2021

The Trader: 3 principles for trading on the stock market

Breakouts are an excellent way to swing trade and profit from bull markets. I love breakouts because they’re a high probability pattern of continuation and also because it means that the price is rising. However, many people try strategies that that are inherently risky. Sadly, one private investor commented that they’d invested into a stock […]

State of the Stock Market – Over or Undervalued?

Since the post-pandemic stock market boom, analysts and experts have warned us that the market was overvalued. Some have gone even further and submitted that we’re in a bubble that is set to burst. However, prices keep rising, suggesting many investors believe there is still value to be found. So which is it? Is the […]

Should you buy Purplebricks shares? | Small-Cap Spotlight Report

Deep pockets, low pricing and fancy IT can’t always guarantee ‘disruptive’ success. Maynard Paton studies the mixed progress of estate-agent challenger Purplebricks Investors love disruptors. Find a pioneering upstart that is stealing market share from industry dinosaurs, and your portfolio may enjoy a huge stock-market winner. Amazon of course is the textbook example. But not […]

Weekly Commentary 23/08/21: Freezing and burning cash in a digital age

The FTSE 100 fell 2.5% last week and remains at the level it was in early May, at 7,048. The China 50 Index was down even more sharply 7.6% to 16,959. Alibaba fell 15% last week, and Tencent was also down 11%. The damage is being done by new data privacy laws that Beijing will […]

3 questions about Oxford Instruments plc | Deep dive into financials

Richard goes deep into Oxford Instruments’ annual reports and SharePad for answers to three questions to establish whether it is a good “pick and shovel play”. In my last article I explained how I used custom tables to find Oxford Instruments, a highly profitable business that seemed to have lost its way and then found […]

Should you buy Hornby shares? | Small-Cap Spotlight Report

Events at Hornby prove how turnarounds can take years. But fresh capital, better management and a return to profit could mean the model-train specialist is over the worst and finally heading towards a proper recovery. Turnarounds can be tempting. You find a business that has hit big trouble with a stock price at rock bottom… […]

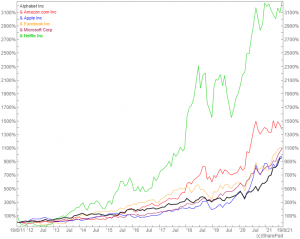

Weekly Commentary 16/08/21: The S&P494

Bruce looks at how stock market indices can be skewed by a few large winners. The same goes for portfolio returns. Stocks covered this week are BOTB’s profit warning, plus H1 results from Clarkson, Ocean Wilsons and Georgia Capital. The FTSE was up +1.0% to 7,193 last week, outperforming the S&P500 which was up 0.5% […]

Journeo PLC | Small-cap, ESG-friendly and on the rise

Journeo PLC (JNEO) is a tiddler I have had on my watchlist for a year or more. At today’s share price of 122p, the market cap is just £10.7 million, so very much at the lower end of valuations of the companies I have covered. Many investors would view this as a concern, a risk […]

Trading with Golden Crosses: Easy win or easy loss?

I should start by saying that I am no technical analysis whiz, and this article will likely bore those with an encyclopaedic knowledge of buy/sell signals and chart shapes (cup and handle, anyone?). I got into investing after I started working at ShareScope, and I desperately wanted it to be easy. Technical analysis seemed like […]

Weekly Commentary 09/08/21: What $16 trillion of negative yields are signalling

Last week the FTSE 100 was up +1.1% to 7,111, Nasdaq was up 1.5% to 15,181, outperforming the S&P 500, up +0.8% to 4,429. Both the Hang Seng index in Hong Kong and the FTSE China 50 Index were up less than 1% last week. The US 10Y bond yield continued to fall to 1.19% […]

4 FTSE miners | Centamin, Fresnillo, Ferrexpo, Petropavlovsk

We looked at two potential stage 2 stocks a few weeks ago here. The issue with some AIM stocks is that they don’t offer the liquidity that some traders prefer. In this article, we’ll look at some FTSE miners that trade on both the FTSE 100 and FTSE 250 indices. These stocks are traded in […]

Financials, filters and FOMO | Using SharePad to find opportunities

Filters are one of the most powerful tools in SharePad, but Richard has been experimenting with another way to discover investment ideas and increase his “market intimacy”. Traders, of course, have price charts to guide them. Many investors focus on financials, and use filters to find new shares with attractive financial characteristics. Being a buy-and-hold […]

Weekly Commentary 02/08/21: Credit and Contagion

The FTSE 100 bobbled about just above 7,000 last week. Nasdaq 100 was down less than half a percent, as strong results from Alphabet, Microsoft and Apple all beat analyst forecasts on the top line. This was offset somewhat by Amazon, which reported sales growth slowing as lockdown measures eased. Maybe Jeff Bezos has timed […]