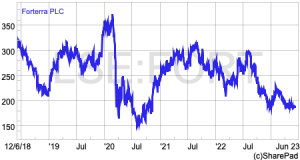

Is now a good time to buy Forterra shares?

Buying shares when they are unpopular can be a profitable investing strategy. Phil takes a look at one of the UK’s leading brickmakers, Forterra, to see if now could be a good time to buy its shares. A good business underpinned by strong long-term demand for new homes The long-term bull case for buying shares