Ploughing through an economic blizzard

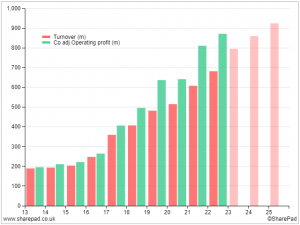

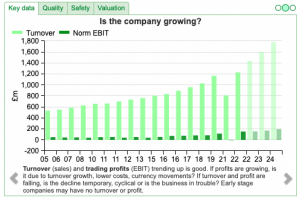

Digging deep into stock market sensation Halma’s history, Richard gains clues about the kind of businesses long-term investors should think about owning in an economic blizzard. I have never owned shares in Halma, in fact, I have never considered owning them even though the business has performed extraordinarily well. Halma: Proof that roll-ups can grow