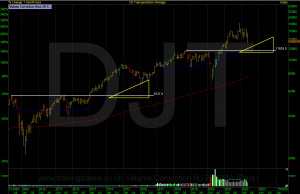

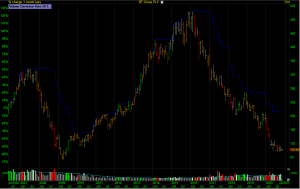

Breakaway gaps, otherwise known as pro gaps, can signify a major change in sentiment and the start of a new primary trend. In this article I will show you how to find pro gaps and more importantly show you some money management tactics to help you get on board a potential new trend in a […]