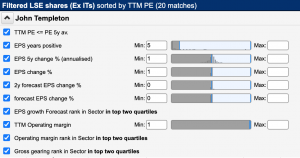

Share prices on London’s Alternative Investment Market (AIM) have come under huge pressure over the past 18 months. But dividends from AIM stocks actually hit a record high in 2022. So what do these mixed signals really mean, and where can you find the best dividends on AIM? I am going to start this article […]