Does high risk really mean high reward, or can lower volatility actually generate a better return? Ben Hobson explores the low volatility anomaly.

An age-old truism of stock market investing is that with great risks come great returns. You don’t have to look far to find investors putting their capital at risk in the hope of lottery-like outcomes. But while stories of windfall payoffs live long in the memory, they are very rare indeed.

Taking a swashbuckling approach to stock-picking isn’t just something that individual investors find instinctive. In fund management, a popular way of trying to beat a benchmark involves taking outsize bets on glamorous, fast-moving shares.

So in many ways, investors of all stripes have a habit of associating higher performance with higher risk. But if you examine trends in returns, this can actually be a mistake. It turns out that focusing on less exciting shares can generate more of a profit.

What risk really means

For most people – and Warren Buffett subscribes to this – risk can be summed up as the possibility of losing money. But investing textbooks will tell you something slightly different.

Classically, risk is a measure of the difference between what you expect to happen and what can actually happen. That means the higher the risk, the wider the range of potential outcomes there are – both good and bad.

While there is no single measure that captures this definition of risk, academics have come up with ways of measuring how a share has behaved in the past to judge how it will behave in the future. One of those is called volatility.

Volatility is a word you often see in headlines when the market is falling. But what high volatility really means is that prices are moving around more (both higher and lower) than they normally do on average. In statistics, the measure is called standard deviation. Whether it’s a single share or an entire market, the wider the movement the higher the volatility.

Another measure used to understand the sensitivity of a stock is called ‘beta’. Beta tells you about share price volatility in relation to the index or market. The market itself has a beta of ‘1’. Stocks with prices that rise more than the market on up-days and fall more than the market on down-days, will have a beta greater than 1. Those that are less sensitive to the market will have a beta of less than 1.

It’s important to remember that volatility and risk aren’t the same thing. However, higher volatility shares can be less predictable and prone to big price moves that make them attractive to some investors. But this is where research shows that higher volatility shares might not be as profitable as you think…

For more on understanding volatility and risk, Phil has written a really useful guide here: The difference between volatility & risk

Introducing the low volatility anomaly

Back in 1975, an economist called Robert Haugen discovered that low-volatility shares often outperformed their higher-volatility peers.

His research examined trends in investor behaviour and found that even professional money managers were attracted by higher volatility shares as a source of higher returns. But this popularity pushed up the valuations of these shares, which crimped their expected returns.

On the flip side, Haugen found that lower volatility shares ended up being cheaper because they were in less demand, and that gave them greater scope to perform well.

Importantly, Haugen’s findings showed that while lower volatility shares were slightly slower to rise in bullish conditions, they were much more resilient to downward pressure in bearish markets.

Like many of the factors that drive stock market returns (such as value, momentum and profitability) a part of why low volatility investing works is believed to be behavioural. Investors tend to be over-optimistic, overconfident and mistakenly equate situations to similar events in the past, which is known as representativeness bias. These can all lead to a preference for higher volatility shares.

How to find low volatility shares

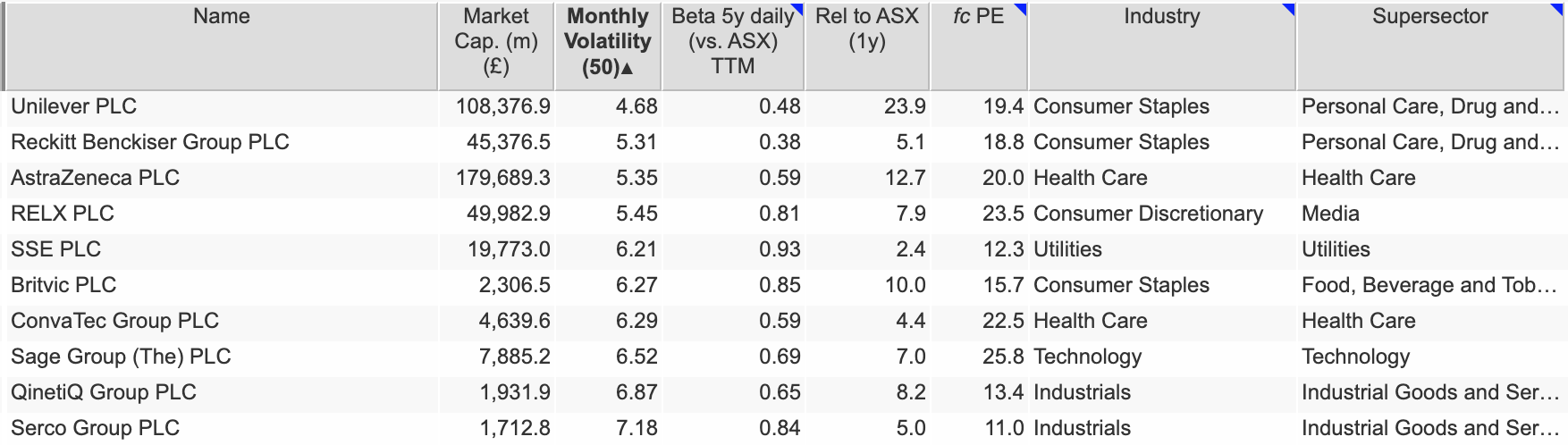

SharePad has a range of tools to explore volatility and use it to filter the market for ideas. In this case, I have taken the FTSE All Share and filtered it using both volatility and beta:

- The list is sorted based on the lowest volatility up to a maximum of 10 (using standard deviation as a measure of a share’s price movements relative to itself) based on monthly volatility over five years

- Beta below 1, which means it has a history of being less sensitive to movements relative to the market

- Positive 1-year relative price strength, which focuses on shares that have performed better than the FTSE All Share in that time

This is how those rules look in the SharePad filter:

You could integrate low volatility measures into just about any investment strategy or style. It can be useful just to see the history of volatility in a share to give you an extra perspective on what you might expect from it.

With these rules, the shares are undoubtedly larger (predominantly FTSE 100) defensive names with high-quality business models and finances. The rules insist on above-average index performance over the past year, but most of these performed close to the index, which is what you would hope to see from this approach.

You can also see that on one simple measure of valuation – the forecast price/earning ratio – low volatility defensives like this are leaning towards expensive based on a rule-on-thumb that anything beyond 20x is in demand.

What can we learn from the low volatility anomaly?

Low volatility has earned itself a place among a handful of recognised stock market factors. In a lot of ways, it is the polar opposite of what many investors see as the fastest route to profiting from shares. But research shows that lower-volatility shares generate superior returns over time.

Not only that, but low-volatility shares tend to stay low-volatility, too. So this isn’t a strategy where you would expect to see continuous churn in the results. Combining it with other strategies can offer a different view and help diversify away from too much speculative risk in your portfolio.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.