In this week’s Market Moves, Ben takes a look at some of the biggest winners and sector trends over the past week, including consumer discretionary shares and housebuilders, plus upcoming financial results for the week ahead.

Shares in the Consumer Discretionary industry have had a very mixed 18 months. As one of the most economically-sensitive business classifications, you’d expect it to wobble when faced with economic clouds on the horizon.

It covers companies in sectors like travel and leisure, retail, autos and parts, and consumer products. In other words, exactly the types of areas that consumers will skip on in a cost of living crisis.

So given its economic exposure, it’s no surprise that some shares in the consumer discretionary space have fallen hard in this late cycle of high inflation and rising rates.

But looking across some of the biggest upward movers in recent weeks, it’s hard to escape the signs that some stocks in this industry sector are moving well on good news.

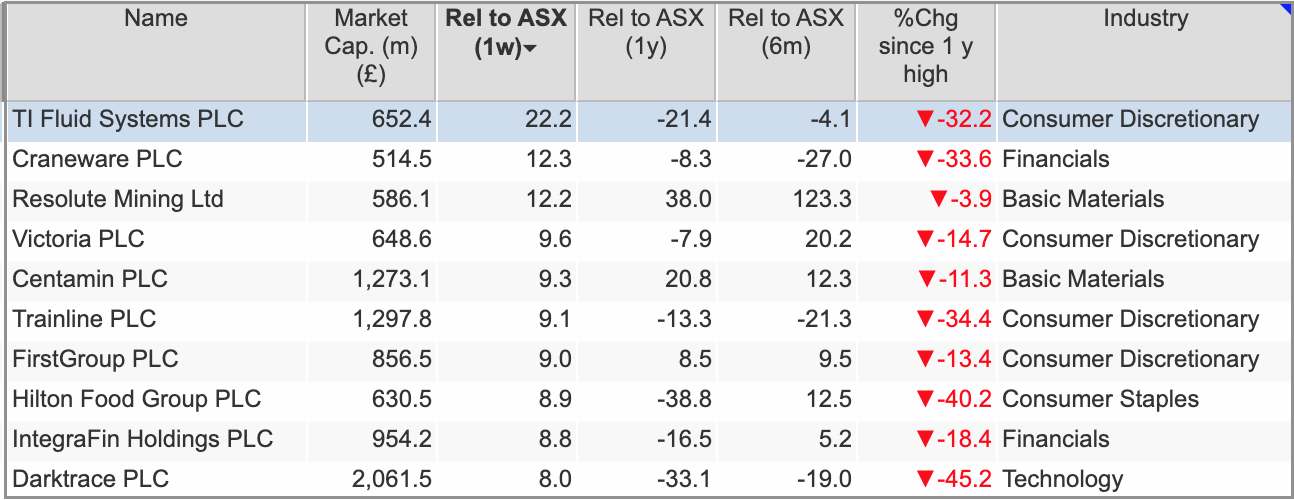

Last week, of all LSE shares with a market cap greater than £500 million, TI Fluid Systems (LON:TIFS) was the highest riser relative to the All Share, with a 22.2% gain.

Now, TI Fluid Systems isn’t an obvious consumer-facing stock; it actually makes components for the auto industry. Its exposure to global supply chains and consumer demand meant that inflation had been very painful for it. But with news that it’s moving past those problems and benefiting from growing demand for electric vehicles, triggered an upbeat trading statement and a major lift in the share price.

That said, TI is still down against the index by 21% over 12 months, which tells you a lot about how badly some of these consumer discretionary shares have suffered.

Four of the top 10 risers in the £500m+ bracket were in the consumer discretionary sector, including floorcovering firm Victoria (LON:VCP) and travel-related groups Trainline (LON:TRN) and FirstGroup (LON:FGP).

Lower down the market-cap range, sub-£500m risers were led by Supply@Me Capital (LON:SYME), which was a late move on Friday. Gold miner Hummingbird Resources (LON:HUM) saw its shares surge to a 1-year high on news that its Kouroussa Gold Mine processing plant is set to start pouring gold later this quarter. Meanwhile, shares in Petro Matad (LON:MATD) also hit a new high on news that it is set to drill its highly anticipated Velociraptor 1 well in Mongolia in June.

Trending sectors – the start of a rebound for house builders?

Both the FTSE 100 and FTSE 250 indices are just scraping positive territory year-to-date. Markets are putting a brave face on American regional banking collapses as we creep towards what seems like the end of the rate-hiking cycle (although UK and European central banks will likely hike again to try and kill off excessive inflation).

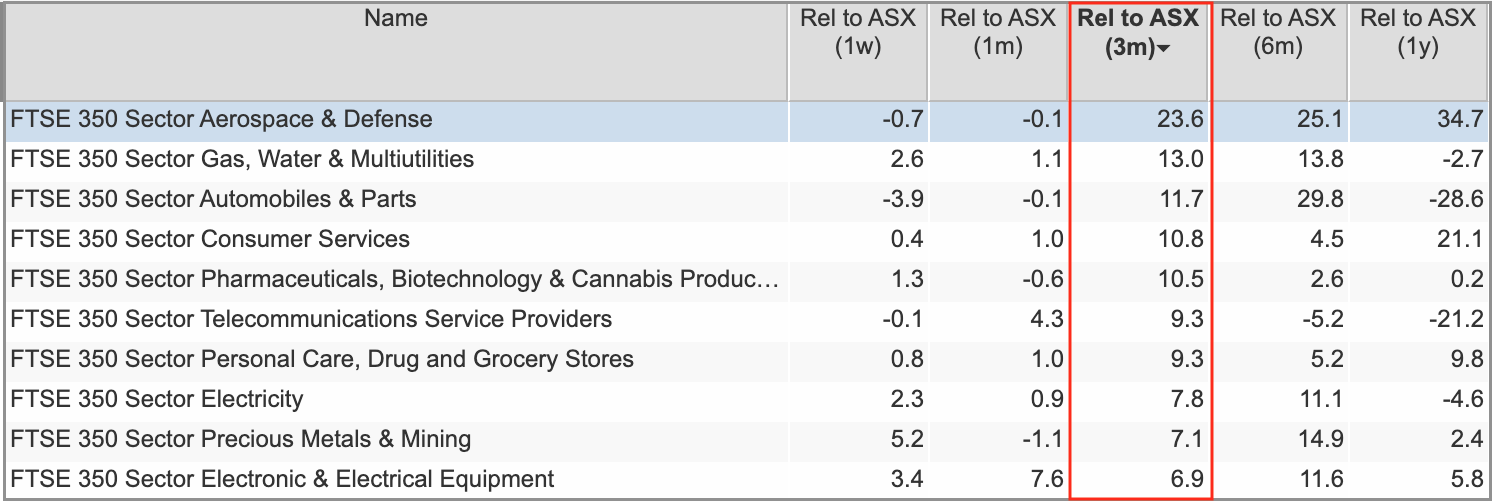

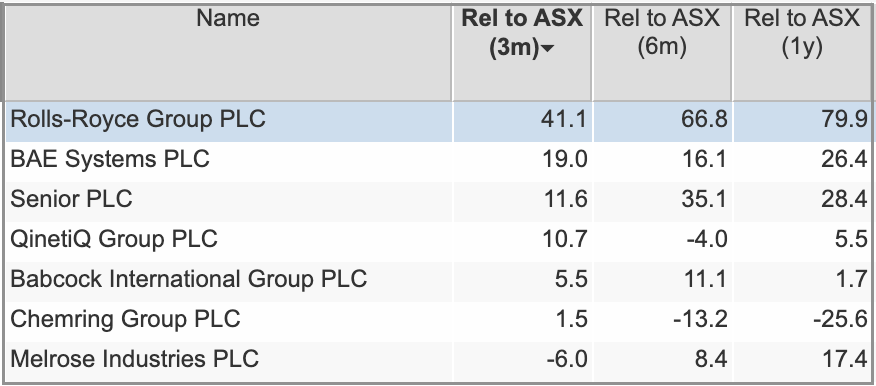

On a 3- 6- and 12-month basis, Aerospace & Defence commands a top performance position among the FTSE 350 sectors.

Rolls-Royce (LON:RR.) has been the biggest winner in that sector, but there have been very solid gains in others like BAE Systems (LON:BA.) and Senior (LON:SNR), in particular:

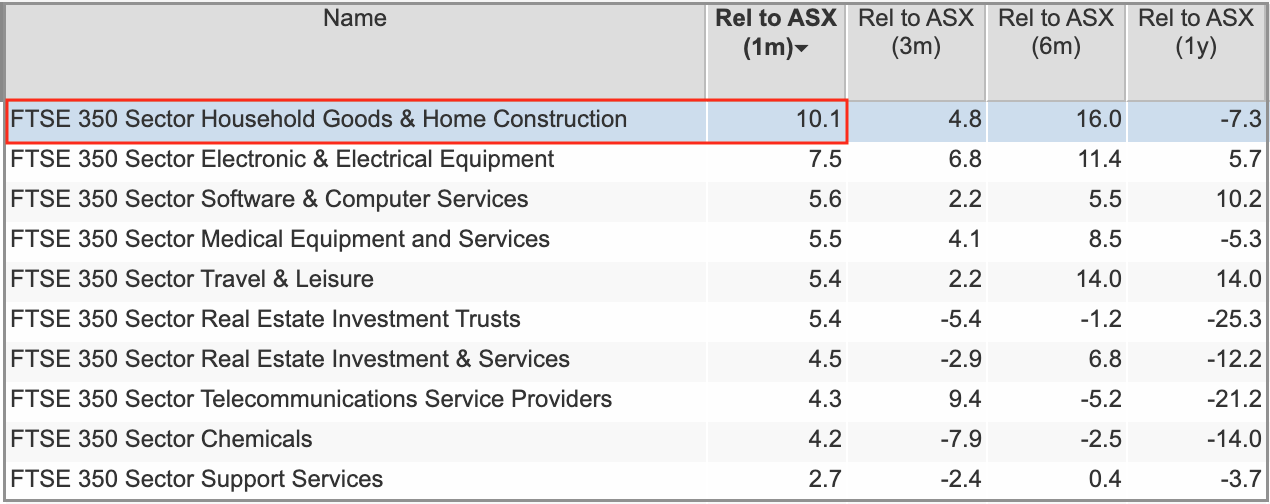

Taking a magnifying glass to recent trends, the 1-month FTSE 350 sector performances suggest that changes are afoot, with Household Goods & Home Construction leading the list.

This is interesting because housebuilders have been in a tough place for some time now. Rising interest rates and the end of the old ‘Help to Buy’ scheme have added friction to sales at a time when the cost of living crisis is hurting home buyers.

This chart of the Household Goods & Home Construction index since 2008 gives an indication of how bad things have got:

But rumours in the news this week that Prime Minister Rishi Sunak is thinking about rebooting the Help to Buy scheme has breathed life into share prices. This week’s council elections didn’t play too favourably for the Conservatives, and while a General Election is still perhaps 20 months away, reinstating some kind of house purchase support scheme seems like an easy win, although it could be very divisive.

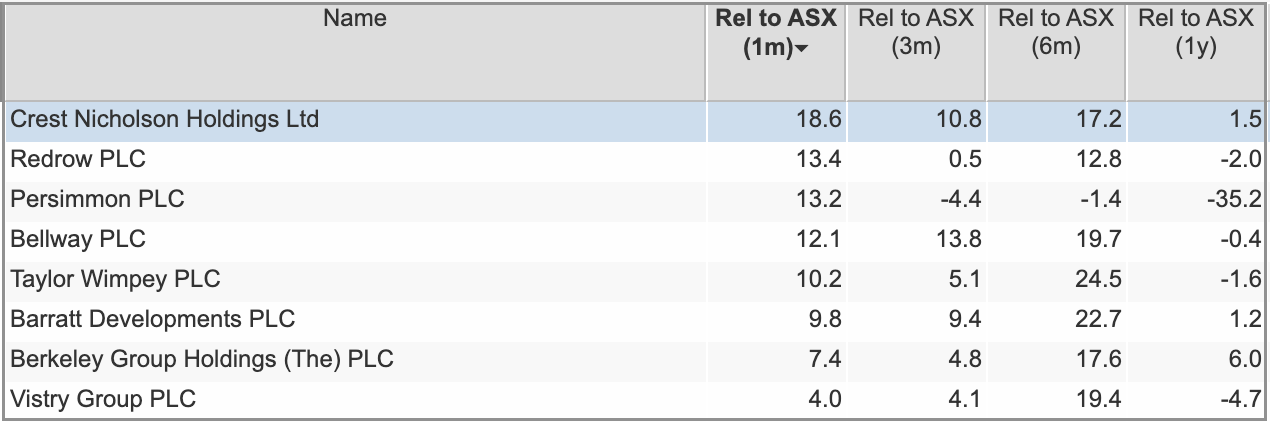

Either way, Crest Nicolson (LON:CRST) has led the pack with a 18.6% gain relative to the All Share over 1 month, followed by Redrow (LON:RDW) and Persimmon (LON:PSN).

Results to look out for

It’s another short week owing to the coronation bank holiday, but there are plenty of updates in the calendar.

Tuesday (9 May) sees interim figures from Treatt (LON:TET) and Victrex (LON:VCT) followed on Wednesday by half-year numbers from fashion giant ASOS (LON:ASC). ASOS has seen its shares slide to less than £7 from over £55 since early 2021, so investors will be hoping for good news.

By contrast, momentum has not been a problem at blue chip food service giant Compass, (LON:CPG), where the shares have been almost unstoppable over the past couple of years and are currently trading close to all-time highs. It also reports interims on Wednesday.

Wednesday should also see a trading update from engineering group Spirax-Sarco (LON:SPX) as well as full year results from auto dealer Vertu Motors (LON:VTU).

On Thursday, FTSE 100 telecoms group Airtel Africa (LON:AAF) will publish its full-year figures, as will Cardiff-based semiconductor firm IQE (LON:IQE). Shares in IQE nearly halved in price in March on a profit warning caused by softer-than-expected H1 sales. Investors will be looking for better news for the full year and signs that broader industry trends are picking up.

Have a good week.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.