Attractive dividend yields are a magnet to many investors, but they come with risks. Ben Hobson explores a strategy for finding high yields without falling into a trap.

Company dividends can play a part in just about any investment strategy. Not only are they a source of cash returns for income investors, but they can also be a pointer to the quality of a business and the confidence of its management.

On this, I always think about something the well-known British investor Jim Slater, once wrote. He looked for adventurous growth shares and was keen to find big upside in small caps. So in a way, he was the last person you’d think about when it comes to dividends. But it turns out that they were a useful clue in his search for reliable growth.

In The Zulu Principle, he wrote: “…the dividend payment and forecast (if any) to some extent corroborate the management’s confidence in the future. The ideal company will have a steadily increasing dividend growing broadly in line with earnings.”

When it comes to strategies that look specifically at company dividends, there are three main flavours: high yield, consistent growth and safety. This week I’m tackling the one that catches the eye of every dividend investor: high yield.

Phil has written some great things on this subject (here), so for a grounding on the role of dividends I’d recommend taking a look at what he says.

What yield really tells you

Yield is one of the most important measures of dividends. One reason is that (on paper at least) the higher the yield the more you should get in cash returns for the money you invest.

It is calculated by dividing a company’s annual dividend-per-share by its share price. If you want to know the forecast yield (which many dividend investors do) the calculation uses the forecast dividend-per-share based on what analysts expect it to be in the future.

It’s important to note that the share price is easily the most sensitive part of this yield calculation. Share prices move up and down all the time, which means the yields on dividend-paying shares are prone to (usually small) fluctuations, too.

This connection between the share price and the yield cuts to the heart of some important considerations with high-yield shares. The fact is that an excessively high yield can be a signal that the share price has fallen, which in turn could mean there are problems. At worst, the dividend could be at risk and what you’re actually facing is a ‘yield trap’.

It’s for this reason that high dividend yield is sometimes used by value investors as a pointer to potentially cheap shares. Indeed, one of the best-known high-yield strategies is called Dogs of the Dow. It’s a classic approach that scrapes the highest-yielding shares from a large cap index and refreshes it every year. But it’s also a bit of a value strategy as well.

The clue here is in the name: these “Dogs” were shares that strategy author Michael O’Higgins saw as likely to be suffering setbacks or were unloved for one reason or another. In other words, they were cheap, which pushed up their yields. But their sheer size was likely to see them through any short-term problems.

While high yield carries risk, it’s still a very important factor for income investors. So how can you use it to your advantage? Let’s start with a look at what the average dividend yield is…

Safer ways of using high yield

Of more than 1,500 shares quoted on the UK market (ex-investment trusts), a third pay a dividend. Around 85% of those payouts, in value terms, comes from the FTSE 100. Another 10-13% comes from the FTSE 250 and the remainder comes from the rest of the market.

In terms of yield, the FTSE 100 average sits between 3.7% and 4.5% and that drops away as you move down the market cap scale.

According to SharePad, of those companies that are forecast to pay a dividend in the coming year, the forecast yields range from as low as 0.3% to as high as 67%. The median sits at 3.6%.

While precise rules come down to personal preference, a starting point here is to set a filter with a minimum forecast yield of 3.6% and a maximum of 11%. I have also looked for a minimum yield last year of 3.2% (which was the median average then) so the results are more likely to find consistently above-average yielders rather than exceptions.

For some, those limits might feel too wide, but they will provide a broad view of what the market has to offer. Currently, around 240 shares (LSE ex Inv Tr) fall into that bracket – but remember that yields are always prone to change, so the results will too.

There aren’t many dividend-specific safety ratios, but one that really is a must in a high yield screen is ‘dividend cover’ and ‘forecast dividend cover’.

Companies pay their dividends from net profits. Shortfalls can be covered using retained earnings from previous years or even debt, but you don’t really want to see too much of that. Especially when you’re trying to check the credibility of a high yield. Dividend cover tells you the extent to which earnings cover the payout.

Cover of ‘1’ is technically enough. Cover of ‘2’ is widely seen as much safer. Somewhere in between will give you more results to investigate. In this screen, I’ve looked for dividend cover – both five-year average and forecast – of 1.5x.

In the spirit of the high-yield “Dividend Dogs” strategy, another safety option worth thinking about is a minimum market cap. Company size is no guarantee of dividend safety, and there are likely to be smaller firms with strong yields you could rely on. But setting a minimum – in this case £750 million – can keep you away from potentially higher risk, financially vulnerable small stocks. With high yield, the more certainty the better.

Here is how those filter rules look.

(You can run this screen for yourself by selecting the “Ben Hobson’s High Dividend Yield filter” within SharePad’s Filter Library. To get to the filter library, click “Filter” on the blue screen, “Apply filter” and then “Library”. If you can’t see my filters just search for ‘Ben’)

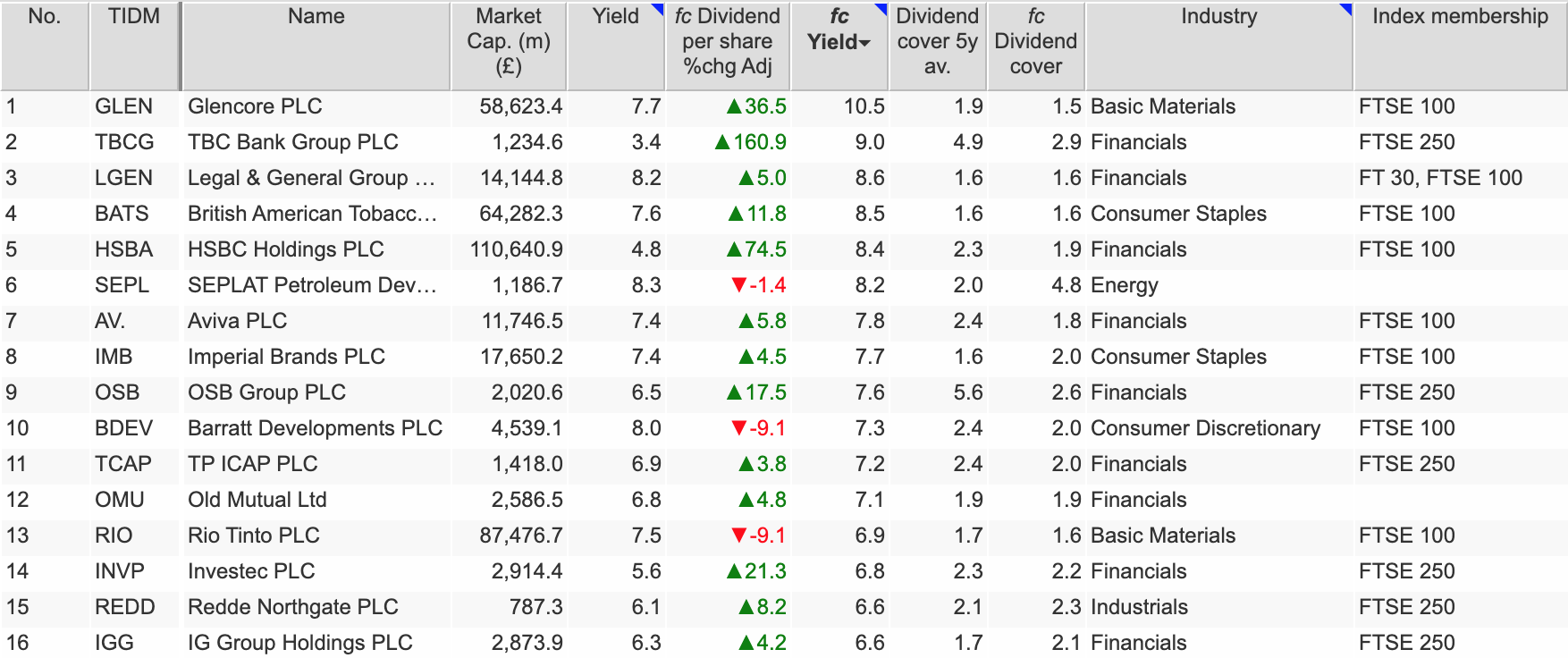

At the time, 53 shares were passing these rules, and the forecast yields of the top 16 (shown) ranged from 10.5% at commodities giant Glencore to 6.6% at trading platform, IG Group.

There are a few observations on the current results of this high-yield approach:

- Financials are a dominant presence in this list. With heightened fears of problems in the banking sector, it’s worth being conscious of the high-yield risks. Dividends were slashed when the 2008 banking crisis unfolded.

- It’s encouraging to see widespread forecasts of rising dividends and the higher forecast yields as a result.

- In terms of dividend cover, most of these top results suggest that companies keep their cover quite consistent over time, which again is promising.

- The rules use a minimum market cap of £750 million, which doesn’t seem to have gotten in the way of the top results. Reducing it to £250 million only adds three names to this top 16.

What can we learn from the high dividend yield strategy?

Yield – and high yield in particular – is a natural focus for both investors seeking cash income and those analysing the strength and valuation of shares. But it is important not to become spellbound by an eye-catching yield. There can be good and bad reasons why a yield is high, and it’s important to protect yourself from a possible trap.

Tools like dividend cover and company size have been deployed effectively in high-yield strategies before. Likewise, borrowing ideas from other dividend strategies, especially measures of growth and safety, could help reinforce a high-yield strategy. I’ll explore some of these ideas in the weeks ahead, and keep an eye on these high-yield shares to see how they perform.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.