In this week’s view of the market, Ben takes a look at fund manager performance, the earnings outlook, sector momentum, one-year share winners and upcoming financial results for the week ahead.

Last year was a difficult one for private investors, so in a way, it’s reassuring to hear that many professionals had a hard time too. That said, the scale of underperformance by UK mid and large-cap funds is something to behold.

Some 97% of UK mid-cap equity funds and 92% of large-cap funds undershot their relevant benchmarks in 2022, according to the latest SPIVA Scorecard from the index provider, S&P.

UK small-cap funds did better, but even 67% of them underperformed.

SPIVA stands for “S&P Indices Versus Active Funds”, where S&P compares active manager performance to relevant benchmarks (you can read the report here). Over the years, the results have consistently found fund managers lagging on average in almost every territory around the world. Last year was an exceptionally bad one for UK managers. But why?

One mooted reason is down to the fact that UK large-caps haven’t exactly been a rip-roaring source of investment profits over the past 20 years. Unlike the US, where mega-cap tech has proved such a huge boost to returns, the UK has been pedestrian by comparison.

There is an argument that such a prolonged spell of ho-hum returns has led managers to dip their toes into smaller indices and growth-oriented shares as a source of alpha. If that is the case, last year turned out to be a trap.

After years in the wilderness, large-cap value came to the fore in 2022, leaving mid- and small-cap growth struggling. It was an unfamiliar environment and it seems to have caught fund managers out.

Growth on the horizon?

Turning to 2023, the market narrative is very much about the pace at which central banks can get a grip on inflation and whether their rapid succession of rate hikes will drag the economy into recession.

We’ve already had casualties in the form of regional US banks like Silicon Valley Bank and Signature Bank. Nerves are jangling about whether these could be the first wisps of smoke for what could turn into a credit crisis for US firms and particularly the commercial real estate sector.

In the UK, after a spluttering but generally positive start to the year, one view is that the market is fairly relaxed about the risk of recession. Economic growth has been better than anticipated and rate hikes are likely to be close to as high as they get this cycle.

This from Lazard Asset Management’s Q2 preview sums up that view:

“…the macro backdrop should be supportive for UK equities in the second half of the year. We remain mildly positive about the prospects for consumers and the broader UK economy, helped by a likely peak in rates.”

Here in the UK, we don’t have the same metronomic earnings season that the US enjoys. That makes it harder to see trends in earnings and forecasts, and the relationship between the two (although you could argue that’s a good thing).

In the States, Q1 earnings season is just kicking off, and expectations are that year-on-year earnings will fall by around -6.5%, according to S&P. That would be the worst decline since early 2020.

That said, 90% of the first 30 companies to report their figures (up to 14 April) beat their average estimates. That’s a better-than-expected performance, but there’s still a long way to go.

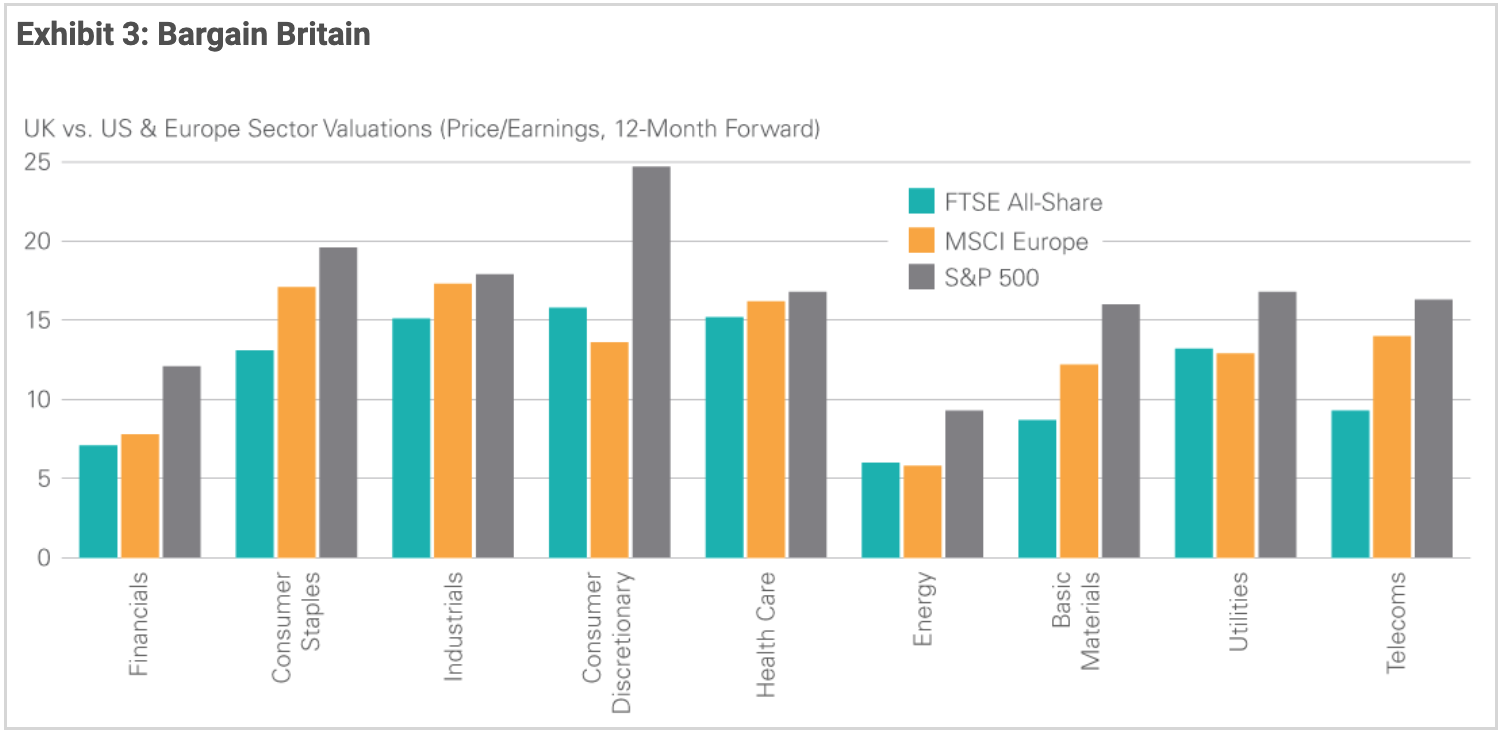

Sector trends – is the UK market cheap?

Based on 12-month forward earnings expectations, there is clear water between the UK, European and US markets when it comes to price/earnings valuations on a sector basis. This chart from Lazard shows that the UK remains cheap across the board versus the US, and generally so against Europe too:

Source: FactSet / Lazard Asset Management (as of 31 March 2023)

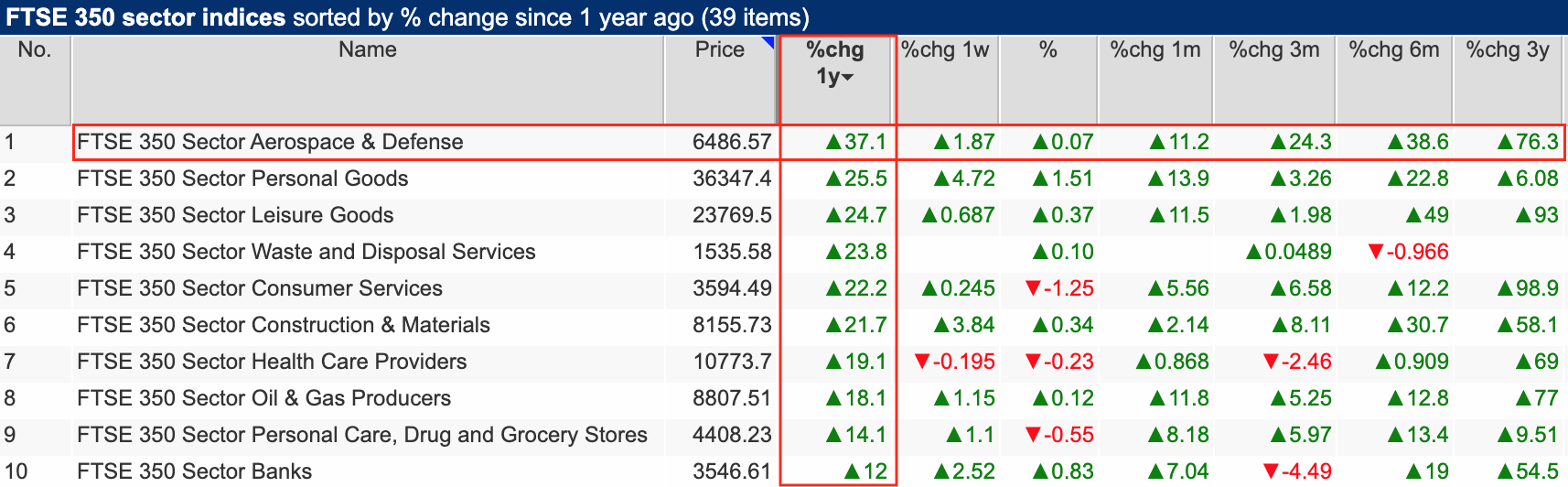

According to SharePad, Aerospace & Defence (Industrials) has been the leading FTSE 350 sector on a one-year basis, with a gain of 37.1%.

Consumer and Personal Goods industries have also been big winners, together with Construction (+22.2%), Healthcare (+19.1%), Oil & Gas (+18.1%) and Banks (+12%).

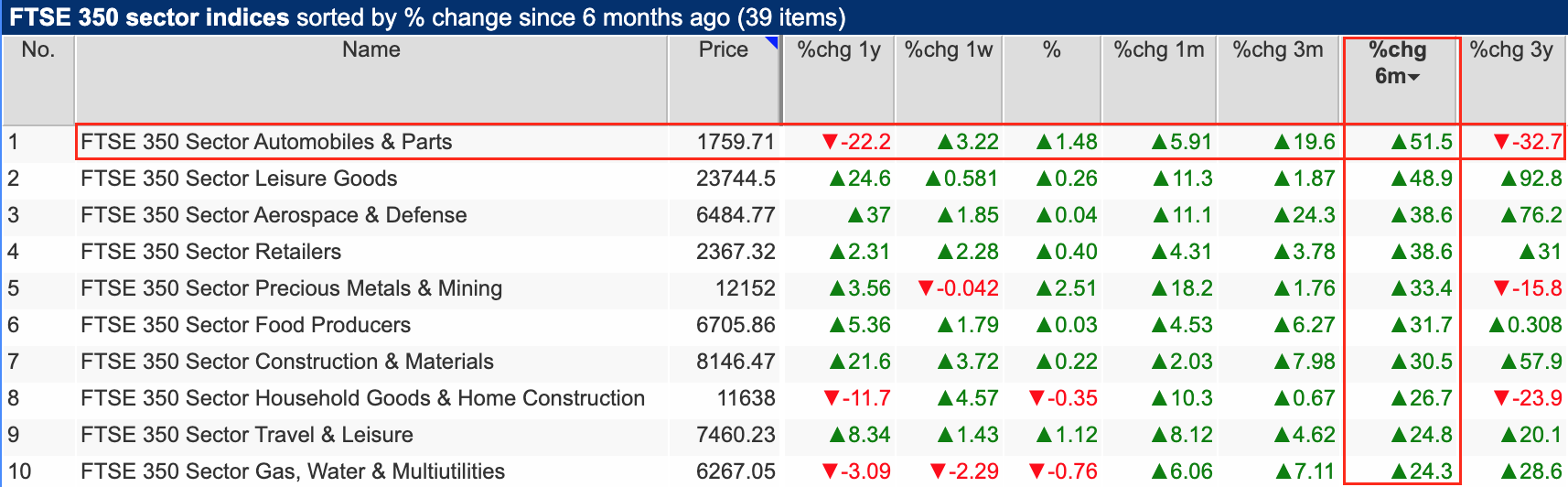

If you sort the sector indices for the strongest performance over six months, you can see a couple of interesting changes in trends. The best performing sector over six months is one of the worst over 12 months: Automobiles & Parts (+51.5%).

On this shorter-term momentum basis, there is certainly a more cyclical, consumer-focused feel to things, with Retail, Household Goods and Travel & Leisure making it into the top 10 performing sectors:

Shares on the move

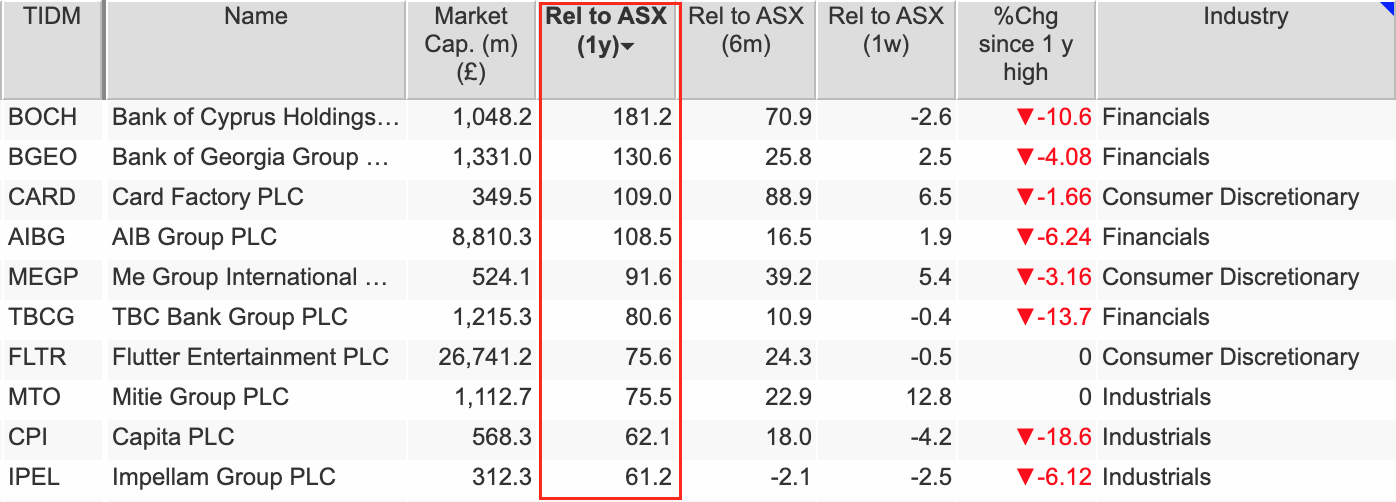

Despite volatility over the past 12 months, there have been some strong gains. Among those shares with a market cap above £250 million, the strongest relative price performances (against the FTSE All Share) have been in financials. Bank of Cyprus leads with a 181.2% rise, with others including Bank of Georgia, AIB and TBC Bank (see the table below).

Popular consumer-facing players like Card Factory and ME Group are also up there, together with fellow small-cap, Impellam. Among the larger stocks, shares in Mitie are trading at new highs on news that it’s set to beat earnings expectations. As is Flutter, the gambling group, which said recently that it is considering a US listing.

SharePad: Top performing shares (larger than £250m) over 12 months

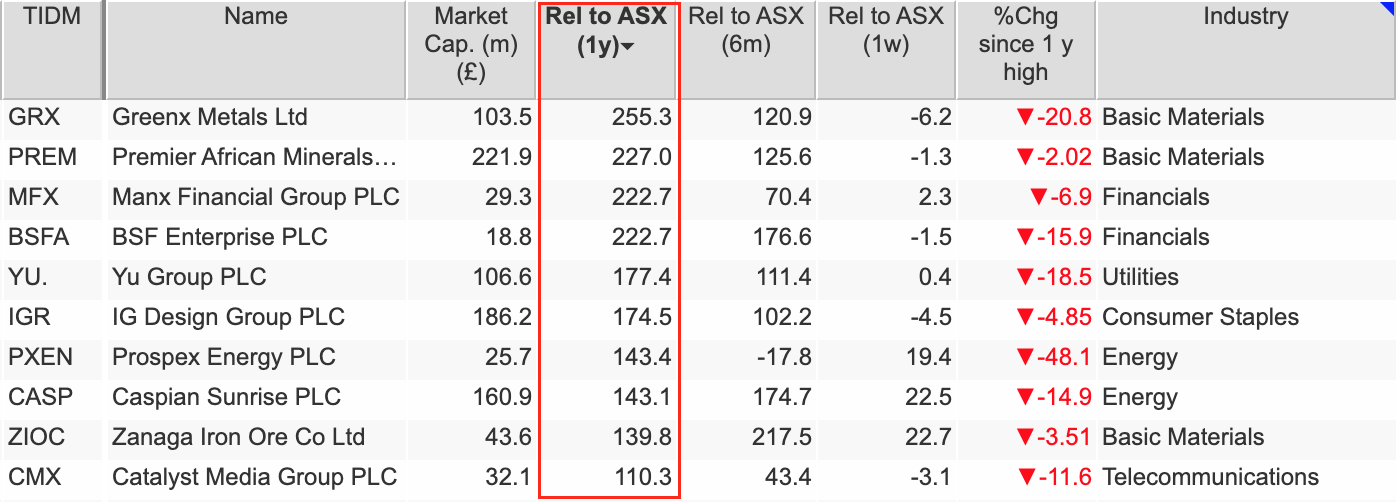

Among those with a market cap under £250 million, the top riser over one year is Greenx Metals, followed by Pan African Minerals. Note that in this market cap range, you can be looking at volatile and speculative shares – especially in natural resources sectors.

That said, the top list does include one or two firms from elsewhere, including IG Design, the giftware company. IG’s shares have slumped over the past couple of years, but the price has picked up noticeably in 2023.

SharePad: Top performing shares (smaller than £250m) over 12 months

Upcoming results – what to look out for

SharePad’s handy ability to screen for upcoming results means you shouldn’t miss a thing (although note that companies don’t have to tell the market the exact dates any more).

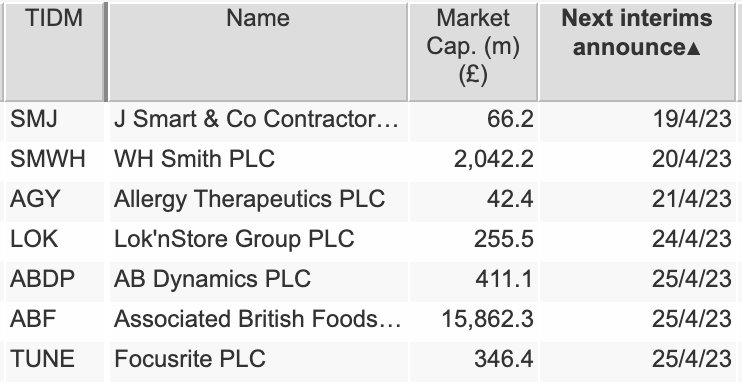

Between now and next week, there are a few interim reports scheduled, including large-cap updates from WH Smith and Associated British Foods.

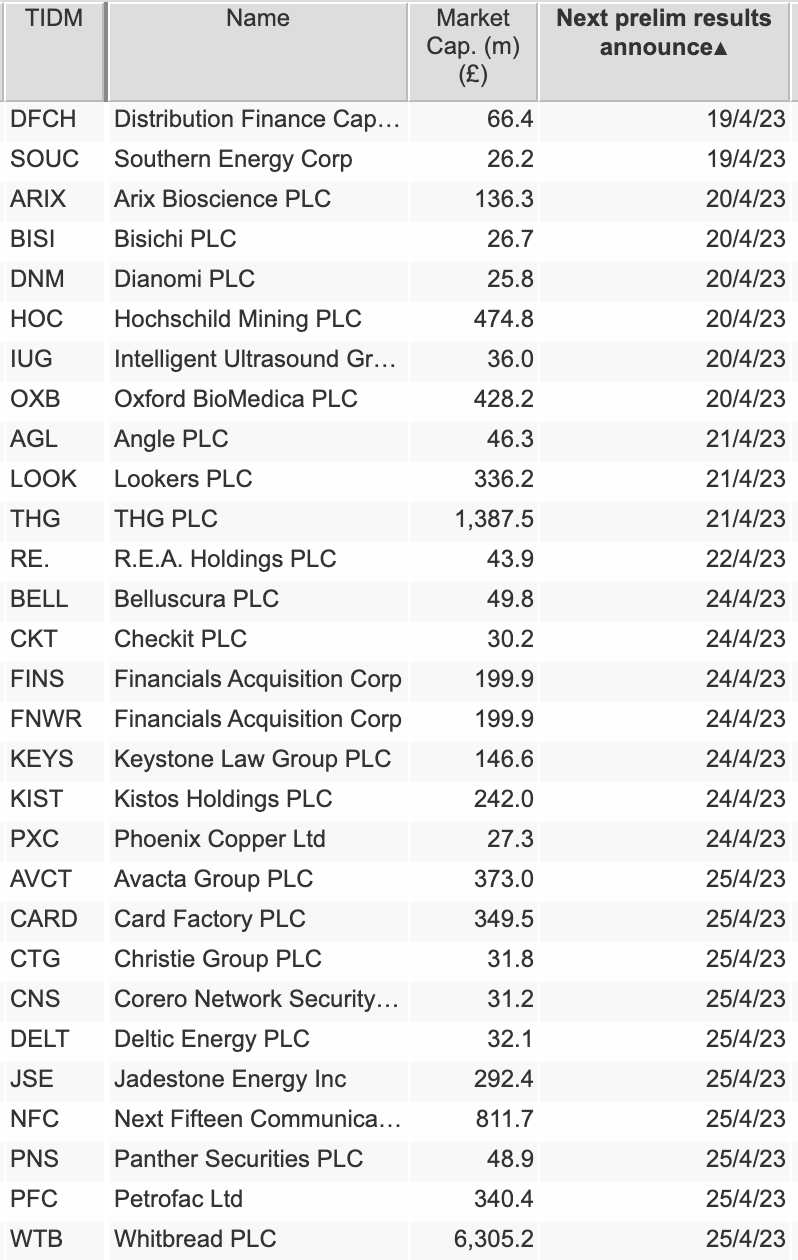

Full-year 2022 results are flooding in at the moment, so there is a bumper crop of news to look out for…

There is a lot to go at there, but it could be worth watching what THG (The Hut Group) have to say later this week about news that it’s in the sights of private equity. Its share price has collapsed since IPO in 2020 but picked up over the past week on talk of a takeover.

Another one is Next 15, the communications consultancy, which has already guided the market that results will be in line with expectations. It’s naturally quite sensitive to business confidence and the shares have lost momentum after a pick-up last autumn. That wasn’t helped by CEO Tim Dyson selling just over £3.1 million of his shares (leaving him with a 4.8% stake) in January.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.