Company dividends appeal to investors for a variety of reasons. Not only are they an important source of investment returns, but they can also tell you a lot about the quality of a business, especially when its payouts are growing.

_______________________

High inflation and rising rates have conspired to hamper equity returns over the past 18 months. After a long bullish period that favoured growth investing, attention has shifted to more defensive stocks with stable cash flows and resilient earnings. This is the natural territory of dividend-paying shares.

A few weeks ago I explored what is perhaps the best-known approach to dividend investing: high yield (How to use a high yield strategy). For many income hunters, yield is vital when it comes to weighing the desirability of a stock. That’s because it’s a simple measure of how much bang you get for your investment pound. The higher the better, in theory.

But there can be problems with high yield. At the extreme, it can be a clue to difficulties in a business and even a signal that a payout is at risk. There are certainly steps you can take to avoid these kinds of ‘yield traps’, but the risks are real. Phil has written about this recently in connection with the energy supplier, SSE (Is SSE an undervalued renewable energy business?)

An alternative view of the world of dividends is to look at what can be a much more instructive signal: dividend growth.

Companies with a track record of progressively growing their payouts over time provoke a warm, fuzzy feeling in the mind of the market. Shares with long track records of sustaining and growing their payouts earn monikers like ‘dividend achievers’ (10 consecutive years of growth) and ‘dividend aristocrats’ (25 years of growth).

These companies often only come with modest yields. That’s partly because the financial quality that gives them the ability to regularly hike their payouts is priced-in by the market. Their shares are rarely cheap, so their yields are rarely exceptionally high.

The trade-off for the investor is that the reliability and compounding effects of a consistently growing dividend can make up for a lower yield.

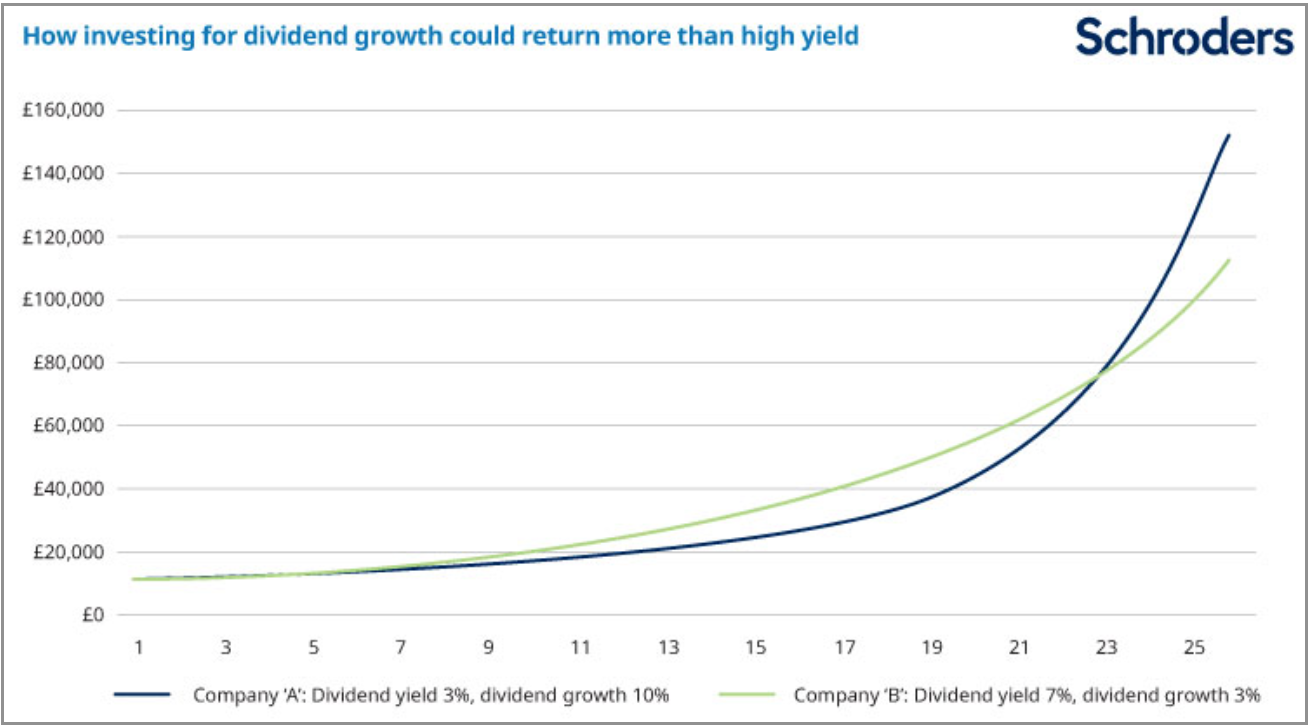

Take a look at this chart from Schroders, which shows how a high dividend yield strategy (yield 7% and growth 3%) slightly outpaces a high dividend growth strategy (yield 3% and growth 10%) over the medium term. But over a longer period of 20 years-plus, compounding makes the dividend growth strategy a much more potent force:

Source: Schroders

Dividends at a time of high inflation

While dividend growth is an all-weather strategy that can be used in any market environment, it’s of particular interest in the current climate of high inflation. Here are some reasons why…

#1. An important source of returns in equities

For a start, high and rising inflation (and the chance that rising rates will cause a recession) has clouded the outlook for earnings and dragged on share prices. In the absence of positive price momentum, dividends play a much more important role in the total returns achievable from stocks. Companies with a record of sustaining and growing their payouts are understandably in demand in this environment.

#2. A reasonable option versus other asset classes

Secondly, in the current conditions, yields on government bonds and even Money Market Funds have risen, making them an appealing alternative source of risk-adjusted returns versus stocks. For those investors who prefer to keep exposure to the stock market, companies that sustain, and grow, their dividend payouts are arguably among the more attractive options.

#3. Dividend growth shares can be better at resisting inflation

Thirdly, high inflation can affect both sales and profits for companies as they face potentially declining demand and higher input costs that either need to be absorbed or passed on. Those with robust finances, strong profitability and pricing power in their businesses are better at defending against inflation – and it’s these firms that are potentially better placed to grow their dividends.

Where to look for dividend growth

According to SharePad, there are currently 392 equities in the LSE (ex-Investment Trusts) universe that have grown their dividend more than once in the past 10 years. Of them, 76 have managed five consecutive years of growth, 43 have managed 10 years and just eight have done it for more than 20 years. As it stands, 315 equities are expected to see their dividend payouts grow in the year ahead.

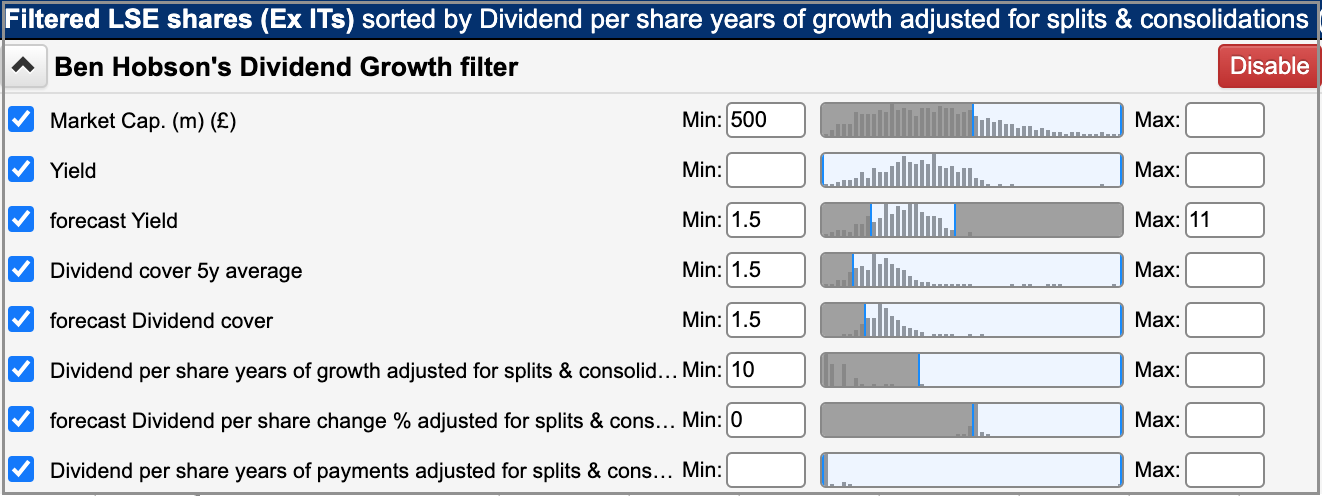

With this Dividend Growth filter I have set the minimum dividend growth history at 10 years – and a requirement for a continuation of growth in the year ahead.

While yield isn’t the priority, I have set a minimum forecast yield of 1.5% to ensure a meaningful payout. As safety measures, the filter also includes a minimum market cap of £500 million and dividend cover (both historic average and forecast) of 1.5 times earnings.

Unsurprisingly, the results of this approach pick up a number of large-cap, defensive names, many of which are synonymous with high-quality, moat-like financial strength.

Obviously, this set of rules focuses on dividends and payout growth, and apart from some basic safety measures, it doesn’t dig any deeper into the companies themselves or their valuations. Large, high-quality dividend growth shares can become expensively priced – so it pays to watch this.

As always you can adjust the rules to suit your own approach or simply use them as an additional filter to an existing strategy.

What can we learn from the high dividend growth strategy?

In an ideal world, high dividend-yielding shares would come with a strong history of payout growth, financial strength and the potential to deliver solid price gains. In practice, these factors are rarely found together.

While high yields are often eye-catching to investors looking for the highest possible returns, a focus on dividend growth has been shown to be more profitable over the longer term.

At a time when economic headwinds are putting pressure on companies, dividend growth can also be an important quality signal. Those firms with the financial strength to maintain progressive payout policies could be a good place to look for those that are most resilient to inflation and better equipped to ride out any recession.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.