In this week’s Market Moves, Ben takes a look at some of the biggest winners and sector trends over the past week, as well as upcoming financial results for the week ahead.

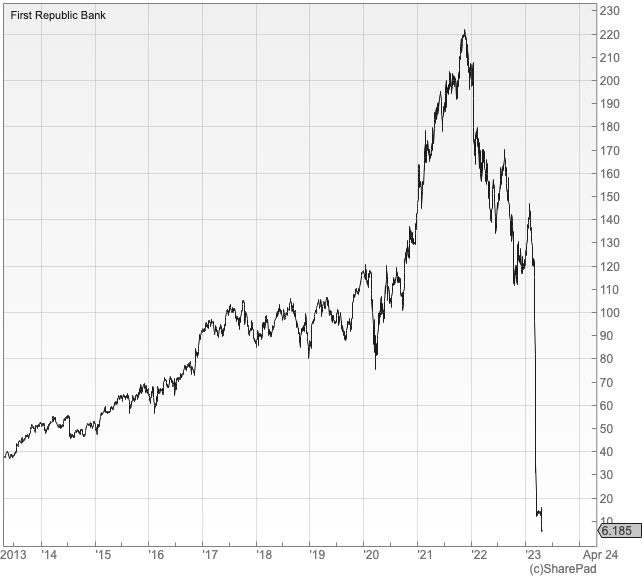

Towards the end of last week, it seemed increasingly likely that another US regional bank – this time First Republic Bank (NYSE: FRC) – was in serious trouble. Here is its staggering 10-year chart:

So far, markets don’t seem to be panicking about these incidents, which have already included the likes of Silicon Valley Bank, Signature Bank and Credit Suisse.

UK quoted bank shares didn’t show particularly strong moves over the past week relative to the All Share index, but it’s worth keeping an eye on this. Bruce covers developments in the banking sector a lot, and you can read his latest commentary here.

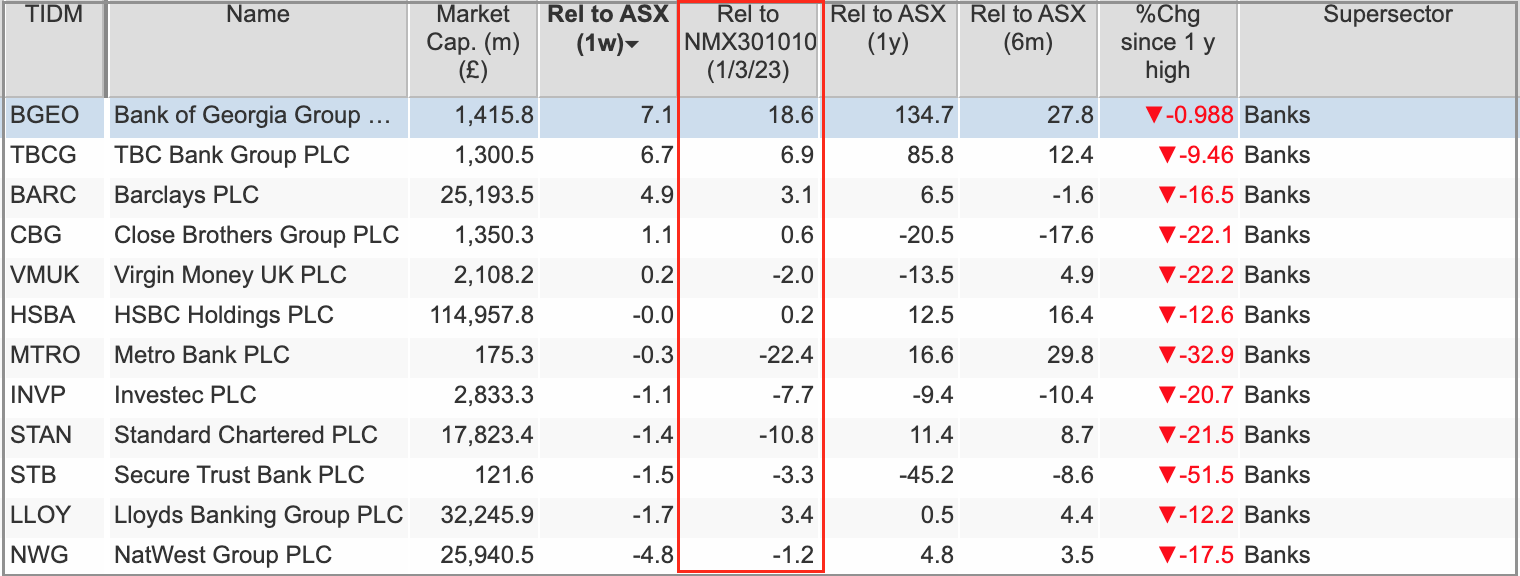

The table below shows banking shares in the FTSE All Share, and with a few exceptions most have performed well over the past year. Higher interest rates have certainly boosted profits in parts.

I have included a column that also compares their price moves relative to the FTSE 350 Bank Sector Index since 1 March (when trouble with US regional banks started). On that basis, shares in Metro Bank (LON:MTRO) have performed the worst (down 22% since then), followed by Standard Chartered (LON:STAN) (down 10.8%):

SharePad: FTSE All Share banks

Elsewhere in the market last week, among the highest risers on the FTSE All Share was healthcare equipment firm Medica (LON:MGP). It jumped 34% on news of a £269 million takeover bid from private equity firm, IK Investment Partners.

Leisure group Rank (LON:RNK) was another top All Share riser, with a relative one-week gain of 25.7%. The lift was down to news that full-year operating profits are set to come in at the higher end (or just above) previous guidance. It has been a mixed year for Rank, which issued a profit warning and slashed guidance last December. The shares are still down by 14% on a one-year basis.

Here are the top All Share risers over the past week:

SharePad: FTSE All Share 1-week risers

On the Alternative Investment Market (AIM), the top riser last week (with a minimum market cap of £30m) was investment bank Numis (LON:NUM), which saw a 63.5% gain against the AIM All Share on news of a £410 million takeover bid from Deutsche Bank.

That was followed by a near 40% jump in the share price of medical technology firm Intelligent Ultrasound (LON:IUG). That was enough to wipe out all of the declines seen in its price through 2022.

Here are AIM’s top risers over the past week:

SharePad: FTSE AIM All Share 1-week risers

Trending sectors – Is AIM showing signs of life?

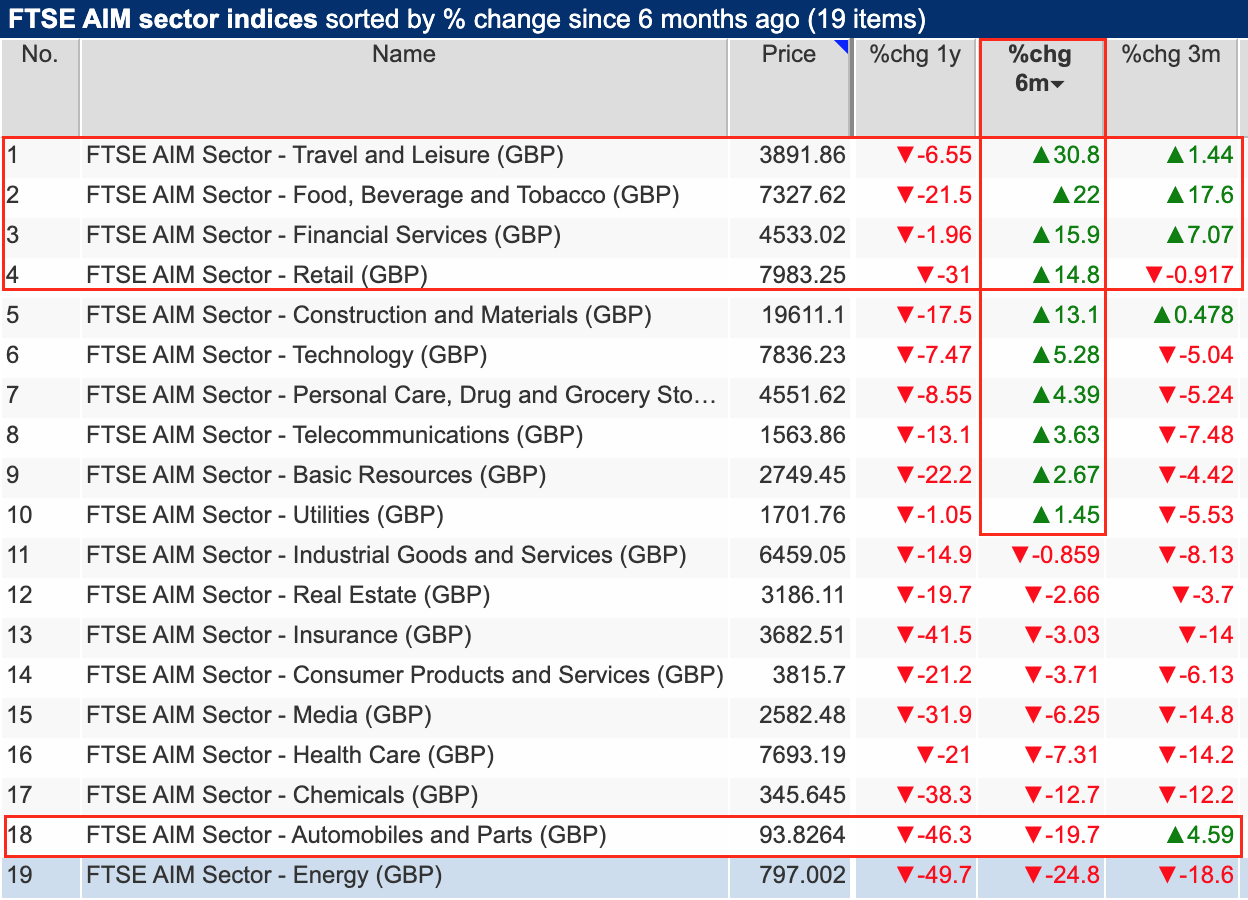

There is no getting away from it, the 727-share Alternative Investment Market (AIM) had a terrible year in 2022. As the chart below shows, the index fell by 31.7% and it remains down by 19.7% on a 12-month basis. But are there any reasons to be cheerful?

SharePad: FTSE AIM All Share

A look at the momentum view of SharePad’s FTSE AIM Sector listings shows that there could be. On a six-month basis – so dating back to around October 2022 – AIM’s Travel and Leisure sector shares have seen a 30% rise. So what is in that sector?

In total there are 26 stocks and, as of late last week, 18 of them currently have positive six-month momentum behind them. It’s perhaps a hint that the market is confident that consumer spending will hold up and benefit these kinds of companies.

It’s very much a mixed bag, with the top five shares in the list accounting for gaming/gambling, concierge services, hostel accommodation, an airline and a pizza restaurant chain:

SharePad: FTSE AIM All Share Travel and Leisure 6-month highest risers

That upbeat sentiment spills out even further when you look at other top-performing AIM sectors over six months (see the table below).

Apart from Travel and Leisure, Food Beverages and Tobacco (consumer staples), Financial Services and Retail (both of which are more cyclical) are all fairly strong, and that is generally holding over three months, too.

SharePad: FTSE AIM All Share sector performance

It’s worth noting that the shorter the time frame, the nosier the data is. Automobiles and Parts is a sector that can do well in an economic recovery, but the positive three-month momentum shown above is down to one very small company (Autins (LON:AUTG)).

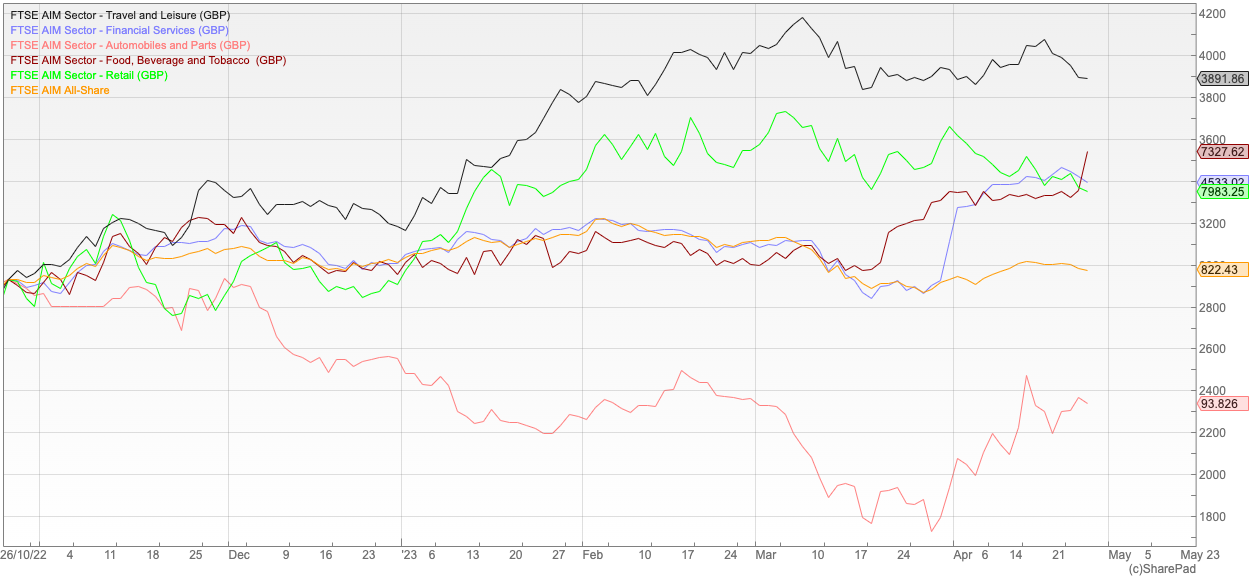

To round this off, here’s a six-month chart showing the performance of the AIM All Share (orange line) versus the sectors mentioned above. Travel and Leisure (black line) has certainly been eye-catching and there has been a sharp recent uptick in Food, Beverage and Tobacco (red) as well.

SharePad: FTSE AIM All Share sector performance

Results to look out for

May gets underway with a short trading week this week owing to the May Day bank holiday. Even so, results and trading updates are filling up the calendar at the moment.

As a disclaimer, the exact publication dates of upcoming reports is never certain. Changes to the schedule do happen, so the best we can do is flag that we’re anticipating them.

Tuesday should see a Q1 trading update from oil giant BP (LON:BP), followed on Thursday by Q1 results from Shell (LON:SHEL).

There are quite a few updates from banking stocks on the way, with a Q1 update from HSBC (LON:HSBA) on Tuesday, followed later in the week by updates from Bank of Ireland (LON:BIRG), Metro Bank (LON:MTRO), OSB (LON:OSB) and half-year results from Virgin Money (LON:VMUK).

For retail watchers, we’re due a trading update from fashion and home products giant Next (LON:NXT), which looks set for Thursday. Further down the market-cap scale – but certainly, of interest to small-cap retail investors, Card Factory (LSE:CARD) is scheduled to publish full-year results on Wednesday.

Don’t forget, for a full list of upcoming results and announcements, you can apply the calendar of upcoming events on the Market View page.

Have a good week.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.