Bruce looks at UK banks’ FY Dec 2021 results and draws out some themes on revenue, profitability, “one off items”, competition, interest rates and price / book valuation. The FTSE 100 sold off sharply last week down -4% on Thursday last week. US markets were more sanguine with the S&P500 down -1.4% and the Nasdaq100 […]

Month: February 2022

Roll-out, Roll-up and public market arbitrage | SBRY, PRZ, COST, DCC, MRL, BREE

Jamie Ward takes a detailed walk through two expansion strategies and outlines the types of company and sectors where investors are likely to find these strategies as well as highlighting how to spot companies using them well. Two common ways for profitable growth for many companies can be summarised as roll-out and roll-up. Roll-out is […]

Screening For My Next Long-Term Winner: James Halstead (LSE:JHD)

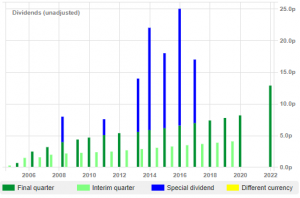

A wobbly market prompts Maynard Paton to search for potential ‘safe havens’. Filters for net cash, high margins and a pandemic-defiant dividend lead to vinyl flooring specialist James Halstead. Recent market wobbles have prompted some ‘back to basics’ filtering. Hence a new screen to identify companies that have strong balance sheets, robust margins and a […]

Weekly Market Commentary 21/02/22 |STAN, HEIQ, THG, FLTA, FRAN| Banking on the metaverse

Bruce remembers a former colleague, who preferred face to face interactions and was rarely at his desk during the afternoon (clue: he wasn’t in the metaverse either). Plus comments on Standard Chartered, HeiQ and Franchise Brand’s bid for Filta. The FTSE was down -1.5% to 7,543 last week. The Nasdaq100 was down -0.6% and the […]

Beazley PLC | Property & casualty insurance and diversification (LSE : BEZ)

The task of investors is to find businesses that have created value, have a good chance of doing so in the future and are run by honest actors. This task is complicated by certain sectors where businesses don’t ‘look’ like most businesses. Jamie Ward returns with a look at Insurance through the lens of one […]

New UK IPOs 16/02/22 | Artemis Resources Ltd ARV, Clean Power Hydrogen plc CPH2, Hercules Site Services plc HERC, Strip Tinning Holdings plc STG

This article will cover four recent IPOs listed on the LSE and what they do. These include: Artemis Resources Ltd. Clean Power Hydrogen plc Hercules Site Services plc Strip Tinning Holdings plc Artemis Resources Ltd. Opening date 7 February 2022 Issue price 3.75p Market cap £52mil Ticker ARV At the helm Mark Potter Potter serves […]

Garmin Ltd | Buy what excites you (NYSE : GRMN)

Richard takes a first look at Garmin. The World’s Simplest Stockpicking Strategy told him to. I can tell you precisely the moment I first thought of buying shares in Garmin, because I tweeted about it. It was Sunday 30 January and I was sitting on the sofa, checking my watch to see what kind of […]

Weekly Market Commentary 14/02/22 |PZC, K3C, SOLI| Never says “never banks” again?

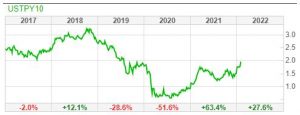

Bruce suggests that while long term “expensive quality” investments have become increasingly popular as discount rates have fallen, a natural hedge for such a portfolio is bank shares, which could now benefit as rates rise with inflation. The FTSE 100 was up +2% to 7,617 last week. The S&P500 and Nasdaq100 were flat. The real […]

Alpesh Patel on US investing: Latest Smart Money Thinking on a Stock Market Crash

The S&P 500 has shed 500 points amid inflation fears. It’s been a punishing start to 2022. Alpesh Patel considers whether it is just a bump on the road or are we set for the stock market crash that some commentators have been predicting for years? Stock market turbulence throughout January has caused a significant […]

Weekly Market Commentary 07/02/22 |RSW, JHD, JOUL| Quality can’t be quantified…

While he is away skiing, Bruce asked ex-fund manager (with 16 years experience) and private Investor Jamie Ward to manage his weekly commentary this week. Jamie looks at the best things about being a private investor compared to being in the Square Mile as well as results from three companies that at some points in […]

Future PLC | One that got away (LSE : FUTR)

Future PLC is one of the outstanding growth stories of the last five years, but it is also one that eluded Richard. He fesses up to the biases that blinded him to the opportunity, and discusses whether it is still one today… Today’s company, Future, is one I should have taken a look at a […]