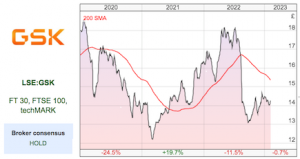

Weekly Market Commentary | 07/02/23 | GSK, DARK, SOM, TPX | New FTSE Highs

As the FTSE 100 reaches a new peak, Maynard looks at another blue-chip measure setting record highs. Plus coverage of GSK, DARK, SOM and TPX. Bruce asked me to compile these commentaries while he is away on holiday. Many private investors swear their portfolios perform better when they’re not watching the markets, and a record