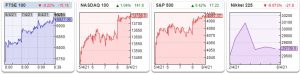

Do we wait for dips? Buy now? Buy more? Is it all over now, again?

Do we wait for dips? Buy now? Buy more? Is it all over now, again?

PZ Cussons is sharpening its focus on 8 “Must Win” hygiene, baby and beauty brands in the UK, Nigeria, Indonesia and Australia.

Markets have been very strong recently, so it’s important not to get carried away. Bruce looks at stocks with accrued income, % revenue recognition, acquisition and fair value accounting adjustments.

April is typically a strong month – perhaps because of all the tax-selling clearing and reducing sell pressure. New ISA money tends to enter the market too. Cash is a position, but many punters feel it burning a hole in their pockets and so tend to end up spending it.

I like companies that boast significant net cash. I therefore apply certain filter criteria to identify some reasonable cash-flush businesses.

Bruce wonders if value vs momentum factors is really the best way to think about companies on the stock market. He also looks at the Novacyt profit warning, The Mission, and two high performance stocks: Volex and Impax.

What defines a worthy stock for investment or retirement income? Unfortunately, for many investors, the answer is a stock that pays dividends. While dividends are a factor (among many) that can be used to judge a stock, it isn’t necessarily the most important or profitable determination to make when investing.

Investing in mining stocks is always a speculative exercise. Where are we in the cycle?

A company’s strategy should not just tell us what it wants to achieve, but why and how. Richard introduces a simple framework for analysing strategy and highlights a good strategy, and one that is more difficult to fathom.

We are most of the way through result season for companies with December year ends. Bruce discusses how companies with patchy track records can border on evasive in their RNS disclosure, without quite crossing the line to unacceptable. Often the share price reactions suggests that investors aren’t fooled though.

I run my filter every week, usually on a Saturday morning. By running the filter every week, it allows five trading sessions to pass and therefore potentially offer up new stocks. Time is a trader’s greatest asset, and it makes no sense to run the filter every day when almost all of the stocks will be the same.

How do you answer that age-old investment conundrum – when to get in and when to get out? Here’s a technical approach to finding the best recovery candidates as they emerge.

Tech stocks were strong performers last year. The pandemic meant that providers of remote services like Zoom Video Communications or Peloton Interactive experienced massive sales growths, while a whole host of cybersecurity and cloud hosting companies did well alongside the usual big players like Microsoft, Apple and Amazon. However, as the economy bounces back from the disruption of COVID-19, tech stocks have slumped.