Do we wait for dips? Buy now? Buy more? Is it all over now, again?

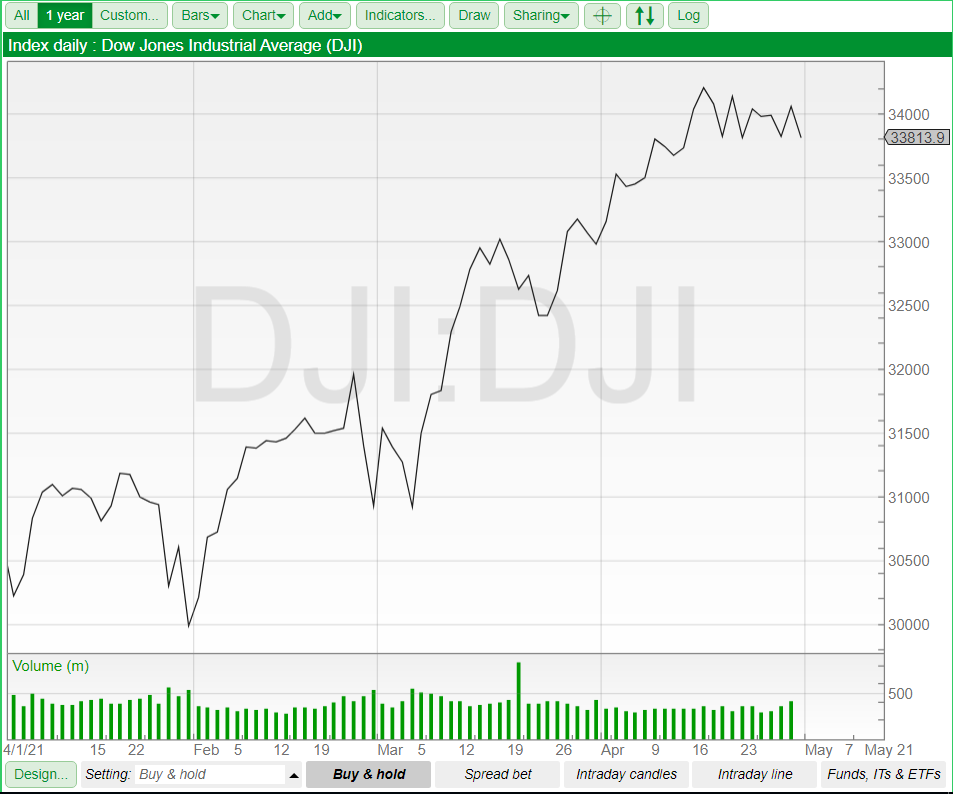

As the Dow Jones Index took a tumble at the end of February, many analysts saw this as the beginning of a long-overdue market correction. Some have floated talk of a stock market bubble for a while, but despite the challenging conditions of the last year, the market rebounded and finished out the year strongly. However, the dip on the 24th of February — which saw the index shed 1000 points — has led some traders to talk of an opportunity to cash in on the slide.

What Are Stock Market Dips?

“Buy the Dips” is a phrase used in investment circles to describe taking advantage of a decline in the price of an asset. It’s based on the Elliott Wave Theory that suggests that even a well-performing stock will have price waves that dip up and down, meaning that investors who get in at the right point can take advantage of the peaks and troughs.

What To Make of The Pullback?

The big thing for investors is to figure out precisely what this pullback means. Analysts have been suggesting that the stock market is overvalued, so these corrections weren’t a complete surprise. However, while buying the dip can be profitable, buying into a falling market would be disastrous for investors.

Time To Buy

Mehvish Ayub at State Street Global Advisors suggests that while the correction was overdue, strong fundamentals and promising company earnings means there is nothing to get too worried about and, if anything, this dip should be seen as an opportunity to buy at a discounted price.

Marko Kolanovic, J.P. Morgan’s Global Head of Macro Quantitative and Derivatives Strategy team, echoes this sentiment. He suggests that as the economy recovers through government assistance and the vaccine rollout, any pullback in the S&P 500 should be seen as a buying opportunity.

Kolanovic remains confident that there is no bubble and cites the yardstick that defines an asset bubble as a tripling of value in the space of three years. The S&P 500 is up 30% over that time period, so, for Kolanovic, this doesn’t meet the criteria, and he feels investors should take advantage of the short-term price decline.

Time To Be Cautious

However, not everyone shares Ayub and Kolanovic’s exuberance. Micheal Hartnett of Bank of America made his case in a research report sent to clients that he expects a lower than 1% rise for the S&P 500 during 2021.

Harnett expressed deep concern about the credit market and suggests that liquidity fears in China could lead to a global correction. Additionally, Harnett cited that gross proceeds from Special Purpose Acquisition Companies had almost quadrupled, in what he felt was a sure sign of the excesses within the broader market. He went on to add that the 3 R’s — rates, regulation and redistribution — were all set to bring an end to the bull market.

While Mike Wilson, the Chief U.S. equity strategist at Morgan Stanley, also sounded a note of caution about the recent surge in share prices. Although he stopped short of suggesting the market was in a bubble, he made clear that until investors cut risk exposure, the corrections won’t be over. Again, Wilson cited strong fundamentals as a reason to be optimistic overall but suggested that a lack of “obvious fundamental catalysts” meant it was hard to time the corrections in new bull markets.

Alpesh Patel’s Conclusion

While it might be tempting to buy the dip, it does require having a very optimistic outlook of the broader market. Catching stocks on the way down and holding on to them longer-term is a perfect plan if you sense they’ll return to previous levels. But it’s easy to miss the train and be left holding a costly ticket.

A wiser move is to be invested in resilient stocks. These are uncertain economic times, and while the vaccine rollout programs are speeding ahead and the economy is recovering from the pandemic, global governments have invested an unprecedented amount of money in recovery and stimulus packages.

When government assistance is eased, the true scale of the damage of the pandemic will be felt across the economy, and loan delinquency could set off a broader decline. In worrying times like these, portfolios with resilient stocks make more sense.

While resilient stocks might not produce the eye-catching, marketing-beating returns associated with buying the dip, a diverse, lower-risk profile can be relied upon to make steady returns. Economic forecasts for the next year are uncertain, and with further corrections possible, exposing yourself to too much risk could go wrong in several ways.

Alpesh Patel OBE

Founder of Alpesh Patel Special Edition of Sharescope

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.