Weekly Market Commentary 13/06/22|ORPH, MRK, AO|Life sciences catch the software bug

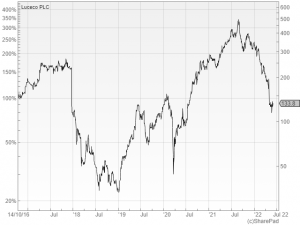

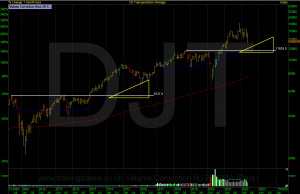

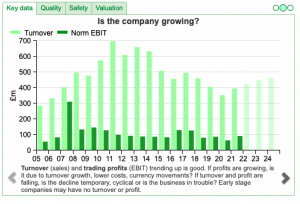

Bruce looks at the spread of expressions like ‘platform’ and ‘flywheel’ from software companies to other sectors, including life sciences. Companies covered ORPH, MRK and AO. The FTSE 100 was down -1.5% in the last 5 days to 7,418. That’s better than the Nasdaq100 -4.8% and S&P500 down -3.8% over the same time frame. Brent