The Top Portfolio Mistakes We’ve Seen from Our Analysis

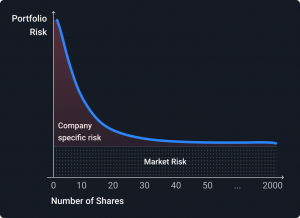

Prepare to be captivated, as I unravel the troubling discoveries I made after analysing dozens of investment portfolios sent to me via my Campaign for a Million to educate a million people to be better investors. Biggest errors 1. Over-diversification: The curse of too many funds A prevalent issue was over-diversification, resulting in subpar performance.