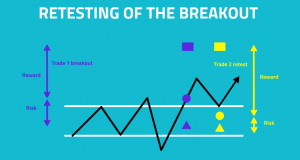

One commodity breakout

It is harder for many private investors to wrap their head around this thought: buying a price only when the stock is higher. The natural instinct is to think that if the stock is lower now, then it can be bought now, and sold higher later. This does, after all, go with the old stock