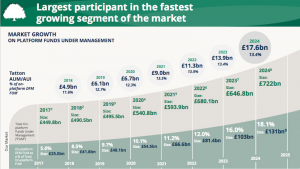

Screening For My Next Long-Term Winner: Tatton Asset Management (LSE: TAM)

Screening for shares with a consistently high margin and ROE leads to model portfolio specialist Tatton Asset Management. Maynard Paton reviews the small-cap’s impressive financials, efficient workforce, owner-aligned founder and bold growth target. Today I have revisited a ShareScope screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity