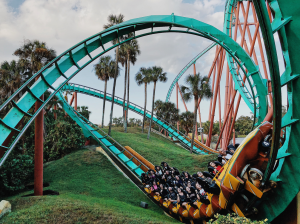

Alpesh Patel OBE looks at the causes and potential strategies when a stock that has risen significantly experiences a sudden drop. When a stock that has risen significantly experiences a sudden drop, it can cause concern for many investors. This situation is common in the stock market, and it’s crucial to understand the reasons behind […]