Prepare to be captivated, as I unravel the troubling discoveries I made after analysing dozens of investment portfolios sent to me via my Campaign for a Million to educate a million people to be better investors.

Biggest errors

1. Over-diversification: The curse of too many funds

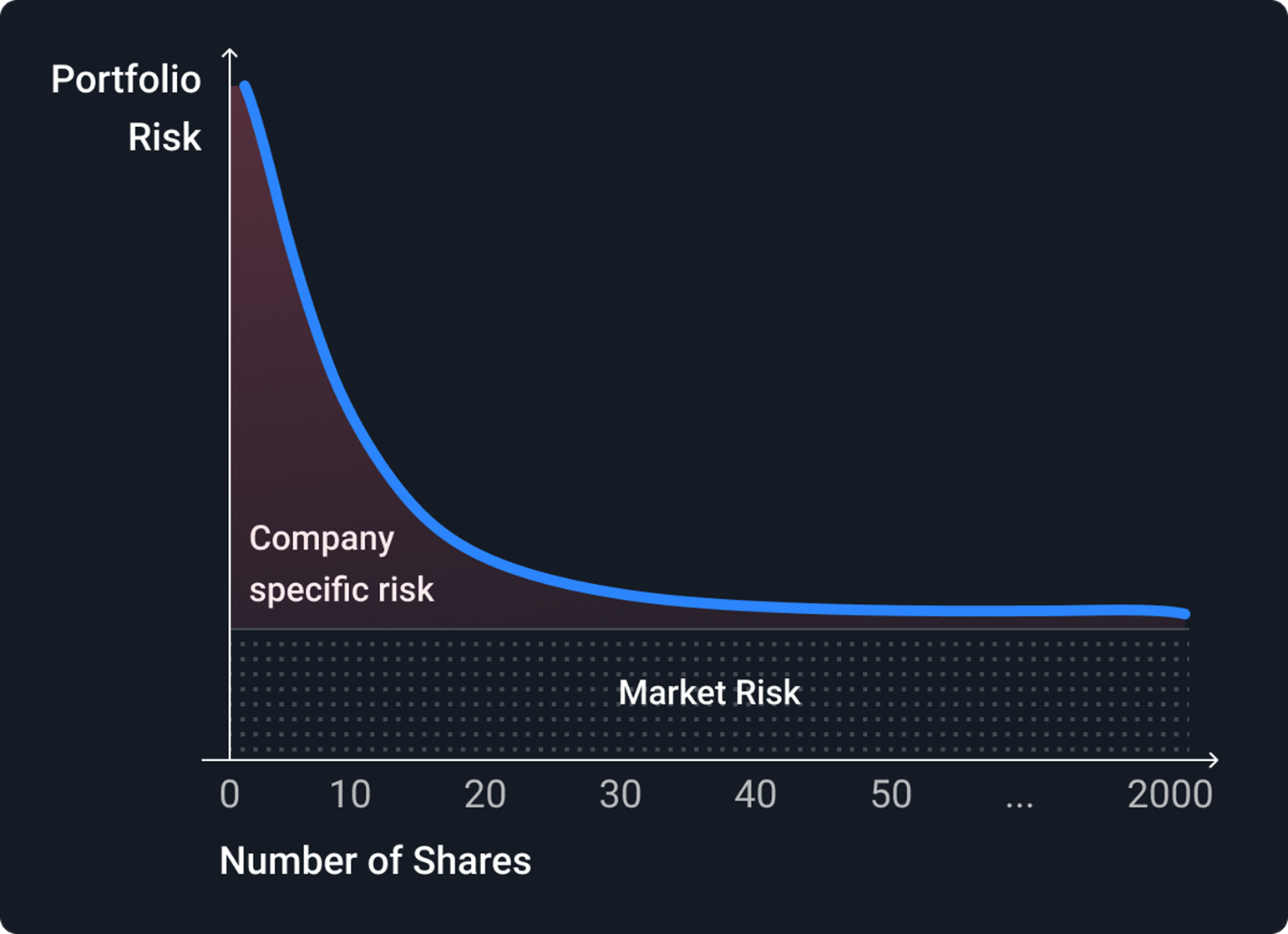

A prevalent issue was over-diversification, resulting in subpar performance. Investors either “sprayed and prayed” or believed that having multiple funds equated to proper diversification. This approach led to portfolios comprising up to a thousand stocks, causing inefficiencies and preventing desired exposure to specific companies like Amazon, Microsoft etc they may wish.

2. Analysis paralysis: The pitfall of owning too many stocks

Similar to the first issue, some investors owned over 50 stocks, falsely assuming it ensured diversification. By presenting successful investors’ portfolios and statistical data, I demonstrated the lack of diversification provided by excessive holdings. This inability to effectively monitor all stocks led to poor performance and frustration.

3. The high-stakes gamble: Too few stocks causing significant losses

A few investors fell into this trap due to time constraints or insufficient knowledge. Having too few stocks in a portfolio amplified the impact of small market movements, often resulting in substantial losses.

4. The misguided trust in investment trusts

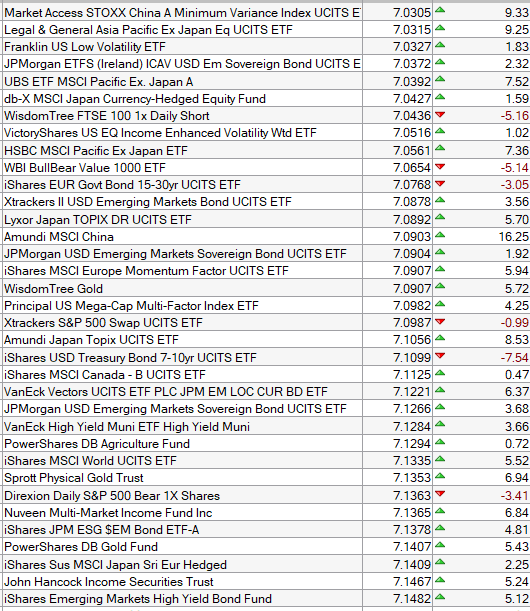

Many investors opted for high-fee investment trusts based on advertisements, unaware of cheaper and more efficient alternatives like Exchange Traded Funds (ETFs). Upon revealing the exorbitant fees and underperformance of these trusts, I introduced the world of ETFs, showcasing their superior returns and lower volatility.

5. The lopsided portfolio: Neglecting value, growth, and income diversity

While some portfolios contained stocks with all three attributes, many were overwhelmed by those lacking in one or more aspects. This imbalance resulted from investors’ lack of understanding, which I aimed to rectify.

6. The overlooked factor: Low Sortino stocks

The Sortino ratio, a measure of risk versus reward, is crucial in optimizing returns for the level of risk taken. Unfortunately, many investors were unaware of this metric, leading to suboptimal portfolios.

7. The unexpected hazard: Higher volatility, lower performance

Unsuspecting investors often underestimated the amount of risk they were exposed to, and I helped them realize the true volatility of their portfolios.

8. Overtrading

Investors often get carried away by market trends and make too many trades, resulting in high transaction costs and reduced profits. To address this error, investors should have a long-term investment plan and stick to it. They should also avoid being swayed by short-term market fluctuations and focus on their investment goals. For investing, I hold for 12 months then review.

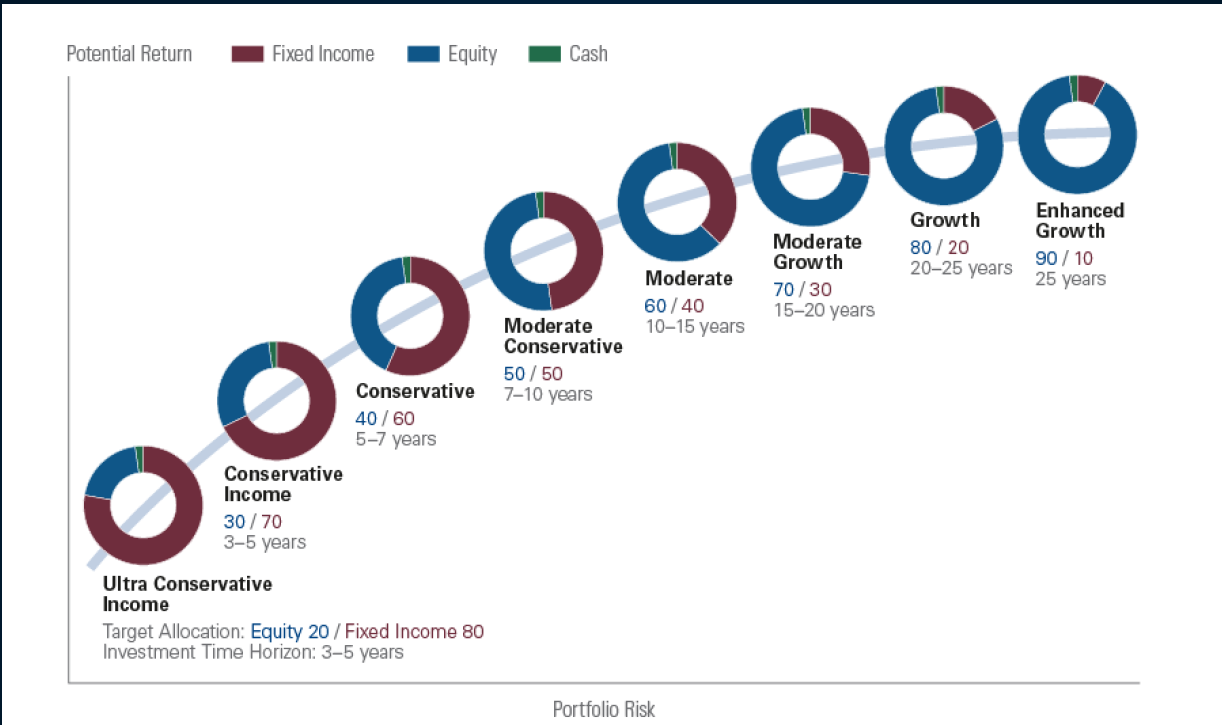

9. Emotional investing

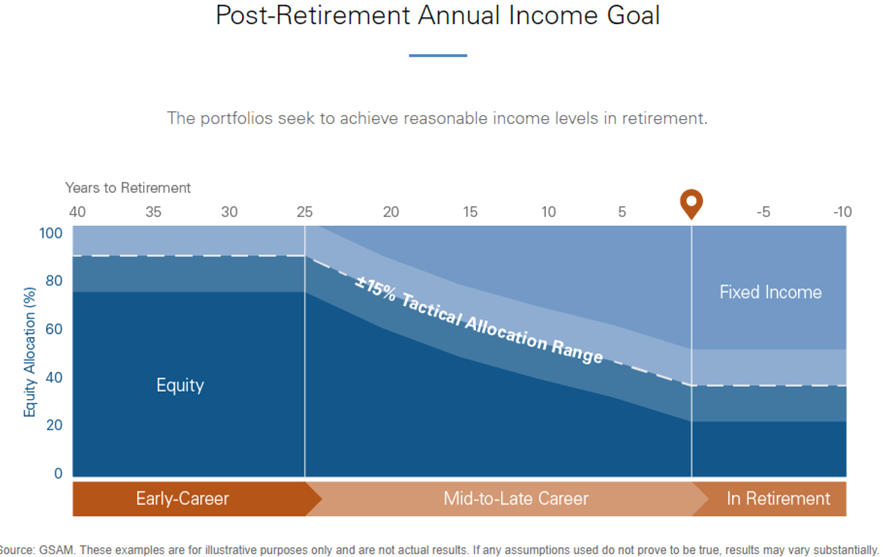

Many investors make investment decisions based on emotions such as fear, greed, or panic. Emotional investing can lead to impulsive decisions that can harm the portfolio. To address this error, investors should have a rational investment plan that takes into account their risk tolerance, financial goals, and investment horizon.

With my expertise and guidance, I aim to transform the investment landscape, empowering individuals to become better investors through my Campaign for a Million.

Analysing investment portfolios

Analysing your investment portfolio is an important task that should be done regularly to ensure that your investments are aligned with your financial goals and risk tolerance. Here are some guidelines that can help you in analysing your portfolio:

1. Know your investment objectives: The first step in analysing your portfolio is to understand your investment objectives. Ask yourself what you want to achieve with your investments, whether it is long-term growth, income, or capital preservation. This will help you determine the types of investments that are suitable for you. Then check the volatility of the stocks. Do they match your risk appetite? For me, if you are risk averse then ETFs with volatility under 10% is important. For moderate risk, stock volatility under 20% does me fine.

2. Review your asset allocation: Asset allocation refers to the mix of different types of investments in your portfolio, such as stocks, bonds, and cash. Your asset allocation should be diversified and aligned with your investment objectives and risk tolerance. Review your asset allocation to ensure that it is still suitable for your current situation.

3. Evaluate your investment performance: Measure the performance of your investments against benchmark indices and your investment objectives. Determine whether your investments are performing well or not and identify the reasons behind their performance.

For me, a 12-month holding a 25% trailing stop is my starting point, then finessing per stock and about 20 stocks in my portfolio.

4. Rebalance your portfolio: Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. It is important to rebalance your portfolio regularly to ensure that it remains aligned with your investment objectives and risk tolerance.

Alpesh Patel

Got some thoughts on this week’s article from Alpesh? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.