Born in the UK

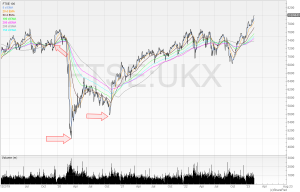

Although Arm will list in the USA, there should be nothing to stop us buying shares in Britain’s top tech company after it floats. This idea leads Richard to a potentially rich seam of investments he has not previously explored: UK firms listed in the USA. Judging by the headlines, news that Arm is to