Weekly Market Commentary | 05/09/23 | SDRY, BNZL, PBEE | Emotional dividends

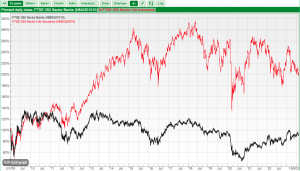

If the price of trophy assets like football clubs are wildly above intrinsic value, perhaps there’s a way for less wealthy investors to benefit from the same theme? Companies covered SDRY, BNZL and PBEE. The FTSE 100 was up +2.4% at 7,511 last week. The index is exactly flat on 5 years, though what 5