A screen for high margins and high ROEs perhaps surprisingly identifies Hollywood Bowl. Maynard Paton studies the bowling group’s growth history, lease accounting, hefty capex and commendable leadership.

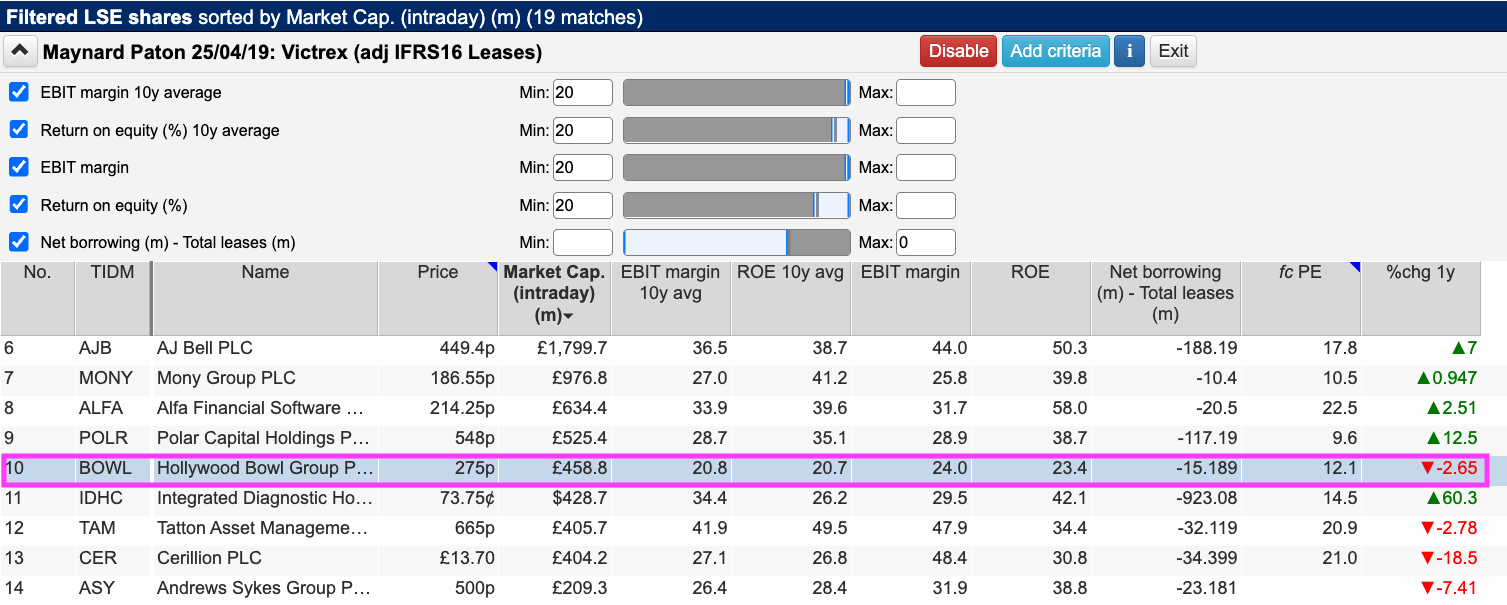

Today I have revisited a ShareScope screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE of at least 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within ShareScope’s helpful Filter Library. My instructions show you how.)

This time the filter returned 19 matches, including Games Workshop, IG Group, Rightmove, Plus500, Polar Capital, Cerillion, Tatton Asset Management, Record and Jarvis Securities.

I selected Hollywood Bowl because ten-pin bowling did not strike me as an activity that could lead to super operating margins and robust capital efficiency.

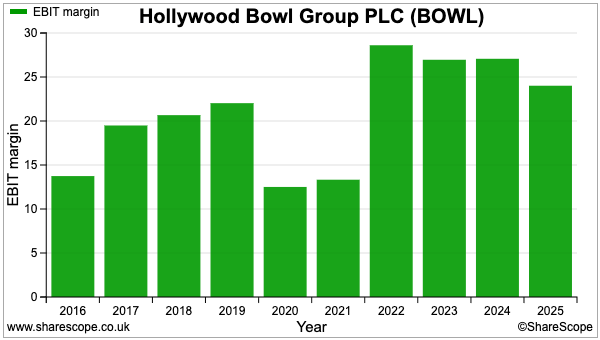

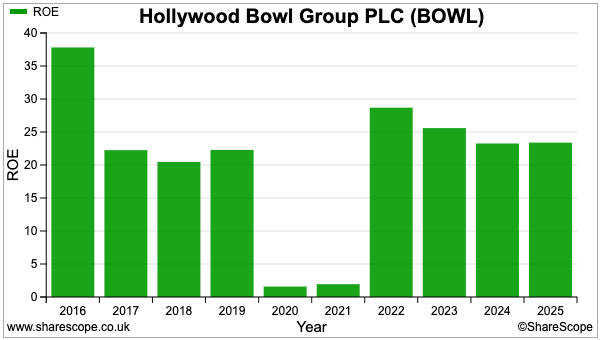

But sure enough, ShareScope shows Hollywood Bowl reporting an average 21% margin and average 21% ROE since 2016 — despite the group suffering badly during the pandemic:

Let’s take a closer look.

Introducing Hollywood Bowl

Hollywood Bowl can trace its lineage back to 1960 when American Machine & Foundry opened the UK’s very first ten-pin bowling centre in Stamford Hill, north London.

The brilliant Best Of British magazine provides a delightful recap of the event:

“The new centre boasted 14 lanes, a fizzy drink fountain and a snack bar. Pin setting was now automatic, scorecards were illuminated and, to increase patronage, the first 10 days of bowling were offered free of charge. The opening ceremony was performed by Eamonn Andrews and guests were Henry Cooper, Carol Leslie, Douglas Fairbanks and Alec Bedser. There were two 21-inch CCTV screens, so that bowling parents could watch over youngsters amusing themselves in a remote playroom. Mountaineer John Hunt rolled the first ball, and it went straight into the gutter. It all seemed so promising. Yet, barely 10 years later, the centre closed on 27 June 1970. The building was demolished, and a supermarket stands there today.”

Although the Stamford Hill unit would close ten years later, AMF had by that time established 15 other UK locations and apparently continued to operate from 15 sites until the 1990s.

Then followed a series of ownership changes, with Goldman Sachs taking charge during 1996 and selling to Bourne Leisure during 2004. Bourne then merged AMF during 2010 with the Hollywood Bowl subsidiary owned by Mitchells & Butlers.

Electra Private Equity acquired the merged AMF/Hollywood Bowl during 2014, bolted on rival Bowlplex during 2015 and then floated what was now renamed Hollywood Bowl during 2016.

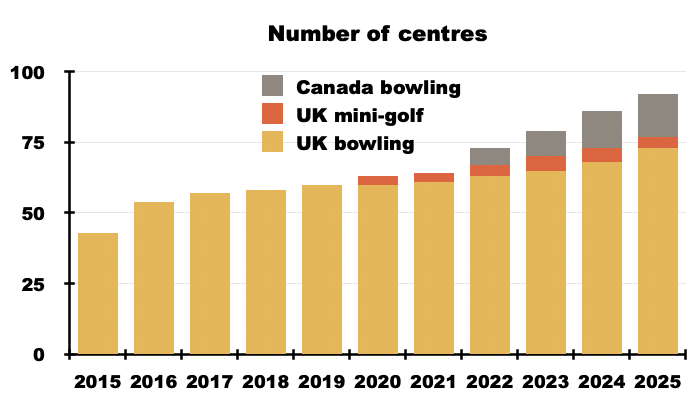

Today Hollywood Bowl operates 73 ten-pin bowling centres and four indoor mini-golf courses in the UK. The group operates a further 15 bowling centres in Canada, having established an initial foothold in the Toronto area by acquiring five sites during 2022:

Hollywood is the UK’s largest ten-pin operator, with Tenpin not far behind as the country’s number two with 58 locations. I understand the total number of UK bowling centres may be approximately 330 and the rest of the sector is comprised of much smaller operators.

Hollywood now operates what it claims to be Canada’s largest branded ten-pin bowling estate and last year treated analysts to a 28-page presentation on the prospects for the territory. Canadian bowling is said to be “similar to the UK bowling sector 10 years ago“.

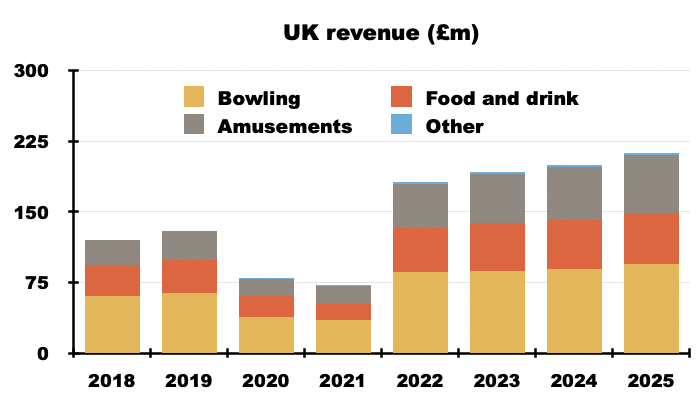

Hollywood’s bowling centres include dining areas and amusement arcades, revenue from which is significant:

I should add the aforementioned mini-golf courses have not proven very popular and their associated revenue is now deemed as ‘Other’.

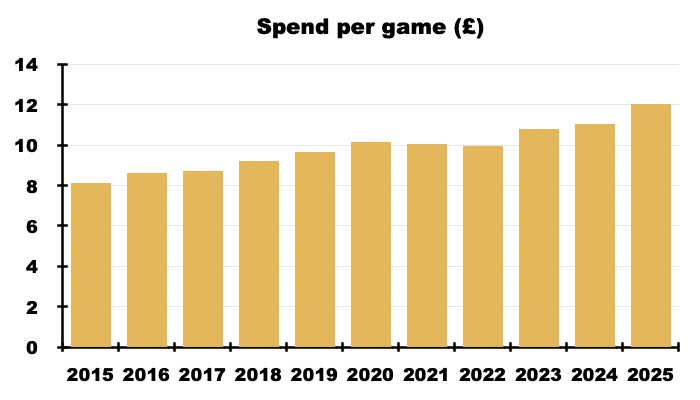

‘Spend per game’ has encouragingly advanced from £8.12 to £12.04 between 2015 and 2025:

Last year Hollywood suffered a 7.5% like-for-like reduction to the number of bowling and mini-golf games played throughout its UK estate. The group claimed the lower footfall was due to “unseasonal weather in the spring and the hot summer, as well as…muted consumer confidence“.

Yet despite fewer customers, last year’s like-for-like UK sales remarkably edged 1% higher due to spending uplifts on food (+6%), drink (+4%) and amusements (+15%).

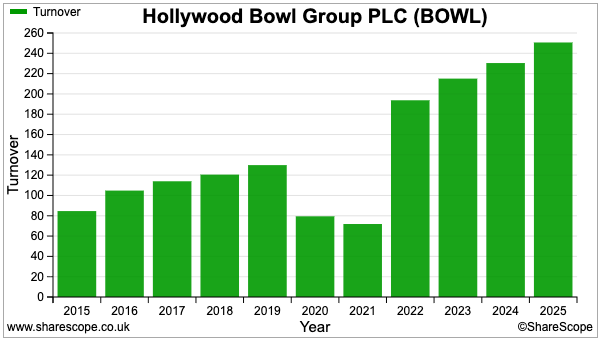

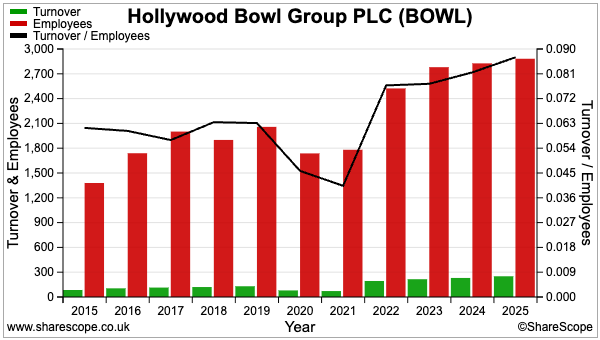

The greater spend per game alongside opening new centres (both in the UK and Canada) pushed group revenue from £86 million to £251 million between 2015 and 2025:

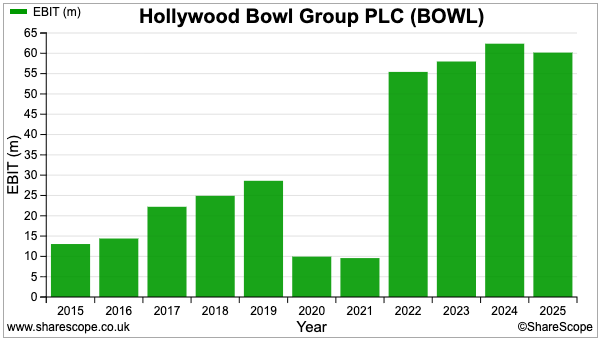

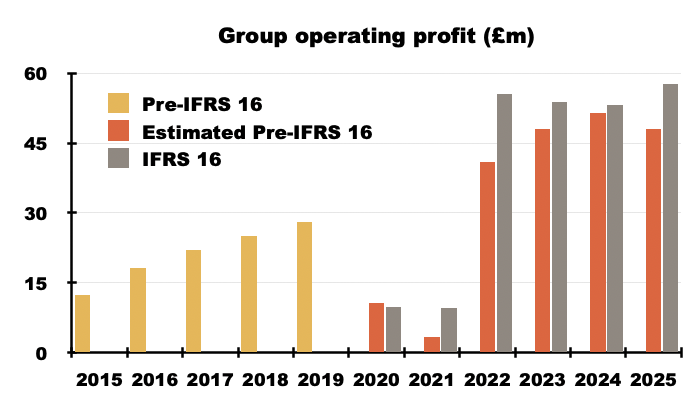

Reported operating profit has meanwhile rallied from £12 million to £59 million:

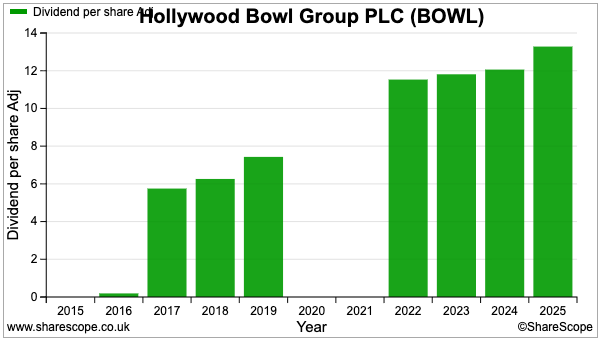

Overlook the understandable dividend suspension during the pandemic, and the payout has trended higher over time:

Special dividends were commendably declared during 2017, 2018, 2019, 2022 and 2023, and totalled a further 14.9p per share.

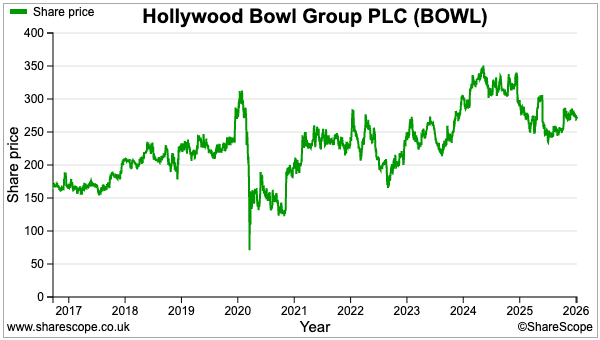

The shares joined the main market at 160p and the recent 275p price supports a £459 million market cap and a spot within the lower reaches of the FTSE 250:

IFRS 16 accounting

A major influence on Hollywood’s financials is IFRS 16, which was introduced during 2019 and changed the accounting treatment of property leases.

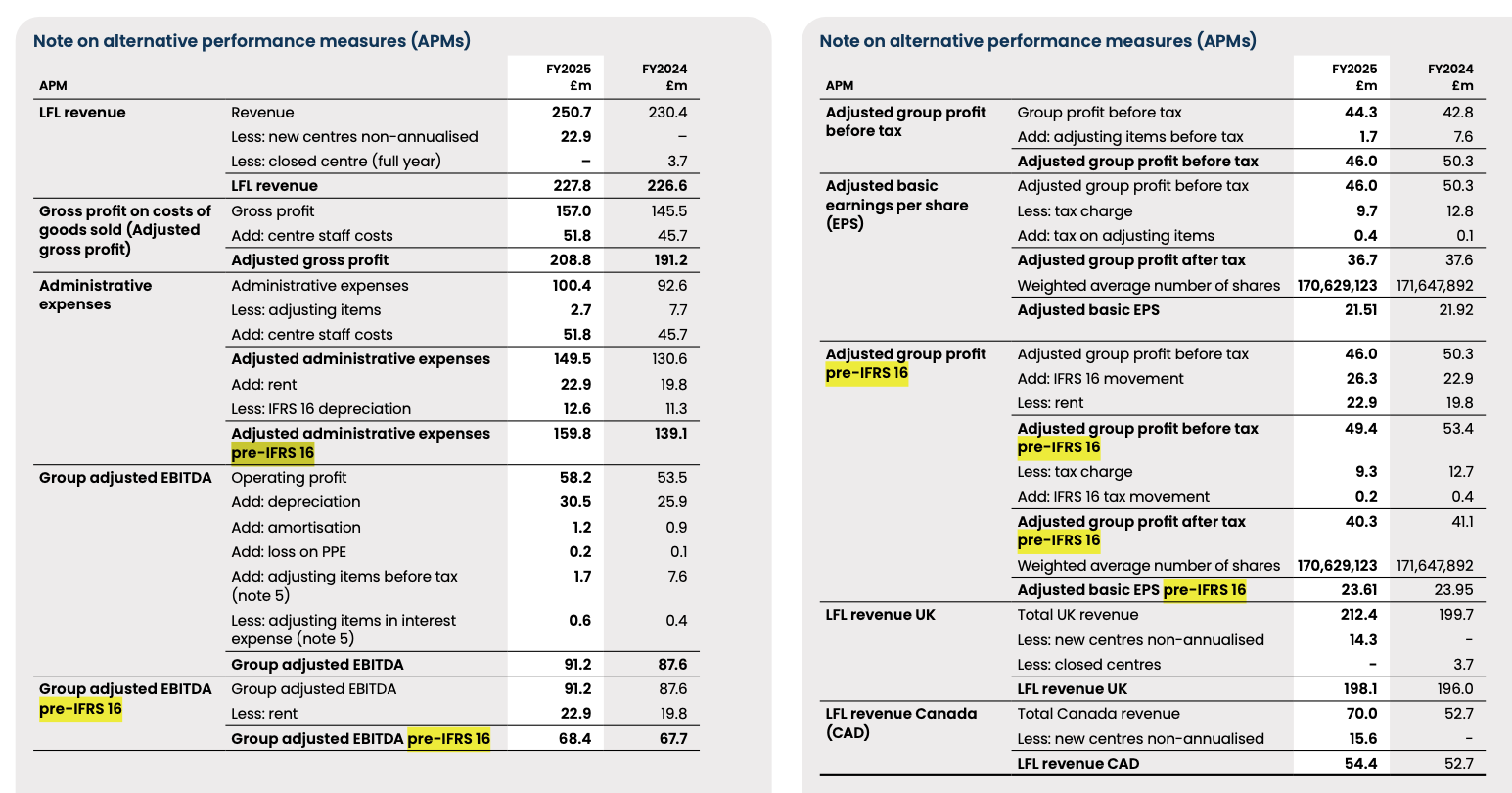

The 2025 annual report provides two pages of ‘alternative performance measures’ that include many ‘pre-IFRS 16’ calculations:

Prior to IFRS 16, a property’s annual rent would be simply charged to the income statement while the remaining rent obligations from the lease would not be included on the balance sheet.

IFRS 16 in contrast treats a property lease as a financial commitment, with future rent obligations now shown as a balance-sheet liability.

IFRS 16 also introduced the concept of a ‘right of use’ asset, which reflects the theoretical beneficial value of the right to use a leased property.

The accounting cost of leasing properties through IFRS 16 is now calculated by i) depreciating the ‘right of use’ assets, and; ii) levying a hypothetical interest charge on the future-rent liability sitting on the balance sheet.

If all that sounds very complicated, it is, and Hollywood actually tells investors and analysts to look at the group’s pre-IFRS 16 numbers:

“IFRS 16 impacts statutory profit only through non-cash depreciation and interest, reducing FY2025 profit before tax by £3.4m (FY2024: £3.1m). These effects unwind as leases mature, though continued regears and extensions – where strategically beneficial – may moderate this decline. Our focus, and where investor and analysts should therefore focus, is on the underlying cash cost of occupancy, which remains aligned with pre-IFRS 16 metrics and reflects the Group’s proactive and disciplined lease strategy.”

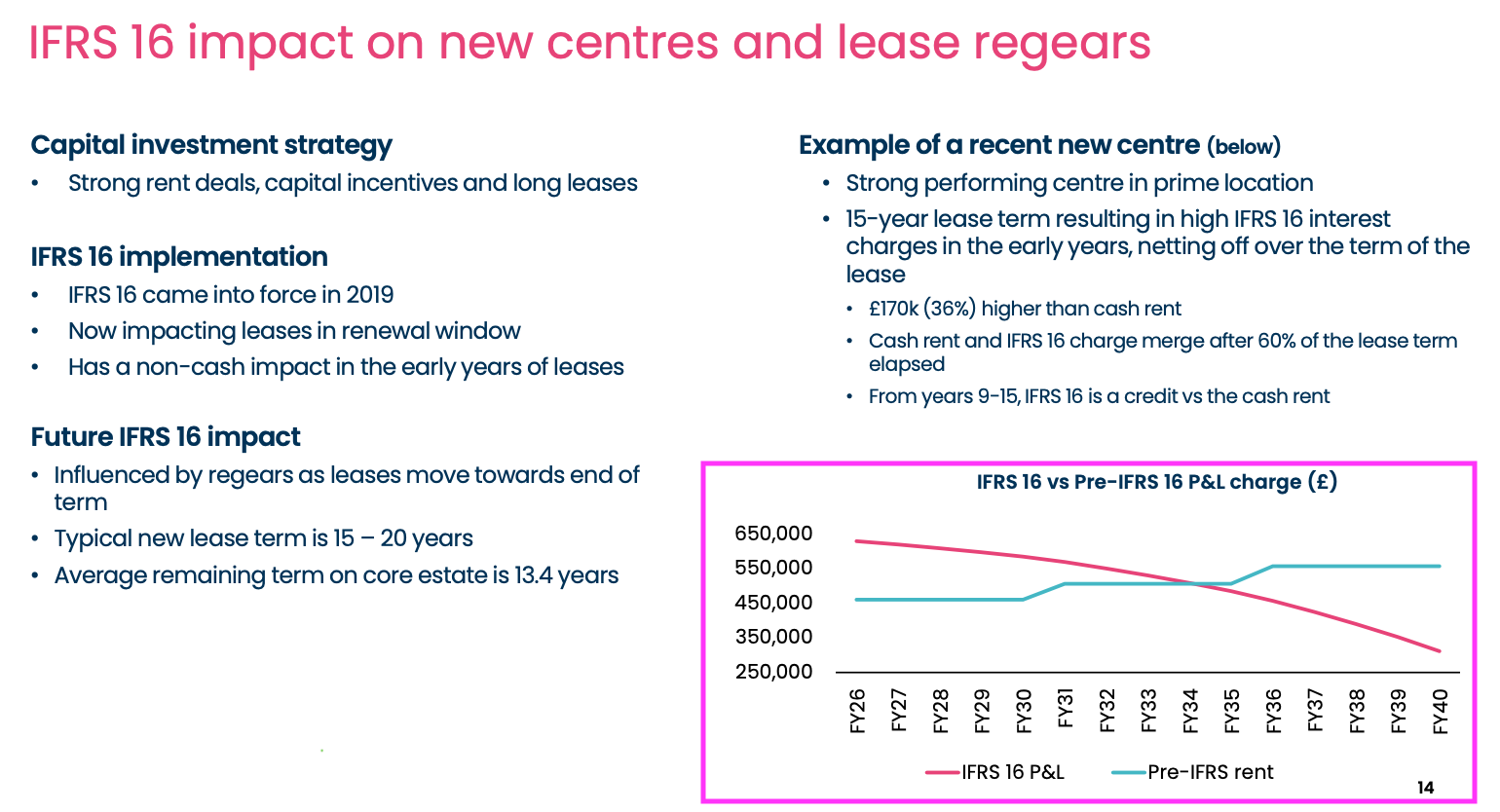

Hollywood provides a helpful example that shows the different accounting expense of the same lease through IFRS 16 and pre-IFRS 16:

The example suggests the first-year accounting cost of a typical property lease is 36% higher under IFRS 16 than prior to IFRS 16.

Hollywood has not consistently disclosed its alternative pre-IFRS 16 measures and I have done my best to make my own pre-IFRS 16 adjustments to operating profit:

I reckon the average operating margin over ten years could be 18% on a consistent pre-IFRS 16 basis versus the aforementioned 20%-plus shown by ShareScope.

I must admit, 18% still feels pretty healthy and 19% for 2025 — as well as 22% for 2022, 2023 and 2024 — underline how lucrative bowling centres can be.

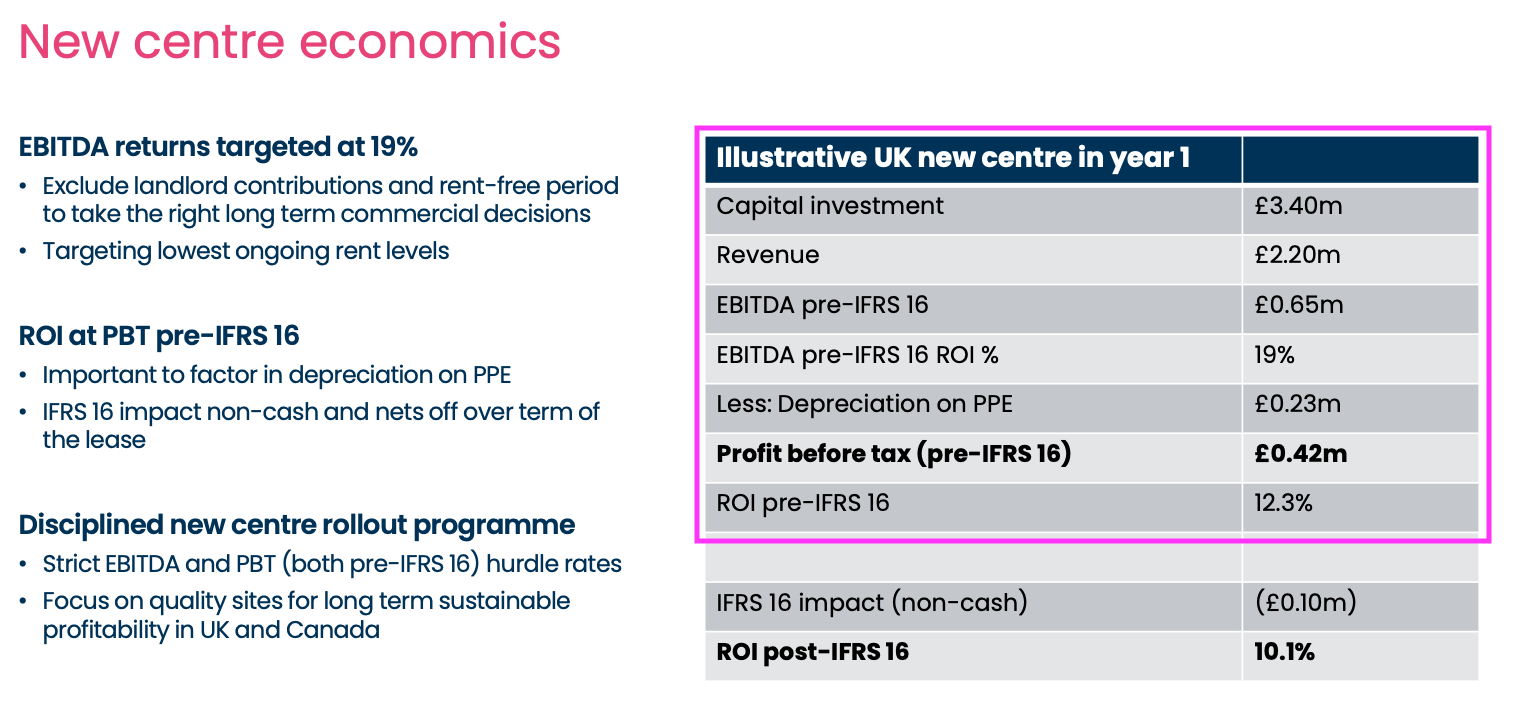

Hollywood claims an ‘illustrative’ new bowling centre will generate revenue of £2.2 million, a pre-IFRS 16 profit of £420k and therefore enjoy a margin of 19%:

Note also a £3.4 million capital investment is required to establish Hollywood’s ‘illustrative’ new centre, which will then earn the group a £420k/£3.4 million or 12% pre-tax return on that investment.

A 12% pre-tax return on investment does not seem great and nor does it correlate to the aforementioned 20%-plus ROEs derived from ShareScope.

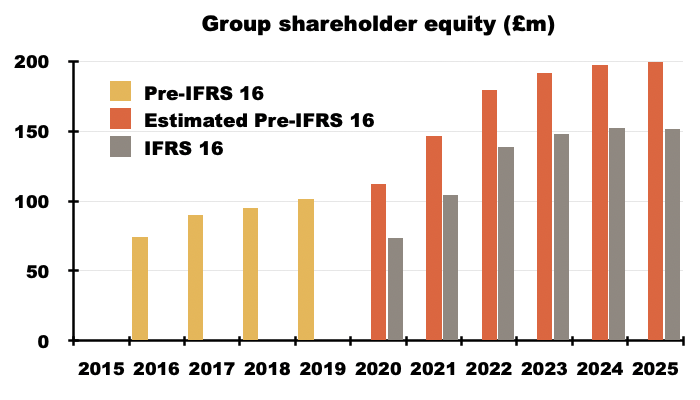

To double check whether IFRS 16 is distorting matters, I have done my best to make my own pre-IFRS 16 adjustments to Hollywood’s shareholder equity:

From my IFRS 16-adjusted sums at least, between 2015 and 2025 Hollywood has advanced its operating profit by £36 million and its shareholder equity by £201 million. The group has arguably reinvested shareholders’ money during those ten years at a pre-tax (pre-IFRS 16) return of 18% (£36m/£201m).

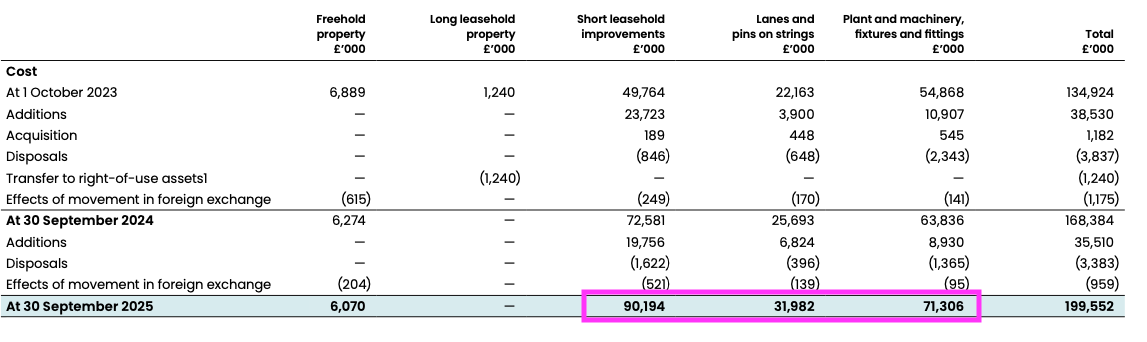

Hollywood’s expenditure on property, plant and equipment suggests an even greater return. The historic cost of fitting out all of the group’s centres is £193 million:

£193 million of bowling-centre expenditure versus my £48 million pre-IFRS 16 operating profit gives an approximate 24% pre-tax return on investment.

I am therefore unsure whether Hollywood’s ‘illustrative’ 12% pre-tax return means:

- New centres no longer enjoy the economics of more established sites;

- New centres take a few years to mature and will eventually enjoy attractive returns well beyond 12%, and/or;

- My sums are wrong.

Capex and cash flow

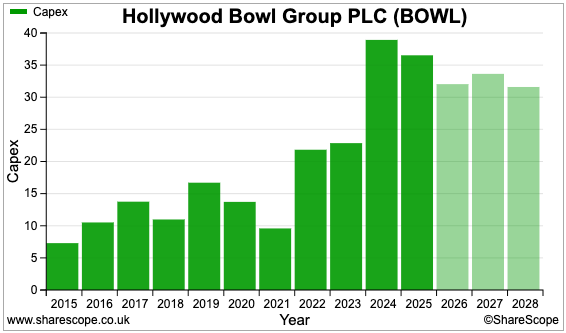

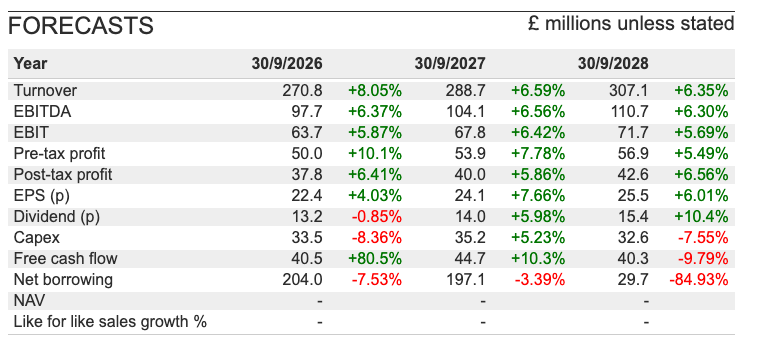

Spending £3.4 million to kit out a new bowling centre explains why Hollywood’s capex topped a hefty £30 million during both 2024 and 2025. Similar sums are forecast for 2026, 2027 and 2028:

Note that more than half of the capex for 2024 and 2025 was spent on ‘leasehold improvements’. This expenditure reflects custom alterations, such as installing new flooring, partitions, lighting and plumbing, to a leased property. Should Hollywood surrender the lease, all of those improvements will revert to the landlord.

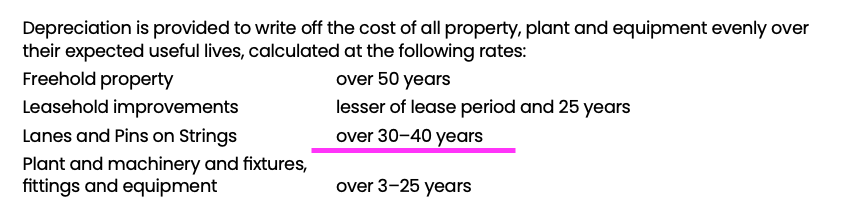

Note, too, that some of Hollywood’s bowling machinery can apparently last for up to 40 years:

I can’t imagine many Hollywood centres are still using kit first installed during the 1980s. Nor would I expect today’s equipment to be resetting bowling pins during the 2060s. I would therefore argue expensing the cost of some machinery over 40 years could unduly flatter reported profit (Phil Oakley analysed Hollywood’s depreciation during 2018).

And be aware how last year’s capex was split three ways:

- £19 million on seven new sites;

- £11m on refurbishing 12 centres, and;

- £7 million on general estate maintenance.

Hollywood claims its refurbishment expenditure is ‘expansionary’, although some refurbs must surely be employed to just sustain customer visits and previous revenue.

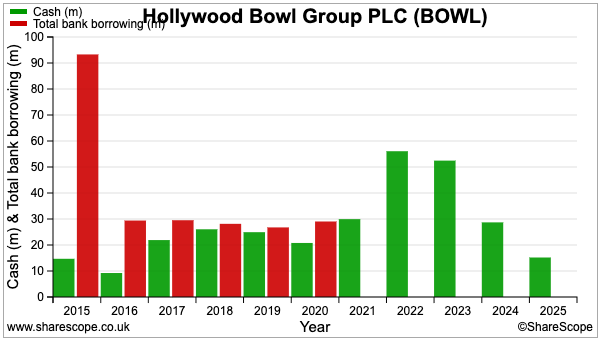

The hefty capex of the last few years has reduced net cash from more than £50 million to £15 million:

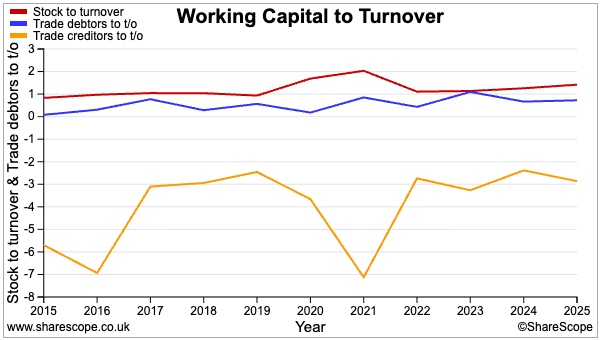

I must add Hollywood’s cash flow is assisted by very favourable working-capital characteristics. Stock and trade debtors are tiny compared to revenue, while creditors include upfront customer deposits:

Boardroom and employees

There’s a lot to like about chief executive Stephen Burns.

Mr Burns is certainly loyal to the group. He joined Hollywood during 2011 as business development director, became chief executive during 2014 and has been in charge ever since:

Mr Burns is also 51 years old, so may well be in charge for some time to come. Hollywood’s progress to date suggests he should be a reliable leader.

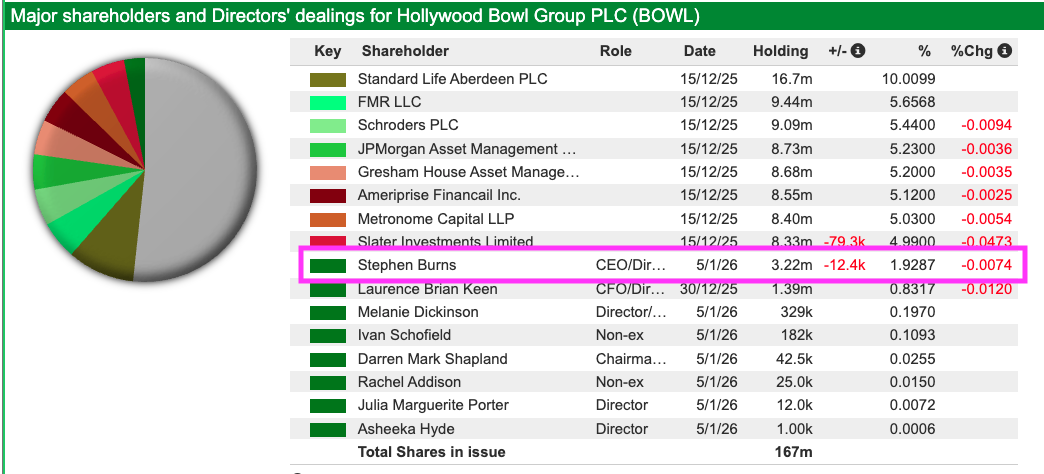

The aforementioned five special dividends may reflect Mr Burns’ consistent shareholding. After reducing his stake by 40% at the flotation, Mr Burns has commendably retained approximately 3.2 million shares that are presently valued at almost £9 million and pay him a useful £427k annual dividend:

I must highlight Hollywood’s ordinary dividend has advanced faster than Mr Burns’ remuneration. Between 2019 and 2025 for example, the dividend increased by 79% while Mr Burns’ salary climbed 23% (to £479k) and his total salary, benefits, pension and bonus gained 42% (to £984k).

Mr Burns has been assisted since 2014 by finance director Laurence Keen, who will step down from the board next month to oversee the Canadian operation. Hollywood’s replacement finance director appears a good recruit — he previously spent five years as finance director at the aforementioned Tenpin, the UK’s number two bowling firm.

Hollywood’s employee productivity reflects very well on the executives:

Revenue per employee was £63k before the pandemic and last year reached £87k. I believe lifting staff productivity is vital for Hollywood, given its exposure to further increases to the living and minimum wages (employees were paid an average of only £20k last year).

Valuation and verdict

ShareScope carries the following forecasts:

Hollywood’s track record makes the prospects of mid-single-digit growth very plausible (for extra perspective, Mr Burns’ LTIP requires 2025 adjusted earnings to improve by at least 15% to 24.78p per share by 2027).

The projections support a near-term 11-12x P/E and a yield close to 5%, which do not appear outrageous given Hollywood’s decent margin and returns on investment.

Mind you, I would urge potential shareholders to double check the accounts and undertake their own IFRS 16 interpretation of margins and ROE. The books typically include a number of exceptional costs as well, including write-downs of the mini-golf sites.

I must confess to swearing off leisure and hospitality shares some years ago following this disastrous personal investment. I now believe businesses that manage scores of lowly paid staff who serve the hard-to-please public within properties that need consistent upkeep tend not to make the greatest of investments.

But Hollywood might be an exception to my rule for anybody attracted by the profitable economics of ten-pin bowling and the ancillary income.

Mix in the group’s stable leadership, well-managed workforce, history of special dividends and longer-term growth potential — management reckons total UK/Canada centres can increase from 92 to 130 by 2035 — and I can easily foresee Hollywood remaining a very respectable long-term performer within the leisure and hospitality sector.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Disclosure: Maynard does not own shares in Hollywood Bowl.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.