All the zeros

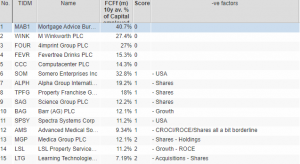

Since Richard started scoring companies in SharePad last April, twelve companies have scored zero strikes, the best possible score. In this article, he decides which of them to research next. Five-strikes-wise, there is not much to report on. I have awarded four shares that have reported in the last two weeks with less than three