The collapse of a handful of banks is provoking fears of contagion and a fair bit of trading. Though we think of traders and buy-and-hold investors as separate breeds, everybody trades. Discipline is as important for those of us who do it infrequently as those who do it daily.

No doubt you have heard, people are panicking about banks. So far it has come in waves at weekends.

The first wave was the run on Silicon Valley Bank (SVB), which was taken over by the US regulator on Friday 10 March.

The second wave was the collapse in confidence in Credit Suisse and its subsequent forced marriage with UBS, another Swiss bank.

As last week drew to a close, people were worrying about US banks and Deutsche Bank shares went into a tailspin.

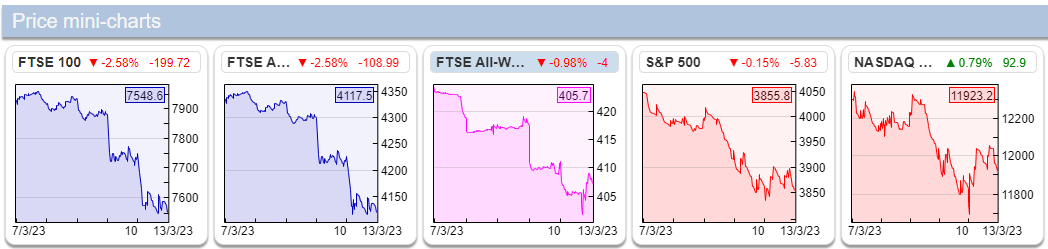

The morning after the first weekend of panic, I logged on to SharePad to see how events at SVB had been received by traders, and clipped a memento, just in case it turned out to be another “here we go again moment”. Here it is for posterity:

Source: SharePad, Markets. Monday Morning, 13 March: The market fell sharply on Friday 10 March and Monday 13 March

Are we on the brink of another crash? I have no idea. I think it is best to assume we are always on the brink of another crash, so we are prepared for it.

Trading for buy and hold investors

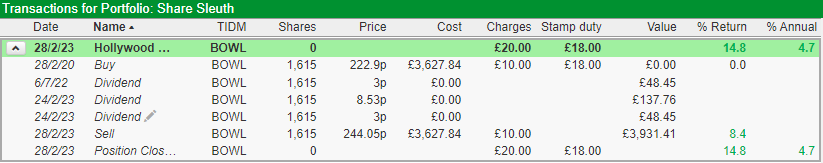

Recently I shared the SharePad chart below in an article. It showed an uncharacteristically short three-year trade in Hollywood Bowl, the operator of bowling centres:

NB: This trade was made in a model portfolio, Share Sleuth, which I run for interactive investor, an investment platform. I administer the portfolio in SharePad. I also owned the shares in my personal portfolio in different amounts, for a similar period.

Although I did not know it at the time, my share purchase occurred during the first wave of something really big. I had bought the shares in the twilight period after Covid 19 had reached our shores but before the lockdown. When the lockdown was announced the day before Hollywood Bowl hit its low, we learned a previously thriving business would not be allowed to operate.

As you can see from the screenshot of SharePad’s Transactions table below, the investment was not disastrous (including dividends it made an admittedly modest 5% annual return).

Source: SharePad, Transactions

But the trade did not go as I had imagined. I added the shares at a price of 229.9p and three weeks later they closed at 70.1p, a decline of 70%!

“It would be interesting to know why you didn’t top up [Hollywood Bowl] BOWL in early 2020 when the shares fell about 75%. Was it (a) terror, (b) slow reactions, (c) both or (d) something else?”

The answer is (b) slow reactions, but it is a bit more complicated than that because the slow reactions are deliberate. They are my defence against making bad decisions when I might be emotional, be that emotion fear or greed.

I could just as easily have dumped my Hollywood Bowl holding at the worst possible moment. It was far from clear the company had a future. Events had turned what had felt like a long-term investment into a speculation.

My trading strategy takes me out of the moment.

The Share Sleuth portfolio is a closed system, no new money enters it and if it did the rules might be a bit different, but as they stand, my rules limit what I can trade, in what size, and when, by:

Requiring me to:

- Write an evaluation of every share

- Revise the evaluation once a year for each holding, after the publication of the annual report

- Sell shares worth 2.5% of the portfolio’s total value if a holding grows too big. The maximum holding size is determined in the evaluation but it cannot exceed 11.5%. It is usually considerably less.

Prohibiting me from:

- Trading an individual share more than once a year

- Considering trades on more than one day a month, and making more than one trade that day

- Buying more shares if it would take a holding to more than 9% of the total size of the portfolio

And by limiting:

- New positions to 2.5% of the value of the portfolio

- Top ups to 2.5% of the value of the portfolio

- Reductions in holdings to 2.5% of the value of the portfolio, unless I am liquidating the holding.

Nine rules are a lot to keep in mind, but I do not actually have to think about them. They are coded into a spreadsheet that tells me which trades are available to me.

Keep calm and carry on

The most famous buy-and-hold investor, Warren Buffet, advises us to be fearful when others are greedy and to be greedy when others are fearful. Such thoughts may have prompted John’s tweet.

My mantra is different. It is not to be fearful or greedy.

Rule number 4, the prohibition on trading shares less than a year after the previous trade, stopped me trading Hollywood Bowl. Actually, I did not consider trading any shares around that time. Rule number 5 restricting my trading activity to one day a month, ensured that.

Even if, by coincidence, I had been thinking about trading that day, there would have been plenty of other beaten-up shares to consider.

In hindsight, I missed a bargain, but I wonder how easy it would have been to bag it. Maybe you would have to be an accomplished full-time trader to do it.

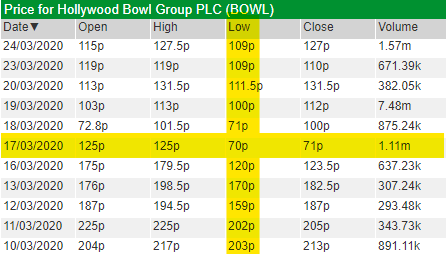

The astonishing thing about extreme moves in the market is how fast they happen. Hollywood Bowl’s low was 70p on 17 March, but there were only two days when the share price low was below 100p and even on those days the high was 100p or more:

Source: SharePad, Prices

Two tribes

When I started investing it seemed there were two tribes, traders and investors. Traders used technical analysis, and market data like prices and volumes. Investors used fundamental analysis, they analysed the financial performance of businesses and their strategies.

Being in one tribe meant you believed the methods of the other tribe were wrong, a hiding to nothing.

I am not sure about that, but I believe mastery of both technical analysis and fundamental analysis is beyond me. They are very different skills that both make significant demands on our time.

I want to be the best buy-and-hold investor I can be because I enjoy figuring out businesses and I think I can make money by owning shares in good companies long enough for their strategies to deliver the growing cash flows they promise.

That means spending as much time as I can on research, which I think I am relatively good at, and as little time as possible on an activity that I think I am bad at. Trading stresses me out even though I do it infrequently, so I outsource it to an algorithm.

Minimising and automating trading activity gives me time to find businesses I trust to navigate recessions and crashes so that I do not have to react.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.