The way companies account for share-based pay tends to erase the cost from profit and free cash flow, which is how we measure their performance. Richard factors share-based payback in and discovers it can make a difference to our perception of businesses, and their valuations.

Every year I read Fundsmith’s annual letter to fund holders not only because I am one of them, but also because Terry Smith, the fund’s manager, started his career as an analyst.

He achieved fame when he wrote a book, “Accounting for Growth” that documented the dubious accounting practices used by companies in the 1980s to pull the wool over investors’ eyes.

The book lost him his job, but established his reputation and his writings continue to reveal the thoughts of his analyst persona.

Reading Terry Smith can help us to become less credulous about companies and their accounts.

What would Terry do?

This year’s letter talked extensively about share-based payments. Many companies ignore them when they calculate adjusted profit, even though there is no good reason for this.

Mr Smith goes further. He says that share-based payments distort operating cash flow and consequently free cash flow, the lifeblood of a business.

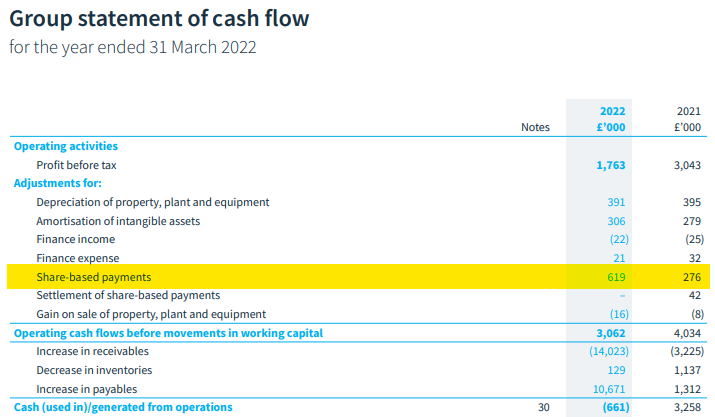

In the operating section of the cash flow statement, non-cash items are added back to profit to determine how much money flowed into, or out of, a business as a result of its day-to-day activities.

Accounting convention dictates companies add share-based payments back to operating cash flow because the calculation is an estimate and does not reflect the cash cost during the financial year.

Mr Smith argues the decision to reward staff in shares instead of cash is a financing decision, and it should not be dealt with in the operating section of the cash flow statement. It should be reclassified to the financing section.

We can simulate this, and its impact on the financial ratios, by undoing the adding back of share-based payments. To do this, we deduct share-based payments from operating cash flow.

It will offend purists because it means we are treating share-based payments as a cash cost, but, he says, this treatment is more reflective of the company’s ongoing cash generation.

To show how share-based payments impact our impression of the quality of a business as well as the valuation, I will do the calculations for D4t4, a small, profitable UK software company.

First, we must locate the value of share-based payments in the cash-flow statement:

Source: D4t4 Annual Report 2022

D4t4 sells marketing and fraud prevention data platforms as a service. If you are in doubt about what a data platform is, this is what a combination of human bumbling (me) and artificial intelligence (ChatGPT) established.

I own a small, and somewhat speculative holding in D4t4 and want to determine the impact of share-based payments not only on profit and cash flow but on the ratios we use to judge a business derived from these numbers.

The impact of share-based payments

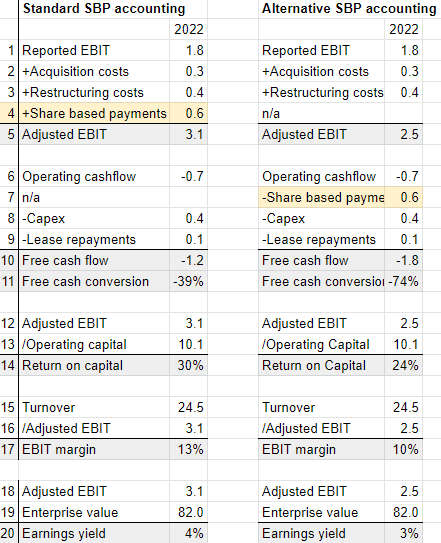

The numbers on the left in the table below are calculated the way that most companies do it.

The figures on the right shows the alternative calculation, the company’s performance and valuation as Fundsmith might calculate it.

We no longer add share-based payments back to profit as we want the cost to be included in the profit figure. And we deduct share-based payments from operating cash flow because we not treating share-based payments as an operating activity:

Note: Reported EBIT, operating cashflow, Capex, Lease repayments and Turnover are from SharePad. Acquisition costs, restructuring costs, and Share-based payments are from the D4t4 Annual Report. Operating capital and Enterprise value are the author’s own calculations, from SharePad and annual report data.

The Free cash flow calculation starts in row 6. A common way to calculate free cash flow is to deduct capital expenditure from operating cash flow, which is the calculation on the left hand side.

Whichever way you look at it, cash flowed out of the business in 2022. D4t4 spent a lot of money towards the end of its financial year on hardware for a customer, which it had not been paid for.

But the accounting rules require D4t4 to add share-based payments back to operating cash flow because it is a non-cash cost. If we are arguing that it is a financing decision as Fundsmith does, we need to undo this by deducting share-based payments from operating cash flow, which happens in row 7 (highlighted in yellow).

According to the standard calculation, free cash flow (-£1.2 million) is 34% higher than the alternative calculation (-£1.8 million).

We can use these figures to calculate other performance ratios. Free cash conversion (row 11) is almost twice as bad at -74% using the alternative calculation. Return on capital (row 14) falls from 30% to 24%, and EBIT (profit) margin (row 17) falls from 13% to 10%.

The company’s shares look more expensive too. Profit in 2022 was 3% of enterprise value as opposed to 4% (row 20).

One of the reasons we adjust data is to make the returns a company earns more comparable to those of all the other companies we might invest in.

Levels of share-based payment range from zero to truly extravagant. Writing them out of the figures, which is what is happening on the left-hand side of the table, could lead to poor comparisons.

An accounting wrinkle we cannot ignore

It is tempting to think we should just give up on companies with high levels of share-based pay, particularly as it is often regarded as a way of disguising boardroom excess.

The problem with that is we would be ignoring a lot of companies, some of which are not just enriching executives.

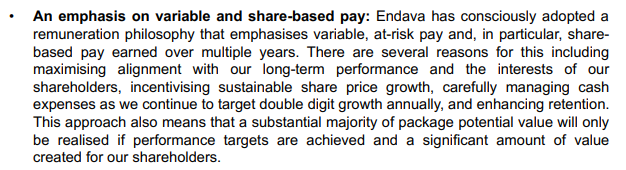

Endava, the UK-domiciled listed US software developer I discovered in this article explains the rationale for share-based pay:

Source: Endava annual report, 2022

In 2022 the Endava board earned an impressive £3.7 million in share-based pay, but total share-based pay was nearly ten times as much (£35 million). At software firms, share-based pay is seen as a way of motivating expensive human capital, without bankrupting companies while they grow.

To invest in companies like these, the harsh reality is that we cannot ignore share-based pay.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.