How I use ShareScope to research companies

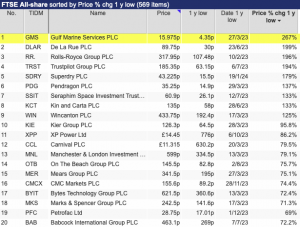

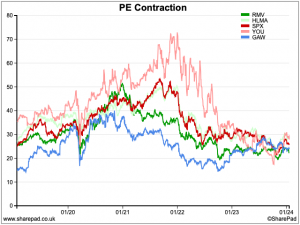

Former Investment analyst and financial journalist Phil Oakley shows how he uses ShareScope to research companies and shares. I have been using ShareScope since it was launched in 2015 and helped to develop many of the features that are in it today. It remains a great resource for private investors and I find it invaluable